Pervious Pavement Market Size 2025-2029

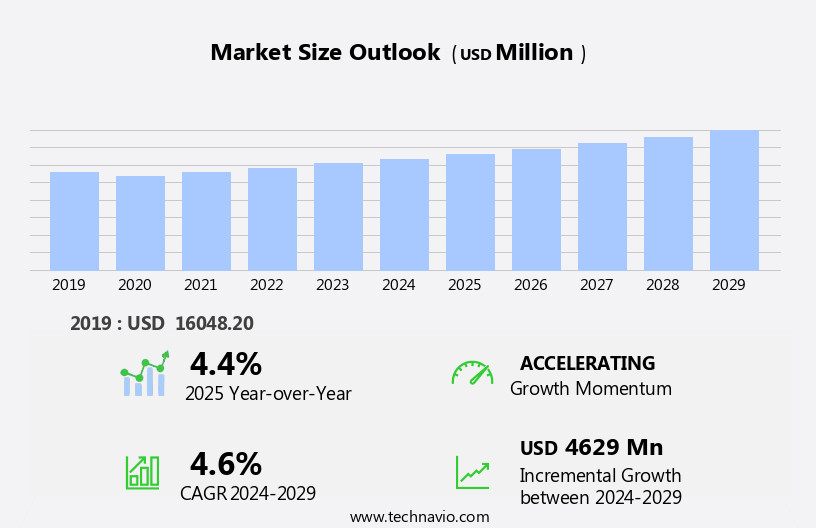

The pervious pavement market size is forecast to increase by USD 4.63 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing urbanization and infrastructure development across the globe. With the rising demand for sustainable and eco-friendly construction materials, pervious pavements have emerged as a popular choice for roads, parking lots, and other applications. These pavements allow stormwater to filter through them, reducing runoff and mitigating the effects of heavy rainfall. Key drivers for the market include stringent environmental regulations, increasing awareness of water conservation, and the need for long-term cost savings through reduced maintenance and repair costs.

- However, the high initial installation costs associated with pervious pavements may act as a challenge for market growth. Despite this, the introduction of new products and technologies, such as permeable concrete and asphalt, is expected to drive down costs and expand the market's reach. Companies seeking to capitalize on this market opportunity should focus on innovation, cost reduction, and sustainable solutions to meet the evolving demands of infrastructure development and environmental regulations.

What will be the size of the Pervious Pavement Market during the forecast period?

- The market encompasses specialized equipment and technologies designed for the construction and maintenance of sustainable infrastructure, primarily utilizing lightweight plastics as filling material in place of traditional asphalt or concrete. This market has gained traction due to increasing concerns over groundwater depletion and the need for effective stormwater management. Pervious pavement systems, consisting of pallet-sized grids, offer numerous benefits, including lower transportation costs, enhanced safety, and reduced tower noise.

- However, the market faces challenges such as saturated markets and a lack of awareness among construction project stakeholders. The use of single-use plastic in pervious pavement production raises environmental concerns, but ongoing research and development efforts are focused on creating more environmentally friendly alternatives. Overall, the market for previous pavement is poised for growth as the importance of water conservation and sustainable infrastructure continues to increase.

How is this Pervious Pavement Industry segmented?

The pervious pavement industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Pervious asphalt

- Pervious concrete

- Block and concrete modular pavers

- Grid pavers

- End-user

- Commercial

- Residential

- Geography

- Europe

- Belgium

- France

- Germany

- UK

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- Europe

By Material Insights

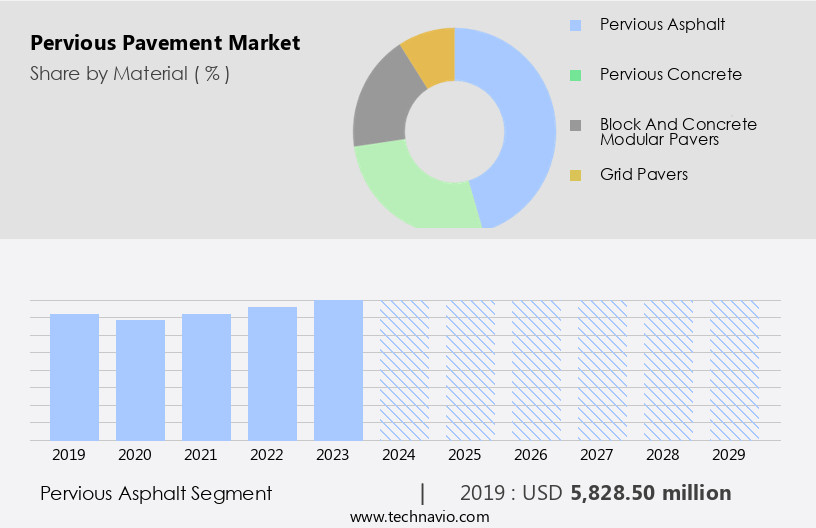

The pervious asphalt segment is estimated to witness significant growth during the forecast period. Pervious asphalt, also referred to as porous or permeable asphalt, is a specialized type of hot-mix asphalt engineered to enhance water infiltration. This is achieved by decreasing the sand or fine aggregates content, creating stable air pockets that facilitate effective drainage. The resulting interconnected void structure enables stormwater to permeate the asphalt layer and enter a crushed stone aggregate bedding and base, which supports the pavement and functions as a stormwater storage and filtration system. Pervious asphalt presents several environmental and economic advantages, making it a suitable substitute for traditional asphalt in specific applications. It assists municipalities in meeting regulatory stormwater management requirements by decreasing stormwater runoff volume and flow rates, while improving pollutant filtration.

Additionally, pervious asphalt contributes to water conservation efforts, particularly in areas of water scarcity, and supports green infrastructure initiatives, including green buildings and sustainable urban development. Its use of lightweight plastics in specialty equipment and pallet-sized grids minimizes transportation costs, while filling material can be sourced from recycled materials such as crushed glass and recycled tires. Despite its high initial cost, the long-term benefits, including water harvesting, management systems, enhanced safety, and groundwater recharge, make pervious asphalt a valuable investment for both residential and commercial construction projects.

Get a glance at the market report of share of various segments Request Free Sample

The pervious asphalt segment was valued at USD 5.83 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

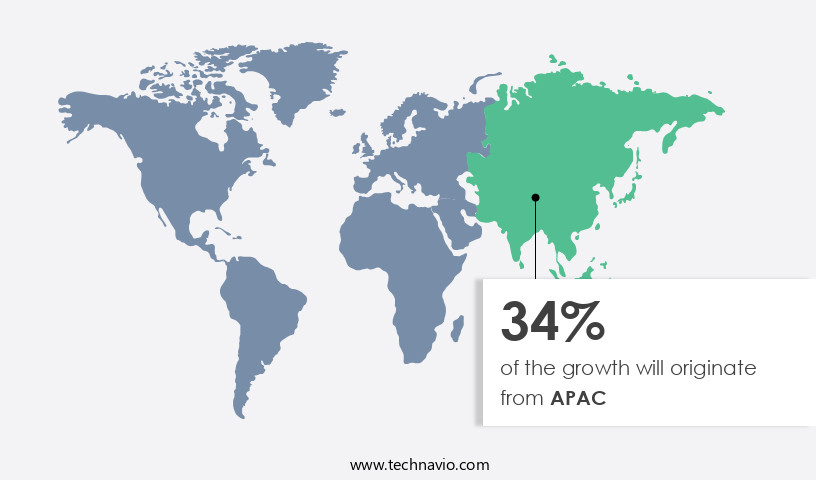

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Another region offering significant growth opportunities to companies is APAC. The European market is experiencing growth due to urbanization and the prioritization of sustainable infrastructure. With approximately 72% of the European Union population living in urban areas as of 2023, there is a pressing need for advanced solutions to manage the challenges of urban development. The European construction industry saw a significant increase in production between 2021 and 2023, with the European Union experiencing over 10% growth in construction output. This expansion encompasses various sectors, including residential, commercial, and civil engineering projects. The resulting rise in construction activities necessitates effective stormwater management solutions, leading to the increased demand for pervious pavements.

Further, these eco-friendly paving systems offer numerous benefits, such as water conservation, groundwater recharge, and noise reduction. Additionally, they contribute to green building initiatives and support sustainable infrastructure development. Key components of pervious pavements include specialty equipment, lightweight plastics, pallet-sized grids, and filling materials. Despite their high initial cost, the long-term benefits and environmental sustainability make them an attractive option for both residential and commercial construction projects.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pervious Pavement Industry?

- Urbanization and infrastructure growth is the key driver of the market. The global population trend towards urbanization is driving a notable increase in the demand for efficient stormwater management systems, thereby fueling the adoption of pervious pavements. As per the United Nations Department of Economic and Social Affairs (UNDESA), approximately 55% of the world's population resided in urban areas by 2024, and this percentage is projected to reach 68% by 2050.

- This demographic shift highlights the importance of advanced infrastructure solutions to address the challenges posed by urbanization. In India, the government's dedication to infrastructure development is evident in the Union Budget 2024-25, with the Finance Minister allocating USD 133.5 billion for capital expenditure, equating to 3.4% of the country's GDP. This substantial investment underscores the priority given to infrastructure projects that cater to the needs of urban populations.

What are the market trends shaping the Pervious Pavement Industry?

- Introduction of new products is the upcoming market trend. The market is experiencing innovation with the introduction of new products. These solutions address urban environmental challenges, such as stormwater management, air quality improvement, and mitigation of urban heat island effects. Sustainability and circular economy principles are at the forefront of these developments. For instance, on March 18, 2025, Lafarge France launched Hydromedia NewAir, a patented draining and depolluting concrete.

- With over 15% useful porosity, this product allows rainwater to permeate its surface, reducing runoff and minimizing flood risks. Hydromedia NewAir also contains activated carbon, which absorbs nitrogen oxide (NOx) and mineralizes it into calcium salts, enhancing air quality. This product's introduction underscores the market's focus on creating eco-friendly and efficient paving solutions.

What challenges does the Pervious Pavement Industry face during its growth?

- High initial installation costs is a key challenge affecting the industry growth. The market faces a notable challenge due to the high initial installation costs. Pervious pavement systems necessitate specialized materials and intricate installation techniques to ensure adequate water infiltration, structural durability, and optimal performance. These prerequisites lead to a higher upfront investment compared to traditional pavement alternatives.

- For example, pervious concrete ranges from USD 8 to USD 16 per square foot, contingent upon project complexity, material quality, and location. In contrast, conventional concrete costs between USD4 and USD8 per square foot. The increased cost is primarily due to the need for exact aggregate mixes, extensive sub-base layers for effective drainage, and skilled labor for proper installation.

Exclusive Customer Landscape

The pervious pavement market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pervious pavement market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pervious pavement market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BASF SE - The company offers pervious pavement solutions such as Elastopave which utilizes the principle of binding suitable mixes of crushed stone with polyurethane to yield a strong, water- and air-permeable surface.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Boral Ltd.

- Breedon Group plc

- CEMEX SAB de CV

- Chaney Enterprises

- CRH Plc

- Davis Concrete Inc.

- Environmental Paving Solutions LLC

- Evolution Pervious

- Fred Adams Paving

- Holcim Ltd.

- Porous Pave

- Raffin Construction Co.

- Sika AG

- Techo Bloc Inc.

- TRUEGRID Pavers

- UltraTech Cement Ltd.

- Unilock Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has witnessed significant growth in recent years, driven by the increasing demand for environmentally friendly and sustainable infrastructure. One such solution gaining popularity is pervious pavement, a type of construction material that allows water to pass through it instead of running off the surface. This feature makes it an effective solution for managing stormwater and reducing the negative impacts of urbanization on water bodies. Lightweight plastics have emerged as a popular choice for manufacturing pervious pavement due to their durability and low weight. These materials enable the production of pallet-sized grids, which are easily transported and installed, reducing transportation costs and streamlining construction activities.

Further, filling materials used in pervious pavement can vary, with single-use plastic being a common choice due to its low cost and availability. However, there are growing concerns regarding the environmental impact of single-use plastic, leading to a shift towards recycled materials such as crushed glass and recycled tires. Pervious pavement is not limited to residential applications but is also gaining traction in commercial spaces. Green building initiatives and government efforts to promote sustainable infrastructure have driven demand for this solution in new constructions. Rapid urbanization and the resulting flood-like situations have highlighted the need for effective stormwater management, further boosting the market.

In addition, water harvesting and management systems are increasingly being integrated into pervious pavement designs to maximize their environmental benefits. These systems allow for the collection and storage of rainwater, contributing to water conservation efforts in areas experiencing water scarcity. The adoption of pervious pavement is not without challenges. The high initial cost and lack of technical expertise required for installation and maintenance can deter potential buyers. However, the long-term benefits, including lower tower noise, enhanced safety, and groundwater recharge, make it a worthwhile investment for those prioritizing environmental sustainability. The market for pervious pavement is saturated, with numerous players offering similar solutions.

Lack of awareness of the technology among potential buyers can hinder growth. To address this, initiatives such as the development of a green infrastructure toolkit and the promotion of smart cities are being implemented to increase awareness and facilitate the adoption of pervious pavement. Pervious pavement is available in various designs, including permeable interlocking concrete pavements and plastic grid systems. Minimum standards for the manufacturing and installation of these products are essential to ensure their effectiveness and durability. Block pavers and grid pavers are popular choices due to their aesthetic appeal and ease of installation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market Growth 2025-2029 |

USD 4.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, Canada, Belgium, Brazil, France, Japan, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pervious Pavement Market Research and Growth Report?

- CAGR of the Pervious Pavement industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pervious pavement market growth of industry companies

We can help! Our analysts can customize this pervious pavement market research report to meet your requirements.