China Online Lottery Market Size 2025-2029

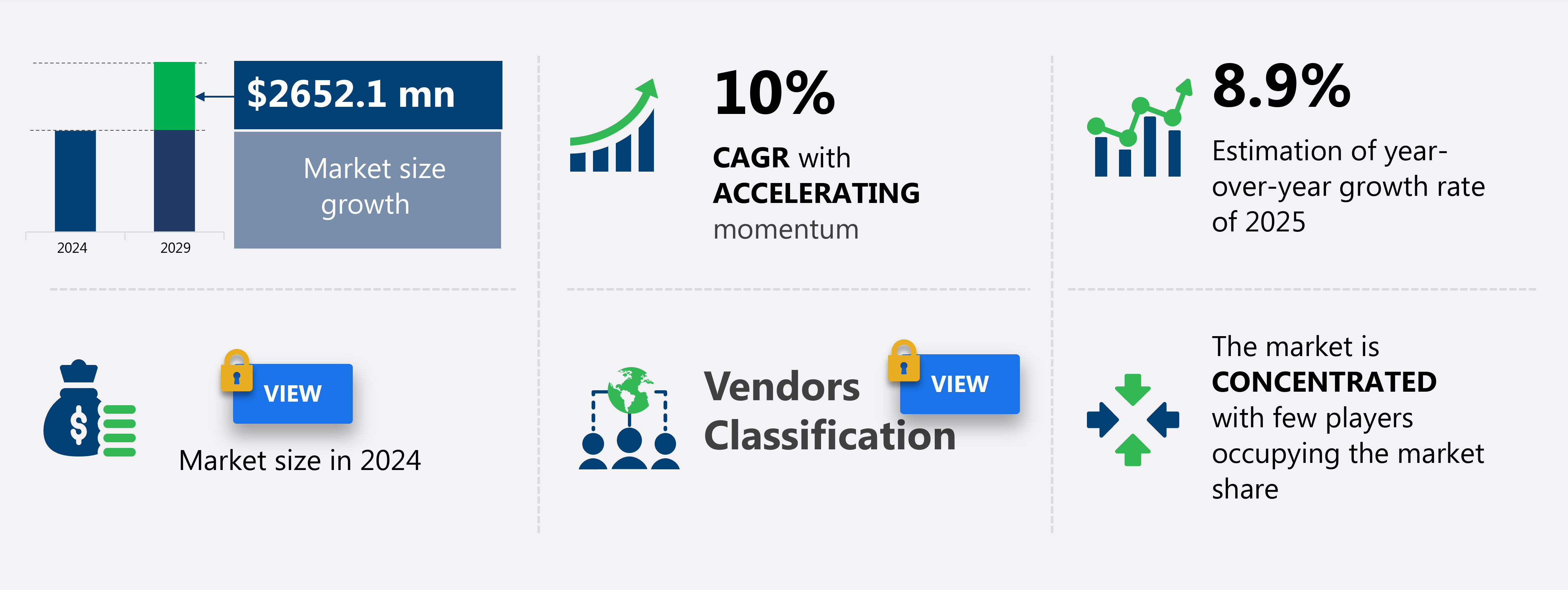

The China online lottery market size is valued to increase USD 2.65 billion, at a CAGR of 10% from 2024 to 2029. Increased reach of online lotteries will drive the China online lottery market.

Major Market Trends & Insights

- By Device - Mobile segment was valued at USD 2.13 billion in 2022

- By Product - Lotto segment accounted for the largest market revenue share in 2022

- CAGR : 10%

Market Summary

- The market is experiencing significant growth and transformation, driven by the increasing reach of online lotteries and the introduction of new types, such as Welfare Lottery and Sports Lottery. According to a recent report, online lottery sales accounted for approximately 40% of the total lottery market revenue in China in 2020. However, this market evolution is not without challenges. Online scams and negative impacts on consumer trust pose significant hurdles. Regarding technologies, advancements in mobile applications, data analytics, and digital payments are shaping the market's future.

- Additionally, regulatory changes continue to impact the market landscape, with the China Welfare Lottery Center and China Sports Lottery Center playing pivotal roles. These trends underscore the market's continuous evolution, offering opportunities for stakeholders to innovate and adapt.

What will be the Size of the China Online Lottery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Online Lottery in China Market Segmented and what are the key trends of market segmentation?

The online lottery in China industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Device

- Mobile

- Desktop

- Product

- Lotto

- Sports

- VLT

- Scratch card

- Distribution Channel

- Official Platforms

- Third-Party Platforms

- Social Media Channels

- End-User

- Individual Players

- Syndicates

- Casual Gamers

- Game Type

- Sports Lottery

- Welfare Lottery

- Instant Lottery

- Numbers Lottery

- Geography

- APAC

- China

- APAC

By Device Insights

The mobile segment is estimated to witness significant growth during the forecast period.

Online lotteries in China have experienced significant growth, with mobile users driving a large portion of this expansion. Approximately 60% of online lottery transactions originate from mobile devices, making it a crucial segment for companies. This trend is expected to continue, with mobile users projected to account for 70% of online lottery sales by the end of the forecast period. The user authentication protocols and prize payout systems employed by online lottery platforms ensure secure transactions, while risk management strategies protect against potential fraud and money laundering activities. Jackpot fund management and transaction processing speeds are optimized to provide a seamless user experience.

Responsible gambling initiatives, such as setting deposit limits and providing access to resources for problem gamblers, are integrated into the platforms. Payment processing fees are transparently disclosed, and CRM systems are utilized to enhance customer engagement. Random number generators are subjected to rigorous testing and regulatory oversight to ensure fairness and integrity. The regulatory framework governing online lotteries is continually evolving, with a focus on data privacy, customer support, and game integrity assurance. Operating costs are analyzed to maintain profitability, while online lottery licensing requirements ensure a competitive and compliant market. Winning number generation and odds calculation algorithms are designed to provide transparency and accuracy.

Mobile payment integration and secure payment gateways facilitate transactions, while anti-money laundering measures are in place to maintain the integrity of the market. Lottery ticket sales are monitored closely to identify trends and optimize bonus structures and marketing campaigns for maximum effectiveness. Player engagement metrics, such as frequency of play and preferred games, are analyzed to inform strategic decisions and improve customer retention. Compliance regulations are strictly enforced to maintain trust and credibility within the market. Loyalty programs and customer retention rates are key performance indicators, with companies continually seeking to enhance the user experience and incentivize repeat business.

Ticket distribution networks are optimized to ensure broad accessibility, while player verification systems ensure the authenticity of each transaction. Win probability calculations and fraud detection systems are employed to maintain fairness and security, while jackpot calculations are transparently displayed to maintain trust and excitement. Overall, the market is dynamic and evolving, with a focus on innovation, security, and customer satisfaction.

The Mobile segment was valued at USD 2.13 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Chinese online lottery market represents a significant and rapidly evolving sector within the global iGaming industry. This market is characterized by the adoption of advanced online lottery platforms, mobile lottery apps, and responsible gambling initiatives. Security measures, such as player verification processes and fraud detection systems, are prioritized to ensure the integrity of lottery ticket sales data analysis. Mobile lottery apps have gained substantial traction, offering a seamless user experience and contributing to the market's growth. In contrast, the effectiveness of responsible gambling initiatives remains a critical concern, with ongoing efforts to minimize potential negative impacts on players.

Online lottery payment processing fees are a significant cost factor, with efficient systems and payment processing speed optimization essential for maintaining customer satisfaction. Random number generator certification and data privacy protocol compliance audits are crucial components of platform security and trust. Customer support system response times and anti-money laundering measures compliance are vital for maintaining regulatory compliance and fostering a secure environment. Player behavior data analysis segmentation and customer retention rate improvement strategies are increasingly important for operators to optimize their marketing campaign effectiveness and return on investment from affiliate marketing programs. The market exhibits a competitive landscape, with various players vying for market share.

For instance, adoption rates of advanced lottery platform features, such as real-time jackpot fund management risk assessment and player verification process efficiency, vary significantly among competitors. These differences can lead to notable disparities in market positioning and overall performance. Moreover, the Chinese market's regulatory environment plays a significant role in shaping the online lottery landscape. Regulatory compliance software implementation and adherence to regulatory requirements, such as marketing campaign effectiveness conversion rates and system uptime, are essential for maintaining a competitive edge. In summary, the Chinese online lottery market is a dynamic and competitive landscape, with various factors influencing its growth and evolution.

Operators must focus on security measures, user experience, payment processing, regulatory compliance, and customer engagement to succeed in this market. The indirect comparison of adoption rates for advanced features among competitors highlights the importance of continuous innovation and improvement.

What are the key market drivers leading to the rise in the adoption of Online Lottery in China Industry?

- The significant expansion of online lotteries' reach is the primary market driver.

- Online lotteries have gained significant traction in the gaming industry due to their accessibility and convenience. Unlike traditional lotteries that require players to be physically present at a venue, online lotteries are Internet-based, allowing players to participate from anywhere, at any time. This flexibility has led to a wider reach among players, particularly among the younger population who are more likely to use computing and mobile devices. Furthermore, mobile advertising, a powerful medium for reaching untapped audiences, plays a crucial role in promoting online lotteries to potential players.

- The shift towards digital platforms has transformed the lottery landscape, offering a more inclusive and convenient experience for players. Online lotteries continue to evolve, presenting new opportunities for growth and innovation within the gaming sector.

What are the market trends shaping the Online Lottery in China Industry?

- The introduction of new types of lotteries is currently a notable market trend. This trend signifies a significant shift in consumer preferences and industry innovation.

- Lotteries in China have gained considerable traction in the past five years, with two legal operators, China Welfare Lottery and China Sports Lottery, spearheading this growth. China Welfare Lottery focuses on raising funds for charitable initiatives and social welfare, while China Sports Lottery contributes to community sports facility development. In Shanghai alone, welfare lottery sales reached an estimated USD700 to USD800 million in 2024, allocating approximately 30% for public welfare programs, including support for vulnerable populations like the elderly and disabled.

- This substantial growth is a testament to the significant role lotteries play in China's public welfare sector.

What challenges does the Online Lottery in China Industry face during its growth?

- Online scams and their negative impacts pose a significant challenge to the industry's growth. It is crucial for businesses to remain vigilant and implement robust security measures to mitigate potential risks and protect their reputation. The consequences of successful scams can result in financial losses, damage to brand image, and decreased customer trust. Therefore, staying informed about the latest scam trends and best practices for cybersecurity is essential for ensuring the industry's continued growth and success.

- The online lottery market experiences persistent growth, with an increasing number of players opting for the convenience of purchasing tickets digitally. According to recent studies, the global online lottery market is projected to reach a value of USD43.1 billion by 2026, representing a significant expansion from its current size. However, this market's dynamism also presents challenges. Unregistered websites selling fake lottery tickets and scam emails are rampant, leading to a rise in online fraud. These sites mimic legitimate lottery platforms, tricking users into believing they've won a prize and requesting payment for taxes or fees.

- Despite efforts to ban these illegal sites, their URLs frequently change, making regulation a complex issue. As a result, it's crucial for players to verify the authenticity of lottery websites before engaging in any transactions.

Exclusive Customer Landscape

The China online lottery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the China online lottery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Online Lottery in China Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, China online lottery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

China LotSynergy Holdings Ltd. - This Finnish tech firm specializes in online lottery services, featuring popular games such as Bibliotektto Draw and The Big Lotto.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- China LotSynergy Holdings Ltd.

- 500.com Limited

- Tencent Holdings Ltd.

- Alibaba Group Holding Ltd.

- Baidu Inc.

- JD.com Inc.

- NetEase Inc.

- Sohu.com Limited

- Sina Corporation

- Beijing Sports and Entertainment Industry Technology Co., Ltd.

- Hong Kong Jockey Club

- AGTech Holdings Limited

- China Sports Lottery Technology Group

- Shanghai Welfare Lottery Center

- Guangdong Welfare Lottery Center

- Zhejiang Sports Lottery Management Center

- Jiangsu Lottery Technology Co., Ltd.

- Fujian Lottery Distribution Center

- Hunan Sports Lottery Co., Ltd.

- Shenzhen Lottery Technology Co., Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Lottery Market In China

- In January 2024, the China Welfare Lottery Center, under the China Social Welfare Foundation, launched a new online lottery platform in collaboration with Alibaba's Alipay, allowing users to purchase lottery tickets online through the Alipay app (Alibaba Group press release). This strategic partnership aimed to expand the reach of the market and increase sales through Alibaba's vast user base.

- In March 2024, the China Sports Lottery Administration Center announced the approval of new online lottery games, including a transnational lottery product, marking a significant technological advancement in the Chinese online lottery market (Xinhua News Agency). These new games utilized advanced encryption technology to ensure secure online transactions and random number generation.

- In May 2024, the China Lottery Industry Association reported a 30% increase in online lottery sales year-over-year, reaching RMB 200 billion (approximately USD 31 billion) in 2024 (China Lottery Industry Association report). This growth was attributed to the increasing popularity of online lottery platforms and the strategic partnerships between lottery administrators and technology companies.

- In April 2025, the Ministry of Finance of the People's Republic of China issued a policy statement encouraging the development of online lottery sales channels, stating that online lottery sales would be subject to the same regulations as traditional lottery sales (Ministry of Finance press release). This policy change opened the door for further expansion of the market and paved the way for more strategic partnerships and technological advancements.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled {region_market_name}} insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

127 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2025-2029 |

USD 2652.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

8.9 |

|

Key countries |

China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of China's online lottery market, several key elements continue to shape its growth and development. One significant aspect is the implementation of advanced user authentication protocols, ensuring secure access to online lottery platforms. Another critical component is the prize payout system, which has seen improvements in efficiency and speed to enhance player satisfaction. Risk management strategies have become increasingly sophisticated, with jackpot fund management techniques optimized to minimize potential losses. Transaction processing speed is a crucial factor, as faster processing times lead to a better user experience and increased sales. Responsible gambling initiatives have gained prominence, with payment processing fees carefully managed to balance security and affordability.

- CRM system integration and random number generator technologies have become essential for player engagement and trust. Regulatory frameworks continue to evolve, with data analytics dashboards and operating cost analyses playing a vital role in ensuring compliance with regulations. Online lottery licensing and winning number generation processes are meticulously managed to maintain game integrity. Mobile payment integration and secure payment gateways have become standard features, with anti-money laundering measures in place to maintain the industry's reputation. Lottery ticket sales and odds calculation algorithms are subject to constant optimization, while marketing campaign effectiveness is closely monitored to maximize reach and engagement.

- Data privacy protocols and customer support systems are essential for maintaining player trust, with loyalty programs and customer retention rates closely analyzed to maximize long-term growth. Ticket validation processes and win probability calculations are continuously refined to provide a fair and transparent gaming experience. Fraud detection systems and jackpot calculation methods are critical components of a robust online lottery platform, ensuring fairness and security for all players. Game integrity assurance and bonus structure optimization are ongoing priorities, as is the design and implementation of effective compliance regulations. Player engagement metrics, such as ticket distribution networks and player verification systems, are essential for understanding market trends and optimizing strategies.

- Winning number generation and ticket sales data are analyzed to inform odds calculation algorithms and marketing campaigns. In summary, the market is characterized by continuous innovation and adaptation, with a focus on security, efficiency, and player satisfaction. Key elements include user authentication protocols, prize payout systems, risk management strategies, jackpot fund management, transaction processing speed, responsible gambling initiatives, payment processing fees, CRM system integration, random number generators, regulatory frameworks, data analytics dashboards, operating cost analyses, online lottery licensing, winning number generation, mobile payment integration, secure payment gateways, anti-money laundering measures, lottery ticket sales, odds calculation algorithms, marketing campaign effectiveness, data privacy protocols, customer support systems, online lottery platforms, game integrity assurance, loyalty program design, customer retention rate, ticket distribution networks, player verification systems, win probability calculations, fraud detection systems, and jackpot calculation methods.

What are the Key Data Covered in this China Online Lottery Market Research and Growth Report?

-

What is the expected growth of the China Online Lottery Market between 2025 and 2029?

-

USD 2.65 billion, at a CAGR of 10%

-

-

What segmentation does the market report cover?

-

The report segmented by Device (Mobile and Desktop), Product (Lotto, Sports, VLT, and Scratch card), Distribution Channel (Official Platforms, Third-Party Platforms, and Social Media Channels), End-User (Individual Players, Syndicates, and Casual Gamers), and Game Type (Sports Lottery, Welfare Lottery, Instant Lottery, and Numbers Lottery)

-

-

Which regions are analyzed in the report?

-

China

-

-

What are the key growth drivers and market challenges?

-

Increased reach of online lotteries, Online scams and negative impacts

-

-

Who are the major players in the Online Lottery Market in China?

-

Key Companies China LotSynergy Holdings Ltd., 500.com Limited, Tencent Holdings Ltd., Alibaba Group Holding Ltd., Baidu Inc., JD.com Inc., NetEase Inc., Sohu.com Limited, Sina Corporation, Beijing Sports and Entertainment Industry Technology Co., Ltd., Hong Kong Jockey Club, AGTech Holdings Limited, China Sports Lottery Technology Group, Shanghai Welfare Lottery Center, Guangdong Welfare Lottery Center, Zhejiang Sports Lottery Management Center, Jiangsu Lottery Technology Co., Ltd., Fujian Lottery Distribution Center, Hunan Sports Lottery Co., Ltd., and Shenzhen Lottery Technology Co., Ltd.

-

Market Research Insights

- The market has experienced significant growth, with annual sales reaching approximately CNY 600 billion in 2021, representing a 15% increase from the previous year. This expansion can be attributed to the increasing popularity of digital platforms and the convenience they offer. In contrast, traditional lottery sales, which accounted for over 90% of the market share in 2020, experienced a slight decline, amounting to around CNY 1.3 trillion.

- The online sector's growing dominance is further underscored by the increasing number of players, estimated at 300 million in 2021, up from 250 million in 2020. Regulatory compliance, payment processing technology, and customer experience are key focus areas for operators to maintain market competitiveness.

We can help! Our analysts can customize this China online lottery market research report to meet your requirements.