Non-Mydriatic Handheld Fundus Camera Market Size 2025-2029

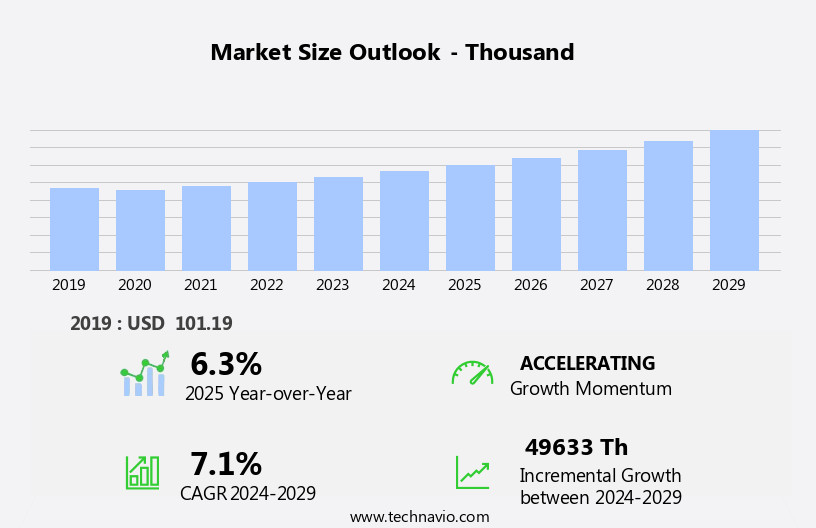

The non-mydriatic handheld fundus camera market size is forecast to increase by USD 49633 thousand, at a CAGR of 7.1% between 2024 and 2029.

- The market is witnessing significant growth, driven by the rising prevalence of eye disorders and the increasing demand for portable diagnostic devices. The market is marked by the introduction of advanced handheld cameras, such as the Welch Allyn Spot Vital Signs Non-Mydriatic Fundus Camera and the NIDEK NM-102N, which offer high-quality images and ease of use. However, the market faces challenges from alternative technologies, including smartphone retinal imaging and optical coherence tomography (OCT) scans. These alternatives offer affordability and accessibility but may not provide the same level of diagnostic accuracy as dedicated handheld fundus cameras.

- The competition from these technologies necessitates continuous innovation and improvement in handheld fundus cameras to maintain market share. Additionally, the market's growth is influenced by demographic shifts, aging populations, and increasing healthcare awareness, creating opportunities for companies to expand their offerings and cater to diverse customer needs.

What will be the Size of the Non-Mydriatic Handheld Fundus Camera Market during the forecast period?

The market continues to evolve, driven by advancements in technology and increasing applications across various sectors of the healthcare industry. Image recognition algorithms and red-free imaging enhance image clarity, enabling earlier detection and diagnosis of retinal conditions such as macular degeneration, diabetic retinopathy, and glaucoma. Data integration and cloud storage facilitate seamless image transfer and remote monitoring, improving patient experience and enabling real-time analysis. Maintenance costs are a significant consideration, with manufacturers focusing on long battery life and ease of use to enhance customer retention. Artificial intelligence (AI) and machine learning are increasingly integrated into handheld cameras, enabling image classification, segmentation, and analysis, while ensuring data security and privacy.

Product development is ongoing, with a focus on software integration, user interface, and autofocus technology to improve image quality and diagnostic accuracy. Regulatory compliance, customer acquisition, and sales and marketing strategies are key areas of focus for market penetration. Pricing strategies and image resolution are also critical factors in the competitive landscape. Handheld cameras are increasingly used as diagnostic tools in eye care, with wide-field imaging and autofluorescence imaging offering additional benefits. The market is expected to continue growing, driven by the need for cost-effective, portable, and efficient retinal imaging solutions.

How is this Non-Mydriatic Handheld Fundus Camera Industry segmented?

The non-mydriatic handheld fundus camera industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Hospitals and clinics

- Ambulatory surgical centers

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

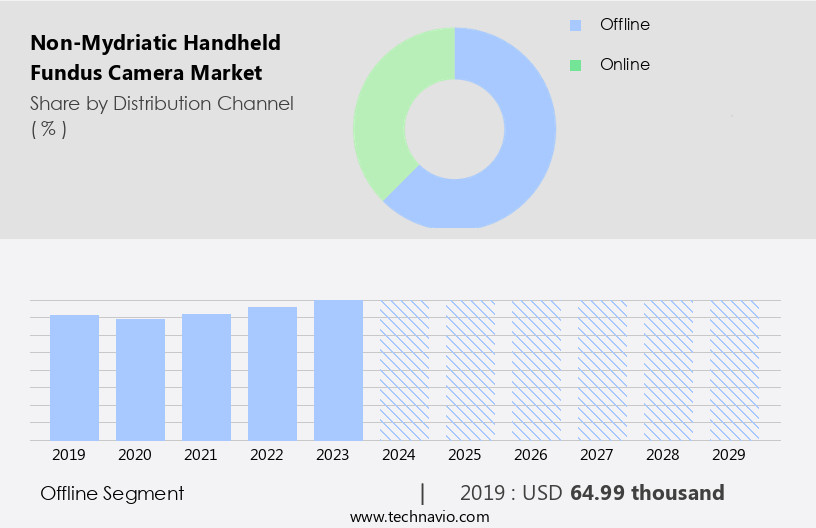

The offline segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by advancements in image recognition technology and red-free imaging. These innovations enhance image clarity, enabling early detection of eye conditions such as diabetic retinopathy, glaucoma, and macular degeneration. Cloud storage and image transfer facilitate remote monitoring and access to patient records, improving customer retention and clinical workflow efficiency. Artificial intelligence and machine learning are integral to image analysis, enabling automatic classification and segmentation of retinal images. Product development is focused on enhancing user experience through features like autofocus technology, user interface, and ease of use. Sales and marketing efforts are aimed at market penetration through various distribution channels, including offline channels.

Offline distribution channels, particularly healthcare institutions and hospitals, play a crucial role in the market. These institutions engage directly with manufacturers for procurement, evaluating usability and functionality in clinical settings. Optometrists and ophthalmologists interact with sales representatives to ensure regulatory compliance and data security. Maintenance costs, battery life, and image resolution are essential considerations for healthcare providers. Fluorescein angiography and autofluorescence imaging are valuable research applications, contributing to the market's growth. Technology licensing and software integration are key strategies for market expansion. Customer acquisition and patient management are essential for long-term success. Pricing strategies and image management systems are critical to maintaining a competitive edge.

Wide-field imaging and ce marking ensure regulatory compliance and improve image quality. FDA approval and clinical trials further validate the diagnostic capabilities of these devices. In summary, the market is dynamic, driven by technological advancements, customer needs, and regulatory requirements. Offline distribution channels, particularly healthcare institutions and hospitals, are key players in the market's growth. Continuous innovation and strategic partnerships will be essential for market penetration and long-term success.

The Offline segment was valued at USD 64.99 thousand in 2019 and showed a gradual increase during the forecast period.

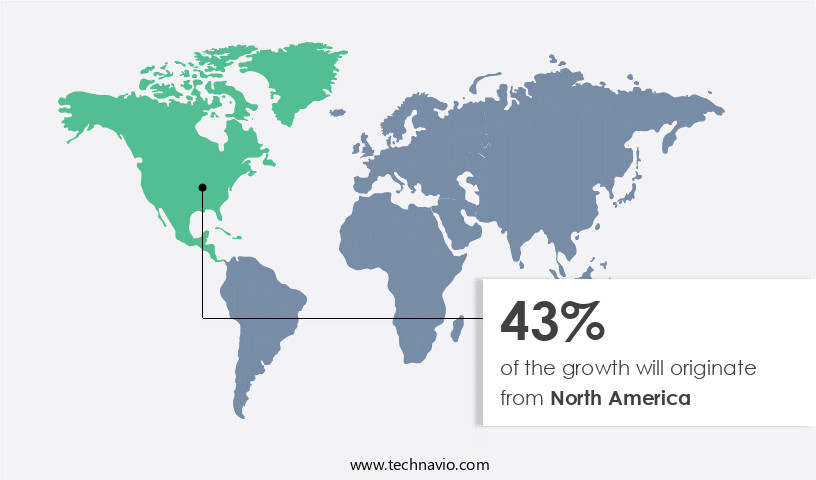

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth in North America due to the high prevalence of eye disorders such as diabetic retinopathy, macular degeneration, and glaucoma. With these conditions requiring regular monitoring and early detection for effective treatment, the demand for portable, non-dilating retinal imaging solutions is on the rise. In the US, the Centers for Disease Control and Prevention (CDC) projects that the number of individuals with diabetic retinopathy will reach 14.6 million by 2050. This condition, the most common form of diabetic eye disease, necessitates frequent retinal examinations. To address the need for efficient and accurate retinal imaging, technological advancements have been made in the field.

These include the integration of artificial intelligence (AI) and machine learning algorithms for image recognition and analysis, improving image quality and segmentation. Red-free imaging and autofluorescence imaging are also gaining popularity due to their ability to provide clearer images and enhance diagnostic accuracy. Cloud storage and data integration enable seamless transfer and access to patient records, ensuring efficient clinical workflows and remote monitoring capabilities. Product development is focused on enhancing image resolution, battery life, and user experience. Sales and marketing strategies aim to increase market penetration through technology licensing and distribution channels. Regulatory compliance, data security, and ease of use are essential considerations for both manufacturers and healthcare providers.

Fluorescein angiography and wide-field imaging are also utilized for research applications and diagnostic purposes. The market is expected to continue its growth trajectory, driven by the increasing demand for cost-effective, portable, and user-friendly retinal imaging solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Non-Mydriatic Handheld Fundus Camera Industry?

- The increasing prevalence of eye disorders serves as the primary market driver.

- The market is experiencing significant growth due to the increasing prevalence of eye disorders and the need for early detection and continuous monitoring. According to the World Health Organization (WHO), approximately 2.2 billion people worldwide had suffered from near or distant vision impairment in 2023. Alarmingly, 1 billion of these cases were preventable or undiagnosed. Among the primary causes of distance vision impairment or blindness, age-related macular degeneration (AMD) had affected 8 million people, and glaucoma had impacted 7 million. Early detection and regular monitoring are crucial for effective management and treatment of these conditions.

- Non-mydriatic imaging technology, which allows for retinal photography without the use of dilating drops, is gaining popularity due to its convenience and patient comfort. This technology is particularly beneficial for diabetic retinopathy screening, as regular monitoring is essential for managing this condition. The market for non-mydriatic handheld fundus cameras is driven by the increasing demand for ophthalmic imaging and the adoption of digital fundus cameras. Wide-field imaging, autofocus technology, and user-friendly interfaces are key features that are enhancing the user experience and driving market growth. Image analysis and research applications are also contributing to the market's growth, as these technologies enable healthcare professionals to make more accurate diagnoses and develop new treatments.

- Ce marking and high image quality are essential considerations for manufacturers to meet regulatory requirements and meet customer expectations.

What are the market trends shaping the Non-Mydriatic Handheld Fundus Camera Industry?

- The introduction of new products is a current market trend. Professionals in various industries are continually innovating and releasing new items to meet consumer demands and stay competitive.

- The market is experiencing substantial growth due to the introduction of innovative products that enable efficient and accessible retinal imaging solutions. One recent example is the launch of Eyer, a non-mydriatic handheld fundus camera by PHELCOM in Japan. This device, which connects to a smartphone, allows for high-quality retinal examinations in a few minutes. Despite challenges such as Japanese certification processes and language barriers, PHELCOM successfully obtained medical device certification in November 2022, showcasing their dedication to regulatory compliance and market expansion.

- The Eyer camera addresses the need for efficient and accessible retinal imaging solutions, particularly in regions with stringent regulatory environments. This innovation is a significant step for PHELCOM in their international growth strategy.

What challenges does the Non-Mydriatic Handheld Fundus Camera Industry face during its growth?

- The expansion of the industry is significantly influenced by the intensifying competition from advanced technologies, posing a significant challenge that must be addressed by market participants.

- The market experiences intense competition from alternative retinal diagnostic tools, such as optical coherence tomography (OCT) and traditional desktop fundus cameras. OCT, in particular, offers high-resolution cross-sectional images of the retina, enabling detailed visualization of retinal layers for accurate diagnosis and monitoring of conditions like macular degeneration, diabetic retinopathy, and glaucoma. This advanced imaging capability, coupled with the comprehensive diagnostic capabilities of OCT, makes it a preferred choice for healthcare providers. As a result, the adoption of non-mydriatic handheld fundus cameras may be limited in certain markets. However, the market continues to evolve with technological advancements, including image recognition, red-free imaging, and artificial intelligence (AI).

- These technologies enhance image clarity and facilitate data integration, cloud storage, image transfer, and remote monitoring. Product development in these areas aims to provide more accurate and efficient diagnostic solutions, making non-mydriatic handheld fundus cameras a viable alternative to OCT and traditional desktop fundus cameras. Maintenance costs and distribution channels also play a crucial role in the market dynamics. Non-mydriatic handheld fundus cameras offer the advantage of lower maintenance costs and ease of use, making them suitable for remote locations and resource-limited settings. Additionally, strategic partnerships and collaborations with key players in the healthcare industry can expand distribution channels and increase market penetration.

- In conclusion, the market faces challenges from advanced retinal diagnostic tools but continues to innovate with technological advancements, focusing on image recognition, red-free imaging, AI, data integration, cloud storage, image transfer, and remote monitoring. Lower maintenance costs and strategic partnerships further contribute to the market's growth and expansion.

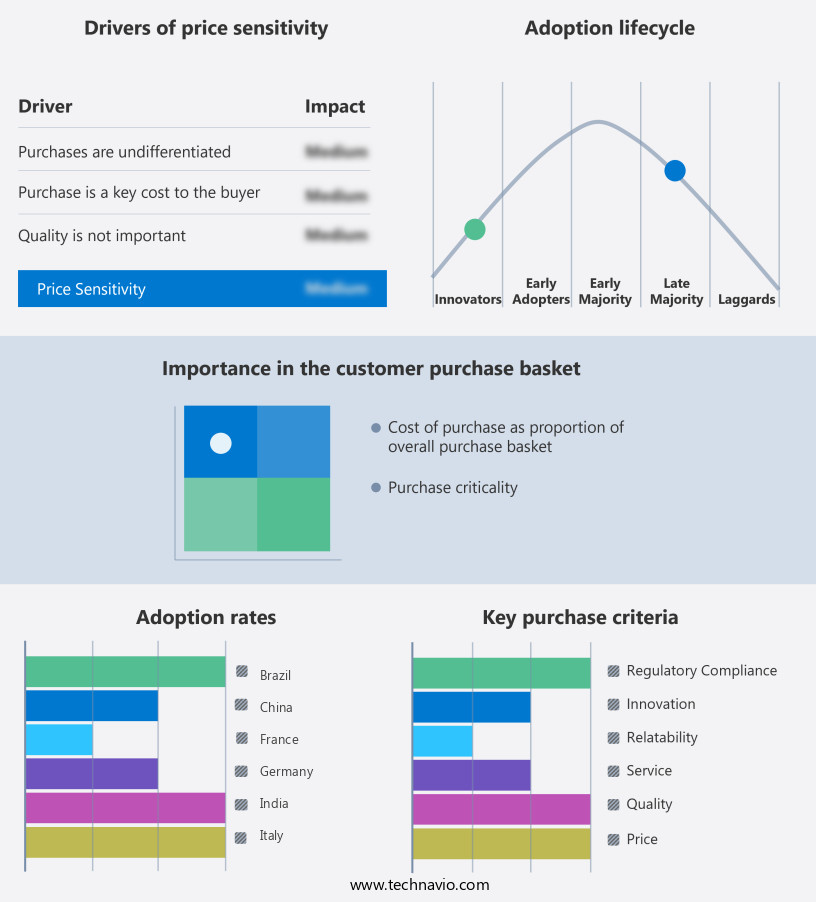

Exclusive Customer Landscape

The non-mydriatic handheld fundus camera market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the non-mydriatic handheld fundus camera market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, non-mydriatic handheld fundus camera market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allm Inc. - This company provides a cutting-edge, non-mydriatic handheld fundus camera solution, such as the Eyer device. Weighing light and compact, this portable tool is effortlessly connected to a smartphone, enabling its use in diverse settings, including bedside examinations, home visits, and assessments for the elderly and pediatric populations. Its innovative design ensures ease of use and versatility, making it an indispensable tool for healthcare professionals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allm Inc.

- Carl Zeiss AG

- Epipole Ltd.

- Hongdee Ophthalmic Equipment

- Kody Medical Electronics Pvt. Ltd.

- NEW VISION

- Optitech Eye Care

- Optomed Oyj

- PHELCOM

- Remidio Innovative Solutions Pvt. Ltd.

- Topcon Corp.

- Volk Optical

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Non-Mydriatic Handheld Fundus Camera Market

- In March 2023, Canon, a leading player in the market, introduced its new model, the CR-2 Plus. This compact and portable device boasts enhanced image quality and faster image processing, making it an attractive option for healthcare professionals in remote areas or small clinics (Canon Europe Press Release, 2023).

- In July 2024, Topcon Medical Systems and Google announced a strategic partnership to integrate Topcon's Non-Mydriatic Fundus Cameras with Google Health. This collaboration aims to streamline patient data management and improve access to diagnostic information for healthcare providers (Topcon Medical Systems Press Release, 2024).

- In October 2024, Optos plc, a leading manufacturer of retinal imaging technology, secured a significant investment of USD50 million from Fidelity Management & Research Company LLC. This funding will support the expansion of Optos' global presence and the development of new technologies (Business Wire, 2024).

- In January 2025, the European Union granted CE Mark approval to Nidek's Non-Mydriatic Handheld Fundus Camera, the Nidek RS-1. This approval marks the entry of Nidek's handheld device into the European market, expanding its reach and increasing competition within the region (Nidek Co., Ltd. Press Release, 2025).

Research Analyst Overview

- The market in healthcare technology is experiencing significant growth due to the increasing demand for remote diagnosis and ocular health monitoring. Automated analysis and image enhancement technologies enable early detection of retinal diseases, including visual field defects and preventive care for eye disease management. The medical device industry is integrating clinical decision support systems to facilitate precise diagnosis and treatment plans. The biopharmaceutical industry leverages fundus photography for drug development, while medical imaging market trends favor digital healthcare and patient engagement.

- Medical device regulations ensure the accuracy and safety of these devices. Precision medicine and healthcare data analytics contribute to improved image interpretation and patient education on visual acuity and retinal disease management.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Non-Mydriatic Handheld Fundus Camera Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 49633 thousand |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, Germany, Japan, China, India, UK, France, Brazil, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Non-Mydriatic Handheld Fundus Camera Market Research and Growth Report?

- CAGR of the Non-Mydriatic Handheld Fundus Camera industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the non-mydriatic handheld fundus camera market growth of industry companies

We can help! Our analysts can customize this non-mydriatic handheld fundus camera market research report to meet your requirements.