North America Cannabis Packaging Market Size 2024-2028

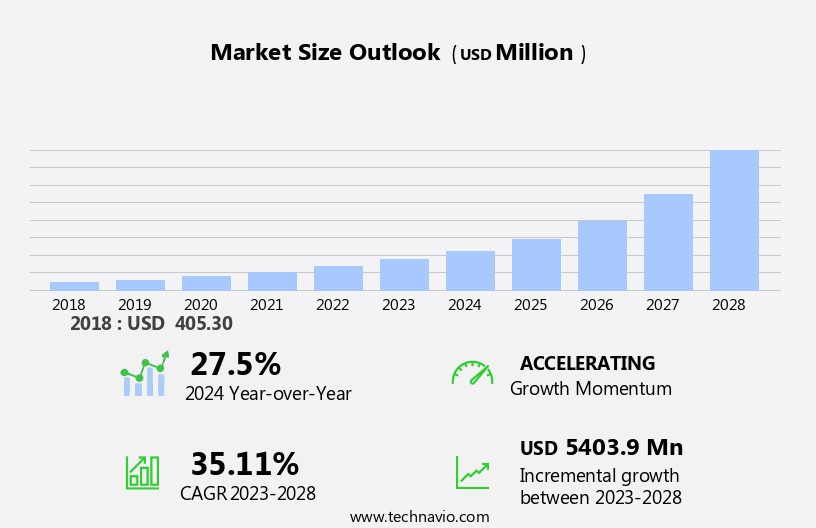

The North America cannabis packaging market size is forecast to increase by USD 5.4 billion at a CAGR of 35.11% between 2023 and 2028.

- The market is experiencing significant growth, driven by the legalization of cannabis in various jurisdictions and the increasing consumer demand for this product. One of the key trends in this market is the rising use of sustainable and eco-friendly packaging solutions, as consumers and regulatory bodies push for more environmentally friendly practices. Another critical factor is the need for regulatory compliance in cannabis packaging, as stringent regulations regarding child-resistant packaging and labeling requirements are being implemented. These regulations ensure consumer safety and create opportunities for companies to differentiate themselves by offering compliant and innovative packaging solutions.

- Companies seeking to capitalize on this market's opportunities must stay informed of regulatory requirements and consumer preferences while investing in sustainable and innovative packaging technologies to meet the evolving needs of the cannabis industry.

What will be the size of the North America Cannabis Packaging Market during the forecast period?

- The market is experiencing significant growth due to the expanding cannabis industry. Cannabis producers and retailers prioritize child-resistant packaging, product labeling with tamper-evident features, and sustainable packaging materials to ensure product safety and security. Innovative designs cater to various product formats, including flower, edibles, and CBD-infused products. Dosage control and product information transparency are essential for medical cannabis users, particularly those with conditions like Lennox-Gastaut Syndrome and Dravet Syndrome, who rely on precise dosages. As the market evolves, regulations continue to prioritize product safety and consumer protection, driving the adoption of advanced packaging technologies.

- The cannabis packaging industry encompasses a wide range of product offerings, from traditional marijuana packaging to specialized solutions for medicinal marijuana, Marinol, and recreational cannabis.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Glass

- Metal

- Plastics

- Cardboard containers

- Type

- Rigid packaging

- Flexible packaging

- Geography

- North America

- US

- Canada

- Mexico

- North America

By Material Insights

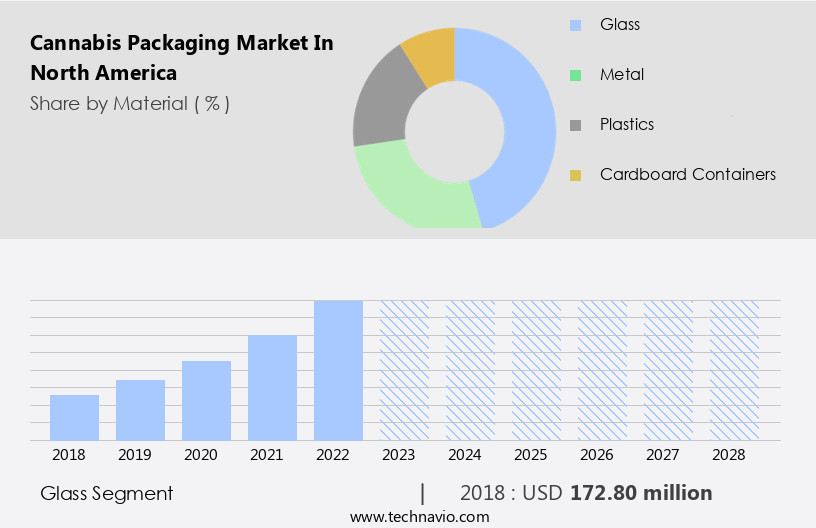

The glass segment is estimated to witness significant growth during the forecast period. The North American cannabis packaging market encompasses various segments, including glass packaging, which is widely utilized by cannabis producers and retailers for its benefits in preserving product quality and sustainability. Glass containers ensure product freshness by maintaining impermeability, preventing the loss of aromas, flavors, and the entry of contaminants, particularly crucial for moisture-sensitive cannabis products. This segment caters to both recreational and medical cannabis, including cannabis-infused beverages, edibles, concentrates, and topicals. Innovative designs, child-resistant mechanisms, tamper-evident seals, and sustainable materials like bio-degradable plastics and recycled paper are integral to the industry's packaging strategies. Product safety, security, and information transparency are essential considerations, with technology advancements enabling UV-resistant packaging, controlled supply networks, and airtight containers.

Compliance with labeling regulations, dose information, and brand recognition are also crucial factors. The market caters to various cannabis formats, ensuring consumer safety and product quality while addressing concerns related to contamination, deterioration, and tampering.

Get a glance at the market share of various segments Request Free Sample

The Glass segment was valued at USD 172.80 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of the North America Cannabis Packaging Market?

- Legalization of cannabis in North America is the key driver of the market. The market has experienced notable growth due to the legalization of cannabis in various jurisdictions for medical and recreational use. The demand for cannabis packaging solutions has escalated, necessitating innovative and child-resistant designs. Regulations highlight the importance of keeping cannabis products secure from minors and children, making child-proof packaging a significant market driver. Manufacturers must balance functionality, visual appeal, and compliance with regulations to cater to this market need.

- Packaging enterprises are adopting specialized packaging solutions, such as flexible packaging, bottles, and jars, to cater to various product formats and branding constraints. Labeling regulations and sustainability concerns are driving the use of biodegradable plastics, recycled paper, and other eco-friendly materials. In the recreational segment, product information transparency and consumer convenience are essential, while medical cannabis products require clear labeling for conditions.

What are the market trends shaping the North America Cannabis Packaging Market?

- Rising use of sustainable and eco-friendly packaging is the upcoming trend in the market. The market is witnessing significant strides towards sustainability. Consumers' increasing preference for eco-friendly packaging and stringent regulations regarding packaging waste and recycling are driving this trend. Sustainable packaging in the cannabis industry involves utilizing materials with a minimal environmental impact throughout their lifecycle.

- This translates to the adoption of recyclable and compostable materials, ethically sourced from sustainable origins. By implementing sustainable packaging practices, cannabis businesses can lessen their carbon footprint and contribute positively to the environment. The enactment of regulations governing packaging waste is a primary catalyst for the growing adoption of eco-friendly packaging solutions in the market.

What challenges does the North America Cannabis Packaging Market face during its growth?

- The need for regulatory compliance in cannabis packaging is a key challenge affecting the market growth. In the North American cannabis packaging market, regulatory compliance is a significant challenge. To ensure product safety and accurate labeling, as well as prevent misuse, strict laws and regulations govern cannabis packaging. One key requirement is the use of child-proof containers to prevent accidental consumption by children. These containers must meet specific safety and efficacy standards.

- Additionally, some jurisdictions have regulations regarding the acceptable materials for cannabis packaging. These restrictions aim to maintain the integrity and safety of cannabis products while adhering to legal requirements. Branding constraints and labeling regulations are essential considerations for packaging enterprises in the cannabis industry. Flexible packaging and plastic bottles and jars are common packaging formats for various cannabis product formats, including recreational and medical cannabis, and CBD infused products.

Exclusive North America Cannabis Packaging Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Berry Global Inc.

- Cannabis Promotions

- Cannaline

- CannaPack Solutions Inc.

- Diamond Packaging

- Dymapak Quark Distribution Inc.

- Elevate Packaging Inc.

- Green Rush Packaging

- Greenlane Holdings Inc.

- Grow Cargo

- IMPAK Corp.

- KacePack

- Kaya Packaging

- Kynd Packaging LLC

- MMC Depot

- N2 Packaging Systems LLC

- Parker Hannifin Corp.

- Sana Packaging

- Smokus Focus

- Stink Sack

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The cannabis industry in North America has experienced significant growth in recent years, leading to a corresponding increase in demand for effective and innovative cannabis packaging solutions. As producers and retailers strive to meet the needs of consumers, they are focusing on various aspects of packaging to ensure product safety, security, and brand recognition. One key area of focus is child-resistant packaging. With the increasing popularity of cannabis products, particularly edibles and concentrates, the importance of child-resistant packaging has become paramount. Producers are investing in packaging enterprises that specialize in child-resistant closures and designs to prevent accidental ingestion by children.

Moreover, product labeling is another critical aspect of cannabis packaging. Producers must adhere to labeling regulations, which include dosage control, product information transparency, and warning labels. Innovative designs that incorporate clear and concise labeling, as well as tamper-evident features, are becoming increasingly popular. Sustainability is also a significant consideration in the cannabis packaging market. Producers and retailers are turning to sustainable packaging materials, such as biodegradable plastics and recycled paper, to reduce their environmental impact. Sustainable packaging solutions are not only better for the environment but also appeal to consumers who prioritize eco-friendly products. Technology advancements are also driving innovation In the cannabis packaging industry.

Furthermore, UV-resistant packaging, specialized packaging solutions, and airtight containers are just a few examples of how technology is being used to improve product quality and consumer safety. Controlled supply networks and tamper-evident seals are also becoming more common to prevent contamination, deterioration, and tampering. The cannabis industry consists of both recreational and medical segments. Medical cannabis products, such as those used to treat conditions like Lennox-Gastaut syndrome and Dravet syndrome, require specific packaging considerations. For instance, child-resistant packaging is essential for medical cannabis products, especially those in the form of cannabis-infused edibles or concentrates. Product formats, such as cannabis-based beverages, cannabis infused edibles, and cannabis concentrates, also require specialized packaging solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 35.11% |

|

Market growth 2024-2028 |

USD 5.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

27.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch