Structural Heart Disease Treatment Devices Market Size 2024-2028

The structural heart disease treatment devices market size is forecast to increase by USD 7.57 billion, at a CAGR of 10% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing prevalence of structural heart diseases. This trend is attributed to the aging population, rising obesity rates, and sedentary lifestyles leading to an increased incidence of heart conditions. Moreover, the strong clinical pipeline for heart valve devices is fueling market expansion, as these innovations offer less invasive and more effective treatment options. Treatment options include surgical procedures and the use of medical devices, such as heart valves and muscle support systems. The market for these devices is experiencing growth due to the increasing prevalence of structural heart diseases and the strong clinical pipeline for innovative heart valve devices. However, high costs associated with these procedures remain a significant challenge for both patients and healthcare systems. As a result, there is a growing emphasis on developing cost-effective solutions and reimbursement strategies to make these treatments more accessible.

- Companies seeking to capitalize on market opportunities must focus on innovation, cost reduction, and strategic partnerships to navigate the competitive landscape and cater to the evolving needs of patients and healthcare providers.

What will be the Size of the Structural Heart Disease Treatment Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and a growing emphasis on improving patient outcomes. Healthcare providers are increasingly leveraging data analytics to gain insights into patient conditions and optimize treatment plans. Atrial fibrillation (AFib), a common heart rhythm disorder, is a major focus area, with interventional cardiologists utilizing precision medicine and electrophysiology (EP) studies to deliver personalized care. Cardiac catheterization and minimally invasive procedures, such as cardiac ablation catheters and implantable cardioverter-defibrillators (ICDs), are gaining popularity due to their ability to enhance quality of life and reduce the need for open heart surgery. Regulatory approvals for innovative devices, such as bioabsorbable stents and AI-assisted diagnosis tools, are fueling market growth.

Patient satisfaction and survival rates are key performance indicators, with healthcare reimbursement and insurance coverage playing crucial roles in market dynamics. Digital health solutions, such as telemonitoring and remote patient monitoring, are transforming heart failure management and enabling earlier intervention. Medical device manufacturers are investing in R&D to develop new solutions for congenital heart defects, valvular heart disease, and other complex cardiac conditions. Machine learning (ML) and AI are being integrated into cardiac devices and diagnostic tools to improve accuracy and efficiency. Cardiac surgeons and medical imaging centers are collaborating to optimize care pathways and ensure timely intervention for patients.

The market is also witnessing the emergence of new players and collaborations, driven by the potential for significant growth in this evolving landscape. The cardiac devices market is expected to continue its dynamic trajectory, with ongoing advancements in technology, regulatory approvals, and clinical trials shaping the future of structural heart disease treatment. Cardiac biomarkers and genetic testing are also emerging as important tools in the quest for personalized care and improved patient outcomes.

How is this Structural Heart Disease Treatment Devices Industry segmented?

The structural heart disease treatment devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Method

- Replacement procedures

- Repair procedures

- End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Cardiac Catheterization Labs

- Specialty Clinics

- Disease Indication

- Aortic Stenosis

- Mitral Regurgitation

- Tricuspid Regurgitation

- Atrial Septal Defect (ASD)

- Patent Foramen Ovale (PFO)

- Left Atrial Appendage Closure

- Congenital Heart Defects

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Method Insights

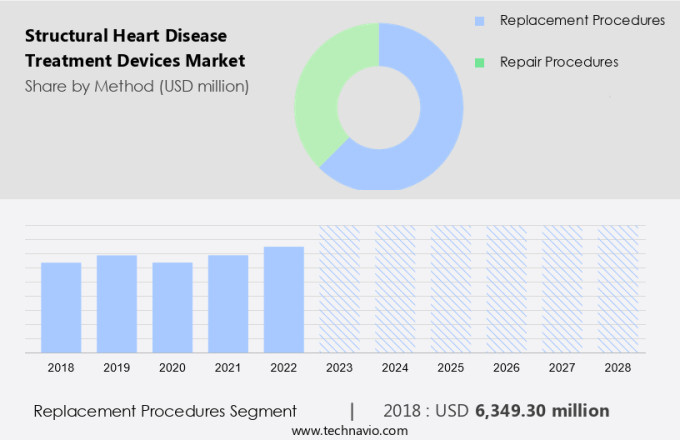

The replacement procedures segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing prevalence of structural heart diseases, such as atrial fibrillation, valvular heart disease, and congenital heart defects. Interventional cardiologists and cardiac surgeons are leveraging advanced technologies, including artificial intelligence, machine learning, and precision medicine, to improve patient outcomes and enhance quality of life. New product launches, regulatory approvals, and ongoing clinical trials for devices like implantable cardioverter-defibrillators, drug-eluting stents, and cardiac ablation catheters are fueling market growth. Digital health and healthcare reimbursement are also playing a crucial role in expanding market access. In the replacement procedures segment, mechanical heart valves and tissue heart valves account for the largest share due to their effectiveness in treating severe valve damage or fatal valve diseases.

Factors such as the growing number of electrophysiology studies for heart failure management, the increasing prevalence of conditions like mitral regurgitation and tricuspid regurgitation, and the rising demand for minimally invasive procedures like transcatheter aortic valve replacement are further propelling market expansion. Medical device manufacturers are investing heavily in research and development to introduce innovative solutions, such as bioabsorbable stents and personalized medicine approaches, to cater to evolving patient needs. Cardiac catheterization laboratories, medical imaging centers, and electrocardiogram facilities are key contributors to the market's growth, as they provide essential diagnostic and therapeutic services for patients with structural heart diseases.

The market is expected to continue its growth trajectory, driven by advancements in technology, increasing patient awareness, and improving healthcare infrastructure.

The Replacement procedures segment was valued at USD 6.35 billion in 2018 and showed a gradual increase during the forecast period.

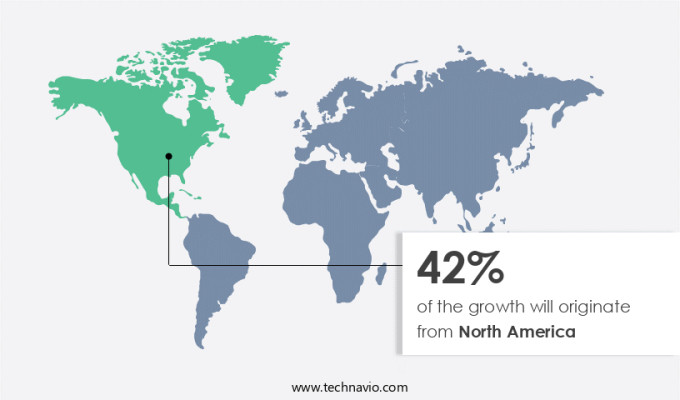

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth due to the increasing prevalence of structural heart diseases, particularly congenital heart defects, which affect approximately 1% of births annually in the US. This market expansion is driven by technological advances and innovative product launches, such as those in the field of precision medicine, artificial intelligence, and digital health. The presence of skilled interventional cardiologists and cardiac surgeons, as well as favorable insurance coverage, further bolsters market growth. Regulatory approvals for new devices, including drug-eluting stents and implantable cardioverter-defibrillators, are also contributing to market expansion. Clinical trials for heart failure management, electrophysiology studies, and valve replacement surgery are underway, with the potential to significantly impact patient outcomes.

The integration of machine learning and personalized medicine is further revolutionizing the treatment landscape, focusing on improving quality of life and survival rates for patients with conditions like atrial fibrillation, mitral regurgitation, aortic stenosis, and ventricular tachycardia. Medical device manufacturers are at the forefront of these advancements, working to develop bioabsorbable stents, holter monitoring devices, and other cardiac devices to address the needs of patients with various structural heart diseases. Cardiac rehabilitation, medical imaging centers, and healthcare technology are also playing crucial roles in the delivery of effective and efficient care. Overall, the market in North America is poised for continued growth, with a strong focus on improving patient outcomes and enhancing the quality of life for those living with these conditions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Structural Heart Disease Treatment Devices Industry?

- The rising prevalence of structural heart diseases serves as the primary market driver.

- Structural heart disease treatment devices play a crucial role in addressing heart valve issues through repair or replacement. The prevalence of structural heart diseases, including heart valve diseases, congenital heart defects, aortic stenosis, and valvular stenosis, is on the rise, driving market expansion. According to the Centers for Disease Control and Prevention (CDC), approximately 40,000 infants in the US are born with congenital heart defects (CHD) each year, with about 25% requiring surgery or procedures within their first year. Advancements in healthcare technology, such as machine learning (ML) and personalized medicine, are revolutionizing cardiac surgery.

- Clinical trials and the use of cardiac biomarkers enable early diagnosis and effective treatment, contributing to increased patient satisfaction. Aortic stenosis, a common valvular heart disease, affects over 2.5% of people aged 75 and older. The need for minimally invasive procedures and improved patient outcomes underscores the significance of the market.

What are the market trends shaping the Structural Heart Disease Treatment Devices Industry?

- A significant trend in the medical device industry is the robust clinical pipeline for heart valve technologies. Heart valve devices, with their potential to improve patient quality of life and extend longevity, continue to garner substantial attention from industry professionals and investors.

- The market is witnessing significant advancements, driven by the investment of key players in research and development of innovative transcatheter valve repair and replacement devices. These devices aim to improve patient outcomes, particularly for those suffering from heart valve diseases. Clinical trials are underway to evaluate the safety and efficacy of these new technologies, with positive results expected to lead to market expansion. Healthcare providers are increasingly turning to interventional cardiologists for minimally invasive procedures, such as cardiac catheterization, which are facilitated by these advanced devices. The integration of data analytics, precision medicine, and artificial intelligence (AI) is also contributing to the growth of the market, enabling better diagnosis and personalized treatment plans.

- Regulatory approvals and insurance coverage are crucial factors influencing market growth, with the focus on improving quality of life for patients and reducing the need for open heart surgery. Overall, the market is poised for continued growth as technology advances and clinical trials yield positive results.

What challenges does the Structural Heart Disease Treatment Devices Industry face during its growth?

- The escalating costs linked to the treatment procedures for structural heart diseases represent a significant challenge impeding the growth of the industry.

- The market encompasses various innovative technologies and devices used to address heart conditions, such as heart transplants, electrocardiograms (ECG), cardiac ablation catheters, antiplatelet therapy, digital health, implantable cardioverter-defibrillators (ICDs), drug discovery, and devices like drug-eluting stents. These advancements aim to improve patient outcomes and quality of life. However, the market faces challenges due to the high costs of these devices and related procedures. For instance, the cost of a heart valve device can range from USD20,000 to USD25,000. This financial burden, coupled with healthcare reimbursement complexities, can hinder market growth.

- Furthermore, medical device manufacturers are investing in research and development to address conditions like congenital heart defects and valvular heart disease through innovative solutions. In conclusion, while the market holds immense potential, the high costs and healthcare reimbursement challenges pose significant obstacles to growth.

Exclusive Customer Landscape

The structural heart disease treatment devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the structural heart disease treatment devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, structural heart disease treatment devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - Abbott's structural heart disease treatment solutions address a range of heart conditions, including congenital and acquired defects like valvular heart disease. These innovative devices, marketed under the Abbott brand, enhance patient care by offering effective alternatives to traditional surgical procedures. By leveraging advanced technologies, Abbott's offerings facilitate minimally invasive interventions, enabling improved patient outcomes and reduced recovery time.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AFFLUENT MEDICAL SA

- Artivion Inc.

- AtriCure Inc.

- Boston Scientific Corp.

- Braile Biomedica

- Coroneo

- Edwards Lifesciences Corp.

- Getinge AB

- Jc Medical Inc.

- Johnson and Johnson Services Inc.

- Lepu Medical Technology Beijing Co. Ltd.

- Lifetech Scientific Corp

- LivaNova PLC

- Medtronic Plc

- Micro Interventional Devices Inc.

- NuMED Inc.

- Terumo Corp.

- TTK Healthcare Ltd.

- W. L. Gore and Associates Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Structural Heart Disease Treatment Devices Market

- In February 2024, Edwards Lifesciences, a leading player in the market, announced the U.S. Food and Drug Administration (FDA) approval of their new transcatheter mitral valve replacement system, Sapien 3 Transcatheter Heart Valve. This innovative device expands the company's product portfolio and addresses the growing demand for minimally invasive heart valve replacement procedures (Edwards Lifesciences Press Release, 2024).

- In June 2024, Medtronic and Abbott Laboratories entered into a definitive agreement for Medtronic to acquire Abbott's medical aesthetics business, including its structural heart business, for approximately USD1.6 billion. This strategic acquisition enables Medtronic to strengthen its position in the market and expand its offerings in areas such as transcatheter aortic valve replacement (Medtronic Press Release, 2024).

- In November 2024, the European Commission granted marketing authorization for Boston Scientific's Lotus Edge Transcatheter Aortic Valve System. This approval marks a significant milestone for the company and provides a competitive edge in the European market, where the demand for transcatheter aortic valve replacement continues to grow (Boston Scientific Press Release, 2024).

- In March 2025, Abbott Laboratories received FDA approval for their new Watchman FLX Left Atrial Appendage Closure Device. This approval represents a technological advancement in the field of atrial fibrillation treatment and further solidifies Abbott's presence in the market (Abbott Laboratories Press Release, 2025). These developments underscore the ongoing innovation and consolidation in the market, driven by regulatory approvals, strategic acquisitions, and new product launches.

Research Analyst Overview

- The structural heart disease treatment market is experiencing significant activity and trends, driven by advancements in cardiac electrophysiology, cardiovascular imaging, and emerging technologies. Pharmaceutical and biotechnology companies are investing heavily in cardiovascular disease prevention, focusing on lifestyle modifications such as healthy diet, cardiac rehabilitation programs, smoking cessation, and weight management. Cardiovascular risk factors, including cholesterol management and diabetes management, remain key areas of interest. Access to healthcare and healthcare policy reforms continue to shape the market, with medical device startups and healthcare investment firms exploring new opportunities in heart failure therapies, valve interventions, and cardiovascular genomics.

- Public health initiatives emphasize the importance of blood pressure control and cardiovascular risk factor management. Regenerative medicine, including stem cell therapy, is a promising area of research, offering potential solutions for structural heart disease. The global healthcare trends towards personalized medicine and patient-centered care are influencing the development of innovative medical devices and therapies in this field.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Structural Heart Disease Treatment Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2024-2028 |

USD 7570.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.9 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Structural Heart Disease Treatment Devices Market Research and Growth Report?

- CAGR of the Structural Heart Disease Treatment Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the structural heart disease treatment devices market growth of industry companies

We can help! Our analysts can customize this structural heart disease treatment devices market research report to meet your requirements.