Pharmaceutical Glass Packaging Market Size 2024-2028

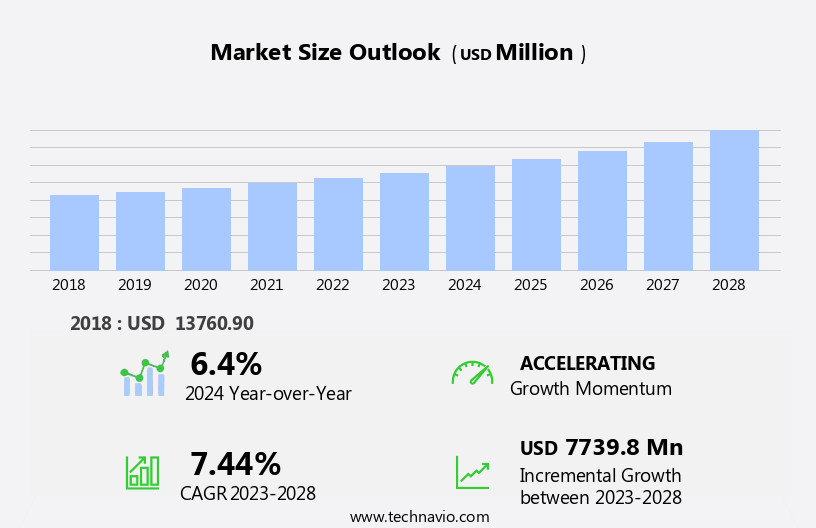

The pharmaceutical glass packaging market size is forecast to increase by USD 7.74 billion, at a CAGR of 7.44% between 2023 and 2028.

- The market is driven by the escalating Research and Development (R&D) investments in the pharmaceutical industry, fueling the demand for advanced and innovative glass packaging solutions. The increasing preference for high-quality pharmaceutical packaging, particularly for injectable drugs and biologics, is another significant market growth factor. However, the market faces challenges, including the risk of counterfeiting in pharmaceutical glass packaging. With the proliferation of counterfeit drugs, there is a growing need for secure and tamper-evident glass packaging solutions to ensure patient safety and product authenticity. Companies in the pharmaceutical industry must stay abreast of these market dynamics to capitalize on opportunities and mitigate risks effectively.

- Innovations in glass packaging technology, such as advanced coatings and specialized designs, can help address the challenge of counterfeiting while meeting the growing demand for high-quality packaging. Strategic partnerships and collaborations between glass packaging manufacturers and pharmaceutical companies can also foster innovation and enhance market competitiveness.

What will be the Size of the Pharmaceutical Glass Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Injection molding techniques and USP standards shape the production landscape, with e-beam sterilization ensuring product safety. Chemical resistance and formulation stability are crucial considerations, as glass defects can compromise product protection and shelf life. Material compatibility and quality control are paramount, with Type III glass and performance standards setting the bar for durability and color stability. Contamination control and cleanroom manufacturing are essential elements, with inspection systems and leak testing ensuring product integrity. Borosilicate glass and heat-resistant glass cater to specific applications, while secondary packaging and pharmaceutical packaging lines optimize production efficiency.

Supply chain management and glass tubing require careful attention, with weight variation and pre-fillable syringes influencing design considerations. Reusable containers and fill lines necessitate material compatibility and dimensional accuracy, while Type I glass and testing methods ensure product safety and tamper evidence. Water vapor transmission and distribution networks impact shelf life, with hydrolysis resistance and pharmaceutical regulations shaping industry standards. Thermal shock resistance and performance standards further ensure product protection, as manufacturing processes adapt to high-speed production and batch traceability. In this ever-evolving market, glass packaging entities continue to innovate, addressing the needs of various sectors while maintaining the highest standards of quality and safety.

How is this Pharmaceutical Glass Packaging Industry segmented?

The pharmaceutical glass packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Generic

- Branded

- Biologic

- Product

- Bottles

- Ampoules and vials

- Syringes

- Cartridges

- Geography

- North America

- US

- Europe

- Russia

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

The generic segment is estimated to witness significant growth during the forecast period.

Glass packaging plays a significant role in the pharmaceutical industry due to its inherent benefits, including sustainability, inertness, impermeability, recyclability, and reusability. This material's ability to protect and safely store products makes it an ideal choice for various generic drugs. Generic drugs, which are more affordable alternatives to branded medicines, account for a substantial portion of the pharmaceutical market. The cost savings associated with generic drugs arise from the absence of the need to repeat animal and clinical studies, as well as lower production costs. In the context of glass packaging, cleanroom manufacturing ensures contamination control, while inspection systems and leak testing maintain product protection and quality.

Heat-resistant borosilicate glass and durable, color-stable types I and II glass cater to various performance standards. Recycled glass is an eco-friendly alternative, and glass tubing and pre-fillable syringes offer versatility. Manufacturing processes, such as injection molding and high-speed production, ensure dimensional accuracy and batch traceability. Performance standards, such as U.S. Pharmacopeia (USP) and hydrolysis resistance, ensure formulation stability and material compatibility. Additionally, glass packaging offers tamper evidence, thermal shock resistance, and water vapor transmission control. Supply chain management is crucial in maintaining the integrity and availability of pharmaceutical products. Distribution networks ensure timely delivery, while packaging design optimizes product protection and shelf life.

The pharmaceutical regulations governing glass packaging are stringent, requiring rigorous testing methods, such as visual inspection and e-beam sterilization, to maintain quality and patient safety. In summary, glass packaging plays a vital role in the pharmaceutical industry, offering numerous benefits and catering to the unique requirements of various pharmaceutical applications. From cleanroom manufacturing and recycled glass to performance standards and supply chain management, the glass packaging market continues to evolve, ensuring the safe and effective delivery of essential medicines.

The Generic segment was valued at USD 9.6 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is witnessing significant growth due to several factors. The US, being the largest pharmaceutical market in North America, contributes significantly to the industry's expansion. The country's globally established players, including Johnson & Johnson, Pfizer, and Abbot Laboratories, are major contributors to the market. The increasing value of US pharmaceutical exports and rising healthcare spending are key drivers. Additionally, the aging population and the implementation of government healthcare insurance programs are further fueling market growth. The intellectual property system in the US protects patented drugs, attracting venture capital investments in the industry. In the realm of glass packaging, cleanroom manufacturing ensures contamination control, while recycled glass is gaining popularity for its sustainability.

Drug delivery systems require heat-resistant glass for effective performance. Borosilicate glass, with its superior chemical resistance and formulation stability, is preferred for pharmaceutical applications. Leak testing and inspection systems ensure product protection and shelf life. Material compatibility and dimensional accuracy are crucial for glass tubing and secondary packaging. Performance standards for durable glass include color stability, thermal shock resistance, and tamper evidence. Hydrolysis resistance is essential for Type II glass, while Type I glass undergoes various testing methods, including visual inspection and water vapor transmission rate testing. Manufacturing processes must adhere to USP standards, and high-speed production and batch traceability are essential for maintaining quality control.

In the context of supply chain management, distribution networks play a vital role in ensuring efficient transportation packaging. The market also focuses on innovative packaging designs, such as pre-fillable syringes and reusable containers, to cater to evolving pharmaceutical regulations and consumer preferences. Fill lines and injection molding processes must meet stringent performance standards to ensure glass defects are minimized. In conclusion, the market in the US is experiencing robust growth due to the increasing value of pharmaceutical exports, rising healthcare spending, and a growing aging population. The market's evolution is characterized by a focus on cleanroom manufacturing, recycled glass, drug delivery systems, and stringent quality control measures, among other trends.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pharmaceutical Glass Packaging Industry?

- The pharmaceutical industry's significant investment in Research and Development (R&D) spending is the primary catalyst fueling market growth.

- Pharmaceutical glass packaging plays a crucial role in safeguarding the integrity of various drug delivery systems. With the increasing investment in pharmaceutical R&D, which accounts for 15-20% of a company's revenue on average, the demand for advanced packaging materials is surging. Cleanroom manufacturing, a critical aspect of pharmaceutical glass packaging, ensures minimal contamination during the production process. This is essential for maintaining the efficacy and safety of pharmaceuticals. Moreover, the use of recycled glass in pharmaceutical packaging is gaining traction due to its environmental benefits and cost savings. Inspection systems, such as leak testing and borosilicate glass's heat resistance, are integral to the production process.

- These systems help maintain the sterility and safety of the packaging, ensuring the drugs' efficacy. Furthermore, secondary packaging plays a vital role in protecting the primary glass packaging from external damage, thereby reducing the breakage rate. Heat-resistant glass and borosilicate glass are popular choices for pharmaceutical packaging due to their ability to withstand high temperatures during sterilization processes. Leak testing is an essential inspection system to ensure the integrity of the glass packaging. This process helps identify any potential leaks or cracks, preventing contamination and ensuring the safety of the pharmaceutical product. In conclusion, the market is driven by the increasing investment in R&D, the need for cleanroom manufacturing, the growing preference for recycled glass, and the importance of contamination control.

- Inspection systems, such as leak testing, and packaging materials, including heat-resistant and borosilicate glass, are essential components of the production process.

What are the market trends shaping the Pharmaceutical Glass Packaging Industry?

- The increasing need for superior pharmaceutical packaging is a notable trend in the market. This demand is driven by the growing emphasis on product safety, efficacy, and patient convenience in the healthcare industry.

- Pharmaceutical glass packaging plays a crucial role in ensuring the quality and efficacy of drugs in the healthcare sector. With the increasing demand for innovative pharmaceuticals, the need for appropriate packaging solutions that adhere to stringent quality standards has become imperative. The US Food and Drug Administration (FDA) and the United States Pharmacopeia (USP) set specific standards for pharmaceutical glass packaging, including chemical resistance, formulation stability, and material compatibility. Manufacturers employ various techniques, such as injection molding and e-beam sterilization, to produce high-quality glass packaging that meets these standards. The glass used is typically Type III, which offers excellent performance in terms of chemical resistance and product protection.

- Quality control measures, such as ISO 9001 certifications, ensure that the manufacturing process is consistent and free from defects. Pharmaceutical glass packaging protects the content from external influences, including light, moisture, oxygen, biological contamination, and mechanical damage. The shelf life of pharmaceuticals is significantly extended with the use of such packaging, which is essential for maintaining the integrity of the drug formulation. The importance of glass packaging in preserving product quality and ensuring patient safety cannot be overstated.

What challenges does the Pharmaceutical Glass Packaging Industry face during its growth?

- The pharmaceutical industry faces significant challenges from the risk of counterfeiting in glass packaging, which poses a threat to industry growth and undermines consumer trust. It is crucial to implement robust security measures to mitigate this issue and ensure the authenticity and safety of pharmaceutical products.

- Pharmaceutical glass packaging plays a crucial role in safeguarding the integrity of medications, ensuring durability and maintaining color stability. However, the complex supply chain presents challenges, as the risk of counterfeit drugs entering the system is significant. Counterfeit pharmaceuticals pose a threat to consumer safety and can financially impact companies. Glass tubing, pre-fillable syringes, and reusable containers are essential components of this market, requiring stringent supply chain management. To mitigate risks, fill lines and testing methods, such as type I glass and visual inspection, are emphasized. Thermal shock resistance is another essential factor, as glass packaging must withstand varying temperatures during manufacturing, transportation, and storage.

- Weight variation, a common issue in glass production, must also be addressed to ensure consistent product quality. Despite these challenges, the market continues to evolve, driven by the need for secure, reliable, and efficient solutions. By focusing on advanced testing methods and supply chain security measures, companies can minimize the risk of counterfeit products entering the system and maintain the trust of their customers.

Exclusive Customer Landscape

The pharmaceutical glass packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical glass packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceutical glass packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acme Vial and Glass Co. LLC - This company specializes in providing pharmaceutical glass packaging, encompassing vials, jars, and bottles, for various applications in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme Vial and Glass Co. LLC

- Arab Pharmaceutical Glass Co.

- Ardagh Group SA

- Beatson Clark

- Becton Dickinson and Co.

- Bormioli Pharma Spa

- Corning Inc.

- DWK Life Sciences GmbH

- Gerresheimer AG

- Hindustan National Glass and Industries Ltd.

- Nipro Corp.

- O I Glass Inc.

- PGP Glass Pvt. Ltd.

- SCHOTT AG

- SGD Pharma

- Shandong Pharmaceutical Glass Co. Ltd.

- Stevanato Group S.p.A

- Stoelzle Oberglas GmbH

- TURKIYE SISE VE CAM FABRIKALARI A.S.

- West Pharmaceutical Services Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pharmaceutical Glass Packaging Market

- In January 2024, Pfizer Inc. Announced the launch of its new range of R Prius⢠glass vials, which are lighter and more durable than traditional glass vials, reducing the overall weight of pharmaceutical packaging and enhancing supply chain efficiency (Pfizer Press Release, 2024).

- In March 2024, Schott AG and Gerresheimer AG, two leading glass packaging manufacturers, entered into a strategic partnership to expand their production capacity and strengthen their market position by combining their expertise in borosilicate glass and specialized glass packaging (Schott AG Press Release, 2024).

- In May 2024, Corning Incorporated received FDA approval for its Valor Glass⢠line of Type I borosilicate glass containers, which are designed to offer improved clarity, strength, and dimensional stability for pharmaceutical applications (Corning Incorporated Press Release, 2024).

- In April 2025, Vitro, a leading glass manufacturer, announced a significant investment of â¬200 million in its European glass production facilities to increase capacity and improve efficiency, focusing on the production of high-quality glass containers for the pharmaceutical industry (Vitro Press Release, 2025).

Research Analyst Overview

- The market is characterized by stringent regulatory affairs and quality assurance requirements, driving the adoption of advanced handling procedures and automated inspection systems. Fill volume accuracy and material selection are crucial factors in ensuring product lifecycle management and packaging integrity. Barrier properties and child-resistant closures are essential for drug product stability and safety standards. Technical specifications, such as neck finish and closure integrity, are vital in the design for manufacturing process. High-pressure sterilization and glass composition are essential for ensuring product yield and physical stability. Regulatory compliance and validation protocols are integral to environmental impact and waste management in the pharmaceutical glass packaging industry.

- Supply chain resilience and weight control are essential considerations in the market, with an increasing focus on product yield and packaging efficiency. Automated inspection and design for manufacturing processes are key trends in the industry, ensuring regulatory compliance and enhancing overall product quality. Safety standards and validation protocols are critical in the market, with a focus on ensuring product integrity throughout the product lifecycle. Regulatory affairs and quality assurance are ongoing concerns, with a growing emphasis on waste management and drug product stability. Material selection and handling procedures are crucial in the manufacturing process, with an increasing focus on automation and efficiency.

- Neck finish and closure integrity are essential in ensuring product safety and regulatory compliance, while high-pressure sterilization and glass composition are critical in maintaining product stability and shelf life. Regulatory requirements and quality assurance are driving the adoption of advanced packaging technologies and automated inspection systems in the market. Technical specifications, such as fill volume accuracy and material selection, are essential in the design for manufacturing process, ensuring regulatory compliance and enhancing overall product quality. The market is subject to rigorous regulatory requirements and quality assurance standards, necessitating the adoption of advanced handling procedures and automated inspection systems.

- Barrier properties and child-resistant closures are crucial in maintaining product stability and safety, while material selection and neck finish are essential in the design for manufacturing process. The market is characterized by a focus on regulatory compliance, product stability, and safety standards. Technical specifications, such as fill volume accuracy and material selection, are critical in the design for manufacturing process, ensuring regulatory compliance and enhancing overall product quality. Regulatory compliance and product safety are key concerns in the market, with a growing emphasis on automation and efficiency in the manufacturing process. Barrier properties and child-resistant closures are essential in maintaining product stability and ensuring regulatory compliance, while material selection and handling procedures are crucial in the design for manufacturing process.

- The market is subject to stringent regulatory requirements and quality assurance standards, necessitating the adoption of advanced handling procedures and automated inspection systems. Technical specifications, such as fill volume accuracy and material selection, are critical in the design for manufacturing process, ensuring regulatory compliance and enhancing overall product quality. Regulatory compliance and product safety are paramount in the market, with a focus on automation and efficiency in the manufacturing process. Barrier properties and child-resistant closures are essential in maintaining product stability and ensuring regulatory compliance, while material selection and handling procedures are crucial in the design for manufacturing process.

- The market is characterized by a focus on regulatory compliance, product stability, and safety standards. Technical specifications, such as fill volume accuracy and material selection, are critical in the design for manufacturing process, ensuring regulatory compliance and enhancing overall product quality. Regulatory compliance and product safety are key considerations in the market, with a growing emphasis on automation and efficiency in the manufacturing process. Barrier properties and child-resistant closures are essential in maintaining product stability and ensuring regulatory compliance, while material selection and handling procedures are crucial in the design for manufacturing process. The market is subject to rigorous regulatory requirements and quality assurance standards, necessitating the adoption of advanced handling procedures and automated inspection systems.

- Technical specifications, such as fill volume accuracy and material selection, are critical in the design for manufacturing process, ensuring regulatory compliance and enhancing overall product quality. Regulatory compliance and product safety are paramount in the market, with a focus on automation and efficiency in the manufacturing process. Barrier properties and child-resistant closures are essential in maintaining product stability and ensuring regulatory compliance, while material selection and handling procedures are crucial in the design for manufacturing process. The market is characterized by a focus on regulatory compliance, product stability, and safety standards. Technical specifications, such as fill volume accuracy and material selection, are critical in the design for manufacturing process, ensuring regulatory compliance and enhancing overall product quality.

- Regulatory compliance and product safety are key considerations in the market, with a growing emphasis on automation and efficiency in the manufacturing process. Barrier properties and child-resistant closures are essential in maintaining product stability and ensuring regulatory compliance, while material selection and handling procedures are crucial in the design for manufacturing process. The market is subject to stringent regulatory requirements and quality assurance standards, necessitating the adoption of advanced handling procedures and automated inspection systems. Technical specifications, such as fill volume accuracy and material selection, are critical in the design for manufacturing process, ensuring regulatory compliance and enhancing overall product quality.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pharmaceutical Glass Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.44% |

|

Market growth 2024-2028 |

USD 7739.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, Russia, China, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceutical Glass Packaging Market Research and Growth Report?

- CAGR of the Pharmaceutical Glass Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pharmaceutical glass packaging market growth of industry companies

We can help! Our analysts can customize this pharmaceutical glass packaging market research report to meet your requirements.