Personal Flotation Devices Market Size 2024-2028

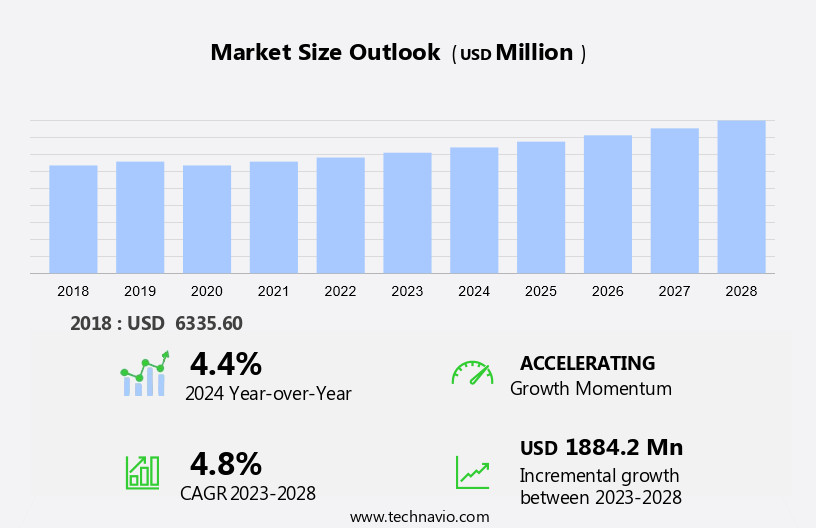

The personal flotation devices market size is forecast to increase by USD 1.88 billion at a CAGR of 4.8% between 2023 and 2028.

- The Personal Flotation Devices (PFDs) market is witnessing significant growth due to the increasing focus on preventing marine fatalities. According to the World Health Organization, approximately 323,000 people drown each year, and three quarters of these fatalities occur in low- and middle-income countries. In response, governments and organizations worldwide are promoting the use of PFDs to enhance water safety. Moreover, the market is witnessing a shift towards stylish and comfortable PFDs to encourage greater adoption. Traditional life vests were often bulky and uncomfortable, deterring many from using them regularly.

- However, advancements in materials and designs have led to the creation of lightweight, flexible, and fashionable PFDs. These new offerings cater to various activities, including fishing, water sports, and recreational swimming. Despite these advancements, challenges remain. One significant challenge is ensuring the correct selection and usage of PFDs based on individual needs and water conditions. Proper education and awareness campaigns are essential to address this issue and promote the importance of wearing PFDs to prevent drowning. Additionally, ongoing research and development efforts aim to create more advanced PFDs that can adapt to different situations and provide enhanced safety features.

What will be the Size of the Personal Flotation Devices Market During the Forecast Period?

- The Personal Flotation Devices (PFDs) market is witnessing significant growth due to the increasing popularity of marine activities and watersports worldwide. These activities, including boating, stand up paddleboarding, and various other water-based pursuits, require adequate safety measures to ensure the well-being of participants. Personal Flotation Solutions: A Crucial Component of Marine Safety Personal Flotation Devices, also known as life jackets or life vests, are essential flotation solutions designed to keep individuals afloat in water. They play a vital role in preventing drowning, especially in emergencies or when dealing with unexpected situations. Comfort and Safety: Two Essential Factors in PFDs Manufacturers prioritize both comfort and safety when developing Personal Flotation Devices. Foam and cork materials are commonly used due to their buoyancy and ability to provide adequate support. Inflatable technology has also gained popularity due to its lightweight design and ease of use. Difference Between Life Jackets and Life Vests Though often used interchangeably, life jackets and life vests serve distinct purposes. Personal Flotation Devices cater to various marine applications, including lifeboat crews, offshore vessels, cruise ships, and ferries, where safety is paramount.

- Moreover, life jackets provide full buoyancy and keep the wearer's head above water, making them ideal for non-swimmers or those in distress. Life vests, on the other hand, offer less buoyancy and allow for more freedom of movement, making them suitable for experienced swimmers and paddlers. Flotation Gear for Various Marine Applications Personal Flotation Devices cater to various marine applications, including lifeboat crews, off-shore vessels, cruise ships, and ferries. The importance of safety In these environments necessitates the use of high-quality, reliable flotation solutions. Innovations in Materials Development Continuous advancements in materials development contribute to the evolution of Personal Flotation Devices. New materials offer improved buoyancy, durability, and flexibility, ensuring both safety and comfort for users.

- Thus, regulatory bodies and Certifications Governmental organizations such as Transport Canada and the US Coast Guard set regulations and guidelines for Personal Flotation Devices to ensure their effectiveness and compliance with safety standards. Certifications from these bodies provide assurance of a product's quality and performance. In summary, the market plays a crucial role in enhancing safety and comfort during marine activities and watersports. With ongoing advancements in materials and technology, these flotation solutions continue to adapt and evolve, ensuring the well-being of users in various marine applications.

How is this Personal Flotation Devices Industry segmented and which is the largest segment?

The personal flotation devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Type I

- Type II

- Type III

- Type IV

- Type V

- Geography

- North America

- US

- APAC

- China

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- North America

By Product Insights

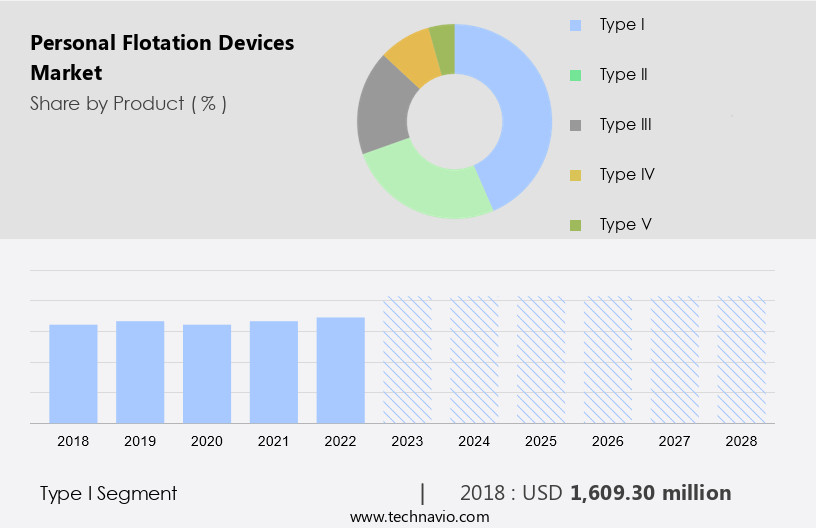

- The type I segment is estimated to witness significant growth during the forecast period.

Personal Flotation Devices (PFDs), including inflatable life jackets and buoyancy aids, play a crucial role in ensuring safety in various water activities. Inflatable technology has significantly advanced PFDs, making them more comfortable and efficient. Type I offshore life jackets, which are best suited for rough, open, and remote water where rescue may take time, are a prime example. These life jackets are available in adult and children's sizes and feature high visibility due to their bright colors and reflective straps. They are designed to turn unconscious wearers face up In the water, providing essential protection.

The market for Type I PFDs is thriving due to the increasing demand for ultra-large vessels In the shipping industry. These vessels require life jackets that offer maximum buoyancy, with at least 22 pounds, to ensure the safety of their crew. Materials development, such as lightweight and durable fabrics, continues to enhance the functionality and comfort of these devices. Inflatable buoyancy aids, another category of PFDs, are increasingly popular for all-day wear due to their streamlined design and ease of use. These aids offer a lower level of protection compared to Type I life jackets but are more suitable for less hazardous water conditions. Overall, the market is expected to grow significantly due to advancements in technology and materials development.

Get a glance at the Personal Flotation Devices Industry report of share of various segments Request Free Sample

The type I segment was valued at USD 1.61 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

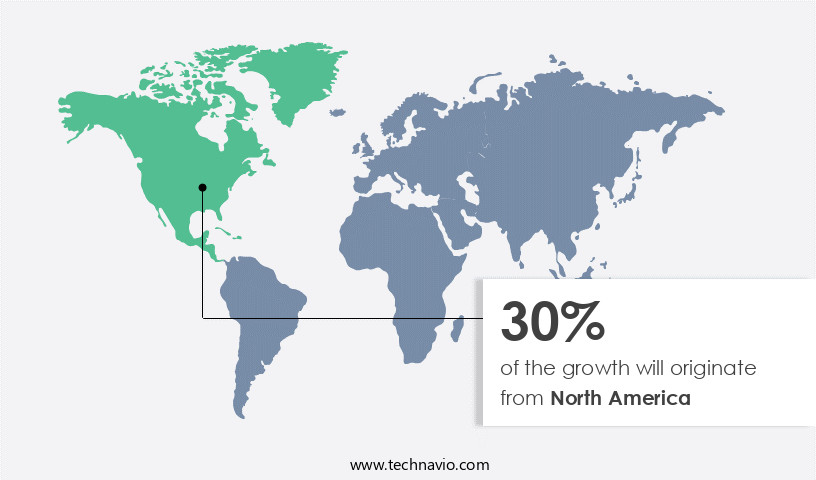

North America is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American region holds a significant position In the global Personal Flotation Devices (PFDs) market, driven by the expanding water-based recreational activities and the rise In the number of recreational parks. These devices are essential in various settings, including swimming pools, recreational parks, and coastal areas, due to the inherent risks involved. A critical factor fueling the growth of the PFDs market in North America is the stringent safety regulations issued by the Occupational Safety and Health Administration (OSHA). As per OSHA's 1926.106, it is mandatory for workers and paddlers in high-risk areas to use approved personal flotation devices such as ring buoys and life jackets. Compliance with these regulations is crucial for ensuring safety in industries like fishing, where workers operate on exposed decks or open, undecked vessels.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Personal Flotation Devices Industry?

Increasing focus on preventing marine fatalities is the key driver of the market.

- Marine incidents resulting in fatalities continue to be a significant concern worldwide. According to various investigative bodies, a substantial number of such incidents occur near harbors and moorings. In response, the demand for Personal Flotation Devices (PFDs) has grown, as these devices are essential for ensuring safety while engaging in water-based activities. The PFD market offers a diverse range of products, including traditional foam floatation devices and advanced inflatable life jackets. These devices cater to various boating activities and water conditions, with different performance levels and limitations.

- For instance, USCG-approved PFDs are highly recommended for boating activities, ensuring compliance with regulatory requirements and enhancing safety. In Europe, approximately 50% of marine casualties were reported by shore authorities. Among various ship vessel types, cargo ships and fishing vessels were the most frequent in reported casualties. In such scenarios, the use of appropriate PFDs can significantly reduce the risk of accidents and save lives. These reports focus on the market trends, growth drivers, challenges, and opportunities, enabling stakeholders to make informed decisions.

What are the market trends shaping the Personal Flotation Devices Industry?

Focus on styling of PFDs is the upcoming market trend.

- Personal Flotation Devices (PFDs), including life jackets and vests, are essential for ensuring safety while engaging in water activities. These devices are designed to help individuals stay afloat in case of accidental falls or emergencies. Properly wearing a PFD is crucial for confidence and enjoyment during activities such as jet-skiing, windsurfing, canoeing, and water skiing. It is vital that the PFD fits correctly, ensuring it snugly conforms to the wearer's body while allowing for unrestricted movement. A variety of PFDs exist, each with unique designs and foam placement to accommodate different body types.

- The right size and fit not only increase safety but also contribute to a more enjoyable experience. Wearing a PFD is a simple yet effective way to prevent drowning, making it an essential investment for anyone participating in water activities. Always ensure your PFD is properly fastened and that you are familiar with its operation to maximize its effectiveness.

What challenges does the Personal Flotation Devices Industry face during its growth?

Selection of right PFDs is a key challenge affecting the industry growth.

- Personal Flotation Devices (PFDs) play a crucial role in ensuring safety while engaging in various water sports activities. These devices are designed to prevent drowning and instill confidence in participants, enabling them to enjoy their experience. PFDs are essential for activities such as jet-skiing, windsurfing, canoeing, water skiing, and dinghy sailing. The selection and proper usage of PFDs are vital.

- They must fit correctly and be securely fastened to the wearer's body. Users should also be familiar with the operation of their PFDs. Three primary types of PFDs exist based on buoyancy sources: foam-only, air-only, and air-foam. The type chosen depends on the specific water sport and the proximity to the shore. By prioritizing safety with the right PFD, water sports enthusiasts can focus on their activities and create memorable experiences.

Exclusive Customer Landscape

The personal flotation devices market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the personal flotation devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, personal flotation devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Astral Buoyancy Co.

- Cal June Inc.

- Confluence Kayaks LLC

- Galvanisers India

- Hansen Protection AS

- Hutchwilco

- Hydrodynamic Industrial Co. Ltd.

- Johnson Outdoors Inc.

- Kent Water Sports LLC

- Kokatat Inc.

- LALIZAS Group

- Marine Rescue Technologies

- Mustang Survival Corp.

- Newell Brands Inc.

- NRS Inc.

- SeaSafe Systems Ltd.

- Spinlock Ltd.

- Stormy Lifejackets Pty Ltd.

- Supreme In Safety Services

- Survitec Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Personal Flotation Devices (PFDs) market plays a crucial role in ensuring safety during various marine activities, including boating, watersports, and off-shore vessels. PFDs, also known as life jackets or buoyancy aids, are essential flotation solutions for individuals engaging In these activities. Life jackets and inflatable buoyancy aids come in different designs to cater to various needs. For instance, stand-up paddleboarding requires specific PFDs that offer freedom of movement. Life vests provide a higher level of protection and are suitable for all-day wear. Materials development and inflatable technology have significantly impacted the PFD market.

Moreover, modern PFDs use foam, cork, or a combination of both for enhanced buoyancy. They also incorporate features like signalling whistles, lights, towing straps, retro-reflective tape, donning notices, and wheelhouse deck mounts. Safety is the primary concern, but comfort is also essential. PFDs are designed to keep users afloat in case of drowning, while ensuring they can move freely for activities like fishing or manoeuvring boats. Open undecked vessels and exposed deck areas of fishing vessels and ferries necessitate the use of appropriate flotation gear. In summary, the market offers various solutions tailored to diverse marine activities, ensuring safety, comfort, and protection for users.

Similarly, when using a stand-up paddleboard in the sea, always wear an approved life jacket for flotation. A consolidated North American standard ensures safety, and a signaling whistle and light are essential for emergencies. In the case of an unconscious person, a towing strap can assist in the rescue. Harbors and fishing vessels require proper safety protocols, including lifejacket use.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2024-2028 |

USD 1.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Key countries |

US, China, UK, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Personal Flotation Devices Market Research and Growth Report?

- CAGR of the Personal Flotation Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the personal flotation devices market growth of industry companies

We can help! Our analysts can customize this personal flotation devices market research report to meet your requirements.