Orthopedic Surgical Robots Market Size 2024-2028

The orthopedic surgical robots market size is forecast to increase by USD 1.49 billion at a CAGR of 27.17% between 2023 and 2028.

- Market growth hinges on several factors including the rise of robotic surgical platforms due to limitations in traditional surgeries, evolving regulatory landscapes, and ongoing technological advancements. These elements collectively drive innovation and adoption within the medical field. The shift towards robotic solutions stems from the need for enhanced precision, reduced invasiveness, and improved patient outcomes, addressing shortcomings in conventional surgical methods.

- Furthermore, regulatory changes play a pivotal role in shaping market dynamics and influencing the development and deployment of advanced medical technologies. With continuous technological progress, including AI integration and surgical automation, the market is poised for further expansion and transformative changes in healthcare practices.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to advancements in technology and the increasing prevalence of musculoskeletal disorders. Orthopedic surgery focuses on the correction of spinal deformities, joint fractures, musculoskeletal traumas, bone infections, and bone deformities. Surgical robots play a crucial role in these procedures, offering precision and accuracy. Key technological advances include acetabulum positioning systems, arthroscopy, and the use of molecular diagnostics in orthopedic research.

- Furthermore, manufacturing companies like Monogram Orthopedics, Engage Surgical, and Extremity Orthopedics are leading the way with new developments in robotic arms and hinges, such as the Triathlon Hinge. Inpatient facilities benefit from these advancements, providing better patient care and outcomes. Orthopedic surgical robots are transforming the field of orthopedics, enabling minimally invasive procedures and improving the human skeletal system's overall health. The market for these robots is expected to continue growing as research in musculoskeletal disorders, such as osteoarthritis, progresses.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Knee surgery

- Hip surgery

- End-user

- Hospitals

- Ambulatory service centers

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

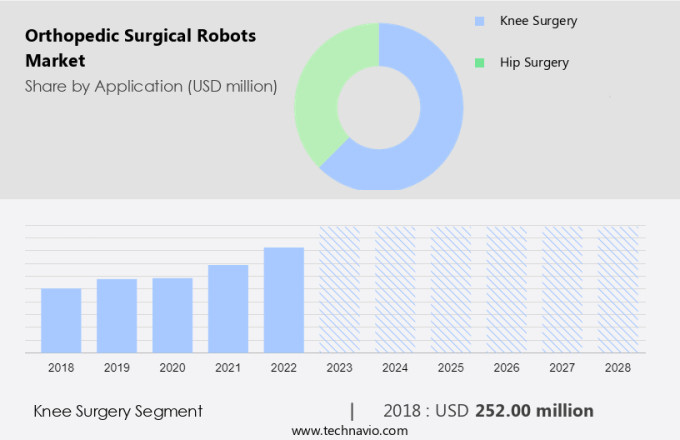

- The knee surgery segment is estimated to witness significant growth during the forecast period.

The market encompasses advanced technologies for knee and hip surgeries, including acetabulum positioning and femur preparation. With an aging population and increasing health complications, there is a growing demand for orthopedic solutions in developed and developing countries. New developments in medtech devices, such as Mako orthopedic robot and Engage Surgical, facilitate precise procedures for knee osteoarthritis, meniscus tear, ligament rupture, and bone fractures.

Furthermore, orthopedic surgeons utilize diagnostic technology and digitization to improve the quality of care for patients with bone deformities, hip fractures, joint disorders, and musculoskeletal traumas. The market expansion is driven by the approval of new prostheses for knees, such as CORI and those from Monogram Orthopedics, and the increasing healthcare expenditure for geriatric population and inpatient facilities. Musculoskeletal research and molecular diagnostics are also significant areas of focus for companies in this market.

Get a glance at the market report of share of various segments Request Free Sample

The knee surgery segment was valued at USD 252.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

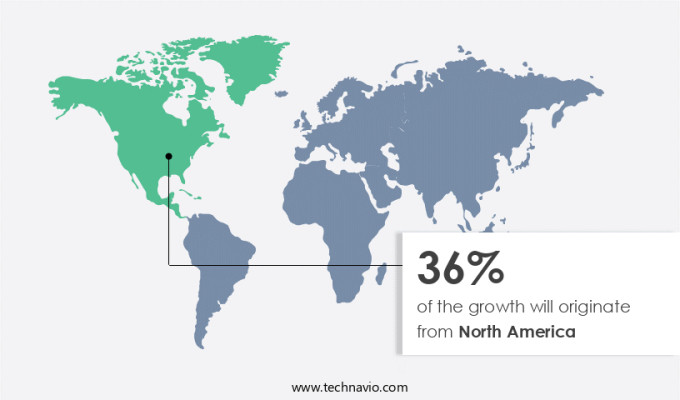

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Orthopedic surgery market in North America is experiencing substantial growth due to the increasing adoption of orthopedic surgical robots and the rise in the number of surgical procedures. Osteoarthritis and Osteoporosis patients are major beneficiaries of this trend. Outpatient centers and podiatrists are key providers of these advanced orthopedic treatments. Precision and safety are crucial factors driving the market, with regulatory standards ensuring quality. Reamer irrigator aspirators and robotic arms are essential robotic equipment used in orthopedic surgeries.

Furthermore, strategic decisions are being made to address skill gaps and the need for skilled expertise in performing complex spinal deformity corrections. Technological advances, such as self-efficacy-enhancing Triathlon Hinge implants, are also contributing to market growth. Surgical robots enable providers to offer minimally invasive procedures, meeting the supportive care needs of patients with osteoarthritis, osteoporosis, and spinal deformities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Orthopedic Surgical Robots Market?

Limitations in conventional surgeries spurring the adoption of robotic surgical platforms is the key driver of the market.

- Orthopedic surgical robots have gained significant attention in the healthcare industry due to their ability to enhance accuracy in implant placement during surgeries. This precision is crucial for addressing various orthopedic conditions such as bone deformities, fractures, infections, and disorders. The aging population, particularly those with health complications, is a major driver for the market's growth. These robots facilitate improved acetabulum positioning, femur preparation, and femoral osteotomies, reducing postoperative complications and hospitalization time.

- Furthermore, new developments in medtech devices, including Mako orthopedic robot and Engage Surgical, enable more efficient arthroscopy, knee replacements, and ligament repair. The market is engaged in manufacturing advanced solutions for extremity orthopedics, meniscus tear, and hip fractures. Digitization and molecular diagnostics play a vital role in the market, ensuring better visualization and preoperative planning. Orthopedic surgeons rely on these robots for hip and knee replacements, addressing conditions like osteoarthritis and bone infections. The market is poised for new developments in musculoskeletal research and traumas, catering to the increasing demand for advanced orthopedic treatments.

What are the market trends shaping the Orthopedic Surgical Robots Market?

An increase in minimally invasive surgery (MIS) procedures in orthopedics is the upcoming trend in the market.

- The market is experiencing significant growth due to the increasing preference for minimally invasive surgeries in orthopedics. Arthroscopy is a common minimally invasive procedure used for bone fractures, joint reconstruction, and extremity realignment. The market is driven by factors such as the aging population, increased healthcare expenditure, and the need to address musculoskeletal disorders like bone deformities, ligament rupture, and meniscus tear. New developments in medtech devices, such as orthopedic surgical robots from companies like Engage Surgical and Monogram Orthopedics, are gaining approval for procedures like acetabulum positioning, femoral osteotomies, and femur preparation.

- Furthermore, these robots enhance precision and reduce health complications associated with traditional surgeries. The market is expected to expand further with the digitization of diagnostic technology and the increasing awareness of minimally invasive procedures for conditions like hip fractures, knee disorders, and knee osteoarthritis. The market is also expected to engage orthopedic surgeons in the treatment of bone infections and joint replacements like CORI knee replacement and Mako orthopedic robot. The growth of the market is further fueled by new developments in musculoskeletal research and molecular diagnostics.

What challenges does Orthopedic Surgical Robots Market face during the growth?

High equipment and maintenance costs are key challenges affecting the market growth.

- The market faces significant challenges, including the high costs of equipment and maintenance, which can exceed USD 1 million. This expense may deter patients from undergoing robotic surgeries, particularly in developed countries with healthcare initiatives, such as bundled payments and reimbursements for joint replacements. The acceptance of robotics in surgeries is also limited, especially in developing countries, due to skepticism towards technology in healthcare. Key applications of orthopedic surgical robots include arthroscopy, acetabulum positioning, and femoral osteotomies.

- Furthermore, these robots are used to address various musculoskeletal disorders, such as bone deformities, fractures, infections, and traumas. New developments in medtech devices, including Mako orthopedic robot and Engage Surgical, aim to improve diagnostics and surgical precision. The aging population and geriatric population's increased need for joint replacements and knee disorders treatment contribute to the market's growth. Musculoskeletal research and digitization are also driving factors. Manufacturers like Monogram Orthopedics and CORI are focusing on addressing health complications and meniscus tear, among other bone and ligament injuries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asensus Surgical US Inc.

- Brainlab AG

- Corin Group Plc

- Curexo Inc.

- Galen Robotics Inc.

- GANYMED ROBOTICS SAS

- Globus Medical Inc.

- Intuitive Surgical Inc.

- Johnson and Johnson Services Inc.

- KUKA AG

- Medtronic Plc

- Nuvasive Inc.

- OrthAlign Corp.

- Renishaw Plc

- Shanghai MicroPort MedBot Group Co. Ltd.

- Siemens AG

- Smith and Nephew plc

- Stryker Corp.

- THINK Surgical Inc.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing adoption of advanced technologies in orthopedic surgeries. The use of these robots enhances precision, flexibility, and accuracy in surgical procedures, leading to improved patient outcomes. Agile and lightweight robots are gaining popularity in the market as they offer easier maneuverability and reduced invasiveness. The market is driven by factors such as the rising prevalence of orthopedic disorders, the growing geriatric population, and the increasing demand for minimally invasive surgeries. Key players in the market include Stryker, Medtronic, and Zimmer Biomet. They are investing in research and development to launch innovative products and expand their market presence.

Furthermore, the market is segmented based on product type, application, and end-user. The product types include robotic arms, robotic systems, and accessories. The applications include hip replacement, knee replacement, and spine surgery. The end-users include hospitals, ambulatory surgical centers, and academic and research institutions. The market is expected to grow at a steady pace in the coming years due to the increasing demand for minimally invasive surgeries and the ongoing advancements in robotics technology. The use of artificial intelligence and machine learning algorithms in orthopedic surgical robots is also expected to drive market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 27.17% |

|

Market growth 2024-2028 |

USD 1.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.98 |

|

Key countries |

US, UK, Germany, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch