Organs On Chips Market Size 2024-2028

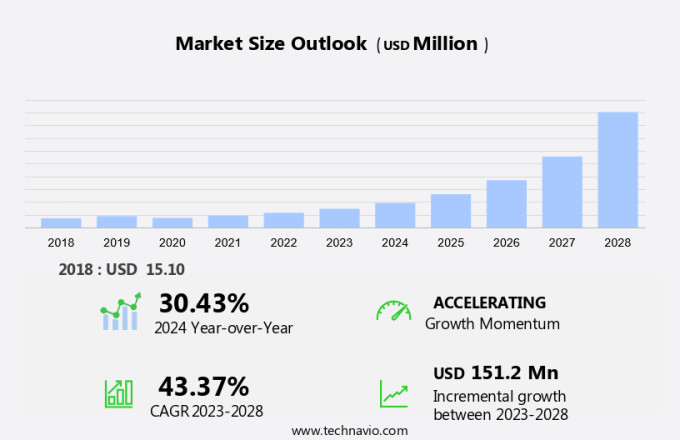

The organs on chips market size is forecast to increase by USD 151.2 million at a CAGR of 43.37% between 2023 and 2028. The market is experiencing significant growth due to the increasing prevalence of chronic disorders and the need for more effective and efficient drug screening and testing methods. This market trend is further fueled by substantial research funding and venture capital investments aimed at advancing the technology. However, the high cost of organ-on-chip technology remains a challenge, limiting its widespread adoption. Despite this, the potential benefits, including improved accuracy, reduced animal usage in research, and the integration of biomaterials to enhance functionality, make it an attractive area for investment and development. The market is poised for growth, with key players focusing on innovation and collaboration to drive down costs, incorporate advanced biomaterials, and expand its applications in various industries.

Organs-on-chips technology is revolutionizing the field of drug discovery and toxicity detection by providing a more accurate and cost-effective alternative to animal testing. This technology uses microengineered devices to culture human cells in a three-dimensional environment that mimics the structure and function of organs, enabling researchers to study the complex interactions between cells and drugs in real-time. The market for Organs-on-chips is expected to grow significantly due to the rising incidence of chronic diseases such as liver diseases, lung cancer, and SARS-CoV-2. The technology is particularly useful in drug discovery, allowing for the screening of new drugs for efficacy and toxicity before clinical trials.

Additionally, the market is segmented into services and products. The services segment includes contract research organizations, academic research institutes, and pharmaceutical and biotechnology companies that offer Organs-on-chips services. The products segment includes the sale of Organs-on-chips devices and consumables. Government organizations such as the Biomedical Advanced Research and Development Authority (BARDA) and the National Institutes of Health (NIH) are investing in Organs-on-chips technology for strategic preparedness in areas such as infectious diseases and opioid overdose. For instance, researchers are developing Organs-on-chips for the detection of drug toxicity and the development of cell-molecule-based immunotherapies, including those for cancer and opioid overdose using QHREDGS molecule and Naloxone.

Moreover, major players in the market include Nippon Telegraph and Telephone Corporation, and various academic research institutes. The market is expected to grow at a significant rate due to the increasing demand for personalized medicine and the need for more accurate and efficient drug discovery techniques.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Lung

- Liver

- Heart

- Kidney

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- Asia

- Japan

- Rest of World (ROW)

- North America

By Type Insights

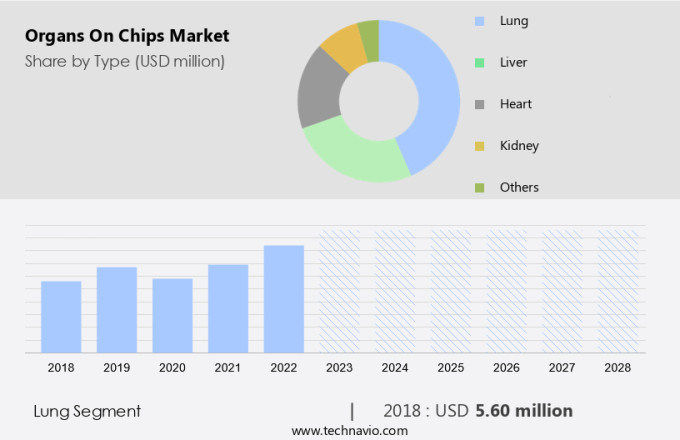

The lung segment is estimated to witness significant growth during the forecast period. Organ-on-a-chip technology, a novel approach in biomedical research, is revolutionizing drug discovery techniques for chronic diseases, including lung cancer and SARS-CoV-2. This technology, developed by academic research institutes and corporations, employs microfluidic devices to create cell cultures that mimic the structure and function of organs, such as the liver, lung, heart, and gut. BARDA, under the Strategic National Stockpile program of the U.S. Department of Health and Human Services, has shown interest in using organ-on-a-chip technology for detecting drug toxicity and developing countermeasures against biothreats, such as opioid overdose and QHREDGS molecule. Pharmaceutical and biotechnology companies are increasing R&D spending on this technology for disease modeling, patient stratification, phenotypic screening, and personalized medication development.

Additionally, Nippon Telegraph and Telephone Corporation, NIAID, and the American Cancer Society are some of the leading organizations investing in organ-on-a-chip technology. This technology holds immense potential in advancing healthcare and improving the efficacy and safety of cell- and molecule-based immunotherapies.

Get a glance at the market share of various segments Request Free Sample

The lung segment was valued at USD 5.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

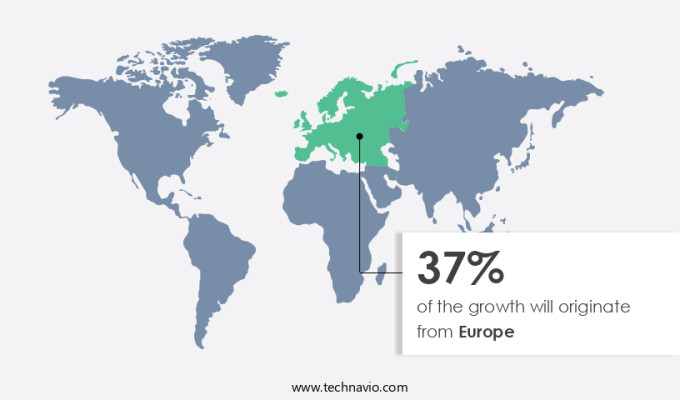

Europe is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Organ-on-a-chip technology, a revolutionary approach in biomedical research, is transforming drug discovery techniques by enabling the simulation of chronic diseases and drug toxicity detection using microfluidic devices. This technology replicates the physiological environment of various organs, such as the liver, lung, heart, and gut, on a chip. The National Institutes of Health's National Institute of Allergy and Infectious Diseases (NIAID), in collaboration with the Biomedical Advanced Research and Development Authority (BARDA), Strategic Preparedness and Response, Health and Human Services, is utilizing organ-on-a-chip technology to model diseases like SARS-CoV-2 and develop personalized medication. Pharmaceutical corporations and academic research institutes, including Nippon Telegraph and Telephone Corporation and the American Cancer Society, are investing heavily in R&D spending to advance organ-on-a-chip technology.

Further, this technology holds potential in disease modeling, patient stratification, and phenotypic screening for various conditions, including lung cancer and opioid overdose. For instance, researchers are developing lung-on-a-chip technology to test the efficacy of cell-based immunotherapies like the QHREDGS molecule for cancer treatment. Additionally, organ-on-a-chip technology can be employed to screen for drug toxicity and optimize dosages, reducing the risk of adverse effects, such as those observed with naloxone, a medication used to treat opioid overdoses.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing prevalence of chronic disorders is the key driver of the market. Organs-on-chips technology is gaining significant attention in the field of drug discovery and disease modeling due to its ability to mimic the complex physiological environment of various organs, including the liver, lung, gut, and heart. This technology is particularly important in the context of chronic diseases, such as diabetes, kidney diseases, and cardiovascular diseases (CVDs), which are on the rise due to factors like physical inactivity, unhealthy diets, and an aging population. The prevalence of CVDs, including strokes, myocardial infarction, and coronary artery diseases, has been increasing, with the CDC reporting that approximately 795,000 people in the US experience a stroke each year.

Further, organs-on-chips can be used for phenotypic screening, patient stratification, and personalized medication development. For instance, they can be employed to detect drug toxicity, such as that caused by SARS-CoV-2, which can help in the development of effective treatments and vaccines. In the case of cancer, organs-on-chips can be used to model various types of cancer, including lung cancer, and to test the efficacy of cell- and molecule-based immunotherapies. The pharmaceutical and biotechnology industries, along with academic research institutes and government agencies like the National Institutes of Health (NIH) and the Biomedical Advanced Research and Development Authority (BARDA), are investing heavily in R&D spending to advance organs-on-chips technology.

Additionally, companies like Nippon Telegraph and Telephone Corporation, QHREDGS molecule, and Microfluidic Chip Shop are at the forefront of this innovation. This technology holds great promise for the development of new treatments for various diseases, including opioid overdose, for which naloxone can be tested using lung-on-chip technology. Overall, organs-on-chips technology is set to revolutionize the way we approach drug discovery and disease modeling, leading to more effective and personalized medication.

Market Trends

A significant increase in research funding and venture capital investments for development of organs on chips is the upcoming trend in the market. The global organs-on-chips market is witnessing significant growth due to the increasing collaborations among market players. These strategic partnerships enable organizations to combine their technological capabilities, thereby enhancing their product offerings and expanding their reach to diverse geographies. For instance, in 2020, CN Bio and Imperial College London joined forces to utilize CN Bio's liver-on-chip technology to deepen the understanding of alcoholic hepatitis and identify new targets for drug discovery and development. Similarly, InSphero AG and ETH Bio Engineering Laboratory entered into a licensing agreement for InSphero's Akura Flow organ-on-a-chip platform in the same year. Moreover, the application of organs-on-chips technology in drug discovery techniques, such as drug toxicity detection, is gaining momentum.

Additionally, this technology is being employed to model chronic diseases like cancer, SARS-CoV-2, and opioid overdose, among others. For instance, the National Cancer Institute (NCI) and the American Cancer Society are investing in organ-on-a-chip technology to develop cell- and molecule-based immunotherapies for lung cancer. Additionally, the Biomedical Advanced Research and Development Authority (BARDA), part of the U.S. Department of Health and Human Services, is funding research on organ-on-a-chip systems for disease modeling, patient stratification, and phenotypic screening to accelerate the development of personalized medication. Major corporations, academic research institutes, and biotechnology companies, such as Nippon Telegraph and Telephone Corporation, National Institute of Allergy and Infectious Diseases (NIAID), and Pharmaceutical companies, are investing heavily in R&D spending to develop advanced organ-on-a-chip systems for microfluidic cell culture devices for various organs like the lung, gut, and heart.

For example, the QHREDGS molecule, a potent antagonist for opioid receptors, is being studied using organ-on-a-chip technology for the development of naloxone, a medication used to reverse opioid overdoses. Overall, the potential of organs-on-chips technology in drug discovery, disease modeling, and personalized medication is immense, making it a promising area for future research and development.

Market Challenge

The high cost of organ on chip is a key challenge affecting the market growth. Organ-on-chip technology, a revolutionary approach in disease modeling and drug discovery techniques, has gained significant attention in the scientific community for its potential to detect drug toxicity and develop personalized medication. This technology mimics the structure and function of various organs, including the liver, lung, heart, and gut, using microfluidic devices and cell culture systems. The application of organ-on-chip technology in chronic diseases, such as cancer and SARS-CoV-2, has been particularly noteworthy. For instance, the National Institutes of Health's (NIH) National Institute of Allergy and Infectious Diseases (NIAID) and the Biomedical Advanced Research and Development Authority (BARDA), under the U.S.

Additionally, department of Health and Human Services, have invested in organ-on-chip systems to develop countermeasures against biological threats and support strategic preparedness. Pharmaceutical corporations and academic research institutes, including Nippon Telegraph and Telephone Corporation, have also shown interest in this technology. They are exploring its potential in the development of cell- and molecule-based immunotherapies for diseases like lung cancer and opioid overdose. However, the high cost of organ-on-chip technology is a significant barrier to its widespread adoption. The construction of these devices involves the use of biomaterials, clogging, simultaneous stirring, and the addition of low viscous additives to cell mixtures.

However, the overall cost includes the surgical procedure, device and console, and continuous medical surveillance. Annual maintenance costs range from USD330 to USD2700. Unfortunately, most of these devices are not covered by insurance. Despite these challenges, the potential benefits of organ-on-chip technology in disease modeling, patient stratification, phenotypic screening, and personalized medication make it a promising area for future R&D spending.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AxoSim Inc. - The company offers organs on chips products such as NerveSim and BrainSim.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allevi Inc.

- Altis Biosystems Inc.

- BICO Group AB

- BiomimX Srl

- BIOND Solutions BV

- CN Bio Innovations Ltd.

- Elveflow

- Emulate Inc.

- Hesperos Inc.

- InSphero AG

- Kirkstall Ltd.

- MIMETAS BV

- NETRI

- Nortis Inc.

- SynVivo Inc.

- TARA Biosystems Inc.

- TissUse GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Organs-on-chips technology, a microengineered system that mimics the structure and function of human organs, is revolutionizing the pharmaceutical and biotechnology industries. This advanced technology enables researchers to study the complex interactions between cells, molecules, and diseases in a more accurate and physiologically relevant way than traditional in vitro methods. One of the primary applications of organs-on-chips is in drug discovery techniques, particularly for chronic diseases such as liver diseases, lung cancer, and heart diseases. Organs-on-chips can help detect drug toxicity and optimize dosing, reducing the time and cost of bringing new drugs to market.

In conclusion, the technology has gained significant attention during the COVID-19 pandemic, with organizations such as the National Institutes of Health (NIH) and Biomedical Advanced Research and Development Authority (BARDA) investing in its development for SARS-CoV-2 research. Major players in the organs-on-chips market include pharmaceutical corporations, academic research institutes, and biotechnology companies. The market is expected to grow significantly due to increasing R&D spending in the pharmaceutical industry, the need for personalized medication, and the potential for phenotypic screening and patient stratification. Organs-on-chips technology is not limited to the lungs, liver, and heart. It can also be used for modeling other organs such as the gut.

For instance, Nippon Telegraph and Telephone Corporation is developing a gut-on-chip for studying intestinal diseases. Moreover, organs-on-chips can be used for disease modeling, drug toxicity detection, and even for developing molecule-based immunotherapies. For example, researchers are using lung-on-chips to study the effects of opioid overdose and to develop naloxone, a drug used to reverse opioid overdose. In conclusion, organs-on-chips technology is a game-changer in the field of drug discovery and disease modeling. Its potential applications are vast, ranging from chronic diseases to personalized medication, and its impact on the pharmaceutical and biotechnology industries is expected to be significant.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 43.37% |

|

Market growth 2024-2028 |

USD 151.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

30.43 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

Europe at 37% |

|

Key countries |

US, Germany, France, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Allevi Inc., Altis Biosystems Inc., AxoSim Inc., BICO Group AB, BiomimX Srl, BIOND Solutions BV, CN Bio Innovations Ltd., Elveflow, Emulate Inc., Hesperos Inc., InSphero AG, Kirkstall Ltd., MIMETAS BV, NETRI, Nortis Inc., SynVivo Inc., TARA Biosystems Inc., and TissUse GmbH |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch