Neopentane Market Size 2024-2028

The neopentane market size is forecast to increase by USD 444 million at a CAGR of 5.9% between 2023 and 2028.

- Neopentane is a valuable chemical compound with increasing applications, particularly In the field of gas chromatography. The market for neopentane is driven by its ability to enhance the efficiency of this analytical technique. However, concerns regarding its toxicity pose a significant challenge to the market's growth. Neopentane's unique properties, such as its low volatility and high thermal stability, make it an ideal solvent for various applications. Dimethylpropane, a colorless and odorless non-toxic gas with a low boiling point, is used primarily in research and the production of butyl rubber. Nevertheless, its potential health hazards, including irritation to the eyes, skin, and respiratory system, necessitate stringent safety measures. As the demand for more efficient and safer analytical methods continues to grow, the market for neopentane is expected to witness moderate growth. Producers must focus on addressing toxicity concerns through research and development of safer alternatives or improved safety protocols to capitalize on this market opportunity.

What will be the Size of the Neopentane Market During the Forecast Period?

- The market encompasses the global trade of this unique hydrocarbon isomer, known for its distinct chemical properties. Neopentane, a pentane isomer with a tetramethyl structure, exhibits various applications due to its low saturated vapor pressure and high heat capacities. Its saturated liquid density is lower than that of other normal alkanes, such as butane, isobutane, pentane, isopentane, hexane, octane, decane, eicosane, and their respective isomers, including constitutional, structural, and stereoisomers. Neopentane's low-temperature region properties, like saturated vapor density and speed of sound, make it an essential component in various industries. Applications include petroleum biomarker fingerprinting and oil spill characterization.

- Neopentane's unique bonding sequence and carbon atom arrangement distinguish it from other hydrocarbons. Additionally, its enantiomers, diastereomers, and cis-trans geometric isomers contribute to its complex chemical structure. Neopentane also plays a role in natural gas hydrate research due to its ability to form stable hydrates. Overall, the market experiences steady growth, driven by increasing demand for its unique chemical properties in various applications.

How is this Neopentane Industry segmented and which is the largest segment?

The neopentane industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Fuel and propellant

- Solvent

- Refrigerants

- Blowing agents

- Others

- Type

- Gas

- Liquid

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Application Insights

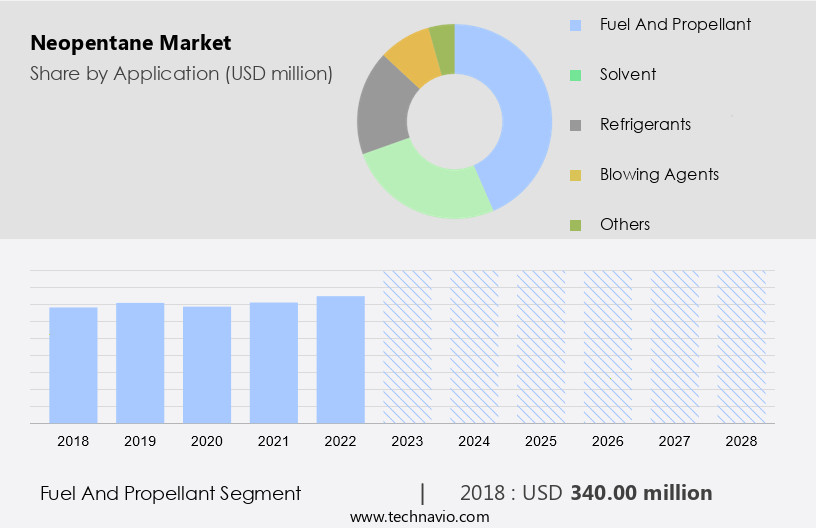

- The fuel and propellant segment is estimated to witness significant growth during the forecast period.

Neopentane is a valuable hydrocarbon In the fuel and propellant industry, known for its high performance and precision in various applications. In aerosol propellants, neopentane provides controlled and consistent release in consumer goods such as deodorants, air fresheners, and insect repellents, due to its stability and compatibility with aerosol systems. In liquid-propellant systems, neopentane functions as a fuel component, offering advantages over solid propellants in applications like space missions and rocket launches. Neopentane's properties include a low boiling point, making it a suitable choice for low-temperature applications. Its density is lighter than air, contributing to buoyancy and dispersion. Neopentane is highly stable, non-reactive, and a solvent in chemical processes, including pharmaceutical applications, extraction, and purification procedures.

Get a glance at the market report of share of various segments Request Free Sample

The fuel and propellant segment was valued at USD 340.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

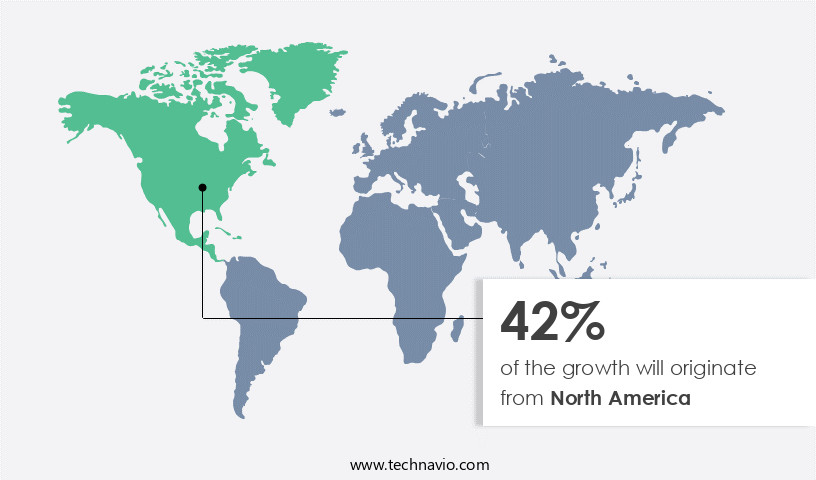

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is projected to expand significantly, with the United States leading the growth. The U.S. Government's focus on clean energy initiatives, such as the Investing in America agenda, is driving demand for neopentane. This initiative includes the development of seven Regional Clean Hydrogen Hubs (H2Hubs), which will promote hydrogen production, storage, and distribution. Neopentane's unique properties, including its low boiling point and high stability, make it an ideal choice for applications like refrigerants and chemical synthesis In the context of decarbonization. Its non-flammable and non-toxic nature further adds to its appeal. Neopentane is a colorless, odorless gas with a lighter-than-air density, offering buoyancy and ease of dispersion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Neopentane Industry?

Enhancing efficiency of neopentane is the key driver of the market.

- The market is experiencing growth due to chemical companies' focus on efficiency and sustainability. ExxonMobil's strategic restructuring in March 2023, merging chemical and downstream sectors, is an illustrative example. This consolidation aims to optimize performance, reduce costs, and cater to customer needs. ExxonMobil Product Solutions Company is committed to producing low-emission fuels for decarbonizing transportation sectors like aviation and marine. Neopentane plays a vital role in formulating these cleaner fuels, making its demand increase. Neopentane's unique molecular structure, with a single methyl group attached to the first carbon atom, sets it apart from other alkanes like Butane, Isobutane, Pentane, Isopentane, Hexane, Octane, Decane, Eicosane, and their isomers (constitutional, structural, and stereoisomers).

- Its molecular structure influences its physical properties, such as saturated liquid density (0.653 g/cm³), saturated vapor density (1.918 g/L), liquid-phase density (0.626 g/cm³), and gas-phase density (0.288 g/cm³). Additionally, neopentane has high heat capacities, a speed of sound (193 m/s), and is a non-reactive hydrocarbon with hydrogen atoms. Neopentane's stability and non-reactive properties make it suitable for various applications, including oil spill characterization, chemical processes, pharmaceutical processes, extraction, and purification procedures. Its physical state as a colorless, odorless, non-toxic gas, with a low boiling point (-12.3°C), makes it suitable for low-temperature applications. Its buoyancy and dispersion properties contribute to its use in natural gas hydrate applications.

What are the market trends shaping the Neopentane Industry?

Application of neopentane in gas chromatography is the upcoming market trend.

- Neopentane is a colorless, odorless, non-toxic gas that belongs to the alkane family, specifically the isomers of butane and pentane. Its unique molecular structure, consisting of a single methyl group attached to a tetrahedral carbon atom, sets it apart from other isomers like isobutane, pentane, isopentane, hexane, octane, decane, eicosane, and their enantiomers and diastereomers. Neopentane's physical properties, such as its saturated liquid density and saturated vapor density, differ significantly from those of its isomers due to its bonding sequence and arrangement of carbon atoms. Its heat capacities and speed of sound are also distinct, contributing to its stability and non-reactive properties.

- In various chemical processes, including oil spill characterization, pharmaceutical processes, and extraction and purification procedures, neopentane's high stability and solvent properties make it an invaluable asset. Its non-flammable nature and inertness in a non-reactive atmosphere further enhance its safety and versatility. Neopentane's low boiling point and lighter-than-air density enable it to exhibit buoyancy and dispersion, making it an essential component in applications like gas chromatography (GC). Its ability to provide a broad retention time range, ensuring a clear baseline and minimal signal-to-noise ratio, is crucial for delivering reliable and reproducible analytical outcomes in sensitive detection scenarios. In summary, neopentane's unique molecular structure and physical properties contribute to its wide range of applications, particularly in GC, where it plays a vital role as a solvent.

What challenges does the Neopentane Industry face during its growth?

Concerns regarding neopentane toxicity is a key challenge affecting the industry growth.

- Neopentane, a member of the alkane family with the molecular formula C5H12, is a hydrocarbon consisting of one central carbon atom bonded to four methyl groups. Neopentane exists in two phases: a liquid-phase density of 0.626 g/cm3 and a gas-phase density of 0.365 g/cm3. The saturated liquid density is 0.626 g/cm3, while the saturated vapor density is 0.373 g/cm3. Neopentane's heat capacities are 1.92 J/g°C for solid, 2.33 J/g°C for liquid, and 3.52 J/g°C for gas. The speed of sound in neopentane is 138 m/s. Neopentane's molecular structure consists of isomers, including constitutional isomers, structural isomers, and stereoisomers. These isomers differ In their bonding sequence and the arrangement of carbon atoms.

- Neopentane's stability and non-reactive properties make it useful in various applications, such as oil spill characterization, chemical processes, and pharmaceutical processes. It is also used as a solvent in extraction and purification procedures. Despite its benefits, neopentane's market acceptance is complicated by the toxicity of its related compound, dimethylpropane. However, its toxicity poses serious health risks, including nausea, vomiting, abdominal pain, and diarrhea upon ingestion and an aspiration hazard due to its low surface tension and viscosity.

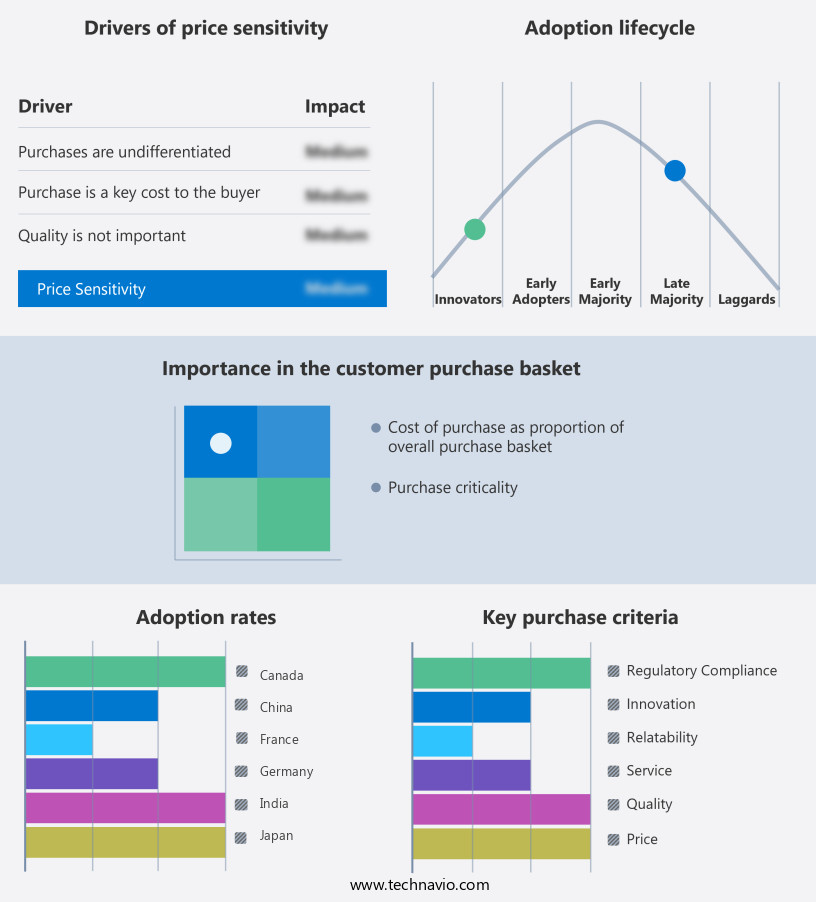

Exclusive Customer Landscape

The neopentane market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the neopentane market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, neopentane market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide

- BASF SE

- Central Drug House Pvt. Ltd.

- Deluxe Industrial Gases

- Honeywell International Inc.

- Junyuan Petroleum Group

- Middlesex Gases and Technologies Inc.

- Restek Corp.

- Sigma Aldrich Chemicals Pvt. Ltd.

- Tokyo Chemical Industry Co. Ltd.

- Vizag Chemical International

- Wiley Companies

- Xiamen Hisunny Chemical Co. Ltd.

- Zhengzhou Meiya Chemical Products Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Neopentane is a member of the alkane family, specifically a pentane isomer. Its molecular structure consists of a central carbon atom bonded to four methyl groups, creating a branched, isomeric structure. Neopentane's unique bonding sequence sets it apart from other pentane isomers, such as isopentane and normal pentane. Neopentane's physical properties are notable for its low boiling point, which places it In the category of low-temperature applications. It is a colorless, odorless, non-toxic gas at standard temperature and pressure conditions. Neopentane's low density, lighter than air, contributes to its buoyancy and dispersion characteristics. The saturated liquid density and saturated vapor density of neopentane are essential properties for understanding its behavior in various applications.

In addition, the heat capacities and speed of sound in both the liquid and gas phases are also crucial for optimizing processes that involve this hydrocarbon. Neopentane's stability and non-reactive properties make it a valuable component in various chemical processes. Its inertness in a non-reactive atmosphere is a significant advantage in industries that require the handling of sensitive materials. Neopentane's high stability and solvent properties are utilized in pharmaceutical processes, extraction, and purification procedures. Despite its non-flammable nature, safety precautions must be taken when handling neopentane due to its low boiling point and potential for rapid evaporation. Its isomeric structure, consisting of constitutional, structural, stereoisomers, and cis-trans geometric isomers, adds complexity to its behavior and handling requirements.

Furthermore, neopentane's role in natural gas hydrate formations is an area of ongoing research due to its potential applications In the energy sector. Its unique properties, such as low boiling point and high stability, make it an attractive candidate for various industrial applications. The hydrocarbon industry continually seeks to optimize processes and improve efficiency, making an in-depth understanding of neopentane's properties and behavior essential. Its role In the alkane family, molecular structure, and physical state contribute to its value in various industries, from chemical processes to energy production. Neopentane's average relative error in density measurements is an essential consideration for industries that require precise control over their processes. Moreover, its heat capacities, speed of sound, and other properties play a crucial role in optimizing processes and ensuring efficiency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 444 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.6 |

|

Key countries |

US, China, Canada, UK, Germany, France, Japan, India, Russia, and South Korea |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Neopentane Market Research and Growth Report?

- CAGR of the Neopentane industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the neopentane market growth of industry companies

We can help! Our analysts can customize this neopentane market research report to meet your requirements.