Packaged Tamales Market Size 2025-2029

The packaged tamales market size is forecast to increase by USD 203.8 million at a CAGR of 5.9% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The increasing popularity of Latin American cuisines in the US and Canada is driving demand for traditional dishes like tamales.

- Moreover, the convenience of ordering food online through portals, smartphones and mobile apps has led to an increase in the sales of packaged tamales. Additionally, the trend of preparing meals at home has gained momentum, particularly during the COVID-19 pandemic, resulting in higher demand for convenient and ready-to-eat options like packaged tamales. These factors are expected to fuel market growth in the coming years.

What will be the Size of the Packaged Tamales Market During the Forecast Period?

- The packaged tamale market presents a vibrant and dynamic sector in the global food industry. This market caters to consumers seeking convenient, authentic Mexican dishes for various occasions, including food at home, catering events, and online on-demand food delivery services. Tamales, a traditional savory dish wrapped in corn husks, offer a rich culinary experience with their flavorful filling and unique cornmeal dough. Tamales come in various meat-based and vegetarian options, reflecting the diversity of Mexican food culture. The market's growth is driven by the increasing popularity of quick meal options and the desire for healthy Mexican food. Homemade tamales, with their artisanal appeal, continue to be a favorite, while industrial production ensures consistent availability.

- Moreover, tamale ingredients, including corn husks, cornmeal, and seasonings, are essential to maintaining authenticity. Innovations in tortilla making machines and tamale production techniques have led to new variations, such as spicy tamales and those wrapped in banana leaves. The market's growth is further fueled by the cultural significance of tamales during festivals, parties, and holidays. Despite the convenience of packaged tamales, homemade versions remain a cherished part of Mexican food culture. Nutrition related to tortilla continues to be of interest to consumers, with many seeking easy and authentic methods for making tamales at home. The market's future looks bright, with opportunities for innovation, cultural preservation, and growth in the food industry.

How is this market segmented and which is the largest segment?

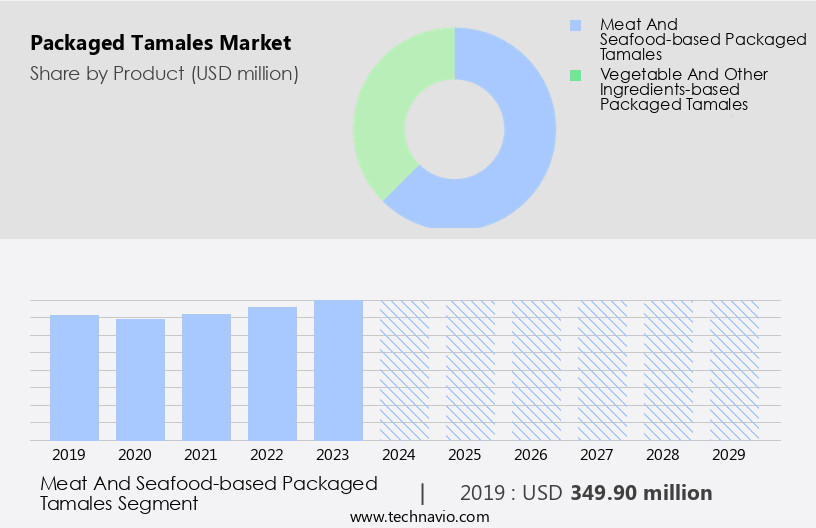

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Meat and seafood-based packaged tamales

- Vegetable and other ingredients-based packaged tamales

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Mexico

- US

- Europe

- UK

- France

- Spain

- APAC

- China

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Product Insights

The meat and seafood-based packaged tamales segment is estimated to witness significant growth during the forecast period. The market encompasses meat and seafood-based options, which is a growing segment due to the increasing number of new companies and innovative flavors. Factors driving market growth include the rising demand for seafood-based products in the US, Mexico, the Philippines, and Spain, as well as the expanding presence of organized retailing outlets. Packaging materials, such as natural and advanced options, ensure product preservation and food safety. Gourmet and ready-to-eat tamales offer convenience and ease for consumers. Vegetables are also gaining popularity in the market, providing a healthier alternative. The market is poised for continued growth due to these trends and the increasing popularity of international cuisine.

Get a glance at the share of various segments. Request Free Sample

The meat and seafood-based packaged tamales segment was valued at USD 349.90 million in 2019 and showed a gradual increase during the forecast period.

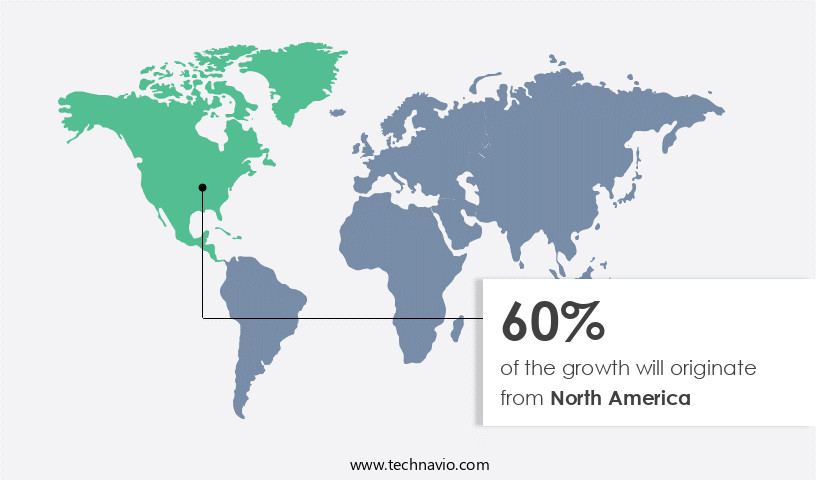

Regional Analysis

North America is estimated to contribute 60% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is experiencing consistent growth due to the increasing number of middle-class families and their desire for convenient meal solutions. With hectic lifestyles, consumers are turning to foodservice outlets, including packaged tamale shops, for ease in meal preparation. In the US, a significant portion of the population prefers tamales, particularly for breakfast, leading retailers to offer these as a product option. Packaging technology advances have enabled longer shelf life and improved texture preservation, making tamales a popular choice for convenience food consumers. The convenience and versatility of packaged tamales cater to the needs of busy individuals, ensuring steady market growth.

Market Dynamics

Our packaged tamales market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Packaged Tamales Market?

Growing popularity of Latin American cuisines is the key driver of the market.

- The market is experiencing significant growth due to the increasing popularity of Mexican cuisine and the expanding Hispanic population. Consumers are increasingly seeking foods with fresh ingredients and authentic flavors, leading to a surge in demand for traditional dishes like tamales. The time-consuming preparation process of cooking tamales from scratch deters many busy individuals, making packaged options an easy solution. Packaged tamales are made using natural ingredients, such as corn dough, meat, vegetables, fruits, and chilies, wrapped in corn husks or banana leaves. The steaming process preserves the freshness and textures of the tamales, while advancements in packaging technology ensure the product's longevity.

- Furthermore, the foodservice sectors, including schools, hospitals, and corporate cafeterias, are significant distribution channels for packaged tamales. Gourmet options, such as seafood-based and cheese-filled tamales, cater to consumer preferences for healthier and more flavorful options. The market for packaged tamales is expected to grow further as more families seek convenient and delicious meal solutions that maintain the taste and authenticity of traditional Mexican dishes. The use of natural ingredients, preservation techniques, and traditional preparation methods ensures that packaged tamales provide the same taste and nutritional value as homemade tamales.

What are the market trends shaping the Packaged Tamales Market?

Growing popularity of food ordering through online portals and mobile apps is the upcoming trend in the market.

- The market continues to grow in response to consumer preferences for authentic flavors and convenient, ready-to-eat solutions. Traditional Mexican dishes, such as tamales, are increasingly popular, particularly among busy individuals seeking an easy and nutritious meal option. These tamales are traditionally made from corn dough, wrapped in corn husks or banana leaves, and filled with seasoned meat, vegetables, fruits, or cheese. The time-consuming preparation process involves steaming the tamales in cooking liquid and applying preservation techniques to ensure freshness. In recent years, there have been advancements in product formulations and packaging technology to maintain the natural flavors and textures of tamales while enhancing their shelf life.

- Moreover, foodservice sectors, including takeaway restaurants and schools, are significant distribution channels for packaged tamales. The use of natural, biodegradable packaging materials, such as corn husks and banana leaves, aligns with consumer preferences for healthier and more sustainable food options. Gourmet tamales, with unique fillings and flavors, have gained popularity among consumers seeking a more exciting and flavorful meal experience. Vegetarian, seafood-based, and fruit-filled tamales cater to various dietary preferences and tastes. The convenience of packaged tamales makes them an attractive option for families and individuals who want to enjoy traditional Mexican cuisine without the time-consuming preparation process. The tamales' authentic flavors and easy-to-prepare nature make them a popular choice for consumers looking for a delicious and nutritious meal solution.

What challenges does Packaged Tamales Market face during the growth?

Increasing at-home preparation of tamales is a key challenge affecting the market growth.

- The market faces challenges due to the growing trend of cooking from scratch at home. The availability of authentic flavors and traditional recipes online has made it easier for consumers to prepare tamales using fresh ingredients and corn husks or banana leaves. The time-consuming preparation process of tamales is often seen as a cultural tradition, adding to the appeal of homemade options. However, the demand for ready-to-eat tamales in various foodservice sectors remains strong. Packaging technology advances have enabled the preservation of tamales' natural flavors and textures using natural preservation techniques. Gourmet tamales with unique fillings, such as vegetables, seafood-based, fruits, and cheese, are increasingly popular in retail outlets and foodservice establishments.

- Moreover, packaging materials play a crucial role in maintaining the freshness of packaged tamales. The use of high-quality, airtight packaging ensures the tamales retain their taste and texture until consumption. The convenience of packaged tamales as a quick and easy solution for busy individuals and families continues to drive demand in the market. The nutritional value of tamales, which includes essential vitamins and minerals from the corn dough, meat, and vegetables, adds to their appeal. Consumer preferences for healthier and more natural food options have led to advancements in product formulations, including the use of chilies and natural seasonings to enhance flavor without adding artificial additives.

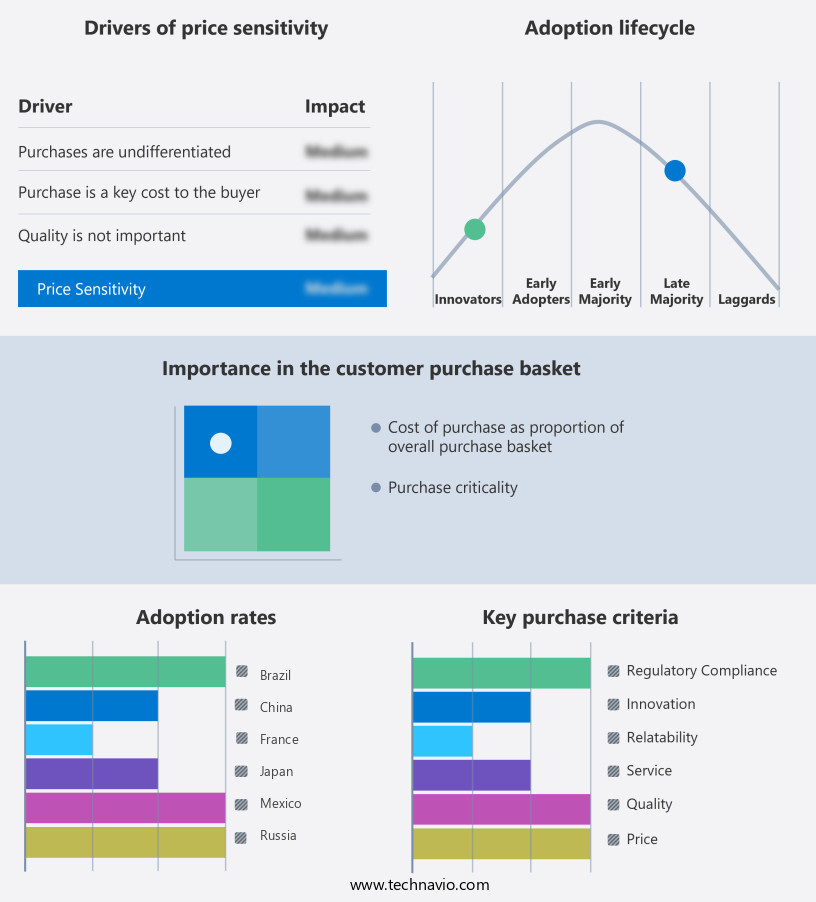

Exclusive Customer Landscape

The packaged tamales market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bueno Foods - The company offers packaged tamales such as hand made pork tamales red Chile and stone ground corn.

The packaged tamales market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALPHA FOODS

- Capra Foods LLC

- Costco Wholesale Corp.

- Del Real LLC

- HEB LP

- Hormel Foods Corp.

- Mi Casa Tamales

- Ruiz Food Products Inc.

- S.C. Johnson and Son Inc.

- Supreme Tamale Co.

- TAMAHLI

- Tamale Addiction

- Tastes Better From Scratch

- Texas Lone Star Tamales

- Texas Tamale Co.

- Todos los derechos reservados La Costena

- Tucson Tamale

- Valley Markets Inc.

- XLNT Foods Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a vibrant and growing sector within the broader ethnic food industry. This market caters to consumers seeking authentic Mexican flavors, convenience, and a connection to traditional dishes. The market offers various product formulations, including corn dough-based and banana leaf-wrapped tamales, each with unique textures and tastes. The nutritional value of packaged tamales varies depending on their ingredients. Corn dough is a staple in many tamale recipes, providing essential carbohydrates and fiber. Meat, vegetables, and fruits are common fillings, adding protein, vitamins, and minerals to the dish.

In addition, some tamales may be prepared with chilies, adding a spicy kick and health benefits. Distribution channels for packaged tamales are diverse, catering to various consumer segments. Retail outlets, including supermarkets and specialty stores, are significant players in the market. Foodservice sectors, such as restaurants and catering services, also rely on packaged tamales as an easy solution for serving authentic Mexican dishes. Preservation techniques are crucial in the market. Steaming is the traditional method for cooking and preserving tamales. However, advancements in packaging technology have enabled longer shelf life and convenience for consumers. Consumer preferences play a significant role in the market.

Furthermore, busy individuals appreciate the convenience of ready-to-eat tamales. Gourmet options cater to those seeking authentic, high-quality flavors. Vegetarian, seafood-based, and fruit-filled tamales cater to diverse dietary needs and preferences. The market for packaged tamales is not limited to Mexican cuisine. Ethnic foods, in general, have gained popularity in recent years, with consumers seeking new and exciting flavors. The market offers various tamale varieties, each with unique textures, flavors, and cultural significance. Packaging materials are essential in the market. Corn husks and banana leaves are traditional wrapping materials, adding to the authenticity and appeal of the product. However, modern packaging technologies offer alternatives, such as plastic or foil, for longer shelf life and convenience. The market is a dynamic and growing sector, offering consumers a convenient and authentic solution to traditional Mexican dishes. The market caters to various consumer segments, from busy individuals to gourmet food enthusiasts, and offers a diverse range of product formulations and flavors. The market's continued growth is a testament to the enduring appeal of Mexican cuisine and the convenience and appeal of packaged tamales.

|

Packaged Tamales Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 203.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, Mexico, UK, The Philippines, Japan, Spain, France, China, Russia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch