Knee Replacement Market Size 2024-2028

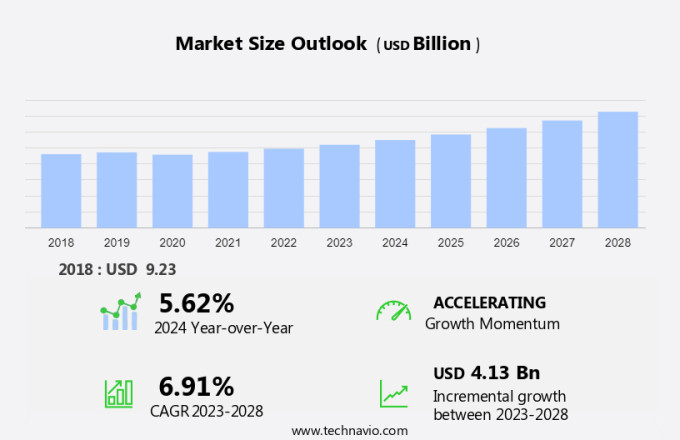

The knee replacement market size is forecast to increase by USD 4.13 billion at a CAGR of 6.91% between 2023 and 2028.

- The market is experiencing significant growth due to several factors. One key driver is the increasing prevalence of rheumatic conditions, such as osteoarthritis and rheumatoid arthritis, which often require knee implants as a solution. Additionally, advancements in technology are playing a major role in market expansion. For instance, the use of 3D technology and modular implants is becoming more common, allowing for greater precision and customization in surgical procedures. Furthermore, the integration of smart implants, which can monitor patient health and provide real-time data to healthcare providers, is a promising trend. However, challenges remain, including the high cost of implants and decreasing healthcare reimbursements, which may limit access to these procedures for some patients. Overall, the market is poised for continued growth, driven by advances in technology and increasing demand for orthopedic solutions.

What will be the Size of the Market During the Forecast Period?

- The market represents a significant and growing sector within the healthcare industry, driven by the increasing prevalence of knee diseases such as osteoarthritis, psoriatic arthritis, and rheumatoid arthritis. These conditions often result in symptomatic knee osteoarthritis, leading individuals to seek relief through surgical interventions. The knee joint, a complex hinge mechanism, is prone to wear and tear due to various factors, including age, injury, and disease. When non-surgical treatments prove insufficient, artificial knee implants emerge as a viable solution. These implants, designed using advanced 3D technology, aim to restore function and alleviate pain. The market for knee implants encompasses a diverse range of products, including below-the-knee implants, smart implants, and modular implants. Below-the-knee implants cater to patients requiring extensive bone loss reconstruction, while smart implants integrate advanced technology to enhance patient outcomes.

- Modular implants offer customizable solutions based on individual patient needs. The orthopedic surgeries market, which includes knee replacement procedures, continues to expand due to the increasing number of aging populations worldwide. The advent of ambulatory healthcare facilities has revolutionized the delivery of knee replacement services, offering patients convenience and cost savings. These facilities enable outpatient procedures, reducing hospital stays and expediting recovery. Advancements in technology, such as 3D printing and biocompatible materials, contribute to the development of more effective and durable knee implants.

- Furthermore, the integration of tissues, including cartilage, into implant designs aims to improve joint function and longevity. Market dynamics, including regulatory approvals, pricing pressures, and competition, influence the market's growth trajectory. Collaborations between industry players and research institutions foster innovation, driving market expansion. In conclusion, the market reflects a dynamic and evolving industry, driven by the increasing prevalence of knee diseases and advancements in technology. As the demand for effective solutions to alleviate pain and restore function continues to grow, the market is poised for continued expansion.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- TKR

- RKR

- PKR

- End-user

- Hospitals and specialty clinics

- Ambulatory surgical clinics

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

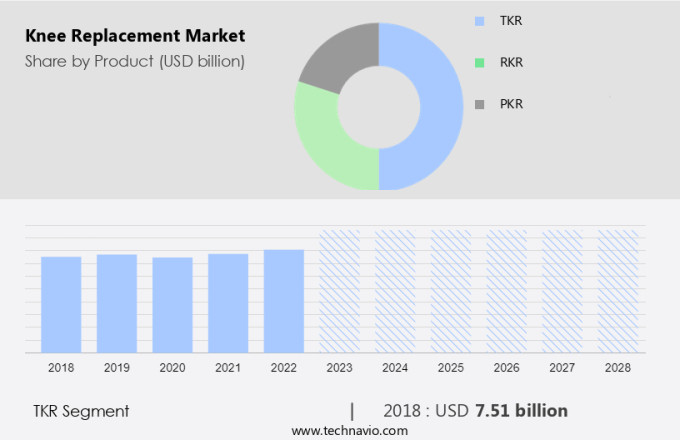

- The TKR segment is estimated to witness significant growth during the forecast period.

The market encompasses various surgical techniques, including total knee replacement (TKR), which is a significant surgical procedure. Hospitals, orthopedic clinics, and ambulatory surgical centers are the primary end-users of these procedures. Hospitals lead the market due to their advanced infrastructure, skilled medical staff, and comprehensive services, including pre-operative assessment, surgical procedures, and post-operative care. TKR surgery involves replacing the damaged or worn-out parts of the knee joint, specifically the bottom part of the thigh bone (femur), the top of the shin bone (tibia), and the kneecap (patella), with artificial knee replacement implants. Knee osteoarthritis is a common condition leading to the need for these surgical procedures.

Further, according to the Centers for Disease Control and Prevention (CDC), approximately 14 million Americans have symptomatic osteoarthritis, making it a significant health concern. Surgical robots and artificial intelligence are increasingly being integrated into knee replacement surgeries to enhance precision and improve patient outcomes. TKR is a crucial intervention for managing knee osteoarthritis and restoring mobility and function.

Get a glance at the market report of share of various segments Request Free Sample

The TKR segment was valued at USD 7.51 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

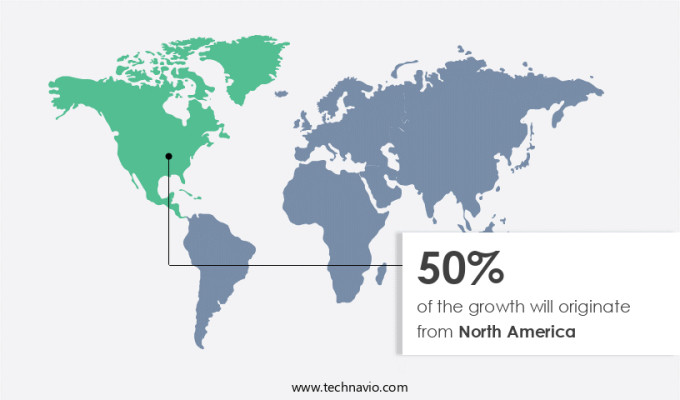

- North America is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American region dominates The market due to several factors, including the high prevalence of knee diseases such as osteoarthritis, psoriatic arthritis, and rheumatoid arthritis. The US and Canada are the major contributors to the market in this region. The market's growth in North America is driven by the increasing adoption of advanced artificial knee implants, improved healthcare infrastructure, and the rising number of knee arthroplasty surgeries. Key players in the market include Johnson & Johnson Services Inc., Smith & Nephew plc, and Stryker Corp., which are at the forefront of providing innovative knee implant solutions to meet the growing demand.

These companies are investing significantly in research and development to introduce new and improved knee implants to cater to the evolving needs of patients. The market in North America is expected to continue its growth trajectory during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Knee Replacement Market?

Increasing government support for healthcare enabling better access to orthopedic procedures is the key driver of the market.

- The market is experiencing significant growth due to the increasing prevalence of knee diseases, such as osteoarthritis, psoriatic arthritis, and rheumatoid arthritis. According to the Arthritis Foundation, symptomatic knee osteoarthritis affects over 15 million Americans. Knee arthroplasty surgery, which involves the replacement of damaged cartilages in the knee joint with artificial knee implants, has become a common treatment for these conditions. The market for knee implants includes various types, such as Fixed-bearing Implants, Mobile-bearing Implants, and Modular implants. Advancements in technology, including 3D technology and Smart implants, are driving innovation in the market. Orthopedic clinics and Ambulatory Surgical Centers are increasingly adopting surgical techniques like Partial Knee Replacement and Revision Knee Replacement to provide more personalized care to patients.

Surgical robots and Artificial intelligence (AI) are also being integrated into knee replacement surgeries to improve accuracy and efficiency. The epidemics of obesity and bone-related ailments are also contributing to the growth of the market. Pain medications and co-occurring illnesses can lead to complications and the need for revision arthroplasty. Customized implants are also gaining popularity to address individual patient needs. The market for knee replacement implants is expected to continue growing due to the increasing demand for minimally invasive procedures and the aging population.

What are the market trends shaping the Knee Replacement Market?

Growing developments in global knee replacement market is the upcoming trend in the market.

- The market is witnessing significant advancements due to the introduction of innovative technologies and surgical techniques in knee arthroplasty surgery. Osteoarthritis, psoriatic arthritis, and rheumatoid arthritis are common bone-related ailments leading to symptomatic knee osteoarthritis, necessitating knee replacement surgeries. The Arthritis Foundation reports a high prevalence of arthritis and rheumatic conditions in the US. Recent innovations include the VELYS Robotic-Assisted Solution by DePuy Synthes, which offers insightful analysis, adaptable implementation, and validated performance for optimized patient outcomes and operational efficiency. The Medacta Group S.A. Launched the GMK SpheriKA Knee Implant, designed to reduce post-operative knee discomfort and enhance patient satisfaction in daily activities after Total Knee Replacement (TKA) by ensuring optimal functional stability.

- Moreover, advancements in 3D technology and artificial intelligence (AI) are leading to the development of smart implants, modular implants, and surgical robots for Orthopedic surgeries. These innovations cater to the increasing demand for minimally invasive procedures and customized implants in Ambulatory Surgical Centers (ASCs) and Orthopedic Clinics. Partial Knee Replacement (PKR) and Revision Knee Replacement are other trends in the market, with Fixed-bearing Implants and Mobile-bearing Implants being popular choices for patients. The market is expected to grow further due to the epidemics of obesity and the increasing number of co-occurring illnesses requiring knee replacement surgeries.

What challenges does Knee Replacement Market face during the growth?

High implant prices coupled with decreasing healthcare reimbursements is a key challenge affecting the market growth.

- Knee arthroplasty surgery, also known as knee replacement, is a common orthopedic procedure for treating bone-related ailments such as osteoarthritis, psoriatic arthritis, and rheumatoid arthritis. This surgical intervention involves the replacement of damaged cartilages in the knee joint with artificial knee implants. According to the Arthritis Foundation, symptomatic knee osteoarthritis affects millions of Americans, making knee replacement surgeries a significant market. The prevalence of knee diseases continues to rise due to epidemics of obesity and aging populations. Knee replacement implants come in various types, including Fixed-bearing Implants, Mobile-bearing Implants, and Modular implants. Partial Knee Replacement and Revision Knee Replacement are also common procedures.

- Ambulatory Surgical Centers and Orthopedic Clinics are increasingly offering these procedures to provide more affordable and accessible options for patients. In summary, the market is driven by the growing prevalence of arthritis and rheumatic conditions, the need for advanced implant technologies, and the increasing affordability of procedures through ambulatory surgery centers and clinics. Despite the high costs, the market is expected to grow due to the significant benefits these procedures offer for improving patients' quality of life.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADLER ORTHO S.p.A.

- Amplitude SAS

- Arthrex Inc.

- B.Braun SE

- Conformis Inc.

- Corin Group Plc

- Enovis Corp.

- Exactech Inc.

- Fuse Medical Inc.

- implantcast GmbH

- Johnson and Johnson Services Inc.

- Just Medical Devices Tianjin Co. Ltd

- Limacorporate SpA

- Medacta Group SA

- Merete Technologies Inc.

- MicroPort Scientific Corp.

- Smith and Nephew plc

- Stryker Corp.

- Waldemar Link GmbH and Co. KG

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Knee arthroplasty surgery, also known as knee replacement, is a medical procedure that involves replacing damaged cartilages in the knee joint with artificial implants. This procedure is often recommended for individuals suffering from osteoarthritis, psoriatic arthritis, and rheumatoid arthritis. Symptomatic knee osteoarthritis and other bone-related ailments can cause significant pain and impact daily life. Artificial knee implants come in various types, including fixed-bearing and mobile-bearing implants. Fixed-bearing implants have a stationary plastic liner, while mobile-bearing implants allow for more natural knee movement. Orthopedic clinics and ambulatory surgical centers offer knee replacement surgeries using advanced surgical techniques and technologies, such as 3D technology and smart implants.

Consequently, these innovations enable customized implants and improved surgical precision. Knee diseases, including arthritis and rheumatic conditions, affect millions worldwide, with epidemics of obesity contributing to the increasing prevalence of osteoarthritis. Pain medications and co-occurring illnesses can complicate treatment, making advanced surgical procedures like knee replacement essential for many. Partial knee replacement and revision knee replacement are alternative options for those requiring less extensive procedures. Surgical robots and artificial intelligence are increasingly utilized in orthopedic surgeries to enhance accuracy and efficiency. The Arthritis Foundation and other organizations provide valuable resources for individuals considering knee replacement surgery. Consult with healthcare professionals to determine the best treatment plan for your unique needs.

Additionally, the knee replacement market is evolving with innovations in artificial knee implants, such as LPS-Mobile Bearing Knees and NexGen LPS-Flex Mobile, designed to offer improved mobility and reduce discomfort. With the prevalence of knee osteoarthritis rising, the demand for total knee replacement (TKR) and partial knee arthroplasty procedures is increasing. Less invasive surgical procedures, including robots-assisted knee replacement surgeries, are gaining popularity for their precision and quicker recovery times. Customized knee replacement implants and advancements in materials for knee replacement surgery are enhancing patient outcomes. The market also sees a growing interest in designs of knee implants, such as fixed bearing and mobile bearing implants, as well as medial pivotal implants. Robotics and the higher diagnosis rate of knee arthritis are driving further advancements in knee osteoarthritis treatment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.91% |

|

Market growth 2024-2028 |

USD 4.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.62 |

|

Key countries |

US, Canada, Germany, France, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch