Neurodegenerative Diseases Therapeutics Market Size 2025-2029

The neurodegenerative diseases therapeutics market size is forecast to increase by USD 24.85 billion, at a CAGR of 9.1% between 2024 and 2029.

- The market is driven by the significant advancements in the drug development pipeline, presenting numerous opportunities for market growth. The increasing aging population further fuels market expansion, as neurodegenerative diseases, such as Alzheimer's and Parkinson's, are more prevalent among older adults. However, the market faces substantial challenges, including the lack of disease-modifying therapies. Despite these obstacles, companies can capitalize on the market's potential by focusing on innovative research and development efforts to address the unmet medical needs in neurodegenerative diseases.

- The successful introduction of disease-modifying therapies could revolutionize the market landscape and significantly impact patient outcomes. Companies must navigate the challenges of complex regulatory requirements and high development costs to bring these therapies to market. By staying informed of the latest research advancements and regulatory developments, companies can position themselves to capitalize on the market's growth opportunities and overcome the challenges associated with neurodegenerative diseases therapeutics.

What will be the Size of the Neurodegenerative Diseases Therapeutics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Neurodegenerative diseases, characterized by the progressive loss of neuronal function and structure, continue to pose significant challenges in the healthcare sector. The therapeutic landscape for these conditions remains dynamic, with ongoing research and development efforts focused on various fronts. Neuropsychological assessment plays a crucial role in diagnosing and monitoring disease progression. Drug delivery systems are being explored to enhance the efficacy and safety of existing treatments. Computational modeling and patient stratification aid in identifying potential therapeutic targets and optimizing clinical trials. Synaptic dysfunction, a common feature of neurodegenerative diseases, is being addressed through exercise therapy, nutritional interventions, and neurotrophic factors.

The blood-brain barrier, a significant barrier to effective drug delivery, is being targeted through innovative drug delivery systems and gene therapy. Diseases such as Huntington's, Parkinson's, and Alzheimer's continue to dominate the research landscape. Amyloid beta plaques and tau protein aggregation are major foci for drug discovery. Monoclonal antibodies and small molecule inhibitors are being investigated for their potential in targeting these proteins. Clinical trials are ongoing for various therapeutic approaches, including stem cell therapy, palliative care, and supportive care. Public awareness and patient advocacy are essential in driving research funding and ensuring a robust pipeline of potential treatments.

In vitro studies and animal models are critical for understanding disease mechanisms and evaluating new therapeutic strategies. Preclinical models help bridge the gap between bench and bedside, while regulatory approval remains a key consideration for bringing new treatments to market. The market is characterized by continuous evolution and unfolding patterns. The integration of various approaches, from neuropsychological assessment to drug development, is essential in addressing the complexities of these conditions and improving quality of life for affected individuals.

How is this Neurodegenerative Diseases Therapeutics Industry segmented?

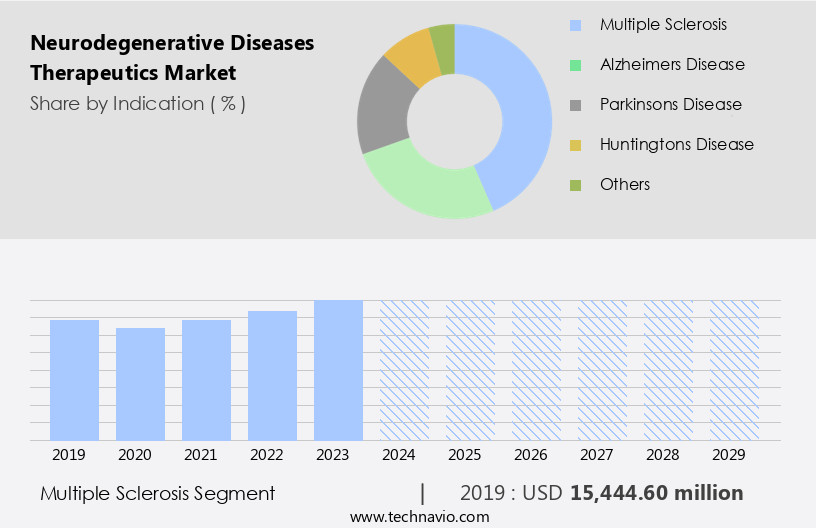

The neurodegenerative diseases therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Indication

- Multiple sclerosis

- Alzheimers disease

- Parkinsons disease

- Huntingtons disease

- Others

- Drug Class

- Immunomodulators

- Interferons

- Decarboxylase inhibitors

- Dopamine agonists

- Others

- Route Of Administration

- Oral

- Injection

- Transdermal

- End-user

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Indication Insights

The multiple sclerosis segment is estimated to witness significant growth during the forecast period.

Multiple sclerosis (MS), a neurodegenerative disease characterized by synaptic dysfunction and immune system attacks on the central nervous system, is experiencing a rising prevalence rate. In the US alone, approximately 1 million individuals live with MS, while globally, around 2.9 million people are affected. This increasing number of cases has driven the research and development efforts in the market. Key players in the industry are focusing on regulatory approval for new treatments, such as Tecfidra, Aubagio, Lemtrada, Gilenya, and Tysabri, to address the unmet medical needs. Simultaneously, researchers are investigating the role of lifestyle modifications, exercise therapy, and nutritional interventions in managing MS symptoms and slowing disease progression.

The blood-brain barrier, a significant challenge in drug delivery, is being addressed through innovative drug delivery systems and computational modeling. Clinical trials are underway to assess the safety and efficacy of stem cell therapy, gene therapy, and monoclonal antibodies for MS treatment. Public awareness campaigns and patient advocacy groups are instrumental in raising funds for research and supporting patients and their caregivers. In vitro studies, neuropsychological assessments, and clinical research are crucial in understanding the disease mechanisms and target validation. Drug repurposing, animal studies, and clinical research on neurotrophic factors, neuropsychological assessment, and cognitive training are ongoing to improve treatment response and quality of life for MS patients.

The market is also exploring the potential of small molecule inhibitors and tau protein aggregation in disease progression. As the market evolves, it continues to prioritize patient stratification, safety, and efficacy in the development of new treatments for neurodegenerative diseases like MS, Huntington's disease, Parkinson's disease, Alzheimer's disease, and prion diseases.

The Multiple sclerosis segment was valued at USD 15.44 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant advancements, driven by the urgent need to address synaptic dysfunction and cognitive decline associated with conditions such as Alzheimer's disease, Parkinson's disease, multiple sclerosis, and Huntington's disease. Lifestyle modifications, exercise therapy, and nutritional interventions are essential components of disease management. Regulatory approval processes are streamlined to expedite the development and availability of new therapies. Innovative approaches like stem cell therapy, gene therapy, and monoclonal antibodies are under investigation to tackle various neurodegenerative diseases. Drug discovery efforts are focused on target validation, high-throughput screening, and computational modeling to identify small molecule inhibitors and neurotrophic factors.

Clinical trials and animal studies are crucial for assessing safety and efficacy, while diagnostic imaging and neuropsychological assessments aid in patient stratification and disease progression monitoring. Public awareness campaigns and patient advocacy initiatives are essential in driving research funding and social support for patients and caregivers. In vitro studies and preclinical models help researchers better understand disease mechanisms and potential therapeutic interventions. Palliative care and supportive care are vital components of managing neurodegenerative diseases, ensuring patients maintain a good quality of life. The North American region is a major contributor to the market due to its robust research ecosystem and presence of leading players like Biogen, Johnson & Johnson, and Pfizer.

Collaborations between these companies and academic institutions are driving the development of advanced therapeutics for neurological diseases, including MS, Parkinson's disease, and Alzheimer's disease. The region's regulatory agencies are also actively supporting clinical trials and drug development, contributing to the market's growth. In summary, the market is witnessing significant advancements in drug discovery, clinical trials, and regulatory approval processes. The market is driven by the need to address cognitive decline, synaptic dysfunction, and the underlying mechanisms of various neurodegenerative diseases. The North American region is a major contributor to the market due to its robust research ecosystem and presence of leading players.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Neurodegenerative Diseases Therapeutics Industry?

- A robust drug development pipeline serves as the primary growth catalyst for the market.

- Neurodegenerative diseases, including Alzheimer's and Parkinson's, are a significant global health concern, affecting over one in three people by March 2024. These conditions are the leading cause of illness and disability worldwide. Major neurodegenerative diseases include Alzheimer's, Parkinson's, Huntington's, and multiple sclerosis. The incidence of Alzheimer's and Parkinson's is rising rapidly, with approximately 6.5 million people in the US living with Alzheimer's in 2023. In response, the market is focused on research and development, with a robust drug development pipeline. For instance, there were around 164 clinical trials assessing 127 drugs in the Alzheimer's disease pipeline in 2024.

- High-throughput screening, monoclonal antibodies, neurotrophic factors, cognitive training, target validation, and small molecule inhibitors are among the key research areas. Diagnostic imaging and supportive care are also essential aspects of managing these conditions. Neurodegenerative diseases impose a significant caregiver burden, necessitating continued research and development efforts. Prion diseases are another area of focus due to their devastating effects. The market dynamics remain strong, driven by the increasing prevalence and incidence of neurodegenerative diseases and the ongoing research and development efforts.

What are the market trends shaping the Neurodegenerative Diseases Therapeutics Industry?

- The aging population represents a significant market trend that is gaining momentum. This demographic shift presents numerous opportunities for businesses catering to the unique needs of older adults.

- The aging global population is experiencing a significant increase, with individuals aged 65 and older projected to double by 2054, reaching 1.7 billion, according to UN data. In the US alone, the population in this age group grew at the fastest rate since the 1880s, reaching 55.8 million in 2023. Several countries, including Switzerland, South Korea, Canada, Romania, and Taiwan, are expected to reach super-aged status by 2025, where over 20% of the population will be 65 or older. This demographic shift often results in a prolonged morbidity phase, where individuals live with chronic illnesses for extended periods.

- Neurodegenerative diseases, such as Alzheimer's and Parkinson's, are among the most common chronic conditions affecting the elderly. To combat these diseases, advancements in neuropsychological assessment, drug delivery systems, computational modeling, patient stratification, and drug development are essential. Cognitive decline, a hallmark of neurodegenerative diseases, can be assessed using neuropsychological tests, enabling early detection and intervention. Drug repurposing, which involves using existing drugs for new indications, is a promising approach in neurodegenerative disease research. Animal studies and clinical research using preclinical models help understand disease progression, particularly tau protein aggregation, a key feature of neurodegenerative diseases.

- These advancements are crucial in developing effective treatments for neurodegenerative diseases and improving the quality of life for the aging population.

What challenges does the Neurodegenerative Diseases Therapeutics Industry face during its growth?

- The absence of disease-modifying therapies poses a significant challenge to the expansion of the industry.

- Neurodegenerative diseases, including Alzheimer's and Parkinson's, are on the rise due to the aging population worldwide. For example, Alzheimer's disease doubles in frequency every five years after the age of 65 and affects up to 50% of those over 85. While there are symptomatic treatments for diseases like Parkinson's and Alzheimer's, there are currently no disease-modifying therapies for some neurodegenerative diseases, such as Huntington's disease, which is caused by a mutation in the huntingtin gene. This lack of treatment options highlights the urgent need for research and development in this area. Lifestyle modifications, such as regular exercise and social support, can help manage symptoms and improve quality of life for those living with neurodegenerative diseases.

- Exercise therapy, including aerobic and resistance training, has been shown to improve cognitive function and reduce the risk of developing neurodegenerative diseases. Research funding and regulatory approval are crucial for advancing drug discovery and bringing new treatments to market. Synaptic dysfunction, the loss of connections between neurons, is a common feature of neurodegenerative diseases. The blood-brain barrier, which protects the brain from harmful substances, can also hinder the delivery of therapeutic agents. Therefore, developing drugs that can cross the blood-brain barrier and target synaptic dysfunction is a key focus in neurodegenerative disease research. In conclusion, the rising prevalence of neurodegenerative diseases necessitates a concerted effort to develop disease-modifying therapies.

- While symptomatic treatments provide some relief, the need for treatments that address the underlying causes of these diseases is urgent. Ongoing research in areas such as synaptic dysfunction and drug delivery systems offers hope for the development of effective treatments.

Exclusive Customer Landscape

The neurodegenerative diseases therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the neurodegenerative diseases therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, neurodegenerative diseases therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Science SA - The company specializes in neurodegenerative diseases therapeutics, with Masitinib in its phase 3 pipeline. This small molecule inhibitor targets mast cells, demonstrating potential in various neurological conditions. By modulating inflammatory responses, Masitinib aims to mitigate disease progression and improve patient outcomes. The compound's efficacy is supported by extensive clinical research, positioning it as a promising treatment option in neurodegenerative disorders.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Science SA

- AbbVie Inc.

- Acadia Pharmaceuticals Inc.

- AstraZeneca Plc

- Biogen Inc.

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- H Lundbeck AS

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Mitsubishi Chemical Corp.

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Neurodegenerative Diseases Therapeutics Market

- In February 2023, Biogen Inc. Announced the US Food and Drug Administration (FDA) approval of Aduhelm (aducanumab), a first-in-class treatment for Alzheimer's disease. This breakthrough marks the first new Alzheimer's therapy approval in nearly two decades (FDA, 2023).

- In April 2024, Roche and AC Immune SA entered into a strategic collaboration to co-develop and commercialize crenezumab, an investigational treatment for Alzheimer's disease. This partnership combines Roche's commercial expertise with AC Immune's scientific know-how, aiming to accelerate the development and potential market entry of crenezumab (Roche, 2024).

- In July 2024, Biogen and Eisai Co. Ltd. Reported a significant funding round of USD3.1 billion to support the development and commercialization of their pipeline of potential treatments for neurodegenerative diseases, including Alzheimer's and Parkinson's diseases (Biogen, 2024).

- In November 2025, the European Medicines Agency (EMA) granted a positive opinion for the use of Aduhelm for the treatment of Alzheimer's disease in the European Union. This decision follows the FDA's approval in early 2023, marking a significant milestone in the global market entry of this new therapy (EMA, 2025).

Research Analyst Overview

- Neurodegenerative diseases, including Alzheimer's, Parkinson's, and Huntington's, pose significant economic and social challenges to healthcare systems worldwide. The market is witnessing rapid advancements, driven by the integration of technologies such as artificial intelligence (AI) and machine learning. AI-powered tools are revolutionizing disease diagnosis and personalized therapy, enabling precision medicine approaches. Microglia activation, astrocyte reactivity, and synaptic plasticity are key areas of focus in neurodegenerative research. Exosome therapy and gene editing are emerging as promising treatments for neurodegenerative diseases, offering potential solutions for mitochondrial dysfunction, axonal degeneration, and oxidative stress. Patient engagement and education are crucial components of effective disease management.

- Digital biomarkers and remote monitoring enable early detection and intervention, while clinical decision support systems facilitate timely and accurate diagnosis. However, ethical considerations and healthcare disparities must be addressed to ensure equitable access to these innovative therapies. Public health policy and big data analysis are essential in addressing the complex challenges posed by neurodegenerative diseases. In summary, the market is experiencing dynamic growth, fueled by technological advancements and a renewed focus on patient-centered care. AI, precision medicine, and digital health technologies are transforming diagnosis, treatment, and disease management, while ethical considerations and public health policy initiatives are critical in ensuring equitable access and social impact.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Neurodegenerative Diseases Therapeutics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

251 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 24852.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, Germany, Canada, China, Japan, UK, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Neurodegenerative Diseases Therapeutics Market Research and Growth Report?

- CAGR of the Neurodegenerative Diseases Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the neurodegenerative diseases therapeutics market growth of industry companies

We can help! Our analysts can customize this neurodegenerative diseases therapeutics market research report to meet your requirements.