Oligonucleotide Synthesis Market Size 2025-2029

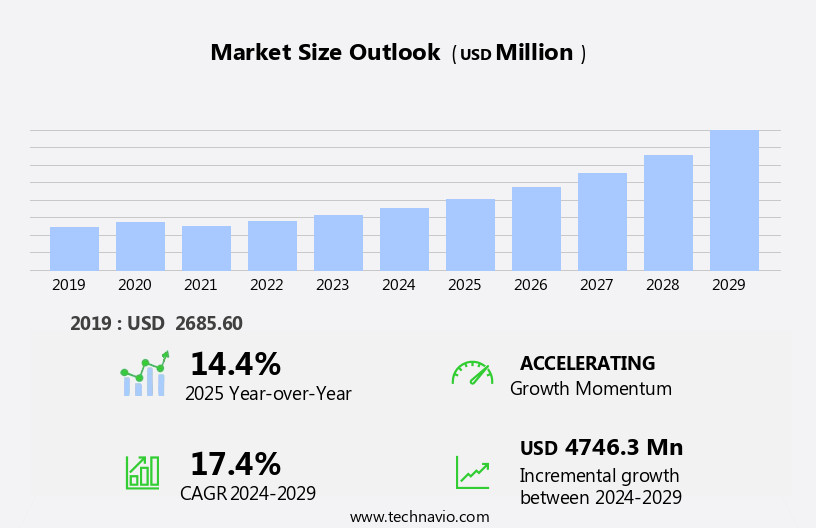

The oligonucleotide synthesis market size is forecast to increase by USD 4.75 billion, at a CAGR of 17.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing shift towards RNA-based therapeutics. This trend is driven by the advancements in RNA technology and the potential of RNA therapeutics to treat various diseases, including genetic disorders and cancer. Another key driver is the integration of Artificial Intelligence (AI) and automation in oligonucleotide synthesis, which enhances efficiency, reduces errors, and lowers production costs. However, the market faces challenges in the form of regulatory issues associated with the approval and commercialization of oligonucleotide therapeutics.

- These challenges include complex regulatory pathways, stringent requirements for clinical trials, and the need for large-scale manufacturing facilities to meet regulatory standards. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay updated on regulatory guidelines and invest in advanced technologies to streamline production processes.

What will be the Size of the Oligonucleotide Synthesis Market during the forecast period?

The market is a dynamic and evolving landscape, driven by advancements in technology and applications across various sectors. Synthesis platforms continue to innovate, with therapeutic oligonucleotides gaining significant attention due to their potential in gene editing and RNA synthesis. Quality control remains a critical focus, with custom oligonucleotides and libraries requiring stringent sequence optimization and base modifications for improved synthesis yield. Coupling reactions and molecular diagnostics are other areas of growth, with bulk synthesis and environmental monitoring also finding applications. Oligonucleotide design and chemical modifications are essential for enhancing stability and sequence complexity, while automated synthesizers streamline the production process.

Next-generation sequencing (NGS) and mass spectrometry are key tools in the oligonucleotide industry, with food industry applications also emerging. Phosphoramidite chemistry remains the backbone of DNA synthesis, while biomedical research and drug discovery continue to drive market growth. Gene synthesis and genetic testing are also significant markets, with oligonucleotide delivery and custom synthesis services playing crucial roles. Oligonucleotide applications span from antisense technology to gene editing, RNA synthesis, and genome engineering. Sequence verification and purification methods are essential for ensuring product quality, while clinical trials and oligonucleotide pricing remain key market considerations. The market analysis reflects ongoing trends, with synthesis scale and sequence length continually increasing to meet the demands of various industries.

How is this Oligonucleotide Synthesis Industry segmented?

The oligonucleotide synthesis industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- PCR primers

- PCR assays and panels

- DNA microarrays

- Fluorescence in situ hybridization

- Others

- End-user

- Pharmaceutical and biotechnology companies

- Research and academic institutes

- Diagnostic laboratories

- Hospitals

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Application Insights

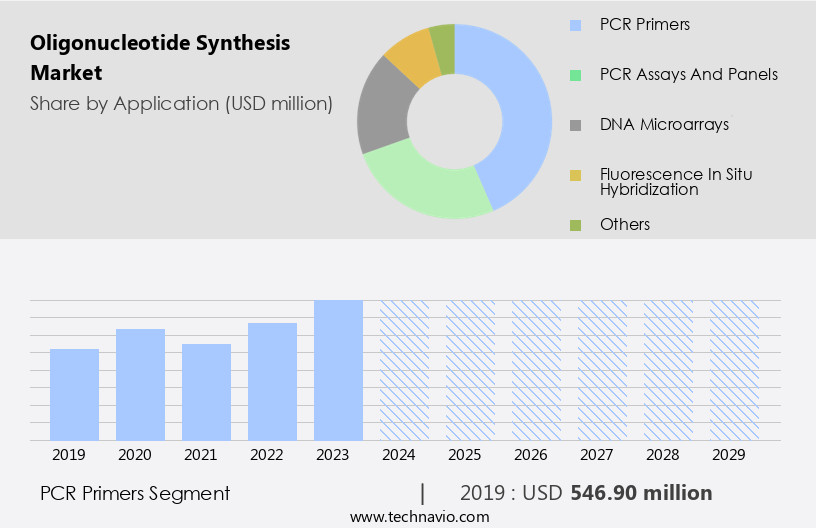

The pcr primers segment is estimated to witness significant growth during the forecast period.

Oligonucleotide synthesis plays a crucial role in various scientific applications, including PCR reactions, gene editing, RNA synthesis, and next-generation sequencing. Companies specializing in oligonucleotide synthesis provide custom design and synthesis services for these essential biomolecules. Melting temperature (tm) is a critical factor in oligonucleotide design, ensuring proper binding and function in various applications. Advanced synthesis platforms, such as solid-phase synthesis and automated synthesizers, enable the production of high-quality oligonucleotides with high synthesis yield. Therapeutic oligonucleotides, including antisense oligonucleotides and siRNAs, are gaining significant attention in the biomedical research and drug discovery sectors due to their potential therapeutic applications.

Oligonucleotide libraries and sequence optimization are essential for the development of these therapeutics. Base modifications and chemical modifications are crucial for enhancing oligonucleotide stability and improving their therapeutic efficacy. Quality control measures, such as sequence verification and purification methods, are essential to ensure the accuracy and purity of synthesized oligonucleotides. Custom oligonucleotide services cater to the unique requirements of researchers, offering flexibility in oligonucleotide length, sequence complexity, and synthesis scale. Oligonucleotide applications extend beyond biomedical research, including molecular diagnostics, environmental monitoring, and food industry. Coupling reactions and sequence optimization are critical aspects of oligonucleotide synthesis, ensuring efficient and accurate synthesis of complex sequences.

Gene synthesis, gene editing, and genome engineering are emerging applications of oligonucleotides, offering potential solutions for genetic testing and clinical trials. Oligonucleotide pricing and synthesis scale are essential factors for researchers and industries considering large-scale production. Innovations in oligonucleotide synthesis, such as phosphoramidite chemistry, continue to drive advancements in the field, enabling the production of high-quality oligonucleotides for various applications. Oligonucleotide synthesis companies also offer online tools and software for oligonucleotide design, assisting researchers in creating optimal sequences for their specific applications.

The PCR primers segment was valued at USD 546.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

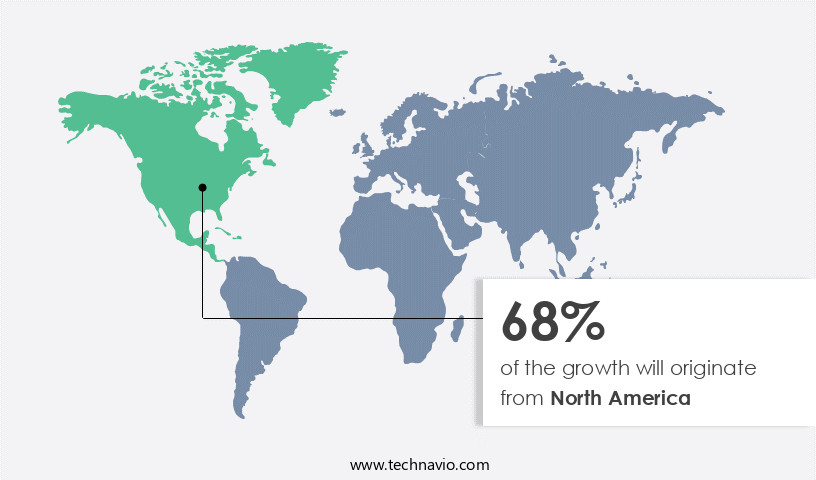

North America is estimated to contribute 68% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in North America where the US is leading the regional market. Advanced technologies and methodologies are being employed by companies in the US to meet the escalating demand for oligonucleotides. For instance, Agilent Technologies Inc. Has enhanced its per-cycle synthesis yield to 99.5% through process modification, surpassing the conventional 98% yield. This improvement in yield is crucial for achieving high fidelity in oligonucleotide synthesis. Furthermore, the US Food and Drug Administration's (FDA) increasing approval of oligonucleotide therapies has facilitated their commercial availability in North America. Most oligonucleotide therapies focus on the treatment of rare diseases such as Homozygous Familial Hypercholesterolemia and Duchenne Muscular Dystrophy.

In terms of trends, there is a growing emphasis on quality control, custom oligonucleotides, oligonucleotide libraries, and oligonucleotide applications. Base modifications, sequence optimization, and coupling reactions are also gaining importance in the market. Molecular diagnostics, bulk synthesis, environmental monitoring, oligonucleotide design, and gene synthesis are some of the significant applications driving market growth. Automated synthesizers, oligonucleotide length, oligonucleotide market analysis, solid-phase synthesis, oligonucleotide services, genetic testing, oligonucleotide delivery, and custom synthesis are other key areas of focus. Oligonucleotide stability, oligonucleotide conjugates, mass spectrometry, food industry, phosphoramidite chemistry, DNA synthesis, biomedical research, drug discovery, sequence complexity, forensic science, sequence verification, genome engineering, antisense oligonucleotides, clinical trials, oligonucleotide pricing, purification methods, and synthesis scale are all integral components of the market dynamics.

The oligonucleotide industry is continually evolving, with advancements in technology and methodologies driving innovation and expansion in various applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Oligonucleotide Synthesis Industry?

- The increasing preference towards RNA-based therapeutics is the primary market driver, reflecting a significant trend in the pharmaceutical industry.

- The market is experiencing significant growth due to the increasing demand for custom-designed oligonucleotides in molecular diagnostics and RNA-based therapeutics. Oligonucleotides are essential components of various applications, including gene synthesis, oligonucleotide design, chemical modifications, and automated synthesizers. In molecular diagnostics, oligonucleotides are used for genetic testing and environmental monitoring. In RNA-based therapeutics, such as mRNA vaccines and RNAi therapies, oligonucleotides play a crucial role in the production of sequence-specific RNA sequences. For instance, mRNA vaccines require custom-designed mRNA sequences encapsulated in lipid nanoparticles, which can only be produced through oligonucleotide synthesis. Additionally, RNAi therapies, which utilize small interfering RNAs (siRNAs) or short hairpin RNAs (shRNAs) to silence specific genes, also rely on oligonucleotide synthesis.

- The length of the oligonucleotides and the need for high-quality, sequence-specific synthesis further drive the demand for oligonucleotide synthesis services. Overall, the market for oligonucleotide synthesis is expected to continue growing as the applications for oligonucleotides expand in various industries.

What are the market trends shaping the Oligonucleotide Synthesis Industry?

- The integration of artificial intelligence (AI) and automation is becoming a significant trend in the market. This innovative approach combines the capabilities of AI to optimize synthesis processes and automation to streamline production, enhancing efficiency and accuracy.

- Artificial intelligence (AI) is revolutionizing the market by optimizing the design process and increasing throughput. Advanced algorithms analyze vast datasets to determine the most effective oligonucleotide sequences for specific applications, considering factors such as sequence specificity, secondary structure formation, and target binding affinity. This accelerates the design process and enhances the success rate of oligonucleotide synthesis. Furthermore, AI-driven automation platforms enable high-throughput production of custom oligonucleotides, allowing for the parallel synthesis of multiple sequences in a single run. This not only increases the throughput and scalability of oligonucleotide synthesis but also makes it possible to produce large quantities rapidly for various applications, including gene editing, RNA synthesis, next-generation sequencing (NGS), oligonucleotide conjugates, mass spectrometry, DNA synthesis, and biomedical research in the food industry.

- Phosphoramidite chemistry remains the primary methodology for oligonucleotide synthesis, ensuring stability and accuracy. Overall, AI-driven advancements in oligonucleotide synthesis are transforming industries, from academia to biotech, by providing faster, more accurate, and cost-effective solutions.

What challenges does the Oligonucleotide Synthesis Industry face during its growth?

- The growth of the industry in the realm of oligonucleotide therapeutics is significantly influenced by the complex regulatory issues surrounding their development and application.

- Oligonucleotide synthesis plays a crucial role in various industries, including drug discovery, genome engineering, forensic science, and clinical trials. The market for oligonucleotide synthesis is driven by the increasing demand for sequence-specific therapeutics and research tools. Sequence complexity and purification methods are key factors influencing oligonucleotide pricing. In drug discovery, antisense oligonucleotides (ASOs) and small interfering RNAs (siRNAs) are used for therapeutic applications due to their high specificity and potency. However, the regulatory challenges associated with their approval process are significant due to their unique biological properties. The lack of specific regulatory guidelines for oligonucleotide therapeutics poses challenges for manufacturers, as they must comply with varying regulations from authorities such as the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA).

- The US FDA classifies oligonucleotide drugs as small molecules under the Center for Drug Evaluation and Research (CDER) jurisdiction. The increasing use of oligonucleotides in genome engineering and gene therapy, as well as in diagnostics and research tools, is expected to drive market growth. The scale of synthesis also plays a role in pricing, with larger synthesis batches leading to cost savings. Sequence verification is a critical step in the oligonucleotide synthesis process, ensuring the accuracy and purity of the final product. Advancements in synthesis technology and automation have improved the efficiency and accuracy of oligonucleotide synthesis, making it an essential tool in various industries.

Exclusive Customer Landscape

The oligonucleotide synthesis market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oligonucleotide synthesis market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oligonucleotide synthesis market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - The company specializes in oligonucleotide synthesis, providing cutting-edge solutions for the rapid production of custom oligonucleotide pools. Our offerings include the advanced SurePrint HiFi technology, enabling the synthesis of high-fidelity oligonucleotides with superior purity and yield. By leveraging innovative techniques and state-of-the-art facilities, we ensure timely delivery and unparalleled quality for our clients in the research and biotechnology industries. Our commitment to excellence and continuous improvement drives us to push the boundaries of oligonucleotide synthesis, empowering our customers to make groundbreaking discoveries and advance scientific knowledge.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Ajinomoto Bio Pharma Services

- Alnylam Pharmaceuticals Inc.

- Amgen Inc.

- Ansa Biotechnologies

- Bio Synthesis Inc

- Biogen Inc.

- Biotage AB

- Danaher Corp.

- Eurofins Scientific SE

- General Electric Co.

- Ionis Pharmaceuticals Inc.

- Kaneka Corp.

- LGC Science Group Holdings Ltd.

- Merck KGaA

- Mettler Toledo International Inc.

- QIAGEN N.V.

- Sarepta Therapeutics Inc.

- Synbio Technologies LLC

- Syngene International Ltd.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oligonucleotide Synthesis Market

- In February 2023, Merck KGaA, a leading player in the market, announced the launch of its next-generation DNA and RNA synthesis platform, VersaBuild, which promises faster turnaround times and improved quality for customers (Merck KGaA press release).

- In November 2024, Thermo Fisher Scientific, another major player, entered into a strategic collaboration with Twist Bioscience to expand its offering in the synthetic biology market, including the production of complex oligonucleotides (Thermo Fisher Scientific press release).

- In March 2025, Dharmacon, a Horizon Discovery Group company, secured a significant investment of USD50 million to expand its capacity for the production of custom oligonucleotides, further strengthening its position in the market (Horizon Discovery Group press release).

- In June 2025, the U.S. Food and Drug Administration (FDA) granted marketing authorization for the use of Sarepta Therapeutics' Exon 51-skipped eteplirsen for the treatment of Duchenne muscular dystrophy, marking a significant milestone in the use of oligonucleotide therapies for genetic disorders (FDA press release).

Research Analyst Overview

- The market is experiencing significant growth, driven by advancements in oligonucleotide characterization and quality standards. Oligonucleotide modification technologies, such as phosphoramidite building blocks and coupling reagents, play a crucial role in ensuring high-quality oligonucleotides for various applications. In the realm of genome sequencing, the integration of exome sequencing and real-time PCR has expanded the utility of oligonucleotides in diagnostic assays and research. Oligonucleotide intellectual property and regulatory affairs are becoming increasingly important as the market expands. Patents related to site-specific modification, oligonucleotide-based therapeutics, and RNA interference (RNAi) continue to shape the competitive landscape. GMP manufacturing processes and capping reagents ensure the stability of oligonucleotides, while biocompatible materials and reverse transcriptases facilitate their use in gene therapy and RNAi applications.

- Fluorescent labeling, cell penetration, and oligonucleotide biosensors expand the potential uses of these molecules in research and diagnostic applications. Oligonucleotide stability studies and deprotecting agents are essential for maintaining the integrity of these molecules during synthesis and storage. DNA polymerases and target enrichment techniques further enhance the versatility of oligonucleotides in various applications, including therapeutics and diagnostic assays.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oligonucleotide Synthesis Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.4% |

|

Market growth 2025-2029 |

USD 4746.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.4 |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oligonucleotide Synthesis Market Research and Growth Report?

- CAGR of the Oligonucleotide Synthesis industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oligonucleotide synthesis market growth of industry companies

We can help! Our analysts can customize this oligonucleotide synthesis market research report to meet your requirements.