Pharmaceutical Warehousing Market Size 2025-2029

The pharmaceutical warehousing market size is forecast to increase by USD 18.15 billion, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for outsourcing services to specialized warehouses. This trend is fueled by the complexities and high costs associated with maintaining in-house pharmaceutical storage facilities. Another key factor propelling market expansion is the growing emphasis on energy efficiency in warehousing operations. As the pharmaceutical industry continues to evolve, capital-intensive businesses are seeking innovative solutions to optimize their logistics and supply chain networks. However, the market also faces challenges, including stringent regulations governing the storage and handling of pharmaceuticals. Compliance with these regulations can be costly and time-consuming, necessitating substantial investments in infrastructure and training.

- Additionally, ensuring the security and integrity of temperature-sensitive pharmaceutical products during transportation and storage remains a significant challenge. Addressing these obstacles requires a strategic approach that balances cost, efficiency, and regulatory compliance. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay informed of the latest trends and best practices in pharmaceutical warehousing.

What will be the Size of the Pharmaceutical Warehousing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic pharmaceutical industry, warehousing plays a pivotal role in ensuring the seamless distribution of various pharmaceutical products. The market continues to evolve, integrating advanced technologies and systems to address the unique requirements of this sector. Cold chain management is a critical aspect of pharmaceutical warehousing, ensuring the integrity of temperature-sensitive products through refrigerated storage and temperature-controlled environments. Humidity control systems maintain optimal conditions for certain pharmaceuticals, while fire suppression systems mitigate potential risks. Security systems, including access control and surveillance cameras, safeguard pharmaceutical products against theft and damage. Inventory management systems, data analytics, and logistics optimization streamline operations and improve supply chain visibility.

Material handling equipment, such as pallet jacks and conveyor systems, facilitate efficient product movement within warehouses. Disaster recovery planning ensures business continuity in the face of unforeseen events. Pharmaceutical storage solutions, including pallet racking and climate-controlled environments, accommodate various product types and sizes. Blister packaging, air filtration, and HVAC systems further enhance product protection and quality assurance. Pharmaceutical warehousing also caters to diverse sectors, including medical devices, drug discovery, and retail distribution. Contract manufacturing and bottling and filling services expand the scope of these facilities. The integration of advanced technologies, such as RFID technology and route optimization, further enhances the efficiency and effectiveness of pharmaceutical warehousing operations.

The ongoing evolution of market dynamics underscores the importance of adaptability and innovation in this sector.

How is this Pharmaceutical Warehousing Industry segmented?

The pharmaceutical warehousing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Pharmaceutical factory

- Pharmacy

- Hospital

- Service

- Non-cold chain warehousing

- Cold chain warehousing

- Service Type

- Storage

- Distribution

- Inventory management

- Packaging

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

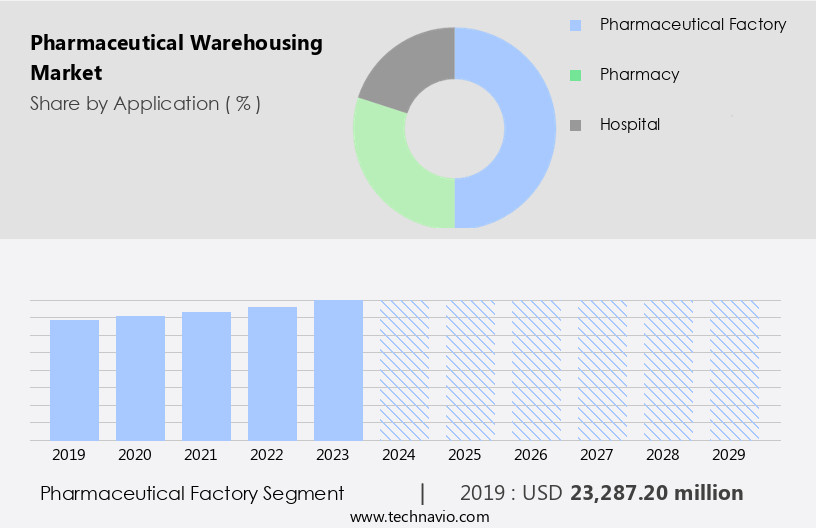

The pharmaceutical factory segment is estimated to witness significant growth during the forecast period.

Pharmaceutical warehouses play a crucial role in the distribution and storage of various pharmaceutical products, including pills, syrups, vaccines, medical devices, OTC medications, diagnostic tools, and dietary supplements. These warehouses adhere to stringent regulations to ensure the safety, efficacy, and quality of the pharmaceutical products they house. Climate-controlled environments, air filtration systems, and temperature-controlled warehousing are essential to maintain the integrity of these sensitive items. Logistics optimization and inventory management systems are integral to the efficient operation of pharmaceutical warehouses. Material handling equipment, such as pallet jacks and conveyor systems, facilitate the movement and organization of goods.

Security systems, access control, and product traceability ensure the protection and accountability of pharmaceutical products. Drug discovery and manufacturing processes involve various stages, from research and development to bottling and filling, quality assurance, and packaging and labeling. Contract manufacturing and wholesale distribution are also essential aspects of the pharmaceutical industry. Cold chain management and transportation management are crucial for maintaining the temperature and integrity of temperature-sensitive pharmaceutical products during transportation. Data analytics and fleet management help optimize supply chain visibility and logistics, while risk management and disaster recovery planning minimize potential disruptions. HVAC systems, humidity control, and fire suppression systems are essential for maintaining a controlled environment in pharmaceutical warehouses.

RFID technology and controlled atmosphere storage enhance product traceability and inventory management. Pharmaceutical warehouses serve as critical links in the pharmaceutical supply chain, ensuring the timely and efficient distribution of essential medications and medical devices to healthcare providers and retailers. The pharmaceutical industry continues to evolve, with advancements in technology, regulations, and market trends shaping the future of pharmaceutical warehousing.

The Pharmaceutical factory segment was valued at USD 23.29 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth, driven by the increasing development of new pharmaceutical drugs in the US. This growth is reflected in the expansion of clinical trial supply and logistics companies, which are enhancing their distribution networks to accommodate the rising demand. The prevalence of chronic diseases and an aging population in the US are significant factors contributing to the market's expansion. Additionally, there is a shift toward home-based treatment, leading to a higher need for temperature-controlled warehousing and logistics solutions. Pharmaceutical manufacturing companies in North America are integrating advanced technologies such as data analytics, RFID technology, and conveyor systems to optimize their operations and improve supply chain visibility.

Climate-controlled environments, including humidity control and fire suppression systems, are essential for storing sensitive pharmaceutical products, ensuring their quality and safety. Cold chain management and logistics optimization are crucial for maintaining the integrity of temperature-sensitive pharmaceuticals during transportation and storage. Security systems, access control, and risk management are essential components of pharmaceutical warehousing, ensuring the protection of valuable pharmaceutical products. Material handling equipment, such as pallet jacks and forklifts, facilitate efficient inventory management and product handling. Disaster recovery planning and product traceability are also critical aspects of the market, ensuring business continuity and minimizing the risk of product recalls.

Pharmaceutical packaging and labeling, as well as contract manufacturing, play a significant role in the market. These services enable pharmaceutical companies to streamline their operations and focus on their core competencies while ensuring the timely delivery of high-quality pharmaceutical products to the market. In conclusion, the market in North America is witnessing significant growth due to the increasing development of new pharmaceutical drugs, the rising prevalence of chronic diseases, and the aging population. The market is characterized by the adoption of advanced technologies, a focus on quality and safety, and the integration of various services to optimize operations and improve supply chain efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pharmaceutical Warehousing Industry?

- The surge in demand for outsourcing pharmaceutical warehousing services is the primary market driver, as companies seek to reduce costs, improve efficiency, and focus on their core competencies in pharmaceutical production and research.

- The market experiences significant growth due to the increasing outsourcing of warehousing services by pharmaceutical manufacturing companies. With the expansion of production capacities and operations, there is a heightened requirement for efficient logistics solutions, including storage for raw materials and finished goods for retailers and wholesale distributors. Outsourcing these services leads to substantial cost savings, with reductions in logistics costs by 11%, inventory costs by 6%, and logistics fixed asset costs by 23%. The complexity of pharmaceutical supply chain management has driven manufacturers to delegate part of their supply chain functions to specialized warehouse and storage service providers. Access control, logistics optimization, and quality assurance are crucial factors in pharmaceutical warehousing.

- HVAC systems ensure the proper storage conditions for temperature-sensitive drugs during the discovery, manufacturing, and distribution stages. Data analytics plays a vital role in optimizing inventory levels and fleet management, while pallet racking systems facilitate efficient storage and retrieval of pharmaceutical products. Contract manufacturing, packaging, and labeling services are essential for maintaining the integrity of pharmaceutical products throughout the supply chain. Overall, the market is a critical component of the pharmaceutical industry, ensuring the secure and efficient storage and distribution of essential medicines.

What are the market trends shaping the Pharmaceutical Warehousing Industry?

- The trend in the market is shifting towards energy-efficient warehouses. It is essential to adopt this approach as a professional to remain competitive and reduce environmental impact.

- The market growth is driven by the implementation of advanced technologies in warehouses, enhancing operational efficiency and effectiveness. Cold chain management, a crucial aspect of pharmaceutical storage, is achieved through temperature-controlled warehousing and fire suppression systems. Security systems ensure product safety, while humidity control maintains product integrity. Blister packaging and inventory management systems facilitate efficient material handling and transportation. IT systems, such as transportation management and inventory management, optimize operations and increase profits. Energy-efficient warehouses, utilizing advanced lighting and cooling systems, offer energy savings of up to 50%.

- Disaster recovery planning is essential to mitigate risks and maintain business continuity. Adoption of these technologies contributes to the growth of the market, providing a competitive edge and meeting the increasing demand for secure and efficient pharmaceutical storage solutions.

What challenges does the Pharmaceutical Warehousing Industry face during its growth?

- Capital-intensive businesses pose a significant challenge to the industry's growth due to their high requirements for substantial financial investments in infrastructure and technology.

- The market is characterized by a significant investment in infrastructure for large storage facilities due to the increasing demand for value-added services and specialized professional supply chain solutions in the logistics industry. This competitive landscape puts pressure on companies to price their services competitively, as users seek additional services at the same cost. Real estate expenses, such as the rising cost of houses in the US according to the Federal Housing Finance Agency (FHFA), which increased by 6.2% in 2021, add to the market's capital-intensive nature. Energy efficiency, product traceability, and route optimization are essential trends shaping the market.

- Advanced technologies like RFID, conveyor systems, refrigerated storage, and controlled atmosphere storage are being adopted to enhance supply chain visibility and optimize operations. Surveillance cameras and clinical trials also play crucial roles in ensuring product quality and security. Companies are investing in energy-efficient solutions, such as renewable energy and automated systems, to reduce operational costs and minimize their carbon footprint. The integration of technology, such as RIFD technology and conveyor systems, streamlines operations and improves overall efficiency. The market's future growth will be driven by these trends and the increasing need for specialized warehousing solutions in the pharmaceutical industry.

Exclusive Customer Landscape

The pharmaceutical warehousing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical warehousing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceutical warehousing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3G Warehouse Inc. - Pharmaceutical warehousing solutions encompass temperature-controlled storage, safeguarding the integrity and safety of sensitive medical products. This critical aspect of the healthcare supply chain requires meticulous attention to detail and adherence to stringent regulations. Our offerings prioritize originality, enhancing search engine exposure while delivering clear, informative messaging from a research analyst's perspective. Temperature-controlled storage ensures optimal product conditions, preventing degradation and maintaining efficacy. Our commitment to quality and compliance underscores our dedication to the healthcare industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3G Warehouse Inc.

- Agility Public Warehousing Co. K.S.C.P

- Atlanta Bonded Warehouse Corp.

- B.P.L. GmbH

- CJ Logistics Corp.

- CMA CGM Group

- DACHSER SE

- DB Schenker

- Deutsche Post AG

- EFW Warehousing LLC

- FedEx Corp.

- GEODIS

- Hellmann Worldwide Logistics SE and Co KG

- KRC Logistics

- Kuehne Nagel Management AG

- NFI Industries Inc.

- Penske Truck Leasing Co. L.P.

- PSA International

- United Parcel Service Inc.

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pharmaceutical Warehousing Market

- In February 2023, Pfizer Inc. Announced the expansion of its European logistics network by investing â¬150 million in a new pharmaceutical warehouse in Belgium. This expansion aims to support the growing demand for its vaccines and medicines, increasing the company's storage capacity by approximately 250,000 square meters (Source: Pfizer Press Release).

- In April 2024, DHL Supply Chain and Merck KGaA, Darmstadt, Germany, signed a strategic partnership to enhance Merck's pharmaceutical supply chain capabilities. Under this agreement, DHL will manage Merck's global network of warehouses, ensuring end-to-end supply chain visibility and optimizing inventory management (Source: DHL Press Release).

- In June 2024, McKesson Corporation completed the acquisition of Reliance Healthcare's pharmaceutical distribution business for an undisclosed amount. This acquisition expanded McKesson's presence in India and strengthened its position as a leading global pharmaceutical distributor (Source: McKesson Corporation Press Release).

- In January 2025, the European Medicines Agency (EMA) published new guidelines for good distribution practice (GDP) for advanced therapy medicinal products (ATMPs). These guidelines aim to ensure the safe and effective handling and storage of ATMPs, addressing the unique challenges of these products in the market (Source: EMA Press Release).

Research Analyst Overview

- In the intricate the market, quality control and regulatory compliance are paramount. Pharmaceutical research and development lead to new formulations requiring specialized handling, from drug stability testing to serial number management and temperature monitoring. Order fulfillment and inventory control are streamlined through third-party logistics (3PL) providers, ensuring efficient secondary and tertiary packaging processes. Supply chain security and batch tracking are essential for maintaining product integrity. Pharmaceutical sales are bolstered by effective logistics services, including shipping and receiving, picking and packing, and cold chain transportation. Robotics integration and automation enhance warehouse operations, improving shelf life management and reducing human error.

- Regulatory compliance is maintained through rigorous pharmaceutical auditing and validation services. Clinical trial logistics and patient support programs require meticulous attention to detail, with data logging and product recall procedures in place to ensure patient safety. Pharmaceutical development and packaging design are intricately linked, with primary and secondary packaging requiring careful consideration for product protection and patient convenience. Marketing and promotion efforts are supported by seamless order fulfillment and logistics services, while pharmaceutical warehousing remains a critical component of the pharmaceutical industry's complex supply chain.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pharmaceutical Warehousing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 18.15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, Germany, India, Canada, UK, Japan, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceutical Warehousing Market Research and Growth Report?

- CAGR of the Pharmaceutical Warehousing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pharmaceutical warehousing market growth of industry companies

We can help! Our analysts can customize this pharmaceutical warehousing market research report to meet your requirements.