Mobile Power Plant Market Size 2024-2028

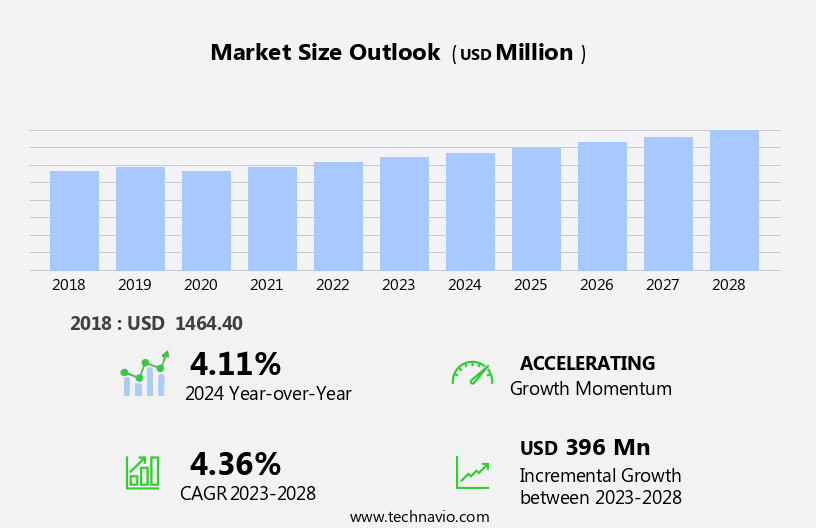

The mobile power plant market size is forecast to increase by USD 396 million at a CAGR of 4.36% between 2023 and 2028.

What will be the Size of the Mobile Power Plant Market During the Forecast Period?

How is this Mobile Power Plant Industry segmented and which is the largest segment?

The mobile power plant industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Fuel Type

- Natural gas

- Diesel

- Others

- Application

- Emergency power

- Oil and gas

- Remote area electrification

- Others

- Geography

- North America

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- Middle East and Africa

- South America

- North America

By Fuel Type Insights

- The natural gas segment is estimated to witness significant growth during the forecast period.

Natural gas is an increasingly popular fuel choice for power generation due to its affordability and efficiency. According to the US Energy Information Administration (EIA), natural gas-fired combined-cycle power plants had the highest capacity utilization percentage among fossil fuels in 2018. This trend is expected to continue, with natural gas capacity utilization projected to reach approximately 80% by 2030. Compared to diesel generators, natural gas power plants produce fewer emissions and do not leave residuals such as ash and soot. This makes them a cleaner option for power generation. Mobile power plants, including those fueled by natural gas, play a crucial role in various industries and applications.

They provide electricity for construction work, remote area electrification, emergency power, and industrial use. Mobile power plants come in various forms, such as self-propelled chassis, trailers, and tracked vehicles. They can also be integrated with renewable energy sources, such as solar panels and solar power grids, to enhance their power range and reliability. Mobile power plants are essential for various sectors, including telecom, railroad, oil and gas exploration and mining, and disaster recovery. They are particularly valuable in remote areas and regions with limited energy capacity, where traditional power grids may not be accessible. Sales channels for mobile power plants include spare parts suppliers, switching apparatus manufacturers, and technology providers.

With the global focus on electrification and the increasing demand for reliable power sources, the market for mobile power plants is expected to present significant opportunities.

Get a glance at the Mobile Power Plant Industry report of share of various segments Request Free Sample

The Natural gas segment was valued at USD 698.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

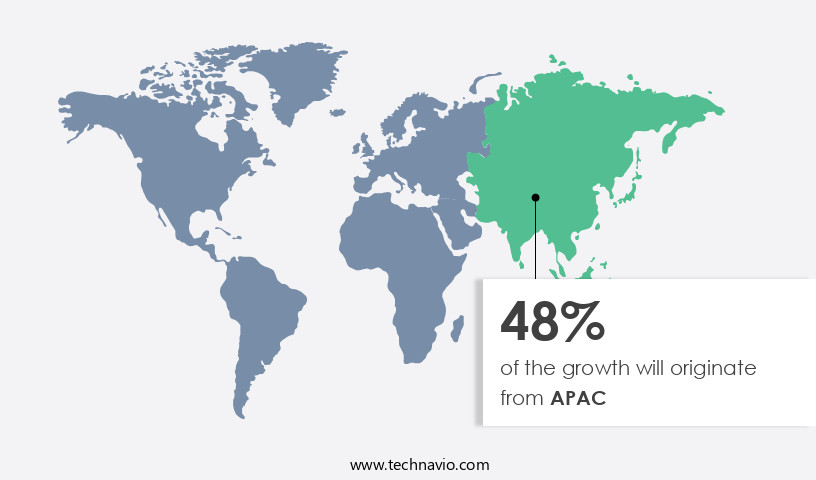

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds a significant position In the global mobile power plant industry, with the US being a key contributor. The aging infrastructure and grid modernization are primary growth drivers, as the US Environmental Protection Agency mandates upgrades for power plants older than 25 years with a capacity above 50 MW. The US is also expected to transition from coal-fired power plants to natural gas-based ones by 2035. Mobile power plants cater to various sectors, including construction activities, disaster recovery, remote area electrification, and industrial use. These plants offer flexibility in power range and can be transported via railroad flatcars, trailers, or tracked vehicles.

They come equipped with electric generators, control consoles, inverters, and switching apparatus. Mobile power plants are increasingly being integrated with renewable energy sources like solar panels and natural gas/LNG. The market encompasses sales channels for spare parts and services, catering to diverse applications such as telecom, oil & gas exploration and mining, and emergency power for buildings and events.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Mobile Power Plant Industry?

Increasing demand for emergency power during natural disasters is the key driver of the market.

What are the market trends shaping the Mobile Power Plant Industry?

Development of floating offshore wind is the upcoming market trend.

What challenges does the Mobile Power Plant Industry face during its growth?

Increasing investment in electricity network for accelerating energy is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The mobile power plant market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mobile power plant market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mobile power plant market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

American Electric Power Co. - The mobile power plant industry encompasses innovative solutions, including solar modules, battery storage systems, and hydrogen storage systems. These technologies enable the generation, storage, and distribution of power in a portable and flexible manner, addressing the growing demand for reliable and sustainable energy sources. Solar modules convert sunlight into electricity, while battery storage systems store excess energy for later use. Hydrogen storage systems generate electricity through the reaction of hydrogen with oxygen, providing a clean and renewable energy source. These mobile power plant solutions cater to various industries, from construction sites and remote oil rigs to disaster relief efforts and military applications. By offering advanced and versatile power generation and storage systems, companies contribute to the evolution of the market and the transition towards a more sustainable energy future.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Electric Power Co.

- ATLAS Corp.

- Caterpillar Inc.

- Dynamis Power Solutions

- EthosEnergy Group Ltd.

- FERROPLAN OY

- General Electric Co.

- Kawasaki Heavy Industries Ltd.

- Korindo Energy

- MAPNA Group Co.

- Meidensha Corp.

- Mitsubishi Heavy Industries Ltd.

- MTU Aero Engines AG

- Mytilineos S.A.

- Porsche Automobil Holding SE

- Siemens AG

- Turbine Technology Services Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of solutions designed to provide electricity in various applications, particularly in remote and off-grid locations. These plants offer flexibility and mobility, making them indispensable in various industries and sectors. Mobile power plants come in various forms, including self-propelled chassis, trailers, and tracked vehicles. They can be powered by different energy sources such as diesel, natural gas/LNG, and renewable energy, including solar and wind. The selection of the power source depends on the specific application and availability of resources. The demand for mobile power plants is driven by several factors. One significant factor is the increasing focus on industrial use, particularly in construction activities and oil & gas exploration and mining.

In these sectors, mobile power plants provide a reliable source of electricity in remote locations where traditional power grids may not be available. Another factor driving the growth of the market is the need for emergency power in natural disasters and other emergency situations. Mobile power plants can be quickly deployed to provide electricity to disaster-stricken areas, ensuring the continuity of essential services and facilitating relief efforts. Moreover, the trend towards remote area electrification and rural electrification is creating new opportunities for mobile power plants. In many developing countries, access to electricity is limited, and mobile power plants offer a cost-effective and efficient solution for providing electricity to rural communities.

The market is also witnessing technological advancements, with innovations in control consoles, inverters, and switching apparatus. These advancements improve the efficiency and reliability of mobile power plants, making them an attractive option for various applications. The sales channel for mobile power plants includes direct sales to end-users and through intermediaries such as distributors and dealers. Spare parts and after-sales services are essential components of the market, ensuring the longevity and optimal performance of the plants. The market for mobile power plants is diverse and global, with applications ranging from telecom and railroad flatcars to oil drilling and power grids.

The market's growth is expected to continue as the demand for reliable and flexible power sources increases in various industries and sectors. In conclusion, the market offers a significant opportunity for businesses and investors, driven by the growing demand for electricity in remote and off-grid locations, the need for emergency power, and the trend towards remote area and rural electrification. The market's technological advancements and diverse applications make it an exciting and dynamic space to watch.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 396 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mobile Power Plant Market Research and Growth Report?

- CAGR of the Mobile Power Plant industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mobile power plant market growth of industry companies

We can help! Our analysts can customize this mobile power plant market research report to meet your requirements.