Nanosilica Market Size 2024-2028

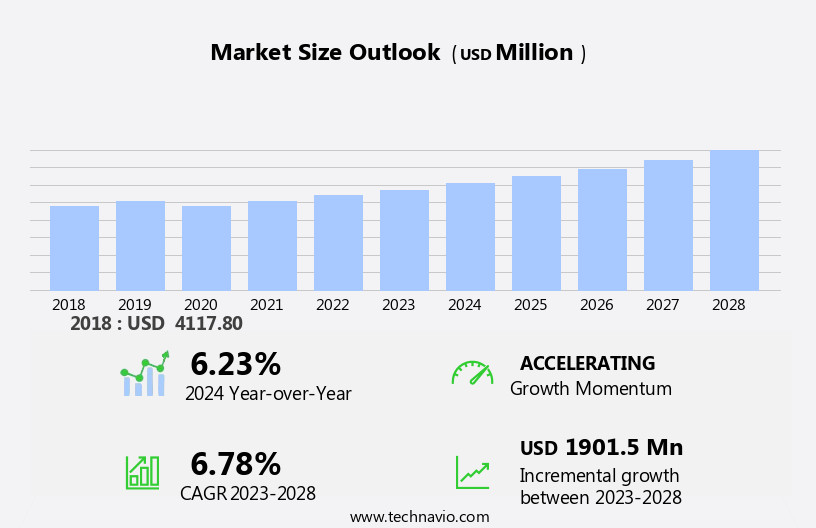

The nanosilica market size is forecast to increase by USD 1.9 billion, at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for nanotechnology in various industries, particularly in the sectors of electronics and healthcare. The miniaturization trend in technology is driving this demand, as nanosilica's unique properties enable the production of smaller, more efficient components. However, the high cost of manufacturing nanosilica poses a significant challenge for market growth. This cost barrier may limit the adoption of nanosilica in mass production applications, requiring continued research and development efforts to reduce production costs and expand the market's reach.

- Companies seeking to capitalize on the opportunities presented by the market must navigate this challenge effectively, potentially through partnerships, economies of scale, or process optimization strategies. Overall, the market holds great potential for innovation and growth, with the ability to transform industries and create new applications in the realms of electronics, energy, and healthcare.

What will be the Size of the Nanosilica Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

Nanosilica, a form of silica with a high specific surface area, continues to gain traction in various industries due to its versatile properties. This nanomaterial offers enhanced performance in applications such as rheology modification, reinforcement, thermal conductivity, and insulation materials. In the realm of concrete, nanosilica enhances mechanical strength and water repellency through surface modification and hydrophobic treatment. In the insulation sector, nanosilica's high specific surface area and particle size distribution contribute to improved insulation properties. As a catalyst support, it offers increased efficiency and selectivity in chemical reactions. In food additives, nanosilica's hydrophobic treatment and particle engineering lead to innovative solutions for texture improvement and stabilization.

The evolving market dynamics of nanosilica are further influenced by its application in catalyst support, where it demonstrates synergistic effects with other additives. In the field of particle size distribution and surface area, advancements in precipitated silica and colloidal silica production continue to shape the industry. Nanosilica's surface chemistry, including hydrophilic treatment and silane coupling agents, expands its potential in various sectors, such as drug delivery and dental materials. Its applications in flame retardancy, transmission electron microscopy, and scanning electron microscopy further highlight its role in material science research and development. The continuous unfolding of market activities surrounding nanosilica is marked by ongoing research and development efforts, focusing on improving dispersion stability, pore size distribution, and bulk density.

As the industry evolves, nanosilica's role in enhancing the properties of various materials is becoming increasingly significant.

How is this Nanosilica Industry segmented?

The nanosilica industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- P type

- S type

- Type III

- Application

- Rubber

- Coatings

- Healthcare and medicine

- Plastics

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

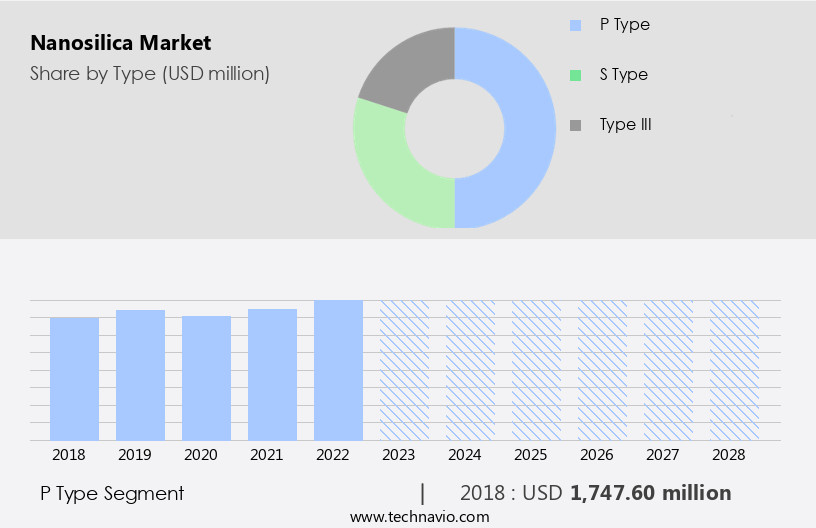

The p type segment is estimated to witness significant growth during the forecast period.

Nanosilica, a type of silica with particles in the nanometer range, is a versatile material used in various industries due to its unique properties. Two primary types, S-type and P-type, differ in their structure and surface characteristics. S-type nanosilica has a spherical shape and a smaller specific surface area (SSA), while P-type, also known as porous nanosilica, contains nanopores and exhibits a larger SSA and higher UV reflectivity. P-type nanosilica's large surface area and amorphous nature make it suitable for applications in coatings, gypsum, batteries, paints, adhesives, and cosmetics. In the coatings industry, it functions as a rheology modifier, reinforcement agent, and viscosity controller.

In high-performance concrete, it improves mechanical strength and thermal conductivity. As an insulation material, it enhances flame retardancy and provides controlled release properties. In catalyst support, it ensures dispersion stability and silane coupling agent efficiency. In food additives, it offers hydrophobic treatment and particle engineering for improved texture and shelf life. The global market for these applications is expected to grow significantly due to factors such as increasing construction activities, particularly in developing regions, and the demand for advanced materials in various industries. Nanosilica also finds applications in dental materials, drug delivery systems, and hydrophilic treatment for specific surface modifications.

Its unique properties, including chemical resistance, abrasion resistance, and pore size distribution, contribute to its wide usage and the market's continued expansion.

The P type segment was valued at USD 1.75 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

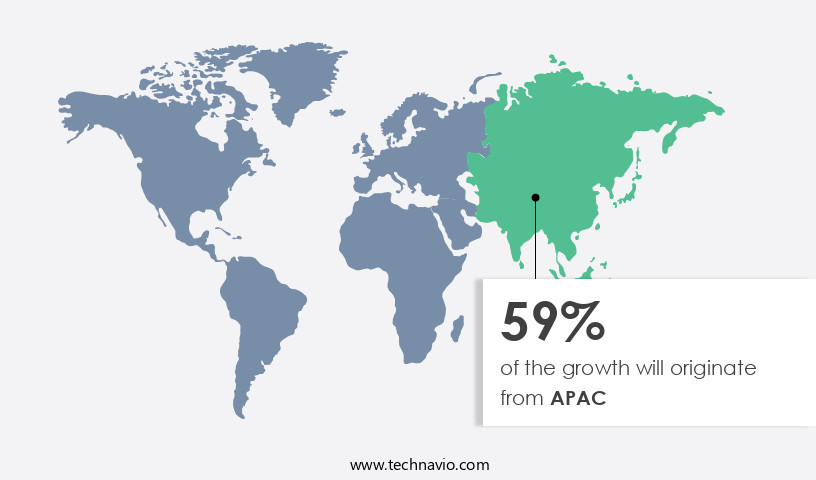

APAC is estimated to contribute 59% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Nanosilica, a versatile nanomaterial, finds extensive applications in various industries due to its unique properties, including rheology modification, reinforcement, thermal conductivity enhancement, and chemical resistance. The global market for nanosilica is witnessing significant growth, driven by its use in high-performance concrete, insulation materials, catalyst support, food additives, and other applications. APAC is the largest and fastest-growing regional market for nanosilica, fueled by the expansion of end-user industries such as consumer durables, electrical and electronics, automotive, and construction in countries like China, Japan, and India. These economies' low labor and operating costs, coupled with improved business standards, contribute to their dominance in the market.

China, in particular, is a significant consumer of nanosilica due to its large population and robust manufacturing sector. Nanosilica's small particle size, high surface area, and ability to form dispersions make it an essential ingredient in various industries. Its hydrophobic and hydrophilic treatments, surface modification, and synergistic effects with other additives further expand its applications. Nanosilica's particle engineering, dispersion stability, and surface chemistry are crucial factors influencing its performance in various applications. Additionally, its use in drug delivery, dental materials, and flame retardancy adds to its market potential. Transmission electron microscopy and scanning electron microscopy are commonly used to analyze the morphology and structure of nanosilica particles.

Silane coupling agents and colloidal silica are often used in conjunction with nanosilica to enhance its properties. Bulk density, mechanical strength, and pore size distribution are essential parameters in evaluating the performance of nanosilica in different applications. In summary, The market is experiencing robust growth, driven by its diverse applications in various industries and regions, particularly in APAC.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Nanosilica Industry?

- The significant surge in demand for nanotechnology serves as the primary catalyst for market growth.

- Nanosilica, a type of nanoparticle, is increasingly utilized in various industries due to its ability to enhance the physical properties of composites. In the realm of paints and coatings, concrete, and plastics, nanosilica acts as a filler or additive, imparting hardness, UV resistance, scratch resistance, and antistatic properties. Its incorporation into nanocoatings significantly boosts their performance, with unique properties such as high surface area, mechanical strength, and thermal stability. The growing emphasis on health and hygiene is fueling demand for nanocoatings in sectors like food packaging and pharmaceuticals. Furthermore, nanosilica offers additional benefits such as viscosity control, chemical resistance, and controlled release.

- In the realm of rheology modifiers, reinforcement agents, and matting agents, nanosilica exhibits synergistic effects, enhancing the overall performance of the materials. Its thermal conductivity and UV resistance make it an attractive option for high-performance applications. Anti-blocking agents also benefit from the use of nanosilica, ensuring smooth and consistent coatings.

What are the market trends shaping the Nanosilica Industry?

- The demand for miniaturization and microelectronics is escalating, representing a significant market trend. This trend is driven by the increasing need for compact and efficient technology solutions.

- Nanosilica, a type of precipitated silica, is a versatile advanced functional material with a high specific surface area, making it an ideal choice for various industries. In the construction sector, it enhances the properties of high-performance concrete by improving its workability and increasing its strength. In insulation materials, nanosilica acts as a catalyst support and provides excellent hydrophobic treatment, leading to improved water repellency and abrasion resistance. Moreover, in the manufacturing of food additives, nanosilica's particle size distribution and surface area contribute to better dispersion and improved product quality. Surface modification techniques like hydrophobic treatment and surface area expansion are used to enhance the properties of nanosilica for specific applications.

- The increasing demand for miniaturized components in various industries, including electronics, is driving the growth of the market. Its ability to form extremely thin conductors and interconnects makes it an essential material for advanced functional material-based miniature electronics, reducing power consumption and improving device performance. The customized offerings and the growing emphasis on product miniaturization are expected to further fuel the demand for nanosilica. With its unique properties, nanosilica is a valuable addition to various industries, contributing to innovation and efficiency.

What challenges does the Nanosilica Industry face during its growth?

- The escalating manufacturing costs represent a significant barrier to growth within the industry.

- Nanosilica, a nanomaterial with unique properties, is produced through intricate and costly manufacturing processes. These methods necessitate the use of specialized equipment and significant energy consumption. Consequently, high production costs limit the widespread adoption and market penetration of nanosilica. The energy-intensive nature of nanosilica production requires high heat and pressure to bond the nanomaterial. This results in increased costs for manufacturers, which can ultimately lead to higher prices for consumers. The affordability of nanosilica may be a barrier for its use in various industries, as companies may be reluctant to incorporate it into their products due to the added expense.

- Nanosilica's unique properties, such as its pore size distribution and surface chemistry, make it valuable in various applications, including flame retardancy, transmission electron microscopy, dispersion stability, scanning electron microscopy, particle engineering, silane coupling agents, and drug delivery systems. In the field of dental materials, nanosilica's properties contribute to improved performance and functionality. Despite its benefits, the high production cost remains a significant challenge for the market's growth.

Exclusive Customer Landscape

The nanosilica market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nanosilica market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nanosilica market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bee Chems - The company specializes in providing advanced nanosilica solutions, including colloidal silica and concrete enhancements like colloidal silica concrete and the Concrete Densifier. These innovative offerings improve material properties, enhancing durability and performance in various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bee Chems

- Cabot Corp.

- Dr. Khan Industrial Consultants Pvt. Ltd.

- Evonik Industries AG

- Fortis Life Sciences

- Fuso Chemical Co. Ltd.

- NanoPore Inc.

- Nanostructured Materials Inc.

- Normet Group Oy

- Nouryon

- US Research Nanomaterials Inc.

- Wacker Chemie AG

- Xetek Industries Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Nanosilica Market

- In January 2024, Hanwha Chemical, a leading nanomaterials manufacturer, announced the commercial launch of its new high-purity nanosilica product line, SilicaOne, aimed at the electronics industry (Hanwha Chemical Press Release, 2024). In March 2024, Evonik Industries AG, a German specialty chemicals company, entered into a strategic partnership with the University of Cambridge to research and develop advanced nanosilica applications in the field of catalysis (Evonik Industries AG Press Release, 2024).

- In April 2024, Merck KGaA, a global life science and technology company, completed the acquisition of Versum Materials, a leading supplier of specialty materials for semiconductor manufacturing, significantly expanding its presence in the electronics industry and gaining access to Versum's advanced nanosilica technology (Merck KGaA Press Release, 2024). In May 2025, the European Union's REACH regulation approved the use of nanosilica in food contact materials, marking a significant milestone for the market's expansion into the food industry (European Chemicals Agency Press Release, 2025). These developments underscore the growing importance of nanosilica in various industries and the continuous efforts of key players to innovate and expand their offerings.

Research Analyst Overview

- Nanosilica, a key ingredient in hybrid materials and composite industry, undergoes rigorous performance evaluation to meet the demands of various applications. Microporous and powder silicas, derived from high-purity silica through surface treatment, ensure quality control in producing functionalized silica for polymer composites. Reactive and modified silicas are subjected to application testing using spray drying and sol-gel process for size reduction, resulting in ultrafine silica. Amorphous and crystalline silicas, including silica aerogel and xerogel, are essential in ceramic composites, while mesoporous silica plays a crucial role in chemical vapor deposition.

- Flame hydrolysis and size reduction techniques contribute to the production of granular and silica slurry. The silica sol market witnesses continuous growth due to the versatility of silica nanoparticles in diverse industries. Regardless, maintaining product specification and ensuring consistent quality remains a priority in the market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Nanosilica Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 1901.5 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nanosilica Market Research and Growth Report?

- CAGR of the Nanosilica industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nanosilica market growth of industry companies

We can help! Our analysts can customize this nanosilica market research report to meet your requirements.