Organic Sanitary Napkins Market Size 2025-2029

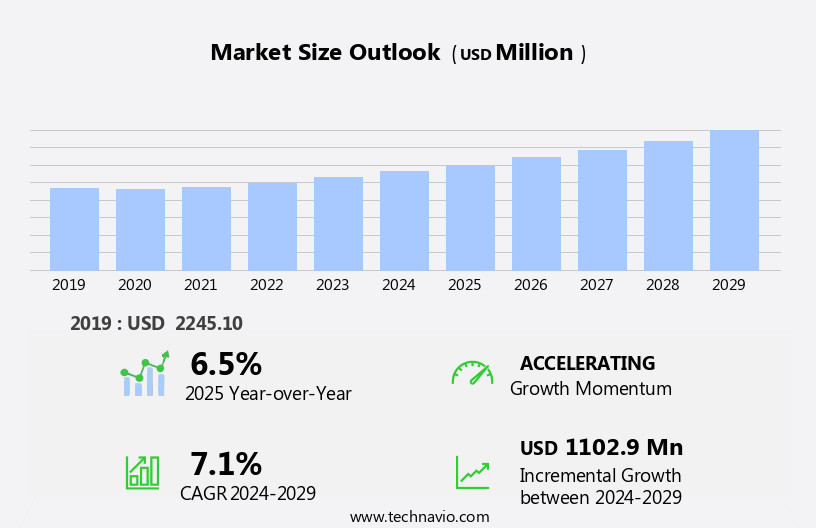

The organic sanitary napkins market size is forecast to increase by USD 1.1 billion, at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing consumer awareness and preference for healthier alternatives to conventional sanitary napkins. This shift in consumer behavior is fueled by concerns over the potential health risks associated with synthetic menstrual products, leading to a rise in demand for organic options. Moreover, the use of raw materials besides cotton, such as bamboo, corn, and banana fibers, adds to the appeal of organic sanitary napkins. However, brand loyalty towards conventional napkins remains a challenge for market growth.

- To capitalize on this opportunity, companies must focus on building consumer trust through transparency in production processes, certifications, and effective marketing strategies. Additionally, investments in research and development to improve product quality and affordability will be crucial in gaining market share. Overall, the market presents a lucrative opportunity for companies seeking to cater to the evolving needs of health-conscious consumers.

What will be the Size of the Organic Sanitary Napkins Market during the forecast period?

- The market represents a growing segment within the absorbent items industry, driven by increasing consumer awareness and concerns regarding the environmental impact of traditional, non-biodegradable cellulosic fiber-based products. This market is characterized by a shift towards the use of biodegradable materials, such as banana fiber, corn starch, and plant-based fibers, to produce eco-friendly alternatives. The adoption of these organic options is fueled by concerns over the harmful effects of artificial components, including toxic substances and dangerous chemicals, commonly found in traditional sanitary napkins.

- Single-use plastics, a significant contributor to environmental degradation and marine life endangerment, are under scrutiny in this context. Chlorine bleach, a common component in conventional sanitary napkins, is also a point of concern due to its potential toxicity. As a result, the organic sanitary napkin market is experiencing strong growth, with consumers prioritizing sustainable and eco-friendly alternatives to mitigate their carbon footprint and minimize their exposure to harmful substances.

How is this Organic Sanitary Napkins Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Organic menstrual pads

- Organic pantyliners

- Distribution Channel

- Offline

- Online

- Material

- Cotton-based

- Bamboo-based

- Hemp-based

- Corn-based biodegradable pads

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

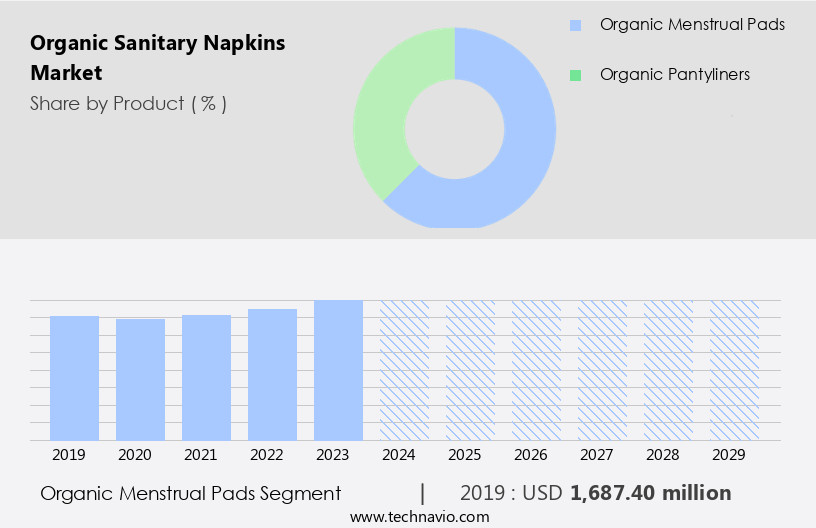

The organic menstrual pads segment is estimated to witness significant growth during the forecast period. The market is experiencing steady growth due to the increasing preference for eco-friendly and healthier menstrual hygiene solutions. Organic menstrual pads, made from biodegradable raw materials like organic cotton, banana fiber, and water hyacinth, are gaining popularity among consumers. These pads offer soft properties, renewable materials, and are free from hazardous chemicals and synthetic components, such as non-biodegradable cellulosic fiber and toxic substances. The female population, particularly working women, are prioritizing their health and well-being, leading to a rise in demand for organic menstrual pads.

Further, consumer uptake of organic menstrual pads is expected to continue, driven by environmental consciousness, sustainable living, and plastic pollution reduction. The market includes local, regional, and international players, offering a wide range of products, including organic menstrual pads, organic pantyliners, eco-friendly napkins, and cotton pads. Innovative products, such as overnight and scented varieties, are also available. The market is expected to grow, as more women become aware of the health risks associated with traditional ones made from non-biodegradable plastic and synthetic materials.

Get a glance at the market report of share of various segments Request Free Sample

The organic menstrual pads segment was valued at USD 1.69 billion in 2019 and showed a gradual increase during the forecast period.

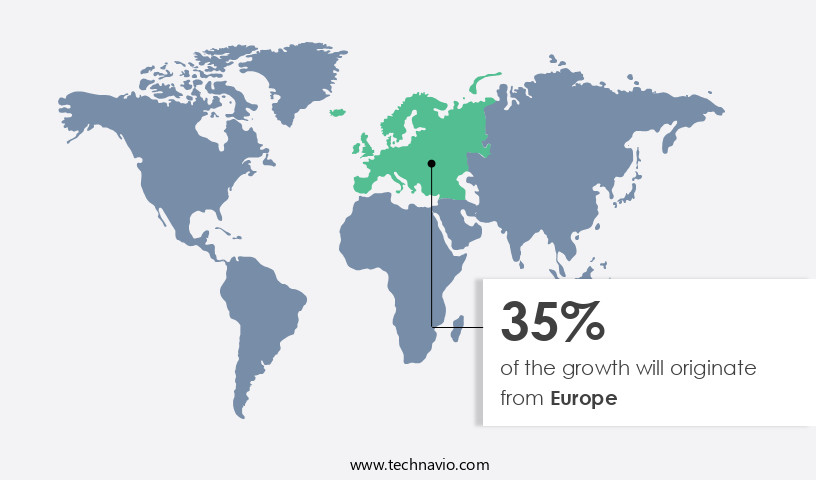

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America, led by the US, is driven by the region's high female population and economic progress. Working women, prioritizing female hygiene and health, fuel the demand for organic alternatives to traditional products. The market's growth is underpinned by consumer uptake of eco-friendly, biodegradable products made from raw materials such as banana fiber, water hyacinth, and corn starch. These plant-based materials offer advantages over non-biodegradable cellulosic fibers and synthetic materials, reducing environmental impact and waste production.

In addition, consumer awareness levels continue to rise, with increasing concern over the health risks associated with hazardous chemicals in traditional products. The market's future growth is expected to be influenced by innovative organic menstrual pads, pantyliners, and eco-friendly napkins, as well as the expanding menstrual cup market. Sustainable production and the use of renewable materials are becoming increasingly important, as consumers prioritize sustainable living and plastic pollution reduction.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Organic Sanitary Napkins Industry?

- Healthy alternative for conventional sanitary napkins is the key driver of the market. Sanitary napkins are an essential product for women during menstruation, enabling them to continue their daily activities with ease. Traditional sanitary napkins, introduced In the 1800s, gained popularity due to their flexibility and comfort. However, prolonged use of these products may lead to health concerns. The primary cause is the raw materials used In their manufacturing. Some of these materials, such as Bisphenol A (BPA), Bisphenol S (BPS), rayon, and dioxin, have been linked to health issues. These chemicals are used In the production of conventional sanitary napkins as plasticizers, synthetic fibers, cellulose gels, and bleaching agents. The use of non-biodegradable plastic and synthetic materials in traditional items contributes significantly to plastic waste and marine life pollution. The production and disposal of these products also pose health risks and contribute to hormonal imbalances. As consumers become more conscious of their impact on the environment, there is a growing trend towards sustainable living and the reduction of plastic pollution. The organic sanitary napkin market is well-positioned to meet this demand, offering healthy alternatives to traditional sanitary napkins while reducing the environmental impact of menstrual hygiene products.

What are the market trends shaping the Organic Sanitary Napkins Industry?

- The use of raw materials besides cotton in organic sanitary napkins is the upcoming market trend. Organic sanitary napkins, which are free from plastic and made primarily from cotton, offer an eco-friendly alternative to conventional sanitary products. However, concerns regarding leakage and comfort have hindered their widespread adoption. To address these issues, manufacturers have started incorporating alternative raw materials, such as banana fiber and wood pulp, into the production of organic napkins. These materials offer similar functionality to conventional napkins while maintaining the environmental benefits. For instance, Saathi Eco, an Indian company, produces eco-friendly sanitary napkins using banana fiber sourced directly from farmers. The use of such raw materials significantly reduces the carbon footprint associated with organic napkins, making them an attractive option for consumers conscious of their environmental impact.

What challenges does the Organic Sanitary Napkins Industry face during its growth?

- Brand loyalty toward conventional napkins is a key challenge affecting the industry's growth. Sanitary napkins are a necessary feminine hygiene product for women, and brand preference plays a significant role in their purchasing decisions. The introduction of conventional napkins transformed the perception of menstruation, enabling women to manage their periods discreetly and continue with their daily activities. This shift led to the popularity and adoption of established brands. Consumers are willing to pay a premium for trusted brands, as evidenced by the market dominance of leading companies in various regions, such as Procter and Gamble and Unilever. The preference for conventional napkins underscores the importance of brand reputation and trust in this market. In addition, another sustainable alternative to traditional sanitary napkins, is also gaining traction. However, the organic sanitary napkin market offers several advantages, including soft properties and ubiquitous availability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the organic market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, organic sanitary napkins market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Apropos - The company offers organic sanitary napkins such as their biodegradable and chemical-free menstrual pads designed for comfort and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Azah Sanitary Pads

- Corman SpA

- COTTON HIGH TECH SL

- Hannah Health One Inc.

- Hengan International Group Co. Ltd.

- Kimberly Clark Corp.

- Lady Anion

- Naturalena Brands

- Ontex BV

- Rael Inc.

- Saathi Eco Innovations India Pvt. Ltd.

- The Honest Co. Inc.

- The Procter and Gamble Co.

- TOTM Ltd.

- Unicharm Corp.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a growing segment within the absorbent items industry, catering to the increasing demand for products made from biodegradable raw materials. This shift towards organic and eco-friendly alternatives is driven by several factors, including growing awareness of health issues and environmental consciousness. The female population, particularly working women, have become more health-conscious and are seeking out products that do not contain hazardous chemicals or synthetic materials. Skin irritation and allergic reactions are common concerns, leading consumers to opt for organic cotton and other natural fibers. Biodegradable raw materials, such as banana fiber and water hyacinth, are gaining popularity as alternatives to non-biodegradable cellulosic fibers and synthetic materials commonly used in traditional sanitary napkins.

Further, these materials offer several advantages, including reduced carbon footprint, waste production, and environmental impact. Consumer uptake of organic sanitary napkins is on the rise, fueled by the increasing availability of these products through various channels, including e-commerce platforms. Local, regional, and international players are introducing innovative products, such as organic menstrual pads, organic pantyliners, and eco-friendly napkins, to cater to this demand. Despite the growing demand, the organic sanitary napkin market still faces challenges, including slow progress in production patterns and consumer education. The use of renewable materials, energy efficiency, and water efficiency are key areas of focus for manufacturers to address these challenges and reduce the environmental impact of their products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market Growth 2025-2029 |

USD 1.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Canada, Germany, China, UK, India, Japan, Italy, The Netherlands, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Organic Sanitary Napkins Market Research and Growth Report?

- CAGR of the Organic Sanitary Napkins industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the organic sanitary napkins market growth of industry companies

We can help! Our analysts can customize this organic sanitary napkins market research report to meet your requirements.