Onychomycosis Treatment Market Size 2024-2028

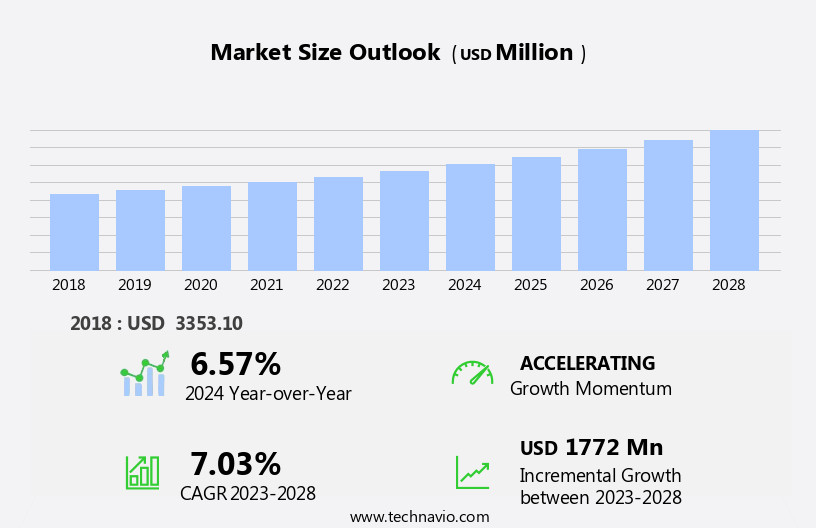

The onychomycosis treatment market size is forecast to increase by USD 1.77 billion at a CAGR of 7.03% between 2023 and 2028.

- The market is witnessing significant growth due to the rising prevalence of fungal diseases, particularly In the context of chronic illnesses. Telemedicine is increasingly being utilized for clinical examinations, making diagnosis and treatment more accessible. A key trend In the market is the adoption of photodynamic therapy (PDT) for onychomycosis treatment, which offers advantages such as minimal side effects and improved patient compliance. However, the emergence of multidrug-resistant fungal pathogens poses a challenge to effective treatment and calls for the development of novel therapeutic approaches. Yeasts are common causative agents of onychomycosis, adding to the complexity of treatment and the need for innovative solutions.Overall, the market is expected to grow steadily due to these factors and the increasing demand for topical treatments for onychomycosis.

What will be the Size of the Onychomycosis Treatment Market during the forecast period?

- The market encompasses the production and sale of pharmaceuticals and technologies used to address Tinea unguium, a common fungal infection affecting the nails. This condition, also known as onychomycosis, is caused by various fungal strains including dermatophytes, yeasts, and non-dermatophyte molds. The market's growth is driven by the increasing prevalence of this infection, which can lead to disfigurement and discomfort for affected individuals. Factors contributing to the spread of onychomycosis include public places such as gymnasiums and swimming pools. Diagnosis of onychomycosis typically involves clinical examination, dermoscopy, and mycological examination. Treatment options include topical drugs like terbinafine and ciclopirox, oral medications, and photodynamic therapies.

- The drugs segment dominates the market due to the availability of effective treatments like Jublia. Onychomycosis affects various populations, including those with chronic illnesses like peripheral artery disease, the geriatric population, and millennials. The discomfort and unsightly appearance of the condition can significantly impact quality of life, leading to a high demand for effective treatments.

How is this Onychomycosis Treatment Industry segmented?

The onychomycosis treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Pharmacological

- Non-pharmacological

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

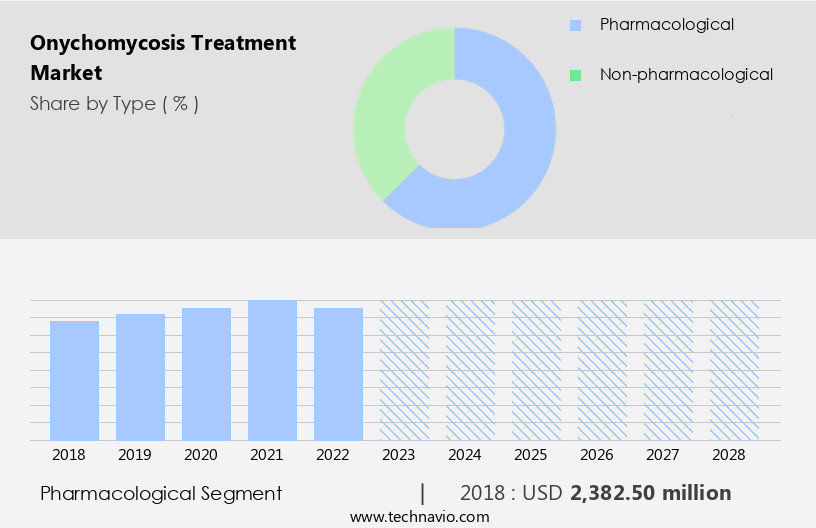

The pharmacological segment is estimated to witness significant growth during the forecast period. Pharmacological treatment for onychomycosis, also known as tinea unguium, involves the use of antifungal medications to alleviate symptoms or cure the fungal infection of the nails. Oral terbinafine is the most effective treatment against the dermatophytes responsible for onychomycosis. Antifungal drugs from the azole and allylamine classes are commonly prescribed. The azole class includes itraconazole (Sporanox), fluconazole (Diflucan), and ketoconazole, although ketoconazole is seldom used due to potential drug interactions and hepatotoxicity. Recent advancements in oral antifungal drugs have led to improved treatment outcomes for patients with onychomycosis. Fungal strains, such as Trichophyton rubrum and Trichophyton mentagrophytes, are prevalent in public places like gymnasiums and swimming pools.

Exposure to fungal agents can occur through wet surfaces, tight clothes, socks, and traumatic nail injuries. Risk factors include diabetes, HIV, peripheral artery disease, and aging populace. Early diagnosis and treatment are crucial to prevent chronic pain, disfigurement, and discomfort. Antifungal therapies include topical therapy, such as Jublia, and drug treatments like terbinafine, ciclopirox, and fluconazole. Laser therapy is also an option for adults with onychomycosis. Fund allocation for onychomycosis treatment is increasing due to its high prevalence and the availability of novel products from companies like Zydus Lifesciences and Anacor Pharmaceuticals. However, low awareness and side effects associated with prescribed drugs remain challenges In the treatment market.

Get a glance at the market report of share of various segments Request Free Sample

The Pharmacological segment was valued at USD 2.38 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is projected to expand due to the rising prevalence of onychomycosis, affecting approximately 14% of the US population annually, according to the CDC. This fungal infection, also known as Tinea unguium, affects 3-5% or 12 million Americans yearly, as per the American Podiatric Medical Association. The geriatric population's growth is a significant market driver, as they are more susceptible to fungal infections. Onychomycosis is contagious and can spread in public places like gymnasiums and swimming pools, increasing its occurrence. Fungal agents such as Trichophyton rubrum, Trichophyton mentagrophytes, and Candida onychomycosis strains cause this infection. Fungal strains thrive in wet surfaces, shoe use, nail sweating, and traumatic nail injuries.

Chronic diseases like diabetes, HIV, and peripheral artery disease increase the risk of onychomycosis. Early diagnosis through clinical examination, dermoscopy, mycological examination, and telemedicine is crucial. Various antifungal therapies, including topical therapies like terbinafine, ciclopirox, Jublia, fluconazole, penlac, ciclodan, ketoconazole, sporanox, itraconazole, kerydin, and efinaconazole, and oral terbinafine, are available. However, side effects like liver damage from oral terbinafine and low awareness of the disease hinder market growth. Market players include Lupin, Bausch Health, and Anacor Pharmaceuticals, among others. The market is segmented by fungal strains, drugs, and geography.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Onychomycosis Treatment Industry?

- Increasing prevalence of onychomycosis is the key driver of the market.

- Onychomycosis, or toenail fungus, is a prevalent infection affecting approximately 10% of the global population. In the United States, the CDC estimates that 2-13% of the population is affected, with the incidence increasing with age. Up to 50% of adults over 70 years old currently experience onychomycosis. The growing prevalence of this condition is a significant factor driving the expansion of the market. This infection can cause unsightly discoloration, thickening, and distortion of the nails, leading to discomfort and embarrassment. Despite the availability of various treatment options, including topical and oral antifungal medications, laser therapy, and home remedies, the challenge of achieving complete cure and preventing relapse remains.

- The market dynamics are influenced by factors such as increasing awareness, rising prevalence, and advancements in treatment methods.

What are the market trends shaping the Onychomycosis Treatment Industry?

- Increasing demand for topical treatment for onychomycosis is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for topical treatments. Topical treatments offer several advantages over systemic therapies, including ease of application, fewer side effects, and improved efficacy. These treatments, such as Kerydin and Jublia, are applied directly to the nail bed and do not enter the bloodstream, making them a preferred choice for patients. Topical treatments provide long-term cure rates with fewer recurrences and are safe for use in elderly patients. The market's growth is driven by the rising prevalence of onychomycosis, increasing awareness of the disease, and advancements in topical treatment technologies.

- Additionally, the convenience and safety of topical treatments make them an attractive option for patients seeking effective and non-invasive solutions for onychomycosis.

What challenges does the Onychomycosis Treatment Industry face during its growth?

- Increase in multidrug-resistant fungal pathogens is a key challenge affecting the industry growth.

- Fungal infections, such as onychomycosis, pose a significant challenge due to the emergence of multidrug resistance. This resistance, which involves simultaneous resistance to multiple classes of antifungal agents, limits the available treatment options. Multidrug resistance is prevalent among common fungal species, including Candida, the most frequent human pathogen. The mechanism behind multidrug resistance includes the initiation of membrane-associated efflux pumps that identify and expel various chemicals, thereby allowing resistance. Several fungal species, such as Aspergillus fumigatus and various Candida species, exhibit antifungal resistance due to environmental influences and multidrug resistance, respectively. This resistance trend underscores the need for continuous research and development of novel antifungal agents and treatment strategies.

Exclusive Customer Landscape

The onychomycosis treatment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the onychomycosis treatment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, onychomycosis treatment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alembic Pharmaceuticals Ltd. - The company specializes in providing effective treatments for onychomycosis, utilizing the medication Efinaconazole. This solution is a valuable addition to our offerings, enhancing our ability to address fungal nail infections and contribute to overall health and wellness. Our commitment to innovation and scientific advancement ensures that we deliver high-quality, research-backed solutions to meet the evolving needs of our customers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alembic Pharmaceuticals Ltd.

- Almirall SA

- Astellas Pharma Inc.

- Bausch Health Companies Inc.

- Bayer AG

- Cipla Inc.

- Dr Reddys Laboratories Ltd.

- Fotona d.o.o

- Galderma SA

- GlaxoSmithKline Plc

- Kaken Pharmaceutical Co. Ltd.

- Lupin Ltd.

- Medimetriks Pharmaceuticals Inc.

- Moberg Pharma AB

- Novartis AG

- Perrigo Co. Plc

- Pfizer Inc.

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

- The OTClab B.V.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Onychomycosis, a fungal infection that affects the nails, is a prevalent health concern worldwide. Fungal strains, including yeasts, are the primary causative agents of this disease. The infection can manifest as a discoloration or thickening of the nail, often appearing as a ring-like band under the nail. Fungal agents thrive in environments with high humidity and warm temperatures, making public places such as gymnasiums and swimming pools potential breeding grounds. The disease can also result from traumatic nail injuries, exposure to wet surfaces, or the use of contaminated footwear. The occurrence of onychomycosis is influenced by various factors, including an aging populace, chronic diseases like diabetes and HIV, and peripheral artery disease.

The disease can lead to chronic pain, disfigurement, and discomfort, affecting adults across various demographics. The market for onychomycosis treatments is experiencing a surge due to the increasing disease incidences and the growing awareness of the importance of early diagnosis and treatment. However, the market faces challenges such as low awareness, side effects associated with certain treatments, and regulatory approvals. Antifungal therapies are the primary treatment options for onychomycosis. These therapies can be segmented into topical and oral treatments. Topical therapies include antifungal drugs like terbinafine, ciclopirox, Jublia, fluconazole, Penlac, Ciclodan, and Ketoconazole, among others. Oral therapies include Sporanox, Itraconazole, Kerydin, Efinaconazole, Griseofulvin, and others.

Laser therapy is a novel approach to treating onychomycosis, offering advantages such as minimal side effects and faster recovery times. Elewski and Charif's research on laser therapy for onychomycosis has shown promising results. The market for onychomycosis treatments is diverse, with players like Lupin, Bausch Health, Anacor Pharmaceuticals, and Zydus Lifesciences, among others, offering various treatment solutions. The market is expected to grow further with the development of customized reports, novel products, and drug therapies. Despite the availability of various treatment options, the disease's prevalence remains high due to factors like the chronic nature of the illness, the need for early diagnosis, and the side effects associated with some treatments.

Therefore, there is a need for continued research and development of effective and safe treatment solutions. In conclusion, onychomycosis is a prevalent fungal infection that affects the nails, and its occurrence is influenced by various factors. The market for onychomycosis treatments is growing due to the increasing disease incidences and the importance of early diagnosis and treatment. Antifungal therapies, including topical and oral treatments and laser therapy, are the primary treatment options. Continued research and development are necessary to address the challenges of the market and improve treatment outcomes for patients.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.03% |

|

Market growth 2024-2028 |

USD 1772 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.57 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Onychomycosis Treatment Market Research and Growth Report?

- CAGR of the Onychomycosis Treatment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the onychomycosis treatment market growth of industry companies

We can help! Our analysts can customize this onychomycosis treatment market research report to meet your requirements.