Petroleum Liquid Feedstock Market Size 2024-2028

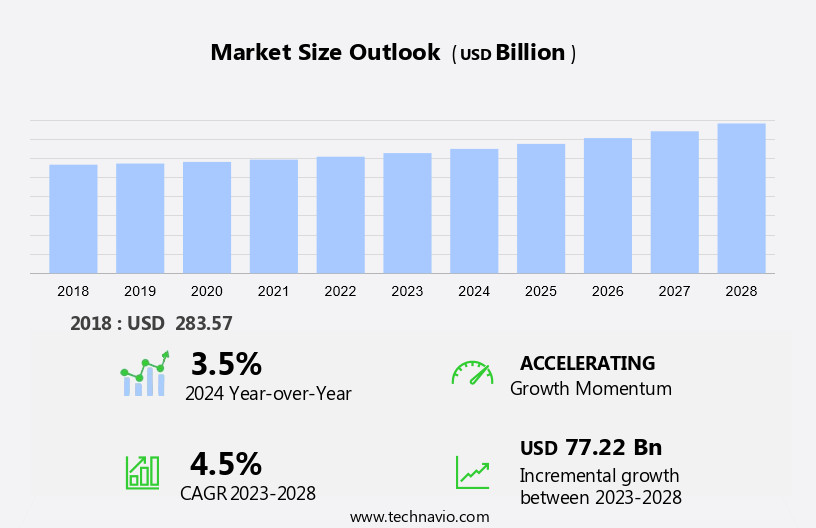

The petroleum liquid feedstock market size is forecast to increase by USD 77.22 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by the rapid expansion of the transportation sector. This sector's increasing demand for fuel is leading to a wave in the consumption of petroleum liquid feedstocks. Another trend influencing the market is the adoption of blockchain technology in the oil and gas refining industry. Blockchain's transparency and security features are expected to streamline operations, reduce costs, and enhance efficiency in the refining process. Hydrocarbons, such as naphthalene, xylene, benzene, toluene, and heavy naphtha, are essential hydrocarbon feedstocks used in the production of industrial solvents, fuels, and other oil-based commodities. However, the market's growth is not without challenges. The volatility in global crude oil prices continues to pose a significant threat to market stability, making it essential for market players to adopt strategies that mitigate price risks and ensure long-term profitability.

The petrochemical industry relies heavily on petroleum liquid feedstocks as the primary raw material for producing a wide range of chemicals, polymers, and other petrochemical products. The automotive fleet and the energy sector are significant consumers of these products, with motor vehicles utilizing petrochemicals for fuel and in the production of plastics and textiles. Petrochemical plants and refineries are the primary sources of these feedstocks, which include oil naphtha, coal naphtha, and wood naphtha.

The petrochemical industry's demand for these feedstocks is expected to grow due to increasing demand from the automotive and energy sectors. Crude material, such as unrefined petroleum, is the primary source of these feedstocks. Oil organizations play a crucial role in the production and distribution of these feedstocks to meet the growing demand from various industries. With the rise of electric vehicles, the demand for traditional fuels may decrease, but the demand for petrochemical products derived from these feedstocks is expected to remain strong due to their wide range of applications.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Naphtha

- Gasoil

- Application

- Industrial solvents

- Cleaning fluids

- Adulterant to petrol

- Gasoline

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Type Insights

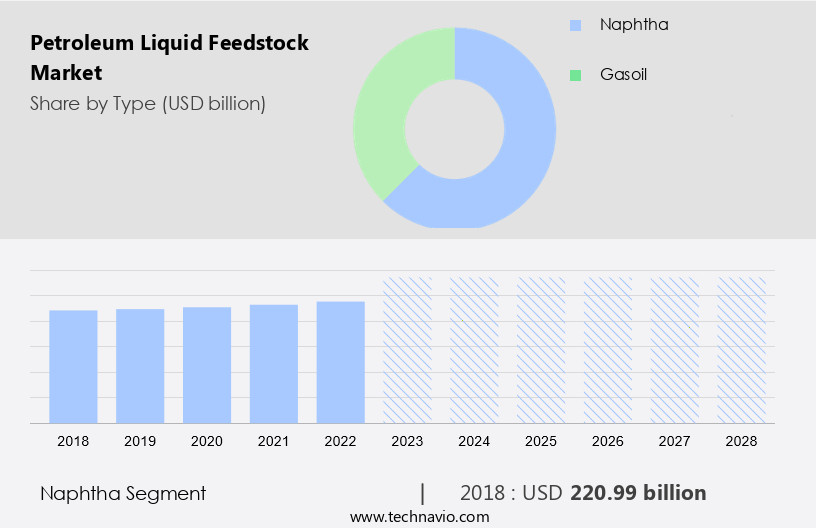

The naphtha segment is estimated to witness significant growth during the forecast period. The petrochemical industry relies heavily on petroleum liquid feedstock derived from crude oil for the production of various chemicals, polymers, and petrochemical products. In the refining process, crude oil undergoes primary distillation, resulting in the production of naphtha. This fractional distillation separates hydrocarbons based on their boiling points, yielding light and heavy naphtha. Light naphtha is primarily used as a feedstock for the synthesis of ethylene, which is further processed to produce synthetic rubber and other essential polymers. Conversely, heavy naphtha serves as a feedstock for the production of high-octane gasoline and aromatics, such as benzene, xylene, and toluene, essential for the automotive fleet and energy sector.

Moreover, naphtha is also used as marine fuel, bunkers, and motor vehicle fuel. With the increasing focus on cleaner energy sources and climate change mitigation, the petrochemical industry is exploring alternative feedstocks, such as biofuels, renewable feedstocks, biomass, waste oils, and even carbon fiber. Simultaneously, the exploration of unconventional crude oil deposits, including shale gas and offshore drilling, continues to expand refinery capacity. Data analytics plays a crucial role in optimizing refinery operations and enhancing the overall efficiency of the petrochemical sector. The chemical sector also utilizes naphtha, coal naphtha, and other hydrocarbons as feedstocks for steam crackers to produce essential chemicals, such as octane, propylene, and butadiene.

The integration of LNG terminals and gas imports further expands the availability of feedstocks, ensuring a steady supply to meet the growing demand for petrochemical products in various industries, including textiles, plastics, and the energy sector.

Get a glance at the market share of various segments Request Free Sample

The Naphtha segment accounted for USD 220.99 billion in 2018 and showed a gradual increase during the forecast period.

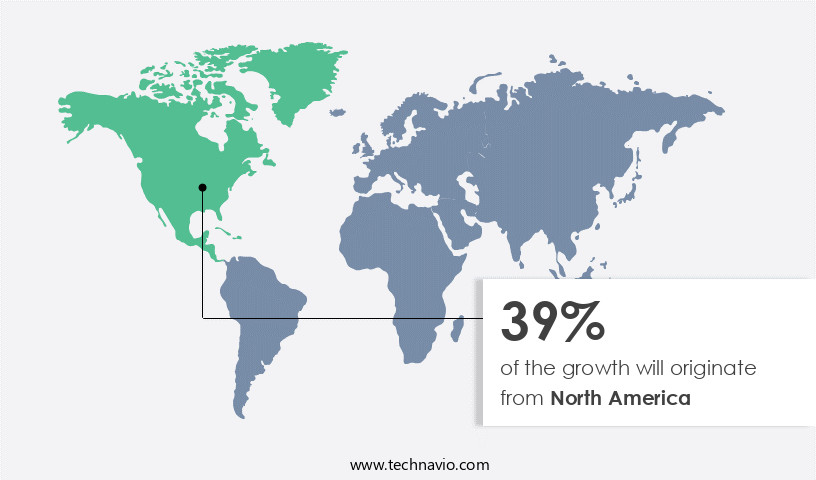

Regional Insights

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is driven by the abundant availability of crude material from countries such as the US, Canada, and Mexico. This crude oil serves as the crude material for the production of essential feedstocks like naphtha and gas oil in refineries. The shale revolution in the US has resulted in an ample supply of raw materials, leading to the expansion of the refining sector in the region. In Canada, the integration of oil organizations ensures a consistent supply of feedstock from oil sands. The transportation sector, particularly automobiles, dominates the demand for fuels like gasoline and diesel in North America.

In 2023, the consumption of these fuels has waved, with the automotive industry continuing to be a significant consumer. Additionally, the chemical industries rely on feedstocks like pentane, paraffin, naphthenes, and aromatics such as xylene, benzene, and toluene for the production of industrial solvents, cleaning fluids, and other essential products. The transition towards electric vehicles is expected to impact the demand for traditional fuels, but the growth of heavy industries and the continued reliance on spark-ignited internal combustion engines in various applications will ensure the ongoing demand for petroleum liquid feedstocks in North America. The construction of new greenfield refineries is also expected to boost the market growth in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Petroleum Liquid Feedstock Market Driver

The rapid growth of transportation sector is the key driver of the market. The Petrochemical industry plays a significant role in the economic development of various sectors, including the automotive fleet and the energy sector. The increasing demand for petrochemical products, such as polymers, naphthalene, and synthetic rubber, has led to a wave in refinement capacity and the production of chemicals and polymers. The automotive industry, in particular, relies heavily on petrochemicals for the manufacturing of motor vehicles and engine vehicles. Naphtha, derived from crude oil or coal, is a primary feedstock used in the production of petrochemicals. The market has seen significant growth due to the increasing demand for petrochemicals in various industries, including textiles, plastics, and the chemical sector.

The energy sector also utilizes petroleum liquid feedstocks as marine fuel and bunkers. The exploration and production of crude oil deposits, offshore drilling, shale gas, and biofuels and renewable feedstocks, such as biomass, waste oils, and carbon fiber, are crucial to meeting the growing demand for petrochemicals. The use of data analytics and the shift towards cleaner energy sources, such as LNG terminals and gas imports, are also driving changes in the petrochemical industry. The petrochemical industry's growth is evident in the increasing refinery capacity and the production of hydrocarbons, such as ethylene and octane, used in the manufacturing of petrochemical products.

The demand for these products is expected to continue growing, driven by the increasing production of automobiles and commercial vehicles, as well as the demand for steam crackers and other petrochemical plants.

Petroleum Liquid Feedstock Market Trends

The adoption of blockchain in the oil and gas refining industry is the upcoming trend in the market. The Petrochemical industry relies heavily on petroleum refineries to produce essential feedstocks such as naphtha, which are further processed into chemicals, polymers, and other petrochemical products. The automotive fleet and energy sector are significant consumers of these petrochemicals, with motor vehicles and engine vehicles utilizing synthetic rubber, ethylene, octane, and steam crackers for fuel production. However, the refining process faces numerous challenges, including the complexity of logistics, particularly in regions with limited refinery capacity. Moreover, the energy sector's transition towards cleaner energy sources, such as biofuels and renewable feedstocks derived from biomass, waste oils, and carbon fiber, poses a threat to traditional petroleum refineries.

The exploration and production of unconventional resources, such as shale gas, offshore drilling, and crude oil deposits, require data analytics to optimize refinery operations and improve efficiency. Climate change concerns and the need for carbon reduction have led to the development of LNG terminals, gas imports, and the chemical sector's shift towards hydrocarbons and oil naphtha alternatives. The refining industry must address these challenges to maintain competitiveness and meet the evolving demands of various industries.

Petroleum Liquid Feedstock Market Challenge

The volatility in global crude oil prices is a key challenge affecting market growth. The market plays a pivotal role in the petrochemical industry, supplying essential raw materials for the production of various petrochemical products, including polymers, naphthalene, and chemicals. These feedstocks, primarily derived from naphtha and crude oil, are integral to the manufacturing of textiles, plastics, synthetic rubber, and steam crackers used to produce ethylene and octane. The automotive fleet and energy sector are significant consumers of these petrochemical products, with motor vehicles and engine vehicles relying on gasoline and diesel, while bunkers and marine fuel require heavy naphtha. Crude oil prices significantly influence the market, as fluctuations impact the profitability of refineries and petrochemical plants.

Lower crude oil prices can lead to the cancellation or postponement of oil and gas exploration and production projects. Conversely, the rise in shale gas exploration and offshore drilling of crude oil deposits has increased global supply, reducing the need for crude oil imports in countries like the US. The chemical sector also relies on petroleum liquid feedstocks, with steam crackers converting naphtha into ethylene, a primary building block for various polymers. The increasing focus on cleaner energy sources and climate change mitigation has led to the exploration of renewable feedstocks, such as biomass, waste oils, and biofuels, as alternatives to traditional hydrocarbons.

Data analytics plays a crucial role in optimizing refinery capacity and managing the supply chain in this dynamic market. LNG terminals and gas imports are becoming increasingly important in the petrochemical industry, providing alternative sources of feedstock for petrochemical plants. The integration of carbon fiber and other advanced materials into various industries is expected to further expand the application scope of petroleum liquid feedstocks. Overall, the market is a critical component of the global energy and chemical sectors, with its dynamics influenced by various factors, including crude oil prices, exploration trends, and the shift towards cleaner energy sources.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BP Plc

- CEF Group

- Chevron Corp.

- China National Petroleum Corp.

- Eni SpA

- Equinor ASA

- Exxon Mobil Corp.

- Gazprom Nedra LLC

- Hindustan Petroleum Corp. Ltd.

- Idemitsu Kosan Co. Ltd.

- Koch Industries Inc.

- Kuwait Petroleum Corp.

- Nayara Energy Ltd.

- Reliance Industries Ltd.

- Rosneft Deutschland GmbH

- Saudi Arabian Oil Co.

- Shell plc

- TotalEnergies SE

- YPF SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The petrochemical industry relies heavily on petroleum liquid feedstocks, particularly naphtha, for the production of various chemicals, polymers, and petrochemical products. The automotive fleet and energy sector are significant consumers of these products, with motor vehicles and engine vehicles utilizing synthetic rubber, ethylene, octane, and other petrochemicals. Refineries play a crucial role in the production of naphtha through the refinement of crude oil, hydrocarbons, and oil naphtha. The exploration and production sector, including offshore drilling and shale gas, contribute to the availability of crude oil deposits. However, the increasing focus on cleaner energy sources, climate change mitigation, and the adoption of renewable feedstocks, such as biomass, biofuels, waste oils, and LNG terminals, are posing challenges to the petrochemical industry.

Further, the chemical sector also utilizes naphtha in the production of steam crackers, which are essential for the manufacture of ethylene and other essential chemicals. The market is expected to witness significant growth due to the increasing demand for polymers, textiles, plastics, and other petrochemical products. Data analytics is also being employed to optimize refinery capacity and improve the overall efficiency of the petrochemical industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 77.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Bharat Petroleum Corp. Ltd., BP Plc, CEF Group, Chevron Corp., China National Petroleum Corp., Eni SpA, Equinor ASA, Exxon Mobil Corp., Gazprom Nedra LLC, Hindustan Petroleum Corp. Ltd., Idemitsu Kosan Co. Ltd., Koch Industries Inc., Kuwait Petroleum Corp., Nayara Energy Ltd., Reliance Industries Ltd., Rosneft Deutschland GmbH, Saudi Arabian Oil Co., Shell plc, TotalEnergies SE, and YPF SA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch