Motor Control Contactors Market Size 2024-2028

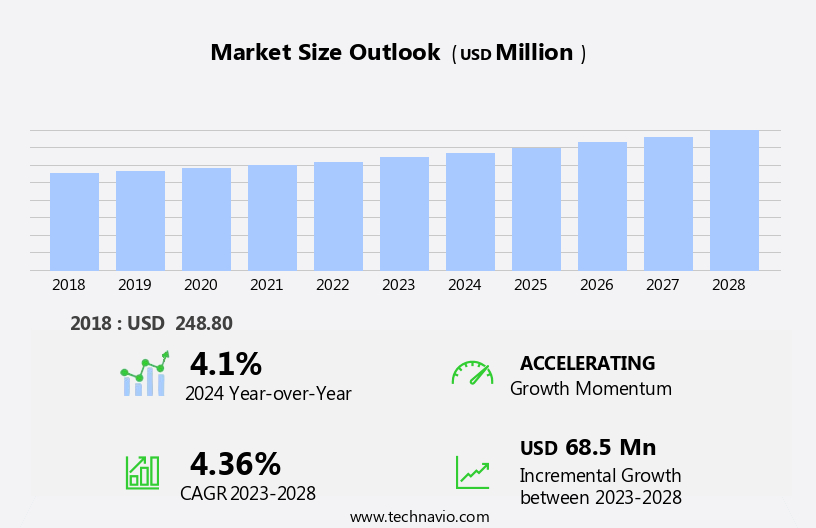

The motor control contactors market size is forecast to increase by USD 68.5 million at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for motor protection devices in various industries, including manufacturing, power generation, and construction. This trend is driven by the need to ensure the reliability and efficiency of motor systems, which in turn leads to cost savings and improved productivity. Another key trend in the market is the emergence of contactors with universal coils, which offer greater flexibility and compatibility with various motor types and applications. This innovation is expected to drive market growth as it caters to the diverse needs of customers and simplifies the installation process.

- However, the market also faces challenges, primarily related to the technical limitations of contactors. These limitations include the potential for arcing and contact bounce, which can lead to premature failure and safety concerns. To address these challenges, manufacturers are investing in research and development to create contactors with advanced features, such as arc-fault protection and contact bounce reduction, to ensure the reliability and safety of motor control applications. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on innovation, quality, and customer service to differentiate themselves in a competitive landscape.

What will be the Size of the Motor Control Contactors Market during the forecast period?

- The motor control market encompasses various electrical components, including magnetic contactors, current shunt resistors, overload heaters, contacts, and coils. These elements play a crucial role in managing electrical power for motors operating on 3 phase AC power. Components such as clamp-on ammeters, phase windings, and enclosures ensure proper motor functioning and overcurrent protection. Key electrical devices, like relays, fuses, and circuit breakers, are integral to motor control circuits. Millivoltage electromagnets and auxiliary contacts facilitate efficient motor operation. Single phasing and knife blade switches are also essential in this context. Motor control components, including contacts, contacts, and overload heaters, manage line current and protect against potential electrical hazards.

- The market for these components is driven by the increasing demand for electric motors in various industries and the need for energy-efficient solutions. Electrical power systems require motor control components to ensure seamless operation and prevent electrical issues. As businesses prioritize energy efficiency and safety, the market for these components is poised for growth. Understanding the dynamics of the motor control market involves staying informed about emerging trends and advancements in electrical power management technology. Market research firms like FMI, Grand View Research, and Vantage Market Research provide valuable insights into this evolving landscape.

How is this Motor Control Contactors Industry segmented?

The motor control contactors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Process industries

- Discrete industries

- Type

- IEC standard

- NEMA standard

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- India

- North America

By End-user Insights

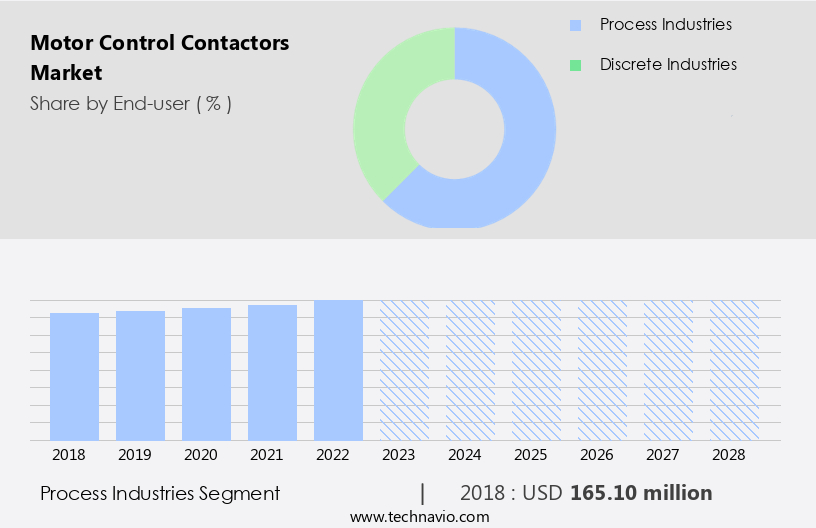

The process industries segment is estimated to witness significant growth during the forecast period.

The Metal Additive Manufacturing Market is witnessing significant growth, particularly in industries such as oil and gas, power, and chemical and petrochemical. In the oil and gas sector, electric motors are increasingly utilized for drilling, mooring, rigs, pumping stations, and draw works. This trend increases the demand for motor control contactors to prevent high currents during switching. Although the oil and gas industry experienced a downturn due to fluctuating oil and gas prices, the recent recovery and stability in crude oil and natural gas prices have prompted companies to invest in new upstream, midstream, and downstream projects.

Motor control circuits, including magnetic contactors, are integral components in the operation of AC motors. These circuits ensure proper starting, stopping, and protecting motors from overcurrent conditions. The use of servo motors and controllers in robotic applications further increases the demand for motor control circuits. In the power industry, AC drives and AC motors are widely used to control the speed and torque of generators and pumps. AC drives are essential for efficient power management and energy savings. The integration of snubber circuits and overcurrent protection devices, such as circuit breakers, fuses, and overload relays, is crucial in ensuring the safe and reliable operation of AC drives and motors.

The chemical and petrochemical industry also relies heavily on electric motors for various applications, including conveyor systems and process control. Motor starters, including pushbutton and motor contactors, are essential components in starting and stopping these motors. Enclosures and wire connections protect these electrical devices from environmental hazards and ensure proper electrical connections. Manufacturing rates in the metal additive manufacturing market are increasing due to advancements in technology and the growing demand for customized and complex components. These advancements include the development of high-performance motors, such as DC motors and electromagnets, and the integration of advanced control systems, such as process control systems and controllers.

In summary, the Metal Additive Manufacturing Market is experiencing growth in various industries, driven by the increasing use of electric motors and the need for efficient motor control. Motor control circuits, including magnetic contactors, motor starters, and AC drives, are essential components in ensuring the safe and reliable operation of these motors. The integration of advanced control systems and the development of high-performance motors are driving manufacturing rates in this market.

The Process industries segment was valued at USD 165.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

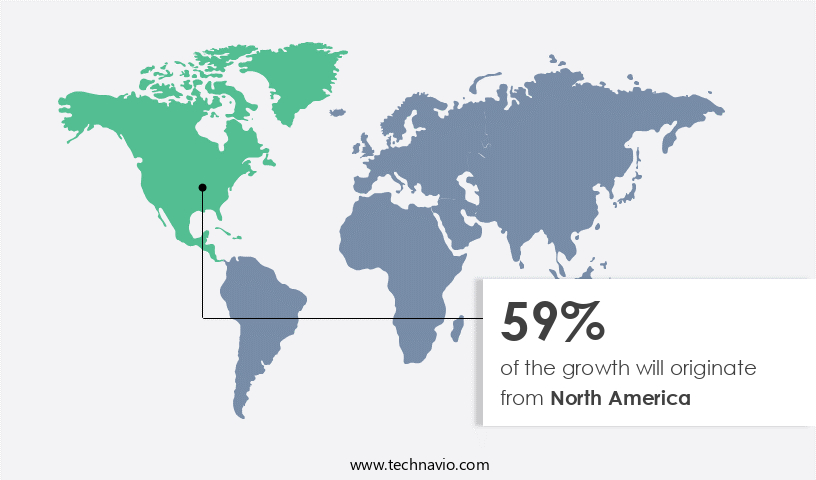

North America is estimated to contribute 59% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The global market for motor control contactors witnessed significant growth in 2020, with North America leading the charge. This region's dominance can be attributed to the expansion of key end-user industries, including oil and gas, chemicals and petrochemicals, and automotive. In the automotive sector, Mexico stands out as a significant production hub, benefiting from its proximity to the US and Canada and favorable government policies. Simultaneously, the chemical and petrochemical industry in North America is poised for growth, driven by the initiation of new projects and the burgeoning oil and gas industry in the US. AC motors, a crucial component in motor control contactors, are extensively utilized in these industries.

The manufacturing rates of AC motors have increased due to the rising demand for automation and electrification in various applications. The integration of advanced technologies, such as servo motors and AC drives, has further fueled market growth. These technologies offer enhanced process control, improved torque, and energy efficiency. Moreover, the adoption of single-phasing and overcurrent protection systems ensures the reliable operation of motor control contactors. Motor control contactors are also essential in robotic applications, where they facilitate the precise control of electric motors. These applications include phase winding, millivoltage control, and clamp-on ammeter measurement. The use of magnetic contactors, electromagnets, and relays in motor control systems adds to the overall functionality and efficiency.

In summary, the market is experiencing substantial growth due to the expansion of key end-user industries and the integration of advanced technologies. The demand for motor control contactors in North America, particularly in the automotive and chemical industries, is expected to remain strong during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motor Control Contactors Industry?

- The significant growth in demand for motor protection devices serves as the primary driver of the market.

- Motor control contactors play a crucial role in industrial applications by facilitating the switching of large electrical power in motors. The increasing adoption of drives and motor control systems in various industries to ensure continuous monitoring and prevent productivity losses has led to the growing demand for motor control contactors. These contactors protect electric motors from high voltage and current fluctuations, ensuring optimal performance in heavy-duty applications. The high cost of repairing faulty motors or transmission lines makes the use of motor control contactors a cost-effective solution for companies.

- By providing reliable switching and protection, motor control contactors help prevent production downtime, loss of raw materials, and non-quality production and delivery. The importance of motor control contactors is further emphasized by the potential risks associated with motor failures, which can lead to expensive repairs and production losses.

What are the market trends shaping the Motor Control Contactors Industry?

- The emerging market trend involves the increasing adoption of contactors with universal coils, offering enhanced flexibility and compatibility in electrical systems.

- The market is experiencing significant advancements, with the introduction of contactors featuring universal coils gaining popularity. Traditional contactors were primarily used to switch loads in applications such as motors, fans, and pumps, while large-size contactors isolated or bypassed these loads and switched resistive loads. However, the emergence of contactors with universal coils offers operators the ability to control voltages on multiple applications. These contactors can be controlled with 40 to 50 different voltages, ranging from 24 V to 500 V AC or DC, using only four different coil options.

- This flexibility makes them a more versatile solution compared to traditionally used contactors, which were voltage-specific. The adoption of these advanced contactors is expected to increase as industries seek to improve operational efficiency and reduce downtime.

What challenges does the Motor Control Contactors Industry face during its growth?

- The growth of the industry is significantly impacted by the technical limitations of contactors, which poses a significant challenge that must be addressed by industry professionals.

- The market faces certain operational and technical challenges that hinder its growth. One of the primary issues is the failure of contactors due to aging, which can be attributed to open circuit coils. This problem arises from the wear and tear of insulation materials used in the equipment, with the lifespan being significantly reduced for every 10 degree C rise in temperature. Additionally, the coil windings, which have a small diameter, are susceptible to chemical attacks, further contributing to contactor failure.

- Temperature and coil windings are critical factors that impact the performance and longevity of motor control contactors.

Exclusive Customer Landscape

The motor control contactors market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motor control contactors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motor control contactors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in motor control solutions, providing advanced technology contactors for various applications. Our product range encompasses 3-pole contactors and overload relays for motor starting and power switching, as well as 4-pole contactors and contactor relays for auxiliary circuit switching. These contactors are engineered for optimal performance and reliability, enhancing search engine exposure for businesses in need of efficient motor control systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AMETEK Inc.

- Danfoss AS

- Eaton Corp. Plc

- Emerson Electric Co.

- Fuji Electric Co. Ltd.

- GlobalSpec LLC

- HIMEL HONG KONG LTD.

- Mitsubishi Electric Corp.

- Panasonic Holdings Corp.

- Rockwell Automation Inc.

- S and P Global Inc.

- Schaltbau GmbH Group

- Schneider Electric SE

- Siemens AG

- TAIGENE inc.

- TECO GROUP

- Toshiba Corp.

- WEG S.A

- Zhejiang CHINT Electrics Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motor Control Contactors Market

- The market has witnessed several significant developments in the recent years, shaping the industry's growth trajectory. Here are the key developments from 2024 to 2025: In Q1 2024, Schneider Electric, a leading player in energy management and automation, launched its Masterpact MTZ range of motor control contactors. This new product line offers enhanced protection against short-circuits and overloads, making it an ideal choice for heavy-duty applications. According to Technavio, this launch is expected to strengthen Schneider Electric's position in The market (Technavio, 2024). In H2 2024, ABB and Siemens, two major players in the market, announced a technological collaboration to develop next-generation motor control solutions.

- This collaboration aims to integrate advanced digital technologies, such as IoT and AI, into motor control contactors, enabling predictive maintenance and energy efficiency. (ABB & Siemens, 2024) In Q3 2025, Eaton Corporation completed the acquisition of Cooper Bussmann, a leading manufacturer of electrical and electronic components. This acquisition significantly expanded Eaton's portfolio in the market, enabling the company to cater to a broader customer base and offer a more comprehensive range of products and services. (Eaton Corporation, 2025) In Q4 2025, Siemens expanded its manufacturing facility in Thailand to cater to the increasing demand for motor control contactors in the Asia Pacific region.

- This expansion will enable Siemens to produce up to 1 million contactors annually, making it one of the largest manufacturing facilities for motor control contactors globally. (Siemens, 2025) These developments reflect the growing competition and innovation in the market, driven by technological advancements, strategic collaborations, and geographic expansions. References: - Technavio. (2024). Schneider Electric's the market 2024-2028: Growth, Trends, and Forecasts. - ABB & Siemens. (2024). ABB and Siemens to Collaborate on Next-Generation Motor Control Solutions. - Eaton Corporation. (2025). Eaton Completes Acquisition of Cooper Bussmann. - Siemens. (2025). Siemens Expands Motor Control Contactors Manufacturing Capacity in Thailand.

Research Analyst Overview

The motor control market encompasses a diverse range of electrical devices designed to manage the flow of power to electric motors and other rotating machinery. Central to this market are motor control circuits, which regulate the starting, stopping, and speed control of AC and DC motors. These circuits employ various components, such as knife blade switches, current shunt resistors, and magnetic contactors, to ensure efficient and reliable motor operation. Frequency plays a crucial role in motor control, with AC motors responding differently to varying frequencies. Phase winding configurations also impact motor performance, influencing the distribution of current and magnetic field within the motor.

Motor control circuits must be designed to accommodate these factors, ensuring optimal motor performance and overload protection. Current is another essential aspect of motor control, with various components, such as current shunt resistors and clamp-on ammeters, used to measure and regulate the flow of electrical current. Overcurrent protection devices, including circuit breakers, fuses, and overload relays, safeguard motors and electrical systems from damage caused by excessive current. Robotic cells and automation applications have significantly influenced the motor control market, driving the demand for advanced control technologies such as servo motors and AC drives. These technologies offer precise speed control, torque regulation, and improved energy efficiency, making them ideal for applications requiring high levels of process control.

Motor starters and controllers are integral components of motor control systems, facilitating the starting and stopping of AC and DC motors. These devices employ various technologies, including pushbutton starters, magnetic contactors, and snubber circuits, to ensure reliable motor operation and overload protection. IEC standards have established guidelines for motor control components and systems, ensuring interoperability and safety. Thermal characteristics and contact resistance are essential considerations in motor control design, with components such as overload heaters and thermal relays used to manage motor temperatures and prevent damage. Power conductors and wire connections are essential components of motor control systems, ensuring efficient power transfer and minimizing voltage drops.

Enclosures and protective devices, such as fuses and circuit breakers, safeguard motor control components from environmental hazards and electrical overloads. Manufacturing rates and production efficiency are key drivers in the motor control market, with motor control systems designed to optimize manufacturing processes and minimize downtime. Alternating current and magnetic fields are essential considerations in motor control design, with components such as electromagnets and relays used to manage motor operation and control. Ramp-up time and response time are critical factors in motor control applications, with fast response times essential for efficient and effective motor operation. Screw terminals and other wire connection methods ensure secure and reliable electrical connections, while the integration of advanced control technologies, such as microcontrollers and digital signal processing, enables more sophisticated motor control applications.

In summary, the motor control market is characterized by a diverse range of electrical components and systems designed to manage the flow of power to electric motors and other rotating machinery. Motor control circuits employ various components, such as current sensors, overload protection devices, and magnetic contactors, to ensure efficient and reliable motor operation. Robotic applications and automation have significantly influenced the market, driving the demand for advanced control technologies and precise motor control. IEC standards ensure interoperability and safety, while power conductors and wire connections facilitate efficient power transfer and minimize voltage drops. The market is driven by factors such as manufacturing rates, response time, and thermal management, with a focus on optimizing motor performance and minimizing downtime.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motor Control Contactors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 68.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.1 |

|

Key countries |

US, China, Canada, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motor Control Contactors Market Research and Growth Report?

- CAGR of the Motor Control Contactors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motor control contactors market growth of industry companies

We can help! Our analysts can customize this motor control contactors market research report to meet your requirements.