Orthopedic Pedicle Screws Market Size 2024-2028

The orthopedic pedicle screws market size is forecast to increase by USD 342.76 million at a CAGR of 7.83% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of spine surgeries and advancements in surgery procedures. The global trend towards an aging population and the subsequent rise in degenerative conditions necessitating orthopedic interventions fuel market expansion. However, high costs associated with spine surgeries pose a challenge for both patients and healthcare providers, potentially limiting market penetration. Regulatory hurdles impact adoption, as stringent regulations necessitate extensive clinical trials and approvals, increasing the time and cost of bringing new products to market. Supply chain inconsistencies also temper growth potential, as demand for orthopedic pedicle screws can be volatile and unpredictable, necessitating a responsive and agile supply chain.

- To capitalize on market opportunities and navigate challenges effectively, companies must focus on cost reduction strategies, regulatory compliance, and supply chain optimization. By addressing these challenges and leveraging advancements in materials science and surgical techniques, market participants can differentiate themselves and capture a larger share of the growing the market.

What will be the Size of the Orthopedic Pedicle Screws Market during the forecast period?

- The market is characterized by continuous advancements in technology and regulatory approvals for innovative implant designs. Implant longevity and spinal stability remain key focus areas, with clinical trials and biocompatibility testing ensuring safety and efficacy. Surgical training and patient education are crucial for optimal outcomes, while economic evaluation and cost-benefit analysis guide healthcare providers in making informed decisions. Artificial intelligence and big data analytics are revolutionizing the industry, enabling predictive modeling and personalized medicine. Health insurance coverage and value-based healthcare are shaping market trends, with a growing emphasis on patient-reported outcomes and quality of life. Advanced surgical techniques, such as stem cell therapy and bone regeneration, offer new possibilities for fracture healing and postoperative rehabilitation.

- Pedicle screw instrumentation continues to evolve, with digital health solutions streamlining workflows and enhancing patient care. Clinical studies and regulatory approvals are essential for the adoption of spinal implant technologies, ensuring the highest standards of safety and effectiveness.

How is this Orthopedic Pedicle Screws Industry segmented?

The orthopedic pedicle screws industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

- Product

- Monoaxial and polyaxial orthopedic pedicle screws

- Cannulated orthopedic pedicle screws

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

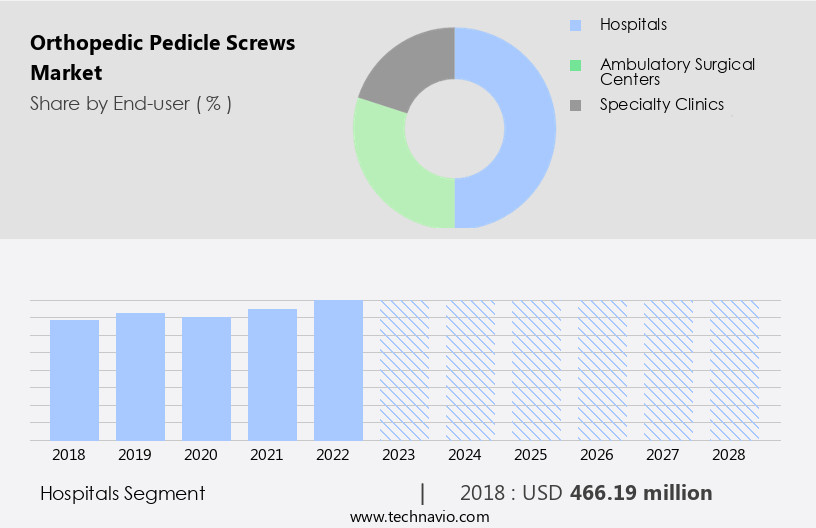

By End-user Insights

The hospitals segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing prevalence of orthopedic conditions, particularly among the aging population. Hospitals and ambulatory surgery centers are key markets for these screws, with the demand driven by advanced medical technologies and an increase in orthopedic procedures. Innovative companies, such as Zimmer, Stryker, and Medtronic, are leading the market with advanced pedicle screw systems. These solutions incorporate various designs, including screw head designs, thread designs, and locking mechanisms, to enhance implant stability and improve surgical techniques. Robotic surgery and image-guided surgery are also gaining popularity for their precision and minimally invasive nature.

The market is further propelled by research and development initiatives, strategic partnerships, and a focus on infection control, patient satisfaction, and minimally invasive surgery. Orthopedic surgeons are increasingly using pedicle screws for spinal fusion procedures to treat conditions like degenerative disc disease, spinal stenosis, and vertebral fractures. The market is also witnessing the emergence of 3D printed implants, bone graft substitutes, and biocompatible materials to enhance implant performance and patient outcomes. Titanium alloys and stainless steel are commonly used materials for pedicle screws due to their strength and biocompatibility. The market is expected to continue growing, driven by these trends and the ongoing advancements in orthopedic technology.

The Hospitals segment was valued at USD 466.19 million in 2018 and showed a gradual increase during the forecast period.

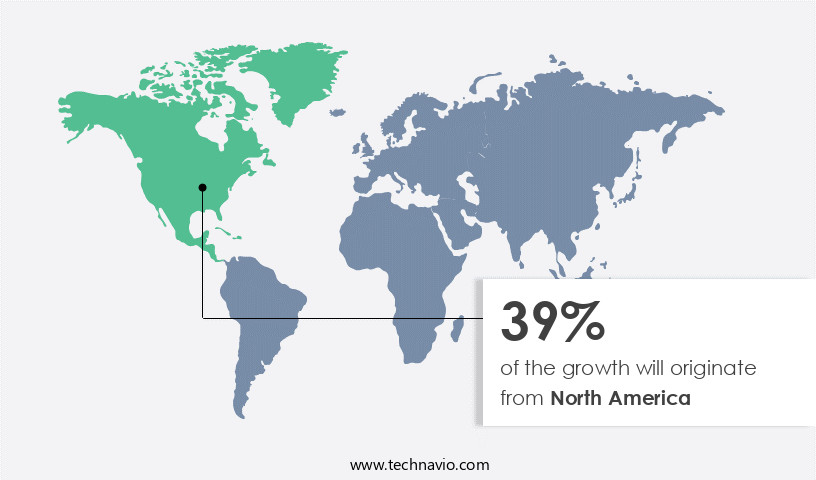

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth, driven by several factors. The increasing prevalence of spinal deformities and degenerative disc diseases, coupled with the rising number of spinal fusion surgeries, particularly in developed countries like the US and Canada, are significant contributors to market expansion. Furthermore, the aging population and the subsequent increase in the incidence of geriatric conditions, such as vertebral fractures and spinal stenosis, are also fueling market growth. In addition, advancements in surgical techniques, including minimally invasive surgery, image-guided surgery, and robotic surgery, are improving patient outcomes and reducing postoperative complications.

Moreover, the adoption of biocompatible materials, such as titanium alloys and stainless steel, in pedicle screw systems is ensuring implant stability and enhancing patient satisfaction. The market is further propelled by the presence of reimbursement policies, which facilitate access to orthopedic implants and bone graft substitutes for patients. Spine specialists in ambulatory surgery centers are increasingly utilizing pedicle screw fixation systems to treat various spinal conditions. Furthermore, the emergence of 3D printed implants and the use of bioresorbable materials in screws and thread designs are offering new opportunities for market growth. However, infection control remains a critical challenge, and companies must focus on addressing this concern to ensure patient safety.

Overall, the market is expected to continue its growth trajectory, driven by these trends and the increasing demand for effective spinal instrumentation solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Orthopedic Pedicle Screws market drivers leading to the rise in the adoption of Industry?

- The significant rise in the number of spine surgery procedures is the primary market driver.

- The rising prevalence of spine disorders, including degenerative disc disease, spondylolisthesis, prolapsed intervertebral disc, spinal stenosis, and osteoporosis, has fueled the demand for orthopedic pedicle screw systems. Elderly populations are particularly susceptible to these conditions, with degenerative disc disease and spinal stenosis being common afflictions. Osteoporosis, an orthopedic condition that weakens bones, increases the risk of fractures, progressive spine deformities, and stenosis, predominantly affects adults aged 50 and above. According to the Centers for Disease Control and Prevention (CDC), approximately 18% of adults aged 65 and older in the US had osteoporosis in their lumbar spine between 2010 and 2020.

- Scoliosis, an abnormal curvature of the spine, is another condition that may require pedicle screw fixation. Orthopedic pedicle screw systems are typically made of biocompatible materials, such as titanium alloys and stainless steel, ensuring minimal reaction from the body. Advanced pedicle screw systems incorporate compression strength and a locking mechanism to enhance stability and promote proper healing. Additionally, minimally invasive surgery using pedicle screws has gained popularity due to reduced post-operative pain, smaller incisions, and quicker recovery times. Furthermore, the development of bioresorbable materials for pedicle screws offers advantages such as eliminating the need for secondary surgeries to remove the screws.

What are the Orthopedic Pedicle Screws market trends shaping the Industry?

- The advancement of surgery procedures represents a significant market trend. This evolution reflects the ongoing commitment to enhancing patient care and outcomes through innovative techniques and technologies.

- The market is driven by advancements in spinal instrumentation, leading to more precise and efficient surgical procedures. These innovations enable medical professionals to address complex spinal deformities in an ambulatory surgery center setting. The integration of screw head designs and thread designs with advanced surgical techniques, such as robotic surgery and image-guided surgery, enhances surgical accuracy and reduces postoperative complications. The adoption of these advanced surgical methods is increasing, as they offer shorter hospital stays and quicker recovery times for patients.

- The future of orthopedic pedicle screws lies in the integration of technology, ensuring safer and more effective surgical interventions.

How does Orthopedic Pedicle Screws market faces challenges face during its growth?

- The escalating costs linked to spine surgery represent a significant barrier to the expansion of the industry.

- Orthopedic pedicle screws are essential implants used in spinal fusion surgeries to restore stability and correct various spinal conditions. However, the high costs associated with these procedures and implants pose a significant challenge for patients. Expenses related to hospital admission, surgery, medical devices like orthopedic pedicle screws, OR usage, and follow-up appointments add to the financial burden. This cost barrier may limit the adoption of these screws in medium and small-sized surgical centers. Despite these challenges, the growing elderly population and an increasing number of spinal disorders, such as degenerative disc disease, scoliosis, spine tumors, and severe accidents resulting in lumbar fractures, fuel the demand for spinal fusion surgeries and, consequently, the use of orthopedic pedicle screws.

- Innovations in technology, such as laparoscopic surgery and 3D printed implants, aim to improve implant stability and reduce costs, making these procedures more accessible. Reimbursement policies and ongoing research to enhance fatigue strength and overall implant durability further support the market's growth.

Exclusive Customer Landscape

The orthopedic pedicle screws market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the orthopedic pedicle screws market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, orthopedic pedicle screws market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alphatec Holdings Inc. - This company specializes in manufacturing advanced roll forming machines, including solutions for roofing panels and glazed tiles, as well as double deck configurations. Our product range caters to various industries, delivering precision and efficiency through innovative engineering and technology. By investing in our machines, businesses can streamline production processes, enhance product quality, and improve overall operational efficiency. Our commitment to research and development ensures continuous innovation and the delivery of cutting-edge solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphatec Holdings Inc.

- B.Braun SE

- Captiva Spine Inc.

- CarboFix Orthopedics Ltd.

- Dieter Marquardt Medizintechnik GmbH

- Evolution Spine

- Genesys Orthopedic Systems LLC

- Globus Medical Inc.

- Johnson and Johnson

- Medacta International SA

- Medtronic Plc

- Mirus LLC

- Orthofix Medical Inc.

- OrthoPediatrics Corp.

- Safe Orthopaedics SA

- Spinal Elements Inc.

- Spineart SA

- SpineGuard SA

- Stryker Corp.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Orthopedic Pedicle Screws Market

- In February 2024, Stryker Corporation announced the launch of its new Osteonics⢠Integrated Pedicle Screw System. This innovative product features an integrated rod design that simplifies the surgical procedure and reduces the risk of screw loosening (Stryker Corporation, 2024).

- In May 2025, Zimmer Biomet Holdings, Inc. Entered into a strategic partnership with OrthoSensor, Inc. To integrate OrthoSensor's real-time monitoring technology into Zimmer Biomet's pedicle screw systems. This collaboration aims to enhance surgical precision and improve patient outcomes (Business Wire, 2025).

- In August 2024, DePuy Synthes, a Johnson & Johnson company, completed the acquisition of OrthoPediatrics Corp. This acquisition expanded DePuy Synthes' orthopedic portfolio, particularly in the pediatric orthopedic segment (Johnson & Johnson, 2024).

- In November 2025, Medtronic plc received FDA approval for its Infuse Elite Total Disc Replacement System, which includes pedicle screws coated with its proprietary Infuse Bone Graft material. This approval marks a significant technological advancement in spinal fusion procedures (Medtronic plc, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in spinal instrumentation and the expanding application across various sectors. Spinal deformity and ambulatory surgery centers are notable areas of growth, as minimally invasive surgical techniques gain popularity. The ongoing development of screw head designs, thread designs, and surgical techniques, such as robotic surgery and image-guided surgery, further enhance the market's dynamism. Implant stability, a critical factor in orthopedic implants, is a focus for innovation. Titanium alloys and biocompatible materials are commonly used for screws, with stainless steel and bioresorbable materials also gaining traction. The integration of 3D printed implants and bone graft substitutes adds to the market's complexity.

Orthopedic surgeons and spine specialists are at the forefront of these advancements, working to improve patient satisfaction and address challenges like postoperative complications, infection control, and vertebral fracture. Reimbursement policies and surgical center regulations continue to shape market trends, while screw diameter, length, compression strength, and fatigue strength remain essential considerations. The market's continuous unfolding is marked by the emergence of new technologies, such as laparoscopic surgery and pedicle screw systems, and the ongoing refinement of existing ones. Pedicle screw fixation and screw thread design continue to be areas of active research, as the industry strives to improve patient outcomes and expand the scope of orthopedic applications.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Orthopedic Pedicle Screws Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.83% |

|

Market growth 2024-2028 |

USD 342.76 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.28 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Orthopedic Pedicle Screws Market Research and Growth Report?

- CAGR of the Orthopedic Pedicle Screws industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the orthopedic pedicle screws market growth of industry companies

We can help! Our analysts can customize this orthopedic pedicle screws market research report to meet your requirements.