Nanocomposites Market Size 2024-2028

The nanocomposites market size is forecast to increase by USD 11.95 billion, at a CAGR of 21.48% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for lightweight materials in various industries, including aerospace and defense, medical, electrical and electronics, and energy. Nanocomposites, which consist of a polymer matrix reinforced with nanoscale particles of metals, ceramics, or other materials, offer superior strength, durability, and functionality compared to traditional materials. However, the high cost of production is a major challenge limiting the widespread adoption of nanocomposites. In the aerospace and defense sector, nanocomposites are being used to manufacture lightweight and strong components for aircraft and military vehicles.

- In the medical industry, nanocomposites are being used to develop advanced medical devices and implants. In the electrical and electronics sector, nanocomposites are being used to enhance the performance of batteries and capacitors. In the energy sector, nanocomposites are being used to improve the efficiency and durability of solar panels and fuel cells. Despite the challenges, the market for nanocomposites is expected to continue growing due to their unique properties and increasing applications in various industries.

What will be the Size of the Nanocomposites Market During the Forecast Period?

- The market is witnessing significant growth due to the unique properties these materials offer in various industries, including electronics, aerospace and defense, medical, and biotechnology. The incorporation of nanoparticles, such as single-walled carbon nanotubes and nanoclays, into polymers and other materials results in nanocomposites with enhanced semiconductor qualities. In the electronic industry, nanocomposites have gained popularity for their adaptability and flexibility in creating advanced packaging materials. These materials offer improved gas transmission rates, essential for protecting sensitive electronic components from environmental factors. Moreover, nanocomposites' oxidation-related resistance ensures extended shelf life, a crucial factor for the longevity of electronic devices.

- Nanocomposites also find extensive applications in the convenience food industry. For instance, nanoparticles like surfactants and additives are used to enhance the properties of packaging materials, ensuring better protection against moisture and preserving the freshness of precooked food items. The automotive sector, specifically in the production of quadricycles, also benefits from nanocomposites. These materials contribute to the manufacturing of lightweight and durable components, reducing overall vehicle weight and improving fuel efficiency. In the case of General Motors, nanocomposites are used as an anticorrosion barrier, ensuring the longevity of automotive parts. In the aerospace and defense industry, nanocomposites are utilized for their exceptional strength and durability.

How is this Nanocomposites Industry segmented and which is the largest segment?

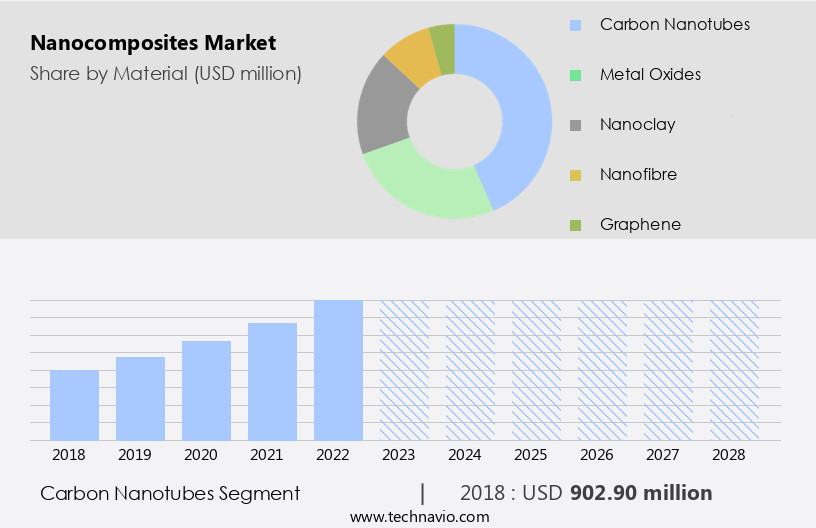

The nanocomposites industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Carbon nanotubes

- Metal oxides

- Nanoclay

- Nanofibre

- Graphene

- Application

- Packaging

- Electronics and semiconductors

- Automotive

- Coatings

- Aerospace and defense

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- France

- Middle East and Africa

- South America

- APAC

By Material Insights

- The carbon nanotubes segment is estimated to witness significant growth during the forecast period.

Carbon nanotubes (CNTs) and graphene nanoparticles are revolutionizing the materials industry by enhancing the properties of composite materials. These nanomaterials offer significant improvements in strength, stiffness, and thermal conductivity, making them valuable additives for various end-user industries. In particular, aerospace, automotive, and construction sectors are incorporating CNTs and graphene nanoparticles to develop lightweight yet strong components. Beyond structural applications, CNTs are being explored for energy storage solutions, such as batteries and supercapacitors, due to their high surface area and conductivity. These nanomaterials are also being studied for use in fuel cells and solar PV cells, contributing to the development of high-performance nanocomposites.

Moreover, the use of CNTs and graphene nanoparticles aligns with the growing trend toward green technologies and sustainable practices. By improving energy efficiency and reducing the environmental impact of chemicals, these nanomaterials contribute to a more eco-friendly industrialization process. The versatility and exceptional properties of CNTs and graphene nanoparticles make them a valuable asset In the production of advanced nanocomposites with a wide range of applications.

Get a glance at the market report of the share of various segments Request Free Sample

The carbon nanotubes segment was valued at USD 902.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

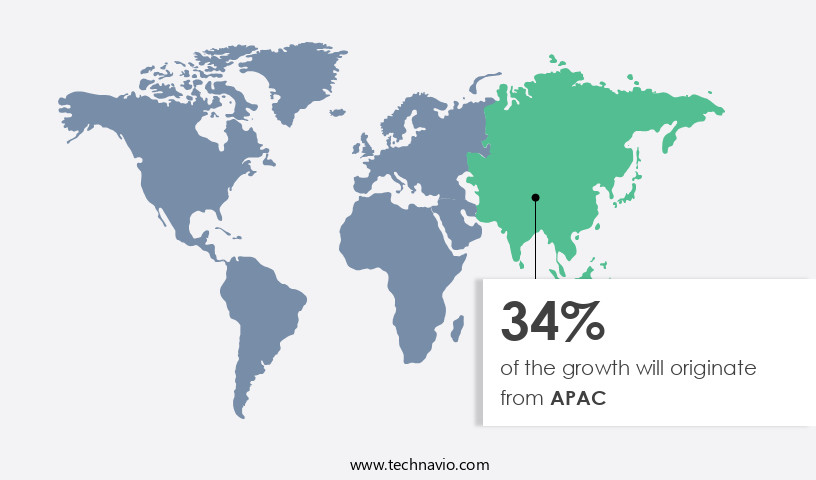

- APAC is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In Asia Pacific (APAC), the economies of China, India, Japan, South Korea, and others are experiencing rapid industrialization, urbanization, and infrastructure development. This region is a global leader in manufacturing, particularly in the sectors of general manufacturing and electronics. Nanocomposites, which are advanced materials made by combining polymers, metals, ceramics, nanoclay, graphene, and nanofibers, are increasingly being used in various manufacturing processes. In the automotive industry, nanocomposites enhance fuel efficiency, safety, and overall vehicle performance by reducing weight and improving strength. In the electronics sector, these materials are essential for creating advanced electronic components, devices, and packaging materials. The APAC electronics industry is vast, making nanocomposites indispensable In the production of high-tech gadgets and sophisticated electronic systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Nanocomposites Industry?

- Nanocomposite coatings are gaining traction as the key driver of the market. Nanocomposite coatings have gained significant attention in numerous industries due to their semiconductor qualities and adaptability. These coatings comprise nanoscale particles embedded in a matrix material, resulting in enhanced properties and functionality. Notably, nanocomposites offer reduced friction and wear, making them indispensable in applications involving sliding or rotating components, such as bearings, gears, and cutting tools.

- Moreover, they can boost thermal and electrical conductivity, rendering them essential in applications requiring efficient heat dissipation or electrical conduction. In the realm of healthcare, nanocomposite coatings are utilized in medical devices and implants to augment biocompatibility, minimize friction, and prevent bacterial growth on implant surfaces.

What are the market trends shaping the Nanocomposites Industry?

High demand for lightweight materials is the upcoming market trend.

- Nanocomposites, which are materials consisting of a matrix phase and dispersed nanoscale particles, have gained significant attention in various industries due to their exceptional properties. In the aerospace and defense sector, nanocomposites are utilized for their high strength-to-weight ratios, making them indispensable in reducing the weight of components. This weight reduction results in increased aircraft capacity or fuel efficiency, leading to improved economics and reduced environmental impact.

- Similarly, in the medical field, nanocomposites are employed for their biocompatibility and enhanced mechanical properties, contributing to the development of advanced medical devices. The electrical and electronics industry leverages nanocomposites for their superior electrical conductivity and insulation properties, enhancing the performance of electronic components. Furthermore, nanocomposites play a crucial role In the energy sector by improving the efficiency and durability of batteries and fuel cells. Both polymer matrix, metal matrix, and ceramic matrix nanocomposites find extensive applications In these industries, making them a vital component of sustainable and efficient manufacturing processes.

What challenges does the Nanocomposites Industry face during its growth?

High cost of production of nanocomposites is a key challenge affecting the industry growth.

- Nanocomposites, a class of advanced materials composed of nanoscale particles dispersed in a matrix, have gained significant attention due to their unique properties and potential applications in various industries. However, the production of nanocomposites comes with certain challenges that can impact their market growth. One such challenge is the high cost associated with the production of nanocomposites. The use of specialized equipment, precise manufacturing techniques, and high-quality nanoparticles necessitates higher production costs when compared to traditional materials. Furthermore, comprehensive testing and characterization are essential to ensure that nanocomposites meet the required quality standards in various end-user industries, leading to additional costs due to the use of specialized equipment and the need for skilled personnel.

- Moreover, the sensitivity of nanocomposites to environmental factors, such as moisture and shelf life, can pose challenges in industries that deal with convenience foods, such as precooked meals. For instance, in the automotive industry, the use of nanocomposites in the production of quadricycles by manufacturers like General Motors requires stringent testing to ensure their durability and performance under varying conditions. Despite these challenges, the nanoparticles market is expected to grow significantly due to the increasing demand for lightweight and high-performance materials in various industries.

Exclusive Customer Landscape

The nanocomposites market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nanocomposites market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nanocomposites market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Arkema SA

- BASF SE

- Briggs Automotive Co.

- Cabot Corp.

- Celanese Corp.

- eSpin Technologies Inc.

- Evonik Industries AG

- Inframat Corp.

- Integran Technologies Inc

- Makevale Group

- Miller Waste Mills Inc.

- Minerals Technologies Inc.

- Nanocyl SA

- NanoSonic Inc.

- Pixelligent

- PlasmaChem GmbH

- Ultramet

- Unitika Ltd.

- Zyvex Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Nanocomposites, a class of materials engineered by integrating nanoparticles into a polymer, metal, or ceramic matrix, have gained significant traction in various industries due to their semiconductor qualities. In the electronic packaging materials sector, nanocomposites offer adaptability and flexibility, making them suitable for use in microelectronics and other advanced electronic applications. The nanoparticles market, including graphene nanoparticles, carbon nanotubes, and nanoclays, is witnessing growth in the aerospace and defense, medical, electrical and electronics, energy, and industrialization sectors. The use of nanocomposites in these industries is driven by their excellent gas transmission rate, oxidation resistance, and long shelf life.

In the consumer lifestyle segment, nanocomposites are used in the production of precooked convenience food packaging due to their non-corrosive properties and ability to withstand high temperatures. Further, the automotive industry also utilizes nanocomposites in the manufacturing of quadricycles and vehicles by General Motors for their lightweight and high-strength properties. Nanocomposites are also finding applications in biotechnology, where they are used in the production of ultrasound probes and surfactants. In the energy sector, nanocomposites are used as anticorrosion barriers and in the production of polymers, metals, and ceramics. The leading market players in the market include Chasm Advanced Materials, Nanosonics, and Birla Carbon.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.48% |

|

Market growth 2024-2028 |

USD 11.95 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.41 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nanocomposites Market Research and Growth Report?

- CAGR of the Nanocomposites industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nanocomposites market growth of industry companies

We can help! Our analysts can customize this nanocomposites market research report to meet your requirements.