Mobile Advertising Market Size 2025-2029

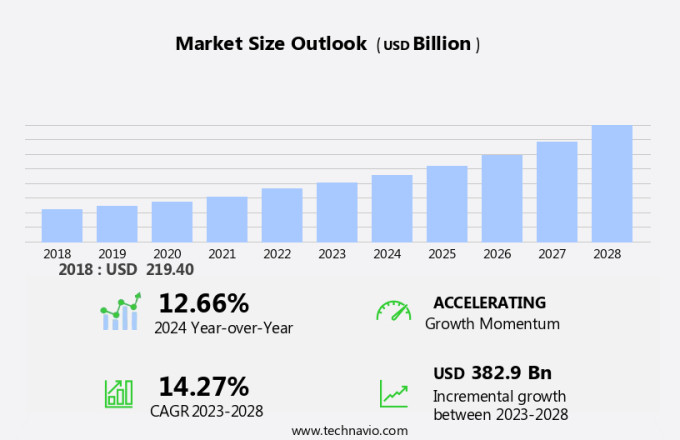

The mobile advertising market size is forecast to increase by USD 430.9 billion, at a CAGR of 14.3% between 2024 and 2029.

- The market is experiencing significant expansion, driven primarily by the increasing popularity of in-app advertising. This trend is fueled by the growing usage of mobile devices for various activities, including social media, entertainment, and e-commerce. Another key driver is the rapid advancement of programmatic advertising, which allows for real-time bidding and targeted ad delivery, enhancing the effectiveness of mobile ad campaigns. However, the market faces challenges as well. Rising privacy and security concerns, particularly with the increasing use of personal data for targeted advertising, necessitate robust data protection measures.

- Companies must navigate these challenges by implementing transparent data handling practices and adhering to stringent privacy regulations to maintain consumer trust and comply with evolving industry standards. To capitalize on market opportunities and stay competitive, businesses must adapt to these trends and challenges, focusing on innovative ad formats, data-driven targeting, and robust data security solutions.

What will be the Size of the Mobile Advertising Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. User acquisition remains a key focus, with attribution modeling and data privacy playing essential roles. Supply-side platforms (SSPs) facilitate the sale of advertising inventory, while conversion rate optimization relies on real-time bidding (RTB) and audience targeting. Video ads and banner ads dominate the scene, with contextual targeting ensuring ad relevance. User retention is a growing concern, with reward video ads and in-app purchases proving effective strategies. Ad fraud detection and brand safety are paramount, with ad verification and ad exchanges ensuring transparency. A/B testing and ad networks provide valuable insights into ad creative performance, while click fraud and ad fatigue pose ongoing challenges.

Mobile measurement and data analytics enable continuous optimization, with location-based advertising adding a layer of personalization. Programmatic advertising streamlines the buying and selling process, with search ads and landing pages playing crucial roles in driving conversions. Behavioral targeting and data privacy regulations add complexity, requiring innovative solutions. The market's continuous dynamism underscores the need for agility and adaptability, with ongoing innovation and evolution shaping its future. Brands are increasingly recognizing the value of reaching consumers through mobile applications, as users spend an unprecedented amount of time on their devices.

How is this Mobile Advertising Industry segmented?

The mobile advertising industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Search

- Display

- Video

- Others

- End-user

- Large enterprise

- SMEs

- Component

- Platforms

- Services

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

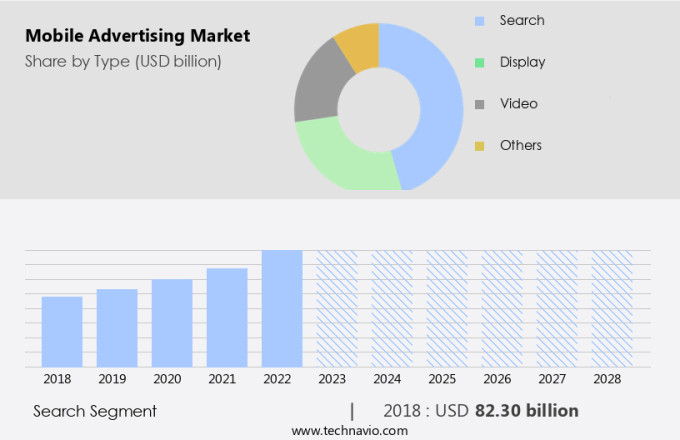

By Type Insights

The search segment is estimated to witness significant growth during the forecast period. In the dynamic world of mobile advertising, various entities play pivotal roles in delivering targeted and effective campaigns. Ad servers facilitate the delivery of ads to the appropriate audience, while fraud detection systems ensure authenticity. Demand-side platforms (DSPs) enable real-time bidding (RTB) for efficient media buying, and ad verification ensures brand safety. A/B testing optimizes ad creative, and ad networks expand reach. Mobile measurement provides insights into campaign performance, and contextual targeting enhances relevance. Ad exchanges facilitate the buying and selling of ad inventory, and click fraud detection mitigates malicious activity. Programmatic advertising streamlines the buying process, and ad fatigue strategies maintain user engagement.

Data privacy is a critical concern, with supply-side platforms (SSPs) managing inventory and conversion rates. Video ads, banner ads, display ads, search ads, and landing pages are essential formats, with user acquisition and attribution modeling driving growth. Behavioral targeting and location-based advertising offer personalized experiences, and in-app purchases and ad tracking provide valuable insights. Marketers continually optimize their strategies, with Google, Facebook, and Microsoft leading the charge in enhancing search ads and extending location-based services to other apps and map services.

The Search segment was valued at USD 91.90 billion in 2019 and showed a gradual increase during the forecast period.

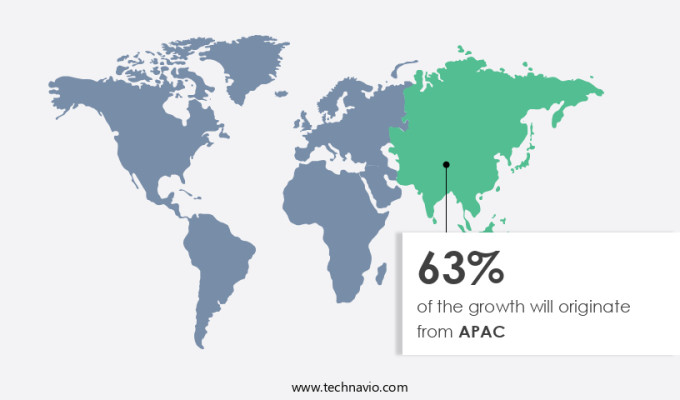

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing use of mobile devices and the Internet, as well as the rising preference for online shopping among consumers. Advertisers are capitalizing on this trend by utilizing various mobile advertising formats, such as in-app advertising, programmatic advertising, and video ads. Demand-side platforms (DSPs) and supply-side platforms (SSPs) facilitate real-time bidding (RTB) and audience targeting, ensuring efficient ad delivery and maximizing conversion rates. Fraud detection and ad verification systems are crucial components of the mobile advertising ecosystem, ensuring brand safety and preventing click fraud. A/B testing and mobile measurement enable continuous optimization of ad creative and campaign performance. Mobile app analytics plays a crucial role in understanding user behavior and preferences, enabling effective targeting and optimization.

Mobile analytics and data privacy regulations play a vital role in shaping the market dynamics. Contextual targeting and location-based advertising offer advertisers the ability to reach their audiences more effectively, while user acquisition and user retention strategies are essential for long-term success. In-app purchases and reward video ads provide monetization opportunities for app developers and publishers. The market is characterized by its complexity, with various entities, including ad networks, ad exchanges, and ad servers, contributing to the intricacy of the ecosystem. Despite the challenges, such as ad fatigue and behavioral targeting concerns, the market continues to evolve, driven by technological advancements and consumer behavior trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mobile Advertising Industry?

- In-app advertising represents a significant growth driver for the market, as businesses increasingly invest in this advertising format to engage consumers directly within applications. The market is experiencing significant growth due to the increasing usage of mobile applications. With users spending over 80% of their mobile time on apps compared to browsers, in-app advertisements have become a popular choice for brands. This trend is driven by the cost-effectiveness of in-app ads and the ability to reach a targeted audience through data collected within the apps and cache files. Mobile ad networks and push notifications remain essential tools for effective mobile marketing strategies.

- Social media ads and native ads are also essential components of mobile advertising strategies. Mobile analytics provide valuable insights into user behavior, enabling advertisers to optimize their campaigns for maximum impact. The market dynamics continue to evolve, with innovations in ad formats, targeting, and measurement driving growth. Brand safety is a crucial consideration in mobile advertising, with interstitial ads and reward video ads being effective formats. Programmatic advertising allows for real-time bidding and automated insertion of ads, increasing efficiency and reach. Ad fatigue is a concern, and creative ad design plays a vital role in maintaining user engagement and high click-through rates (CTR).

What are the market trends shaping the Mobile Advertising Industry?

- Programmatic advertising is currently experiencing significant growth, positioning it as the next major market trend. This trend signifies a shift towards automated, data-driven media buying, increasing efficiency and precision in digital advertising campaigns. Programmatic advertising has become a valuable tool for businesses seeking user acquisition and user retention through digital channels. This approach offers several advantages that encourage marketers and advertisers to invest in programmatic advertising. Real-time data and insights are among the key benefits, enabling advertisers to make adjustments during campaigns for optimal effectiveness.

- Additionally, programmatic advertising employs audience targeting, conversion rate optimization, and real-time bidding (RTB) through supply-side platforms (SSPs) to reach the right audience at the right time with the most relevant ads. Furthermore, video ads and banner ads can be utilized to cater to various marketing objectives. Data privacy is a priority in programmatic advertising, ensuring user data is protected and used ethically. Overall, programmatic advertising offers a streamlined, efficient, and effective solution for businesses looking to engage their audience and drive growth. They can gain a deeper understanding of their audience and communicate with consumers in a unique and personalized way. Transparency is another crucial aspect of programmatic advertising. Advertisers can track essential metrics, such as ad placement sites, costs, and consumer views, ensuring accountability and maximizing return on investment.

What challenges does the Mobile Advertising Industry face during its growth?

- The expansion of the industry is significantly challenged by the escalating privacy and security concerns, necessitating substantial investments in safeguarding data and maintaining consumer trust. The market faces significant challenges due to increasing concerns over privacy and data security. With consumers growing more conscious of how their personal information is collected and utilized, there is a rising demand for greater transparency and control. High-profile data breaches and misuse of personal data have intensified public skepticism and regulatory scrutiny, leading to stringent regulations such as the GDPR and CCPA. This expansion aimed to capitalize on the growing gaming industry and the increasing popularity of mobile gaming.

- Location-based advertising and in-app purchases are also gaining popularity. Data analytics plays a crucial role in optimizing ad campaigns and improving user experience. Behavioral targeting and ad tracking are essential components of effective mobile advertising strategies. As the market evolves, it is essential for businesses to stay informed and adapt to the changing regulatory landscape while maintaining user trust and privacy. Adhering to these regulations can be intricate and costly for advertisers, necessitating investments in robust data security infrastructure and privacy practices. Two primary types of mobile advertising, display ads and search ads, continue to dominate the market.

Exclusive Customer Landscape

The mobile advertising market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mobile advertising market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mobile advertising market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alphabet Inc. - The company specializes in mobile advertising solutions, delivering visually engaging ads that appear on smartphones and tablets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- AppLovin Corp.

- Criteo SA

- DIGI117 Ltd.

- Digital Turbine Inc.

- DotC United Group

- EPOM

- GUMGUM Inc.

- InMobi Pte. Ltd.

- Leadbolt Pty Ltd.

- Matomy Media Group Ltd.

- Media and Games Invest SE

- Meta Platforms Inc.

- MOLOCO Inc.

- Unity Technologies Inc.

- Verizon Communications Inc.

- Yeahmobi Inc.

- Zynga Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mobile Advertising Market

- In January 2024, Google announced the launch of its new advertising solution, Google Ads for Games, allowing in-game mobile advertising through its AdMob platform (Google, 2024).

- In March 2024, Facebook and Meta Platforms Inc. signed a strategic partnership with Amazon to integrate Amazon's advertising platform into Facebook's Audience Network, enabling advertisers to reach Facebook users on Amazon's mobile apps and websites (Reuters, 2024). This collaboration expanded the reach of both companies' advertising offerings and provided advertisers with more options to target their audiences.

- In May 2024, Verizon Media Group completed the acquisition of Fluent, a leading people-based marketing and measurement platform, for approximately USD 310 million (Bloomberg, 2024). This acquisition strengthened Verizon Media's advertising capabilities by integrating Fluent's technology and data to enhance its targeting and measurement offerings in the market.

- In April 2025, Apple introduced App Tracking Transparency (ATT), a new privacy feature in iOS 14.5, requiring apps to ask users for permission before tracking their data for targeted advertising (Apple, 2025). This significant policy change impacted the mobile advertising industry, forcing advertisers to adapt their strategies and focus on contextual and interest-based targeting.

Research Analyst Overview

In the dynamic market, user experience (UX) and mobile app development continue to shape the industry's trajectory. Push notifications and interactive ads, powered by AI-driven predictive modeling, enhance user engagement. Performance marketing thrives through marketing automation, attribution modeling, and cross-channel attribution. Mobile wallet integration and in-app messaging streamline transactions and communication. SMS marketing and rich media ads expand reach, while call-to-action (CTA) optimization drives conversions. User interface (UI) design and creative testing ensure visually appealing and effective ad campaigns. Affiliate marketing and influencer marketing expand brand reach, and email marketing remains a staple for targeted customer segmentation. Mobile payment gateways facilitate seamless transactions, while mobile advertising platforms offer analytics and transparency to optimize campaigns.

Cross-device tracking fuels personalized advertising and improved campaign performance. The Mobile Advertising Market is undergoing dynamic transformation with the integration of AI-powered advertising, enabling real-time personalization and predictive targeting across mobile platforms. Brands are leveraging intelligent algorithms to deliver tailored messages that resonate with users' behaviors and preferences. As competition intensifies, the art of ad copywriting becomes more critical, combining creativity with data to craft compelling messages that drive clicks and conversions. Simultaneously, sleek and intuitive mobile design ensures that ads blend seamlessly into user interfaces, enhancing engagement without disrupting the mobile experience.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mobile Advertising Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.3% |

|

Market growth 2025-2029 |

USD 430.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.1 |

|

Key countries |

US, China, Canada, Mexico, India, Japan, UK, Germany, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mobile Advertising Market Research and Growth Report?

- CAGR of the Mobile Advertising industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mobile advertising market growth of industry companies

We can help! Our analysts can customize this mobile advertising market research report to meet your requirements.