Optical Lens Market Size 2024-2028

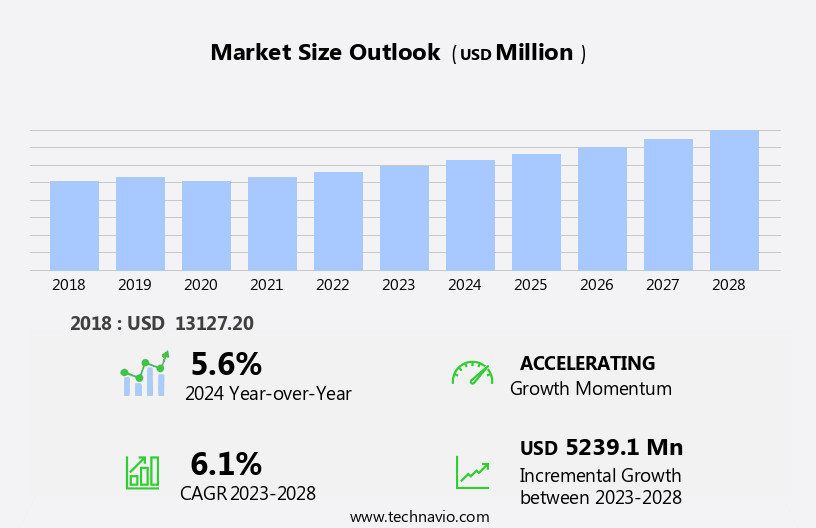

The optical lens market size is forecast to increase by USD 5.24 billion at a CAGR of 6.1% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing popularity of dual-lens cameras in smartphones. This trend is expected to continue as consumers demand higher quality images and enhanced features from their mobile devices. Additionally, the emergence of night vision devices with thermal imaging technology is expanding the market's reach into new applications, such as security and surveillance. However, the market is not without challenges. Safety concerns associated with the use of contact lenses, which contain optical lenses, continue to pose regulatory hurdles.

- Companies must navigate these challenges by investing in research and development to ensure the safety and efficacy of their products. To capitalize on market opportunities, businesses should focus on innovation, particularly in the areas of miniaturization, lightweight designs, and advanced materials. By addressing these trends and challenges, companies can position themselves for long-term success in the market.

What will be the Size of the Optical Lens Market during the forecast period?

- The market encompasses a diverse range of transparent optical components used in various applications, including vision correction for myopia, hyperopia, astigmatism, and presbyopia, as well as image focusing for photography and diagnostic medical imaging. Market growth is driven by increasing prevalence of visual dysfunctions, such as myopia and eye-related conditions exacerbated by prolonged screen time on digital devices. Consumers seek solutions in the form of optical lenses for eyeglasses, contact lenses, and curved surfaces for magnification. Technological advancements in blue light-blocking coatings, anti-reflective coatings, and multifocal lenses cater to evolving consumer needs.

- The market's sizeable potential is further fueled by the integration of optical lenses in consumer electronics, such as computers, smartphones, tablets, digital cameras, and e-readers. Optical lenses' role in vision care and image projection continues to expand, with applications in ophthalmologic lenses, cataract ry, and diagnostic medical imaging.

How is this Optical Lens Industry segmented?

The optical lens industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Consumer electronics

- Healthcare

- Life science

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By End-user Insights

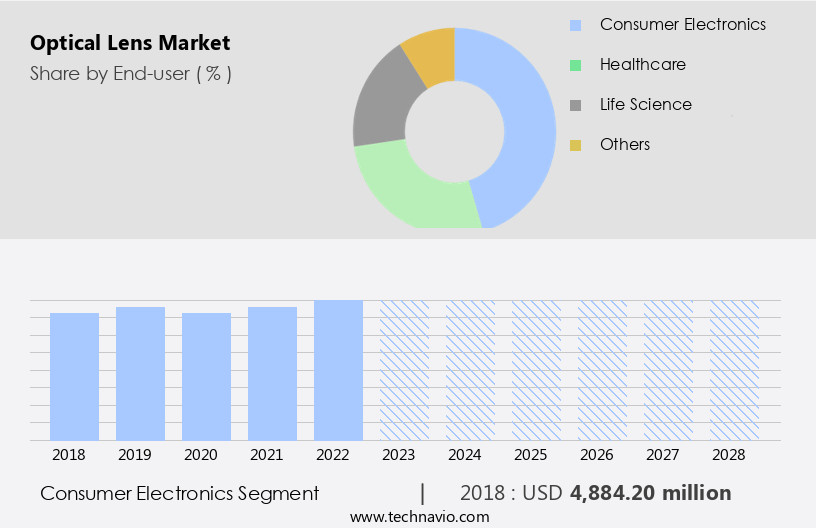

The consumer electronics segment is estimated to witness significant growth during the forecast period.

The consumer electronics sector is experiencing notable growth in the market due to the escalating demand for advanced imaging technologies in mobile devices, augmented reality, cameras, and projectors. With an estimated 1.34 billion smartphones sold worldwide in 2023, the necessity for high-quality lenses in smartphone cameras becomes increasingly apparent. Furthermore, the sales of digital single-lens reflex (DSLR) cameras, amounting to 7.2 billion units globally in 2023, further fuel the demand for optical lenses in imaging devices. Consequently, this segment is anticipated to exhibit a substantial CAGR in comparison to healthcare, life sciences, and defense sectors. Optical lenses play a pivotal role in enhancing the performance of digital devices, ensuring optimal image focusing, and addressing vision correction efficacy for users.

This trend is driven by the continuous evolution of consumer electronics, including smartphones, tablets, and cameras, as well as emerging technologies such as virtual reality (VR) and augmented reality (AR). Additionally, the increasing popularity of content creation on social media platforms and the growing photography career opportunities further boost the demand for advanced imaging lenses. However, challenges such as optical aberrations, screen time, and digital eye strain necessitate the development of innovative lens technologies, such as blue light-blocking coatings and AI-based machine vision, to cater to the evolving needs of consumers. In summary, the market is poised for significant growth, particularly in the consumer electronics sector, as the demand for advanced imaging technologies continues to escalate.

Get a glance at the market report of share of various segments Request Free Sample

The Consumer electronics segment was valued at USD 4.88 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing application of optical lenses in various industries, particularly consumer electronics. In North America, the market is thriving, driven by the in smartphone sales, which reached USD73 billion in 2023, and the rise in DSLR camera sales, with 2.16 million units sold. Optical lenses are integral to these devices, enhancing image quality and functionality. Moreover, the healthcare and life sciences sectors are also contributing to the market's expansion, with the use of optical lenses in medical imaging, ophthalmic applications, and automotive lenses. The demand for high-quality lenses for eyeglasses, including premium frames and progressive lenses, is increasing due to the growing concern for eye health.

Additionally, the emergence of technologies like converging lenses, VR, and AR, and the integration of AI-based machine vision in machine vision and imaging lenses, are expanding the market's scope. The market's growth is further fueled by the increasing use of optical lenses in content creation, such as HD videos, image processing software, and telephoto zoom lenses, and the rise of social media platforms and photography careers. However, challenges like optical aberrations, vision disorders, and the shortage of ophthalmic lenses due to travel restrictions, are hindering the market's growth. The market is also witnessing the development of durable products, including contact lenses and disposable contact lenses, and the integration of blue light-blocking coatings, anti-reflective coatings, and diverging lenses to address vision dysfunction and digital eye strain.

The market's future looks promising, with the increasing demand for optical lenses in consumer electronics, healthcare, and life sciences, and the ongoing advancements in lens technology.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Optical Lens Industry?

- Growing popularity of dual-lens camera in smartphones is the key driver of the market.

- The increasing prevalence of social media platforms and their influence on image sharing has fueled the demand for dual-lens camera smartphones. This trend is driving the market growth as users no longer rely on professional photography equipment for capturing high-quality images. Influencers and social media enthusiasts can now produce immaculate visual content directly from their mobile devices. This shift in consumer behavior has prompted smartphone and tablet companies to integrate superior camera systems into their offerings.

- As a result, the market for optical lenses is anticipated to expand significantly during the forecast period. The adoption of these advanced camera systems is expected to attract a large customer base and provide a competitive edge to companies in the market.

What are the market trends shaping the Optical Lens Industry?

- Emergence of night vision devices with thermal imaging is the upcoming market trend.

- The integration of thermal imaging into night vision devices represents a significant advancement in military technology. Night vision technology enhances situational awareness by illuminating surroundings during nighttime operations. Thermal imaging, on the other hand, enables soldiers to locate targets in poor visibility conditions. Previously, soldiers carried separate devices for night vision and thermal imaging, adding to their burden and requiring them to switch between devices based on operational needs, thereby consuming valuable mission time.

- In 2015, BAE Systems introduced a headset that combined both technologies, streamlining the soldier's equipment and improving situational awareness in real-time. This innovation underscores the market's focus on enhancing military capabilities through technological advancements.

What challenges does the Optical Lens Industry face during its growth?

- Safety concerns associated with use of contact lenses is a key challenge affecting the industry growth.

- The market faces challenges due to safety concerns surrounding the use of contact lenses. Improper handling and prolonged wear can lead to severe eye infections, irritation, and corneal abrasions. In extreme cases, these conditions may result in blindness. Dust and chemicals trapped behind the lens can also cause damage to the cornea, while excessive eye watering can lead to irritation. These risks may hinder the demand for contact lenses and negatively impact market growth.

- It is crucial for consumers to adhere to proper care instructions to mitigate these risks and ensure the safety and effectiveness of optical lenses.

Exclusive Customer Landscape

The optical lens market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the optical lens market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, optical lens market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accurate Optics India - The company specializes in manufacturing and supplying a range of precision optical lenses, including condenser, double concave, double convex, and plano-convex variants. These lenses cater to various applications, offering superior clarity and accuracy. With a commitment to innovation and quality, the company's offerings enhance the performance of numerous industries, from microscopy to telecommunications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accurate Optics India

- Bausch Lomb Corp.

- Carl Zeiss AG

- Cosina Co. Ltd

- Essilor International SAS

- HOYA CORP.

- Lensel Optics Pvt Ltd.

- Meade Instruments

- Menicon Co. Ltd.

- Nikon Corp.

- Olympus Corp.

- Thorlabs Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of applications, spanning various industries from consumer electronics to healthcare. This market is driven by the increasing demand for advanced imaging technologies and vision correction solutions. The proliferation of digital devices, such as smartphones and tablets, has fueled the growth of the market. The continuous improvement in camera technology and image processing software has led to an increase in demand for high-quality lenses for these devices. Moreover, the rise of e-commerce platforms has made it easier for consumers to access affordable eyeglasses and premium frames, further expanding the market.

The eyewear sector is another significant contributor to the market. With the increasing awareness of eye health and the prevalence of eye-related conditions such as astigmatism, hyperopia, myopia, and presbyopia, there is a growing demand for corrective lenses. Furthermore, the development of new technologies, such as converging and diverging lenses, multifocal lenses, and blue light-blocking coatings, has opened up new opportunities in this market. The automotive industry is another key player in the market. The increasing adoption of advanced driver assistance systems (ADAS) and the development of autonomous vehicles require high-performance imaging lenses for various applications, such as image focusing, object detection, and image processing.

The healthcare sector also presents significant growth opportunities for the market. Diagnostic medical imaging, microscopy, and ophthalmologic applications are some of the areas where optical lenses play a crucial role. The development of AI-based machine vision and laser processing technologies has led to more accurate and efficient diagnostic tools, further driving the demand for optical lenses in this sector. The consumer electronics industry, including cameras, e-readers, and virtual reality devices, is another significant market for optical lenses. The demand for high-definition videos and images, as well as the need for precise image focusing, has led to the development of advanced imaging lenses for these devices.

The market is also influenced by various trends, such as the increasing use of transparent optical components in various applications, the growing popularity of augmented and virtual reality technologies, and the development of durable and personalized eyewear. Moreover, the market is also impacted by factors such as the increasing screen time and the resulting digital eye strain, the shortage of glass for lens manufacturing, and the growing demand for affordable eyewear in developing countries. In , the market is a dynamic and diverse industry that is driven by various factors, including technological advancements, consumer demand, and industry trends.

The market is expected to continue growing as new applications and technologies emerge, offering significant opportunities for companies operating in this sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2024-2028 |

USD 5239.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

5.6 |

|

Key countries |

US, Canada, Germany, China, UK, Japan, India, Italy, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Optical Lens Market Research and Growth Report?

- CAGR of the Optical Lens industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the optical lens market growth of industry companies

We can help! Our analysts can customize this optical lens market research report to meet your requirements.