Oral Cancer Therapeutics Market Size 2024-2028

The oral cancer therapeutics market size is forecast to increase by USD 1.62 billion at a CAGR of 10.03% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing incidence and prevalence of oral cancer worldwide. According to the World Health Organization, there were approximately 354,000 new cases of oral cancer in 2020. This trend is expected to continue due to rising risk factors such as tobacco use, alcohol consumption, and HPV infections. Additionally, the research and development of new drugs is a major growth factor in the market. Patients with oral cancer, particularly those with dentures or lack of dexterity, often face challenges in accessing appropriate treatment.

- However, the side effects of chemotherapeutics, such as mucositis and xerostomia, remain significant challenges in the treatment of oral cancer. Despite these challenges, advancements in targeted therapies and immunotherapies offer promising solutions for improving patient outcomes and quality of life. Overall, the market is poised for continued growth due to the increasing burden of the disease and the development of new and innovative treatments.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the rising prevalence of oral cancer, driven by tobacco consumption, alcohol consumption, and the human papillomavirus (HPV). Oral cancer treatment includes surgery, radiation therapy, chemotherapy, targeted therapy, and minimally invasive surgeries. Surgery remains the primary treatment method, while radiation therapy and chemotherapy are used for advanced stages. Targeted therapy and immunotherapy are emerging treatment options. Diagnostic techniques, imaging technologies, and biomarker testing play a crucial role in early detection and treatment.

- Moreover, molecular diagnostics and geriatric population are gaining importance in the market. Research institutions, healthcare organizations, the Oral Cancer Foundation, and dental technology developments are also contributing to market growth. However, side effects such as hair loss, mouth sores, and loss of appetite limit the patient's quality of life and hinder market growth. The elderly population, with a higher risk of oral cancer, is a significant market segment. Root caries and pearl are also factors influencing the market. The market is expected to grow, driven by changing lifestyles and advancements in technology.

How is this market segmented and which is the largest segment?

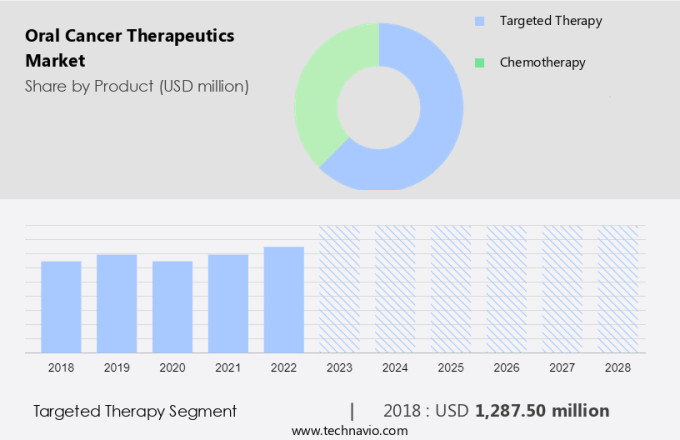

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Targeted therapy

- Chemotherapy

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- India

- Rest of World (ROW)

- North America

By Product Insights

- The targeted therapy segment is estimated to witness significant growth during the forecast period.

Oral cancer treatment encompasses various modalities including surgery, radiation therapy, chemotherapy, and targeted therapy. Surgery remains a primary treatment option for early-stage oral cancer, while advanced stages may require a combination of modalities. Risk factors such as tobacco consumption, alcohol consumption, and human papillomavirus infection contribute significantly to the incidence of oral cancer. Changing lifestyles and an aging population further increase the prevalence of this disease. Diagnostic techniques, such as biopsies and imaging tests, play a crucial role in early detection and accurate diagnosis. Advanced technologies, including molecular diagnostics and imaging technologies, facilitate early identification and personalized treatment plans. Geriatric population and healthcare organizations are focusing on patient-centric approaches, including telemedicine and remote monitoring, to improve access to oral cancer care.

Dental technology developments, such as minimally invasive surgeries and root caries prevention, aim to reduce side effects, including hair loss, mouth sores, loss of appetite, nausea, and vomiting. The global geriatric population and the increasing prevalence of oral cancer necessitate a global footprint for oral cancer treatments, with research institutions at the forefront of developing new and effective therapies. The side effects of traditional oral cancer treatments, such as surgery, radiation therapy, and chemotherapy, have led to the exploration of new treatment modalities and the integration of technology to enhance patient care and improve outcomes. The global oral cancer market is expected to grow significantly due to the increasing burden of disease, aging population, and advancements in technology and treatment modalities.

Get a glance at the market report of share of various segments Request Free Sample

The targeted therapy segment was valued at USD 1.29 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

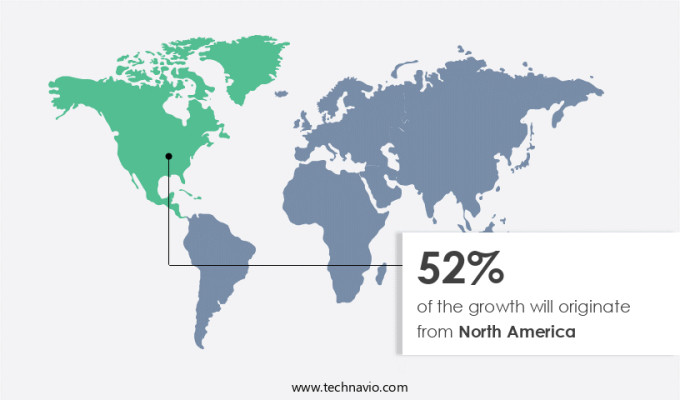

- North America is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Oral cancer, a formidable health concern, necessitates effective treatment strategies. Traditional methods include surgery, radiation therapy, and chemotherapy. Minimally invasive surgeries are increasingly popular due to reduced recovery time and fewer side effects. Tobacco consumption and alcohol intake are significant risk factors, while human papillomavirus (HPV) infection is on the rise due to changing lifestyles. Diagnostic techniques, such as biopsies and imaging tests, aid in early detection. Imaging technologies and molecular diagnostics, including Pearl, are advanced tools in oral cancer detection.

Moreover, the geriatric population is disproportionately affected, necessitating patient-centric approaches, telemedicine, and remote monitoring. Research institutions and healthcare organizations collaborate to develop new oral cancer treatments, such as targeted therapy. Dental technology advancements offer promising solutions for root caries prevention. Side effects like hair loss, mouth sores, loss of appetite, nausea, and vomiting necessitate improved healthcare infrastructure. The global geriatric population's oral cancer treatments require a global footprint, with a focus on smoking cessation, HPV vaccination, and early detection.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Oral Cancer Therapeutics Market?

The increasing incidence and prevalence of oral cancer are the key drivers of the market.

- The global market for oral cancer therapeutics is experiencing significant growth due to the rising incidence and prevalence of oral cancers, particularly squamous cell carcinoma and verrucous carcinoma. According to the Oral Cancer Foundation, approximately 54,000 Americans are expected to be diagnosed with oral cavity and pharynx cancer in the US this year. Oral cancers are more common in men than women, and the lack of dexterity in elderly patients and those with conditions like Type 2 diabetes can hinder early diagnosis.

- Clinical trials for new therapeutics are ongoing to address the unmet need for effective treatments, as current options such as chemotherapy and targeted therapy have not significantly reduced mortality rates. Hospitals and clinics, dentists, and ENT specialists are key players in the market, providing diagnosis and treatment services to patients. The increasing burden of oral cancer is expected to attract pharmaceutical companies to invest in the development of novel therapies, thereby driving market growth.

What are the market trends shaping the Oral Cancer Therapeutics Market?

Increased R&D of new drugs is the upcoming trend in the market.

- The market is witnessing significant growth due to the rising incidence of oral cancer and the need for advanced treatment options. Oral cancer encompasses various types, including squamous cell carcinoma and verrucous carcinoma. Therefore, there is a growing focus on the development of novel therapeutics and combination therapies to address this unmet need. For instance, Gliknik Inc. Is advancing the clinical trial stage of biropepimut-S (GL-0817), a peptide immunomodulator, for the treatment of squamous cell carcinoma of the oral cavity.

- Additionally, this targeted therapy is designed to prevent the recurrence of high-risk squamous cell carcinoma by targeting important epitopes within the cancer protein MAGE-A3. The clinical trial for biropepimut-S (GL-0817) is ongoing in seven countries, involving hospitals and clinics, and is being conducted in collaboration with dentists and ENT specialists. Additionally, other oral conditions, such as oral leukoplakia and erythroplakia, are also being explored as potential indications for this therapy. Type 2 diabetes, a known risk factor for oral cancer, is also being considered as a potential patient population for biropepimut-S (GL-0817).

What challenges does Oral Cancer Therapeutics Market face during the growth?

Side effects of chemotherapeutics are a key challenge affecting the market growth.

- Oral cancer, which includes squamous cell carcinoma and verrucous carcinoma, can be debilitating for patients, particularly those witha lack of dexterity due to advanced age or dental issues such as dentures. Clinical trials continue to explore new treatment options, including chemotherapeutics, to improve survival rates and reduce side effects. Common chemotherapeutics used in oral cancer treatment include Carboplatin, 5-fluorouracil, paclitaxel (TAXOL), docetaxel (TAXOTERE), and hydroxyurea. However, these treatments come with side effects, such as nausea and vomiting, which can significantly impact patients' quality of life. Delayed acute chemotherapy-induced nausea and vomiting can be challenging to manage, especially in hospitals and clinics, where patients may require constant monitoring.

- Furthermore, gastrointestinal side effects can lead to local ulceration, pain, malabsorption, anemia, and fatigue. Patients with conditions like Type 2 diabetes, oral leukoplakia, or erythroplakia may be more susceptible to these side effects. Dentists and ENT specialists play a crucial role in managing oral cancer patients' overall health and ensuring they receive appropriate care during chemotherapy treatment.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amneal Pharmaceuticals Inc.

- AstraZeneca Plc

- Bristol Myers Squibb Co.

- Cipla Inc.

- Eli Lilly and Co.

- Endo International Plc

- F. Hoffmann La Roche Ltd.

- Fresenius SE and Co. KGaA

- GlaxoSmithKline Plc

- Intas Pharmaceuticals Ltd.

- Lupin Ltd.

- Merck and Co. Inc.

- Pfizer Inc.

- Sanofi SA

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Co. Ltd.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Oral cancer is a significant health concern worldwide, and the demand for effective treatments is on the rise. Oral cancer treatment includes various modalities such as surgery, radiation therapy, chemotherapy, targeted therapy, and minimally invasive surgeries. Tobacco consumption, alcohol consumption, and human papillomavirus infection are leading risk factors for oral cancer. Changing lifestyles and the elderly population are also contributing to the increasing incidence of oral cancer. Diagnostic techniques, imaging technologies, and biomarker testing play a crucial role in early detection and accurate diagnosis of oral cancer. Molecular diagnostics and advanced technologies, such as Pearl, are revolutionizing oral cancer treatment.

Side effects of oral cancer treatments, including hair loss, mouth sores, loss of appetite, nausea, and vomiting, are significant concerns for patients. Healthcare organizations and research institutions are focusing on patient-centric approaches, telemedicine, and remote monitoring to improve the patient experience. Dental technology developments, such as minimally invasive surgeries and biopsies, are also gaining popularity. The global geriatric population and the increasing global footprint of oral cancer are driving the growth of the market. Oral Cancer Foundation is one of the leading organizations dedicated to raising awareness and providing support for oral cancer patients. The market is expected to grow significantly due to the increasing incidence of oral cancer and the availability of new treatments and technologies. However, healthcare infrastructure and dental caries remain significant challenges in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 1.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

US, Canada, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch