North America Motorhome Market Size 2024-2028

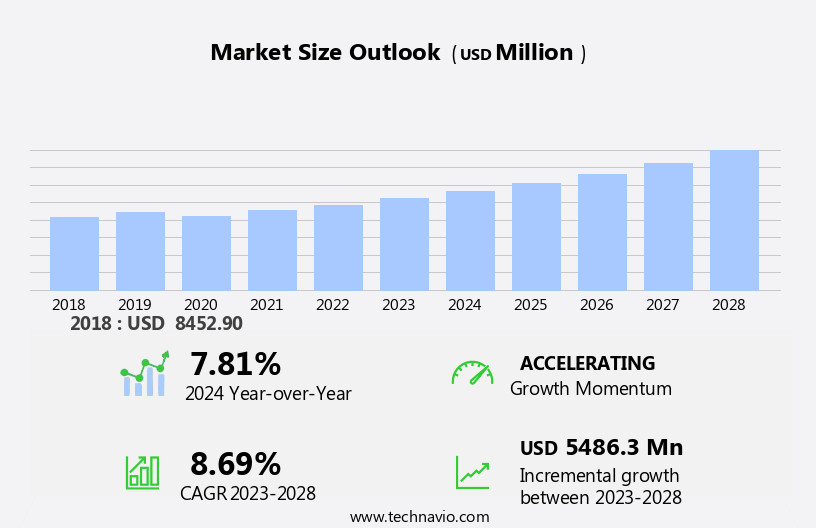

The North America motorhome market size is forecast to increase by USD 5.49 billion at a CAGR of 8.69% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of recreational vehicles (RVs) by various consumer demographics. This trend is fueled by the desire for outdoor adventures and the flexibility that RVs offer. Recreational vehicle parks and campgrounds continue to expand to accommodate the rising demand. The motorhome market's size and direction reflect the growing trend towards flexible, mobile living solutions and the desire for self-sufficient travel experiences. Additionally, RV manufacturers are expanding and upgrading their product lines to cater to diverse consumer preferences, including luxury and eco-friendly options. However, challenges persist, such as the high initial cost of RV ownership and the associated maintenance expenses. These issues may limit market growth, but ongoing innovations in RV technology and design are expected to mitigate these concerns. Overall, the market is poised for continued expansion, driven by evolving consumer needs and industry advancements.

What will be the size of the North America Motorhome Market during the forecast period?

- The North American motorhome market encompasses a diverse range of recreational vehicles (RVs), including motorhomes, towable RVs, camper vans, truck campers, and mobile offices. These self-contained units cater to various lifestyle preferences and use cases, such as road trips, mobile offices, command centers, medical clinics, and isolation units. Motorhomes are further classified into Type A, Type B, and Type C, based on their size and design, with Type A being the largest and Type C being the most popular. Motorhomes offer amenities like bathrooms, showers, kitchen facilities, storage space, beds, and laundry facilities, making them an attractive alternative to traditional lodging options. The market's growth is driven by the burgeoning tourism industry and the increasing popularity of outdoor recreation.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Leisure activity

- Business activity

- End-user

- Direct buyer

- Fleet owner

- Geography

- North America

- Canada

- Mexico

- US

- North America

By Application Insights

- The leisure activity segment is estimated to witness significant growth during the forecast period.

The North American motorhome market has witnessed significant growth due to the increasing popularity of road trips and recreational activities. This market can be segmented based on motorhome types, including towable and motorized recreational vehicles, such as Type A, Type B, and Type C motorhomes, truck campers, camper vans, and RVs. Consumers engage in various leisure activities, including camping, vacation, seasonal use, and attending concerts, festivals, and multi-day events. Manufacturers cater to diverse consumer preferences by offering motorhomes with innovative technology, high-tech features, and commercial applications, such as mobile offices, command centers, medical clinics, and educational facilities. These vehicles come equipped with essential amenities like bathrooms, showers, isolation units, laundries, classrooms, bunkrooms, and sleeping facilities.

Materials like Copper, Steel, and Aluminum are used In the production of motorhome vehicles, while electrification activities and battery-operated components contribute to green mobility. The market is driven by fleet owners, direct owners, and business activities, with rental motorhomes also playing a significant role. The motorhome vehicle OEMs focus on providing electrical components, batteries, wireless systems, and kitchen facilities, ensuring ample storage space, beds, and commercial vehicle applications. The tourism industry and outdoor recreation economy benefit from the expansion of the motorhome market. RV parks and campgrounds cater to the needs of motorhome owners, offering amenities and services that enhance their camping experience. Overall, the North American motorhome market continues to grow, driven by consumer demand for mobility, convenience, and the ability to engage in leisure activities.

Get a glance at the market share of various segments Request Free Sample

The leisure activity segment was valued at USD 5.04 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of North America Motorhome Market?

Increasing adoption of RVs by different generations of consumers is the key driver of the market.

- Motorhomes, or recreational vehicles (RVs), continue to gain popularity in North America due to their versatility and ability to offer a blend of comfort and adventure. RVs come in various types, including towable recreational vehicles, motorized recreational vehicles, and alternatives like truck campers and camper vans. Type A, B, and C motorhomes cater to diverse consumer needs, with Class C motorhomes and Class B motorhomes being favored by younger generations. RV parks and campgrounds along tourist routes provide leisure and outdoor activities, making RVs an ideal choice for vacation and travel. RVs serve not only as mobile homes but also as mobile offices, command centers, medical clinics, and even classrooms or bunkrooms for larger groups.

- Innovative technology and high-tech features, such as electrification activities, battery-operated components, and wireless systems, contribute to the green mobility trend. This, in turn, attracts a broader audience, including millennials, to the RV market. Manufacturers are expanding their production capabilities to cater to the increasing demand for RVs. For instance, Winnebago, a leading RV manufacturer, recently celebrated the production of its 500,000th motorhome. This milestone underscores the growth and potential of the RV industry. RVs offer a unique blend of luxury and affordability, making them an attractive option for various business activities, such as fleet owners, direct owners, and rental motorhomes. The RV industry's continued growth is driven by the increasing demand for mobility, leisure, and outdoor recreation. Motorhome vehicle OEMs are investing in electrical components, batteries, and automotive batteries to meet the evolving needs of consumers.

What are the market trends shaping the North America Motorhome Market?

Expansion and upgrades in product lines is the upcoming trend In the market.

- The market has experienced significant growth in recent years, driven by an increase in road trip popularity and the expanding active leisure market. Motorhomes, as part of the recreational vehicles (RV) category, include towable and motorized options such as Type A, Type B, and Type C motorhomes, truck campers, camper vans, and more. This growth has led to increased investments in manufacturing and retail facilities, resulting in a more extensive network of RV parks and campgrounds along tourist routes. Manufacturers have responded by expanding their product offerings beyond motorhomes, providing aftermarket services, and incorporating innovative technology and high-tech features.

- For instance, some motorhomes now include mobile offices, command centers, medical clinics, bathrooms, showers, isolation units, laundries, classrooms, bunkrooms, and sleeping facilities. These developments cater to diverse needs, enabling motorhomes to serve as versatile solutions for vacation, travel, and seasonal use. Moreover, the motorhome market is embracing green mobility through electrification activities and battery-operated components. This trend is particularly appealing to the young generation, who are increasingly environmentally conscious. The market is also seeing an increase in demand for RV rentals, further expanding business opportunities for fleet owners and direct owners. Thus, the market is experiencing a growth in demand, driven by the active leisure market, increasing road trips, and innovative technology. Manufacturers are responding by expanding their product offerings and investing in aftermarket services, creating a vibrant and dynamic industry.

What challenges does North America Motorhome Market face during the growth?

Problems associated with RV ownership is a key challenge affecting the market growth.

- Motorhomes, as part of the recreational vehicle (RV) market, offer Americans the freedom to embark on road trips and explore tourist routes in towable and motorized forms. These RVs, including Type A, B, and C motorhomes, truck campers, camper vans, and Class A, B, and C commercial motorhomes, provide sleeping facilities, bathrooms, showers, isolation units, laundries, classrooms, bunkrooms, and kitchen facilities for leisure and business activities. The RV industry's growth is driven by the active leisure market, with consumers seeking outdoor activities and vacation opportunities. Millennials, in particular, are drawn to the convenience and flexibility of RVs, making them a popular choice for multi-day events, concerts, festivals, and seasonal use.

- RVs are typically constructed from materials like copper, steel, and aluminum, but their longevity is affected by exposure to adverse weather conditions. Maintenance and repair costs can be substantial due to the need for electrification activities and battery-operated components, which contribute to the overall cost of ownership. Innovative technology and high-tech features, such as wireless systems, are increasingly integrated into RVs, enhancing the user experience. Fleet owners, direct owners, and rental motorhome providers benefit from these advancements, as they cater to the demands of the travel industry and the outdoor recreation economy. Motorhome vehicle OEMs continue to invest in electrical components, batteries, and automotive battery technology to meet the evolving needs of the RV market.

Exclusive North America Motorhome Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Berkshire Hathaway Inc.

- Entegra Coach Inc.

- GMC Motorhomes International

- Gulf Stream Coach Inc.

- Nexus RV

- Pleasure Way Industries Ltd

- REV Group Inc.

- Thor Industries Inc.

- Triple E Canada Ltd.

- Winnebago Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The North American recreational vehicle (RV) market encompasses a diverse range of motorized and towable vehicles, including motorhomes, camper vans, truck campers, and travel trailers. These vehicles cater to the active leisure market, providing mobility and convenience for road trips and camping adventures. Motorhomes, a type of self-contained RV, offer various classes such as Type A, Type B, and Type C. Type A motorhomes are large, spacious vehicles built on a bus chassis, providing ample living space and amenities. Type B motorhomes are compact and van-like, offering a more agile driving experience. Type C motorhomes are a blend of Type A and Type B, featuring a cab-over design that provides additional sleeping space. Recreational vehicles have gained popularity as mobile offices, command centers, medical clinics, and even classrooms. They offer isolation units, bathrooms, showers, laundries, and sleeping facilities, making them versatile for various business activities. RV parks and campgrounds serve as essential destinations for RV travelers, providing access to tourist routes, leisure activities, and outdoor activities. The tourism industry and outdoor recreation economy benefit significantly from the RV market's growth. The RV industry has seen a growth in demand from the millennial generation, who value the flexibility and affordability of RV travel. Class C motorhomes and camper vans have gained popularity due to their smaller size and lower cost compared to Type A motorhomes.

The RV market is witnessing a shift towards electrification activities, with battery-operated components and green mobility becoming increasingly important. Copper, steel, and aluminum are popular materials used in RV manufacturing due to their durability and lightweight properties. Innovative technology and high-tech features are becoming standard in modern RVs, including wireless systems, kitchen facilities, storage space, beds, and electrical components. Commercial motorhome vehicle OEMs invest heavily in research and development to meet the evolving needs of the RV market. Fleet owners and direct owners utilize RVs for seasonal use, vacation travel, and multi-day events such as concerts and festivals. Rental motorhomes offer an accessible option for those who do not wish to invest In their own RV. Thus, the North American RV market is a dynamic and growing industry, catering to the diverse needs of travelers and businesses alike. The market's continued evolution reflects the changing preferences and priorities of consumers, driven by advancements in technology and a growing appreciation for outdoor recreation and mobility.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

130 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.69% |

|

Market growth 2024-2028 |

USD 5.49 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

7.81 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch