Natural Antioxidants Market Size 2024-2028

The natural antioxidants market size is forecast to increase by USD 669.6 million at a CAGR of 7.07% between 2023 and 2028.

- The market is experiencing significant growth due to increasing demand from the cosmetics business and the nutraceutical industry. Pine, Acerola seed, green tea, and other plant-derived antioxidants are gaining popularity in both dry and liquid forms. Tocopherols, derived from natural sources, are also in high demand. The market is witnessing significant growth due to the increasing demand for Cosmetics and organic skincare products with natural ingredients. However, the high cost of natural antioxidants is a challenge for market growth. Synthetic antioxidants derived from petroleum products continue to be used due to their lower cost. The market is expected to continue its growth due to Urbanization and demands for vitamins, Carotenoids, and other antioxidants' health benefits. The trend toward a healthier diet and growing population further fuels the demand for natural antioxidants. To stay competitive, companies must focus on innovation and cost reduction while maintaining product quality.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing consumer preference for healthier food and beverage options and the rising demand for clean-label products. Antioxidants are essential compounds that inhibit the oxidation and decomposition process in various products, including processed food and dietary supplements. These compounds are naturally found in various sources such as trees, plants, nuts, roots, seeds, and leaves. The market is driven by the nutraceutical industry, which includes dietary supplements and functional foods. Consumers are increasingly turning to these products to maintain their health and wellness, and natural antioxidants are a popular choice due to their numerous health benefits.

- Online retail channels have also played a significant role in the growth of the market. The convenience and accessibility offered by e-commerce platforms have made it easier for consumers to purchase natural antioxidant-rich products from the comfort of their homes. The demand for natural antioxidants is not limited to the nutraceutical industry. They are also widely used in the cosmetics and skincare industry due to their anti-aging properties. The increasing products demand is derived from trees/plants, such as bioactive compounds found in barks, is driven by growing health and wellness awareness, as consumers seek natural solutions to support their well-being and combat the oxidation/decomposition process in the body. Natural antioxidants help protect the skin from damage caused by free radicals, making them a popular ingredient in various skincare products. The natural sources of antioxidants include various trees, plants, nuts, roots, seeds, and leaves.

How is this market segmented and which is the largest segment?

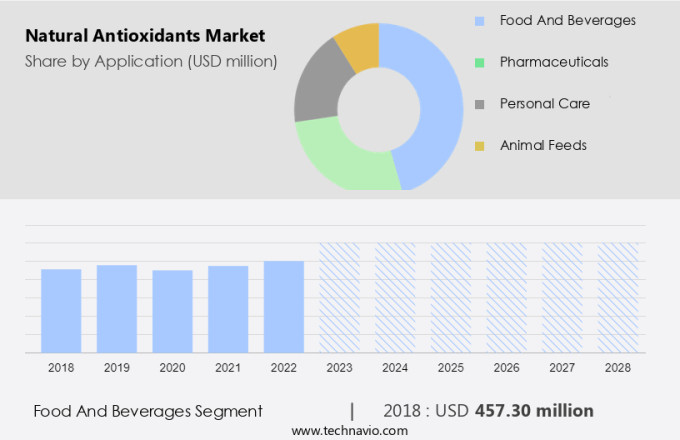

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverages

- Pharmaceuticals

- Personal care

- Animal feeds

- Type

- Vitamin C-based

- Vitamin E-based

- Polyphenols-based

- Carotenoids-based

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

- The food and beverages segment is estimated to witness significant growth during the forecast period.

Natural antioxidants play a significant role in the food and beverages industry, acting as both essential nutrients and product enhancers. The oxidation of food can lead to spoilage and undesirable flavors, reducing freshness and ultimately impacting health benefits. Antioxidants, such as rosemary extracts, tocopherols, and ascorbic acid, are increasingly utilized to prevent oxidation and extend the shelf life of various food and beverage products. These natural antioxidants are particularly popular in the beverage sector, where they contribute to improved shelf life and flavor stability. The regulatory requirements for organic certifications and consumer demand for healthier processed and convenience foods further fuel the adoption of natural antioxidants in the industry.

Get a glance at the market report of share of various segments Request Free Sample

The food and beverages segment was valued at USD 457.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The natural antioxidant sector is witnessing significant growth in various industries, including body lotions, creams, shampoos, and conditioners. According to recent market research, APAC is the leading region in the market, accounting for the largest share in 2023. This growth can be attributed to the increasing population and rising disposable income, leading to an increase in demand for personal care products. Furthermore, the elderly population in the region is growing, leading to a higher demand for antioxidant-rich skincare products, particularly those for skin whitening and anti-aging. In the health sector, natural antioxidants are gaining popularity in the prevention and treatment of chronic disorders such as heart problems and diabetes.

Furthermore, processed edibles, fortified foods, and beverages are increasingly being infused with natural antioxidants to enhance their nutritional value and extend their shelf life. Unilever Plc's Dermalogica brand offers various antioxidant-rich products, such as intensive moisture balance face moisturizers, which are abundant in vitamins and other antioxidants. Growing consumer awareness about personal hygiene and wellness is driving demand for natural antioxidant-infused personal care products. The market is expected to register the fastest growth rate during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Natural Antioxidants Market?

The rising demand of natural antioxidants from the personal care industry is the key driver of the market.

- Antioxidants are essential compounds that neutralize free radicals, which can cause oxidative stress and damage to cells. Free radicals are unstable atoms that can harm the skin's structure and genetic material, leading to inflammation, hyperpigmentation, acne, and wrinkles. External factors such as sunlight, pollution, environmental toxins, tobacco, and stress contribute to the formation of free radicals. One natural antioxidant is Rosemary Extract, derived from the Rosemary plant. It is available in both liquid and dry forms and is used as additive in various industries, including food and beverages, dairy and frozen desserts, personal care, animal feed, pharmaceuticals, and more.

- Rosemary Extract functions as an antioxidant by scavenging free radicals and preventing cell damage. It also stimulates collagen production, which is essential for maintaining youthful-looking skin. In the food industry, it is used as a natural preservative and flavor enhancer. In personal care products, it is used for its antioxidant and anti-inflammatory properties. Antioxidants like Rosemary Extract are crucial in preventing and repairing the signs of aging caused by free radicals. They help protect the skin from environmental stressors and maintain its natural radiance and elasticity.

What are the market trends shaping the Natural Antioxidants Market?

Growing demand for nutraceutical antioxidants is the upcoming trend in the market.

- Antioxidants are essential components of various nutraceutical products, derived from natural sources such as phytochemicals. These compounds, including alkaloids, terpenoids, and polyphenols, are found in a broad range of food products and dietary supplements. Antioxidants play a crucial role in the prevention of degenerative and chronic diseases due to their ability to neutralize free radicals in the body. Vitamins C and E, as well as newer ingredients like lutein and lycopene, are popular antioxidant ingredients in nutraceuticals.

- The therapeutic potential of antioxidants is significant due to their multiple mechanisms of action. Regulatory bodies overseeing the nutraceutical industry ensure the safety and efficacy of these compounds. Consumers increasingly prefer natural antioxidants over synthetic alternatives due to health concerns and the desire for more holistic approaches to wellness.

What challenges does Natural Antioxidants Market face during its growth?

High product cost is a key challenge affecting market growth.

- Natural antioxidants, derived from plants such as pine and acerola seed, green tea, and others, are essential components in the cosmetics business. These antioxidants help protect the skin from damage caused by free radicals. Tocopherols, a type of natural antioxidant, are commonly used in the industry. However, the cost of producing tocopherol has risen due to the limited supply of vegetable oil, a key raw material. Vegetable oil is also in high demand for use in other industries and cooking purposes, leading to an increase in its price. As a result, the cost of natural antioxidants in their dry and liquid forms can be significant.

- While synthetic antioxidants derived from petroleum products offer a lower cost alternative, there is growing consumer demand for natural options. To meet this demand, research and development efforts are ongoing to find new sources and production methods for natural antioxidants. This trend is expected to continue as the global population grows and the demand for cosmetics with natural ingredients increases.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A and B Ingredients Inc.

- Adisseo Co.

- Air Liquide SA

- Archer Daniels Midland Co.

- Ashland Inc.

- BASF SE

- BIOTECNOLOGIAS APLICADAS SL

- Cargill Inc.

- DuPont de Nemours Inc.

- Eastman Chemical Co.

- IMCD NV

- Indena S.p.A.

- Kalsec Inc.

- Kemin Industries Inc.

- Koninklijke DSM NV

- Prinova Group LLC

- Ricela Health Foods Ltd.

- Synthite Industries Pvt. Ltd.

- Trigon Antioxidants Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The natural antioxidant market is witnessing significant growth due to the increasing demand for clean label products in various industries, including cosmetics and nutraceuticals. Natural antioxidants derived from fruits, vegetables, herbs, spices, trees, and nuts are gaining popularity as they offer health benefits and help prevent the oxidation process in food and beverages. These antioxidants, such as phenolics, carotenoids, polyphenols, Vitamin C, and vitamin E, are effective in neutralizing free radicals, which contribute to chronic diseases like cancer, heart disease, and diabetes. The demand for natural antioxidants is driven by the rising awareness of health and wellness, urbanization, and the increasing prevalence of chronic disorders.

Furthermore, the food and beverages industry is a significant consumer of natural antioxidants, with processed foods and convenience foods being major application areas. However, the cosmetics business also uses natural antioxidants in various personal care products, including moisturizers, body lotions, creams, shampoos, and conditioners. Regulatory bodies and organic certifications play a crucial role in the growth of the natural antioxidant market. The market is witnessing an increase in the production and use of natural antioxidants from various sources, such as rosemary extract, butylated hydroxyanisole, and tocopherols. Despite the availability of synthetic antioxidants like petroleum-derived additives, the demand for natural antioxidants is growing due to their health benefits and consumer preference for clean label products. The market is expected to continue its growth trajectory in the coming years, driven by the increasing demand for natural antioxidants in various industries and applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.07% |

|

Market Growth 2024-2028 |

USD 669.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.45 |

|

Key countries |

China, US, Japan, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch