Endocrinology Drugs Market Size 2025-2029

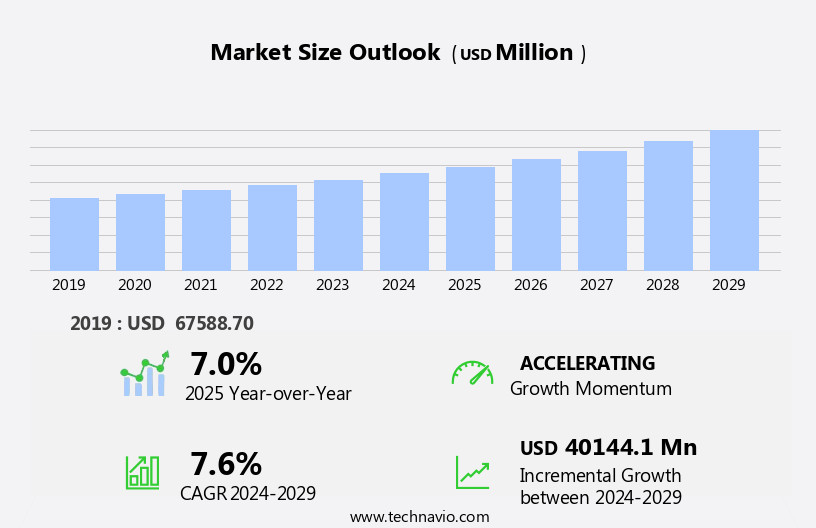

The endocrinology drugs market size is forecast to increase by USD 40.14 billion, at a CAGR of 7.6% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing incidence of endocrine disorders and the association between obesity and these conditions. Endocrine disorders, such as diabetes, thyroid gland disorders, and pituitary gland disorders, are on the rise due to various lifestyle factors and aging populations. Obesity, a major risk factor for several endocrine disorders, is also a growing health concern worldwide. However, the market faces challenges as well. The patent expiry of major endocrinology drugs is leading to increased competition and price erosion.

- This trend is particularly noticeable in the insulin market, where several key patents have expired or will expire soon. Companies must innovate and differentiate their offerings to maintain market share and profitability. Strategic collaborations, acquisitions, and investments in research and development can help companies navigate these challenges and capitalize on the market's growth opportunities.

What will be the Size of the Endocrinology Drugs Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in drug efficacy and delivery systems. Injectable medications, a key segment, are increasingly being used to treat various endocrine system disorders, including Cushing's syndrome, diabetes mellitus, adrenal insufficiency, and pituitary tumors. Drug interactions are a significant concern, necessitating careful monitoring by healthcare providers. Biosimilar drugs are gaining traction, offering cost-effective alternatives to branded growth hormone and antidiabetic drugs. However, ensuring drug safety and regulatory approvals remain critical. Clinical trials are ongoing for new formulations, such as transdermal patches and oral medications, to improve patient compliance and reduce healthcare costs.

Drug interactions and adverse reactions, including hypoglycemic agents and insulin sensitizers, pose challenges. The hypothalamic-pituitary-adrenal axis and thyroid hormone play crucial roles in maintaining endocrine balance. Sodium-glucose cotransporter 2 inhibitors and dipeptidyl peptidase-4 inhibitors are among the latest classes of antidiabetic drugs under investigation. Patient monitoring and disease management are essential components of endocrine care. Addison's disease and polycystic ovary syndrome are among the many endocrine disorders requiring ongoing attention. The market's continuous dynamism underscores the importance of drug delivery systems, regulatory approvals, and drug safety in addressing the evolving needs of patients and healthcare providers.

How is this Endocrinology Drugs Industry segmented?

The endocrinology drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Therapy Area

- Diabetes drugs

- hGH

- Thyroid hormone disorders

- Others

- Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

.

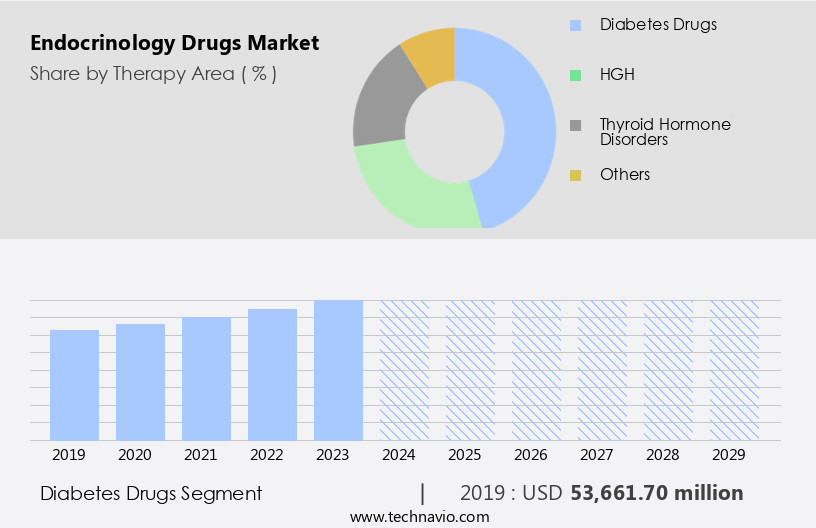

By Therapy Area Insights

The diabetes drugs segment is estimated to witness significant growth during the forecast period.

The market is driven by the high prevalence of endocrine system disorders, such as diabetes mellitus, pituitary tumors, Cushing's syndrome, and Addison's disease. Diabetes, a major non-communicable disease, dominates the market due to its increasing prevalence and the availability of various treatment options. Type 2 diabetes, in particular, accounts for a significant market share due to its high incidence and the availability of various treatment classes, including oral medications like insulin sensitizers, sulfonylureas, and glucagon-like peptide-1 receptor agonists, and injectable medications such as insulin and insulin analogs. Drug interactions and adverse reactions are major concerns in endocrinology drug therapy, necessitating careful patient monitoring.

Clinical trials play a crucial role in assessing drug efficacy and safety, while regulatory approvals ensure the marketed drugs meet stringent safety and efficacy standards. Biosimilar drugs offer cost-effective alternatives to branded drugs, expanding access to treatment. Growth hormone, thyroid hormone, and corticosteroids are among the other therapeutic areas contributing to the market. Drug delivery systems, such as transdermal patches and injectable formulations, offer improved patient compliance and convenience. Healthcare costs and disease management are significant factors influencing market trends. The FDA's approval of new drugs, such as sodium-glucose cotransporter 2 inhibitors and glucagon-like peptide-1 receptor agonists, continues to drive market growth.

Pharmaceutical formulations, including injectable medications and oral drugs, cater to the diverse treatment needs of endocrine disorders. Patient monitoring and drug safety remain key concerns, necessitating continuous research and innovation.

The Diabetes drugs segment was valued at USD 53.66 billion in 2019 and showed a gradual increase during the forecast period.

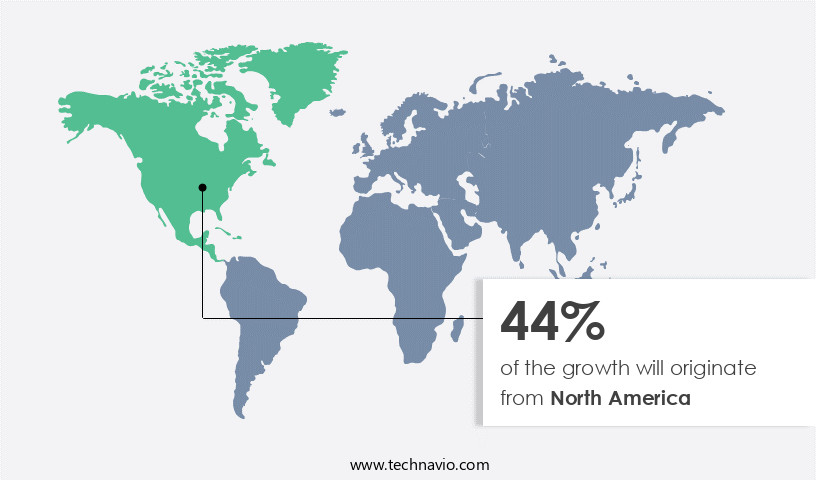

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing steady growth, driven by the significant presence of leading anti-diabetic medications in the region. The US is the primary contributor to this market's revenue, with approximately 38.1 million adults diagnosed with diabetes as of 2024. This large patient population fuels the demand for various treatments, including injectable medications like Lantus, JANUVIA, Victoza, Humalog, and JANUMET. Canada and Mexico also witness an increasing prevalence of diabetes due to rising obesity rates, further boosting market growth. Clinical trials are ongoing for various endocrine system disorders, such as pituitary tumors and Cushing's syndrome, to develop effective treatments.

Growth hormone therapies, hormone replacement therapies, and biosimilar drugs are also under development to address various conditions, including adrenal insufficiency, Addison's disease, and hypoglycemic agents. Drug safety, drug interactions, and patient monitoring are crucial aspects of endocrinology drug development, ensuring the delivery of effective and safe pharmaceutical formulations. Regulatory approvals from the FDA are essential for market entry, and healthcare providers rely on these approvals to offer their patients the most effective treatments. Transdermal patches, oral medications, and insulin sensitizers, such as sodium-glucose cotransporter 2 inhibitors and dipeptidyl peptidase-4 inhibitors, are among the various drug delivery systems under development to improve patient compliance and treatment outcomes.

Healthcare costs remain a significant concern, with disease management strategies and cost-effective treatment options becoming increasingly important. Endocrine system disorders, such as polycystic ovary syndrome and thyroid hormone imbalances, also require ongoing care and treatment. As the market evolves, pharmaceutical companies focus on developing innovative solutions to address these challenges and improve patient outcomes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Endocrinology Drugs Industry?

- The prevalence of endocrine disorders serves as the primary growth factor for the market. Endocrine disorders, particularly diabetes, are on the rise due to the increasing global aging population. With advancements in technology leading to extended life expectancy, the proportion of the elderly and dependent population is growing, placing a significant strain on healthcare spending. Diabetes, the most prevalent endocrinology disorder, is a major public health concern, with its incidence disproportionately higher in low- and middle-income countries. In response to this growing health issue, the pharmaceutical industry has developed various therapeutic options. Hormone replacement therapies are used to treat hormonal imbalances, while insulin sensitizers and sodium-glucose cotransporter 2 inhibitors help manage diabetes.

- These drugs improve insulin sensitivity and reduce blood sugar levels, respectively. The Food and Drug Administration (FDA) plays a crucial role in ensuring the safety and efficacy of these endocrinology drugs through rigorous approval processes. Pharmaceutical formulations of these drugs are designed to optimize their therapeutic benefits and minimize side effects. In conclusion, the increasing incidence of endocrine disorders, particularly diabetes, necessitates continuous research and development of effective therapeutic options. The pharmaceutical industry's focus on creating safe and efficacious drugs, such as hormone replacement therapies, insulin sensitizers, and sodium-glucose cotransporter 2 inhibitors, is essential in addressing this public health challenge.

What are the market trends shaping the Endocrinology Drugs Industry?

- The relationship between obesity and endocrine disorders is gaining significant attention in the healthcare industry. Endocrine disorders, such as diabetes and thyroid disease, are increasingly being linked to obesity, making this association a prominent market trend in healthcare research and treatment.

- The market is witnessing significant growth due to the increasing prevalence of endocrine disorders, particularly those related to obesity. Obesity is linked to various endocrine disorders such as diabetes, hypothyroidism, and polycystic ovary syndrome (PCOS), among others. These disorders can be primary causes or secondary effects of obesity. The rising incidence of obesity, driven by sedentary lifestyles and unhealthy diets, is a major factor fueling the demand for endocrinology drugs. Injectable medications, including growth hormones and antidiabetic drugs, dominate the market. Drug efficacy and safety are critical factors influencing market growth. However, drug interactions and adverse reactions remain concerns.

- Biosimilar drugs, which offer cost savings without compromising on efficacy, are gaining popularity. Clinical trials play a crucial role in assessing drug safety and efficacy. They help identify potential drug interactions and adverse reactions. Continuous research and development efforts are aimed at improving drug efficacy and minimizing adverse reactions. The focus is on developing harmonious and immersive drug delivery systems that strike a balance between therapeutic benefits and patient comfort. In conclusion, the market is driven by the increasing prevalence of obesity-related endocrine disorders. Drug efficacy, safety, and cost savings through biosimilar drugs are key market trends. Ongoing clinical trials and research efforts are aimed at addressing drug interactions and adverse reactions.

What challenges does the Endocrinology Drugs Industry face during its growth?

- The expiry of patents on major endocrinology drugs poses a significant challenge to the industry's growth trajectory.

- The market is experiencing significant changes due to the patent expiry of major drugs. This trend poses a considerable challenge for pharmaceutical companies as generic manufacturers enter the market, leading to increased competition and potential revenue decline. For instance, the loss of exclusivity on widely used diabetes mellitus drugs opens the door for cheaper generic alternatives, capturing a substantial market share. Similarly, cushing's syndrome and adrenal insufficiency treatments face similar challenges. Healthcare service providers must adapt to these changes by exploring new drug delivery systems, such as transdermal patches, to maintain patient care and differentiate from competitors.

- Regulatory approvals and patient monitoring remain crucial to ensure the safety and efficacy of new treatments. The market dynamics necessitate strategic adjustments for pharmaceutical companies to maintain profitability and market share.

Exclusive Customer Landscape

The endocrinology drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the endocrinology drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, endocrinology drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in the development and commercialization of innovative endocrine therapies. Our portfolio includes Natesto, a novel testosterone replacement therapy approved for hypogonadotropic hypogonadism.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Acerus Pharmaceuticals Corp.

- Ascendis Pharma AS

- Bayer AG

- Beta Cell NV

- Biocon Ltd.

- Eli Lilly and Co.

- Endo International Plc

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- Hanmi Pharm Co. Ltd.

- Ipsen Pharma

- Merck and Co. Inc.

- Novartis AG

- Novo Nordisk AS

- Oramed Pharmaceuticals Inc.

- Pfizer Inc.

- Sanofi SA

- Takeda Pharmaceutical Co. Ltd.

- VeroScience LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Endocrinology Drugs Market

- In February 2024, Novo Nordisk, a leading pharmaceutical company, announced the launch of SEGLARA (selinexor), an innovative treatment for multicentric Castleman disease (MCD), following its FDA approval. This new drug represents a significant advancement in managing this rare and complex condition, expanding the company's endocrinology drug portfolio (Novo Nordisk press release, 2024).

- In June 2025, Eli Lilly and Company entered into a strategic collaboration with Provention Bio, a biotech firm, to develop and commercialize PRO101, a potential diabetes prevention drug. This partnership combines Eli Lilly's expertise in diabetes treatment with Provention Bio's innovative research, aiming to address the growing need for preventive measures against type 1 diabetes (Eli Lilly press release, 2025).

- In September 2024, Sanofi, a major player in the market, completed the acquisition of Synthorx, a biotech company specializing in peptide-conjugate therapeutics. This strategic move is expected to strengthen Sanofi's position in the endocrinology sector by adding Synthorx's proprietary technology platform and pipeline of potential treatments (Sanofi press release, 2024).

- In March 2025, the European Commission approved the use of Lilly's Jardiance (empagliflozin) as a preventive treatment for cardiovascular diseases in adults with type 2 diabetes. This approval marks a significant milestone in the fight against diabetes-related complications and underscores the growing importance of preventive measures in endocrinology drug development (European Commission press release, 2025).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of genetic testing and personalized therapy in diagnosing and treating various endocrine disorders. Endocrine disruptors, environmental factors that interfere with hormonal balance, are also gaining attention, leading to a focus on preventive measures such as lifestyle modifications and health literacy. Diagnostic imaging and medical devices, including insulin pumps and continuous glucose monitors, are transforming disease management by providing real-time data for synthetic hormone therapy and exercise therapy. Health economics and public health initiatives are further fueling innovation in drug discovery and development for autoimmune disorders and hormonal imbalances.

- Genetic engineering and precision medicine are revolutionizing endocrinology, enabling targeted treatments for individual patients based on their unique genetic makeup. Blood glucose monitoring and dietary management continue to be essential components of effective treatment plans, while hormone receptors and patient education are crucial for optimizing patient outcomes. Innovations in healthcare, such as synthetic hormones and hormonal therapies, are improving quality of life for millions of patients, while advancements in drug development and health economics are making these treatments more accessible and affordable. The future of endocrinology lies in the intersection of technology, science, and patient-centered care.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Endocrinology Drugs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 40144.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.0 |

|

Key countries |

US, Canada, China, Germany, UK, France, Japan, Italy, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Endocrinology Drugs Market Research and Growth Report?

- CAGR of the Endocrinology Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the endocrinology drugs market growth of industry companies

We can help! Our analysts can customize this endocrinology drugs market research report to meet your requirements.