Photography Equipment Market Size 2024-2028

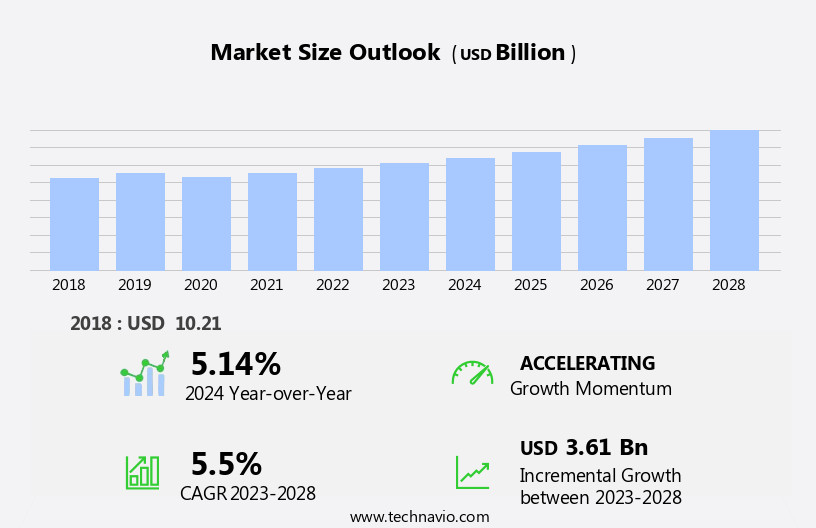

The photography equipment market size is forecast to increase by USD 3.61 billion at a CAGR of 5.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by product innovation and portfolio extension leading to premiumization. Manufacturers are focusing on introducing high-end cameras and accessories to cater to the increasing demand for Mirrorless Interchangeable Lens Cameras (MILCs) and waterproof models. Additionally, the high adoption of smartphones with advanced camera features has resulted in a shift in consumer preferences towards compact and versatile equipment. However, this trend poses a challenge for traditional photography equipment manufacturers as they face increased competition from smartphone brands.

- Another obstacle is the rising cost of raw materials and manufacturing, which may lead to price increases and potential decreases in market penetration. Companies seeking to capitalize on market opportunities should focus on offering differentiated features and value-added services to maintain a competitive edge. Effective operational planning and strategic partnerships can also help navigate these challenges and ensure long-term success in the market.

What will be the Size of the Photography Equipment Market during the forecast period?

- The market continues to evolve, catering to the diverse needs of advanced professional photographers and beginners alike. Lighting, a fundamental aspect of capturing high-quality images, remains a key focus. From external hard drives and strobes to editing tools, the landscape is constantly shifting. Intermediate photographers explore mirrorless cameras with swivel LCD panels, while smartphones and social media platforms expand the reach of photography. Full-frame DSLRs and advanced editing software cater to professional needs, with cancellation policies and liability limitations shaping business considerations. Accessories such as light modifiers, reflectors, and remote triggers enhance the creative prowess of photographers. Usage rights, photography props, and digital editing tools further refine the art.

- Weatherproof camera bags and tripods are essential on-site equipment, with tripods available in various sizes and materials. Indoor shoots require specialized equipment like speedlights and modifiers, while outdoor photography necessitates neutral density filters. Client trust and licensing agreements shape the industry, with retouching techniques and equipment investment playing crucial roles. Light stands and workflow optimization are on-site essentials, ensuring a seamless photoshoot experience. The market's dynamism extends to niche areas, with used photography equipment offering cost-effective solutions for beginners and enthusiasts. Camera systems and lenses cater to various specialties, from landscape to portrait photography. Trust and reliability remain paramount in this ever-evolving market, shaping the future of photography equipment and applications.

How is this Photography Equipment Industry segmented?

The photography equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Cameras

- Lenses and others

- Technology

- DSLR

- Mirrorless

- Action Cameras

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

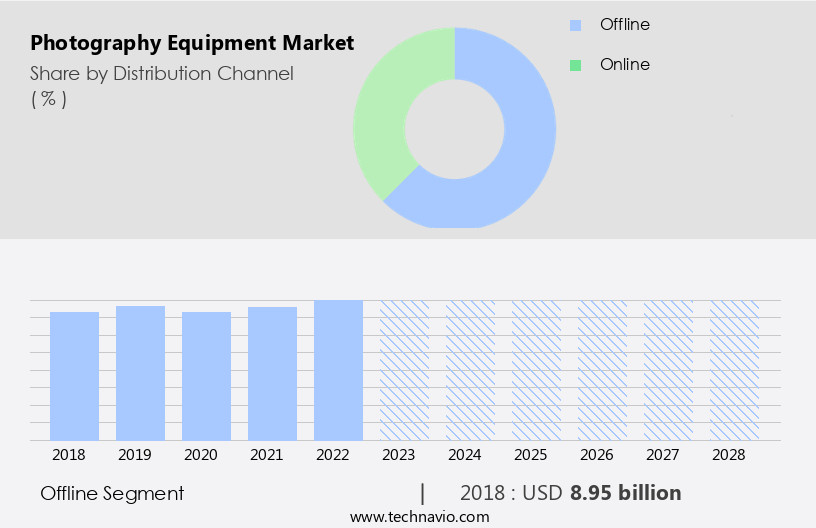

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of tools and accessories used by advanced professional photographers and beginners alike. Cameras, such as full-frame DSLRs and mirrorless cameras, are integral to the industry, with features like swivel LCD panels and advanced editing software catering to the needs of intermediate and professional photographers. Lighting equipment, including strobes and light modifiers, plays a crucial role in indoor shoots, while external hard drives ensure data security for valuable photography assets. Beginners often start with entry-level cameras and smartphones, leveraging social media platforms to showcase their work. Editing tools and digital editing workflows are essential for enhancing image quality and client trust.

Accessories like tripods, polarizing filters, and weatherproof camera bags are essential on-site essentials. Business considerations, such as cancellation policies and licensing, are essential for photographers to understand. Usage rights, photography contracts, and remote triggers facilitate efficient workflows and client satisfaction. Speedlights and light stands provide versatility for various lighting techniques. Neutral density filters and reflectors are valuable tools for managing lighting conditions. Advanced editing software and lenses cater to creative prowess, enabling photographers to capture and edit high-quality images. Used photography equipment and niche accessories offer cost-effective alternatives for those investing in photography equipment. Photography skills and photography props are essential for producing compelling visuals. The market for photography equipment is dynamic, with trends like mirrorless cameras and advanced editing software gaining popularity. Photographers must navigate liability limitations and retouching techniques to maintain client trust and deliver high-quality photoshoots.

The Offline segment was valued at USD 8.95 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

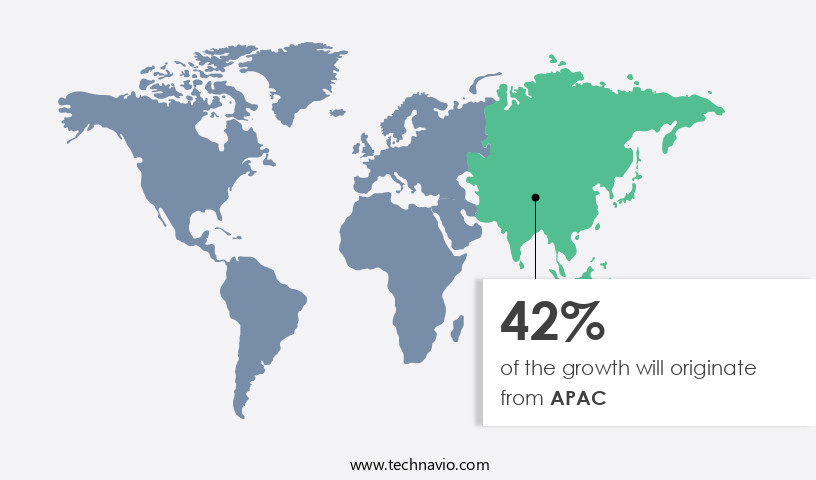

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is a significant contributor to the North American industry, with a high demand for advanced tools among professional photographers. Lighting solutions, such as strobes and modifiers, are essential for capturing high-quality images, especially during indoor shoots. Beginner photographers often start with entry-level cameras and basic accessories, including external hard drives for data storage and swivel LCD panels for easier composition. Intermediate photographers may invest in mirrorless cameras and advanced editing software for refining their creative prowess. The use of social media for sharing and showcasing photographs has increased, making smartphones a formidable competitor in the market.

In fact, the US had the highest smartphone penetration rate in 2020, with companies holding the maximum market share in terms of smartphone shipments. However, the preference for high-quality equipment remains strong, with full-frame DSLRs and weatherproof camera bags being popular choices. Business considerations, such as cancellation policies and licensing, are crucial for photographers. Tripods, speedlights, and remote triggers are on-site essentials for various photography techniques, including lighting and retouching. Accessories like filters, reflectors, and lenses cater to specific photography niches, while used photography equipment offers an affordable alternative for those with a limited budget. Photography contracts and digital editing workflows are integral parts of the photography business.

Trust and client trust are essential for building a successful photography business, with reliable equipment and efficient workflows contributing to a professional reputation. The market for photography equipment is dynamic, with trends shifting towards advanced editing software, specialized equipment, and customizable photography kits. Despite the competition from smartphones, the market for photography equipment continues to evolve, offering opportunities for both professionals and enthusiasts.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Photography Equipment Industry?

- Product innovation and portfolio extension, which include the introduction of premium offerings, are the primary factors fueling market growth.

- The market is driven by the increasing demand for high-quality cameras with advanced features and functionalities. As a result, companies are focusing on product premiumization by offering innovative solutions to differentiate themselves from competitors. For instance, Nikon Corp. Has introduced action cameras under the KeyMission product line, which are easy to carry and ideal for recording and sharing adventure sports and activities. These cameras offer add-on features and designs, justifying their higher price points. Another trend in the market is the growing popularity of used photography equipment. This niche segment caters to clients who are looking for cost-effective alternatives without compromising on quality.

- Furthermore, photo editing workflows and modifiers are becoming essential tools for photographers to enhance their creative prowess. Memory cards and camera systems, including speedlights and lenses, are also integral components of a comprehensive photography kit. Trust is a critical factor for clients when choosing photography equipment, and companies must ensure they deliver reliable and high-performing products to maintain client trust during photoshoots.

What are the market trends shaping the Photography Equipment Industry?

- The market trend indicates a growing demand for Milk Intake insurance policies (MILCs) and waterproof cameras. These two product categories are experiencing increased popularity among consumers.

- The market caters to advanced professional photographers and beginners alike, providing a range of tools to enhance their craft. Mirrorless interchangeable cameras have gained significant traction due to their convenience and ease of use. These cameras, which lack the internal mirrors found in DSLRs, allow light to pass directly through the lens and image sensors, resulting in a more streamlined design. This trend is driven by the demand for portable and efficient photography solutions. Users can also attach third-party lens adapters and lenses from various brands to expand their creative possibilities.

- Additionally, external hard drives, editing tools, strobes, speedlights, swivel LCD panels, and tripods are essential accessories for photographers to store, edit, and light their images effectively. Social media platforms have further fueled the market's growth, enabling photographers to showcase their work and reach broader audiences.

What challenges does the Photography Equipment Industry face during its growth?

- The widespread adoption of smartphones poses a significant challenge to the expansion of various industries.

- The market faces a significant challenge due to the increasing popularity of high-quality smartphone cameras. With the rise in smartphone usage, the demand for digital and DSLR cameras has decreased. Smartphones, equipped with advanced features such as high-resolution dual camera lenses, have become a preferred choice for capturing images and videos. This trend poses a threat to the sales of digital and DSLR cameras, as using mobile devices for photography is more convenient. However, the market for photography accessories continues to grow. Photographers and enthusiasts invest in accessories such as light modifiers, reflectors, polarizing filters, and flashes to enhance their photography skills and improve image quality.

- The usage of advanced editing software and digital editing techniques further adds to the demand for these accessories. Moreover, photography props and remote triggers are essential tools for professional photographers and hobbyists alike. The adoption of these accessories is driven by the need to create unique and high-quality content for personal and commercial use. In conclusion, while the sales of digital and DSLR cameras may be affected by the rise of high-quality smartphone cameras, the market for photography accessories continues to thrive. Players in the photography equipment industry must adapt to this trend by offering innovative and high-quality accessories to cater to the evolving needs of photographers and enthusiasts.

Exclusive Customer Landscape

The photography equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the photography equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, photography equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Canon Inc. (Japan)

- Nikon Corporation (Japan)

- Sony Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- Panasonic Holdings Corp. (Japan)

- Leica Camera AG (Germany)

- GoPro Inc. (United States)

- Olympus Corporation (Japan)

- Sigma Corporation (Japan)

- Tamron Co., Ltd. (Japan)

- Zeiss AG (Germany)

- Hasselblad (Sweden)

- Phase One A/S (Denmark)

- Ricoh Imaging Company Ltd. (Japan)

- DJI Technology Co., Ltd. (China)

- Manfrotto (Italy)

- Profoto AB (Sweden)

- Broncolor (Switzerland)

- Godox Photo Equipment Co., Ltd. (China)

- Arri Group (Germany)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Photography Equipment Market

- In February 2024, Canon Inc. Introduced the EOS R5 C camera, a new addition to their full-frame mirrorless line, catering specifically to cinematographers and filmmakers (Canon Inc. Press release, 2024). This innovative product launch marked Canon's commitment to the professional video market, offering 8K RAW recording capabilities and advanced autofocus features.

- In October 2024, Sony and Panasonic announced a strategic partnership to develop a new interchangeable lens system, aiming to challenge Canon and Nikon's dominance in the market (Bloomberg, 2024). The collaboration is expected to result in a more diverse range of lenses and greater compatibility between the two brands, potentially attracting a larger customer base.

- In March 2025, Fujifilm Corporation completed the acquisition of Xerox Corporation's document business for approximately USD6.1 billion (Reuters, 2025). Although primarily focused on document solutions, this acquisition expanded Fujifilm's presence in the imaging industry, providing potential synergies with their photography equipment business.

- In June 2025, DJI, the leading drone manufacturer, unveiled the Ronin 5, a handheld gimbal stabilizer designed for mirrorless cameras, marking a significant technological advancement in the market (DJI press release, 2025). This product allows photographers to capture stabilized footage with their mirrorless cameras, opening up new possibilities for content creation and enhancing the overall user experience.

Research Analyst Overview

In the dynamic the market, intermediate photographers seek to enhance their creative prowess with an array of tools. They invest in essential gear such as tripods, remote triggers, and modifiers, including softboxes and umbrellas as photography props. Flashes, both speedlights and standalone units, provide versatile lighting solutions for indoor shoots. Advanced professionals, meanwhile, require advanced editing software and full-frame cameras with high-quality lenses. Beginner photographers often start with an entry-level camera and a basic photography kit. Smartphones, with their impressive cameras and convenience, have gained popularity as an alternative. As the market evolves, used photography equipment offers cost-effective options for those on a budget.

The photography market is evolving rapidly, driven by demand from hobbyists and professionals alike. Sales of beginner digital cameras remain strong as new enthusiasts enter the field, often starting with indoor shoots to master lighting and composition. As skills improve, many transition to intermediate photographer gear, including full-frame cameras for enhanced image quality. Essential tools like tripods and remote triggers ensure stability and precision, while speedlights offer greater control over lighting. The need for fast, high-capacity memory cards grows with higher-resolution formats. This dynamic market reflects trends in content creation, social media, and e-commerce, making photography both an art form and a valuable professional service.

External hard drives ensure ample storage for vast collections of high-resolution images. Memory cards, an indispensable component, offer varying capacities and speeds to accommodate different shooting styles. Lenses, an essential investment, cater to various focal lengths and shooting conditions. Light stands and swivel LCD panels streamline the photoshoot process, while advanced editing software allows for post-production refinements. The photography equipment landscape continues to expand, offering endless possibilities for both hobbyists and professionals alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Photography Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2024-2028 |

USD 3.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.14 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Photography Equipment Market Research and Growth Report?

- CAGR of the Photography Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the photography equipment market growth of industry companies

We can help! Our analysts can customize this photography equipment market research report to meet your requirements.