Phthalic Anhydride Market Size 2024-2028

The phthalic anhydride market size is forecast to increase by USD 908.5 million at a CAGR of 3.59% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the expansion of the construction industry. This sector's increasing demand for phthalic anhydride as a key ingredient in the production of certain types of resins is fueling market expansion. Moreover, the growing trend towards green and sustainable resins is creating new opportunities for market participants, as phthalic anhydride is used in the production of these eco-friendly alternatives. However, the market also faces challenges, including health concerns related to the exposure to phthalic anhydride. Strict regulations and growing awareness of the potential hazards associated with this chemical are likely to impact market growth.

- Companies seeking to capitalize on market opportunities must focus on developing innovative, safer alternatives to phthalic anhydride while navigating the complex regulatory landscape. Effective supply chain management and cost optimization strategies will also be crucial for market success. Overall, the market presents both challenges and opportunities for participants, requiring strategic planning and a deep understanding of market dynamics.

What will be the Size of the Phthalic Anhydride Market during the forecast period?

- The market is a significant player in the global chemical industry, primarily used as a key intermediate in the production of various derivatives. Its primary applications include the manufacture of unsaturated polyester resins for coatings, plastics such as PVC and PVC products, alkyd resins, and synthetic resins. Phthalic Anhydride also finds application in the production of maleic anhydride, polyester polyols, and polyhydric alcohols. The market is driven by the demand for these derivatives in various end-use industries, including paints and coatings, electric vehicles, and the agricultural industry. The market is expected to grow steadily due to increasing demand for PVC and its derivatives in construction, automotive, and packaging industries.

- Additionally, the expanding use of Phthalic Anhydride in the production of wood stains and other specialty applications is further fueling market growth. Overall, the market is anticipated to remain robust, driven by the versatility and wide applicability of Phthalic Anhydride and its derivatives.

How is this Phthalic Anhydride Industry segmented?

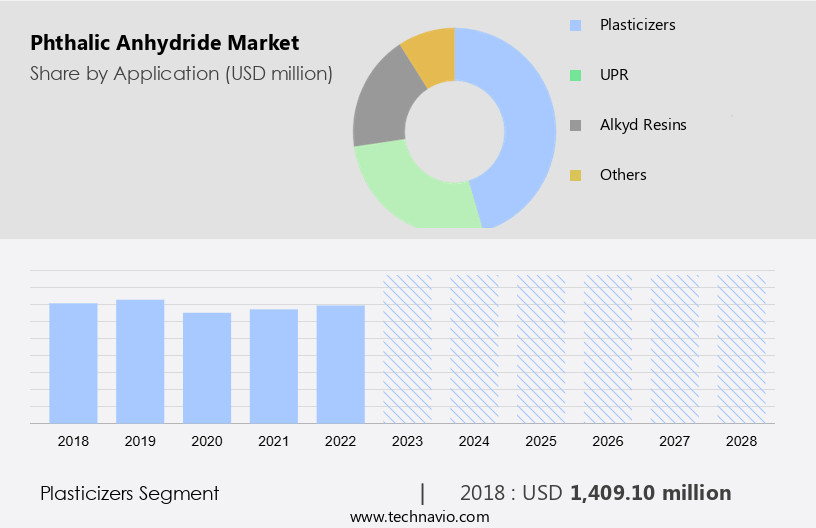

The phthalic anhydride industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Plasticizers

- UPR

- Alkyd resins

- Others

- Type

- O-xylene catalytic oxidation

- Naphthalene catalytic oxidation

- Geography

- APAC

- China

- India

- North America

- US

- Canada

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

The plasticizers segment is estimated to witness significant growth during the forecast period.

Phthalic anhydride is a crucial chemical intermediate, primarily used in the production of plasticizers. Plasticizers, such as phthalates, are essential additives that enhance the flexibility and durability of plastics. The market for phthalic anhydride is significant, driven by its extensive applications in various industries. Notably, it is a key raw material for producing plasticizers for polyvinyl chloride (PVC) products, which are widely used in construction, automotive, and consumer goods sectors. Furthermore, phthalic anhydride is employed in the synthesis of unsaturated polyester resins, alkyd resins, and polyester polyols, which are integral components of paints and coatings, including heat-resistant paints, maritime coatings, insulation varnishes, and xanthene dyes.

Additionally, it is used in the production of maleic anhydride, benzoic acid, and orthophthalic acid, which are essential intermediates in the manufacture of various chemicals and polymers. The demand for phthalic anhydride is expected to grow due to the increasing industrial demand for these applications. The automotive industry's expansion, driven by the production of electric vehicles, and the construction industry's growth are significant factors contributing to the market's growth. Phthalic anhydride's cost efficiency and chemical stability make it an indispensable component in various manufacturing processes. However, environmental concerns and regulations regarding its use may pose challenges to the market's growth. Ensuring product purity and maintaining a sustainable supply chain are essential to mitigate these challenges.

Get a glance at the market report of share of various segments Request Free Sample

The Plasticizers segment was valued at USD 1409.10 million in 2018 and showed a gradual increase during the forecast period.

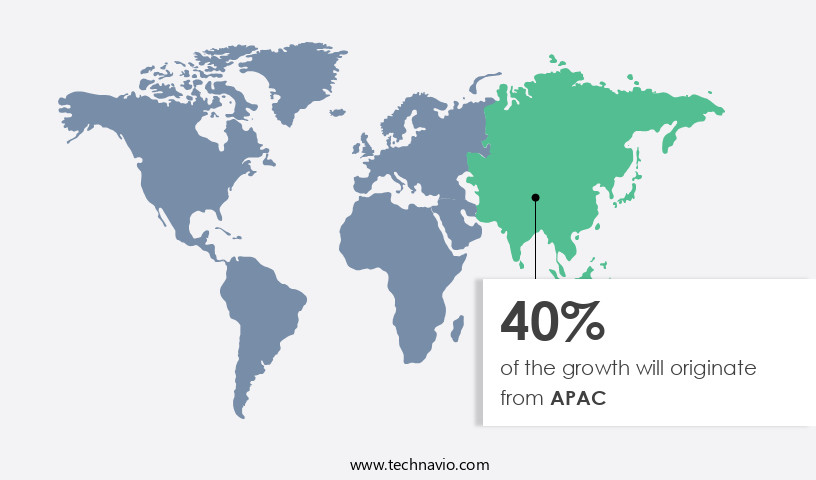

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is projected to expand at a steady pace, driven by its extensive applications in various industries. The Asia Pacific region leads the global market due to increasing industrialization and urbanization, particularly in China and India. Phthalic Anhydride is a crucial raw material in the production of Polyvinyl Chloride (PVC), Alkyd resins, Unsaturated polyester resins, and Polyester polyols. In the construction sector, it is used in the manufacture of PVC pipes, flooring, cables, and insulation materials.

Furthermore, it is employed in the production of heat resistant paints, maritime coatings, insulation varnishes, xanthene dyes, and benzoic acid. Phthalic Anhydride also plays a significant role in the chemical industry as a precursor to Phthalate esters, orthophthalic acid, and maleic anhydride. Its applications extend to the production of polyester resins, glyptal resins, and heat resistant paints. The market's growth is influenced by the increasing demand for cost-efficient and chemically stable products in various industries. The market's supply chain is supported by manufacturing processes that ensure product purity and environmental sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Phthalic Anhydride Industry?

- Growth of construction industry is the key driver of the market.

- Phthalic anhydride plays a crucial role in the production of polyvinyl chloride (PVC), a widely used material in the construction industry. PVC is essential in the manufacture of pipes, fittings, profiles, flooring, and other construction components. The expanding demand for PVC-based construction materials directly fuels the necessity for phthalic anhydride. Phthalic anhydride serves as a fundamental raw material in the production of plasticizers, such as DOP and DINP. Plasticizers improve the flexibility, durability, and workability of various construction materials, including PVC-based products.

- The thriving construction industry's continuous growth necessitates the use of plasticizers, consequently driving the demand for phthalic anhydride. Urbanization, population growth, and infrastructure development projects worldwide contribute to the increasing demand for construction materials, further boosting the market for phthalic anhydride.

What are the market trends shaping the Phthalic Anhydride Industry?

- Growing demand for green and sustainable resins is the upcoming market trend.

- In developed economies, such as Canada, the US, and Germany, there is a growing preference for eco-friendly development resins. Green sustainable resins and related energy-saving systems are gaining popularity in both developed and developing regions. In the US, the Leadership in Engineering and Environmental Design (LEED) initiative encourages the use of low-impact construction methods and materials with minimal synthetic chemicals. This trend presents opportunities for the creation of alternative resins.

- Additionally, the adoption of green and sustainable resins contributes to reducing industrial toxic gas emissions from sectors like automobile and chemical industries, thereby preserving the atmospheric ecological balance.

What challenges does the Phthalic Anhydride Industry face during its growth?

- Health hazards due to exposure to phthalic anhydride is a key challenge affecting the industry growth.

- Phthalic anhydride, a chemical compound, poses health risks to those exposed to it. The vapor, fumes, or dust form can irritate mucous membranes and the upper respiratory tract. Workers may experience conjunctivitis, hoarseness, cough, bloody nasal discharge, nasal mucosa atrophy, occasional bloody sputum, bronchitis, emphysema, bronchial asthma, skin sensitization, urticaria, and eczematous response. Clinical sensitization has been reported in workers with chronic exposure. It's essential to minimize exposure to this chemical to prevent these health issues. Despite its potential hazards, phthalic anhydride remains a vital industrial chemical.

- Its production and use continue to impact various industries, including polyester resins, solvents, and plasticizers. Proper safety measures, including personal protective equipment and adequate ventilation, can help mitigate the risks associated with handling this compound.

Exclusive Customer Landscape

The phthalic anhydride market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the phthalic anhydride market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, phthalic anhydride market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGROFERT AS - The company specializes in providing phthalic anhydride for use as plasticizers and coatings, contributing to various industries with high-quality, effective solutions. This versatile chemical compound enhances the functionality and durability of numerous products, ensuring customer satisfaction and market competitiveness. Our offerings align with the company's commitment to innovation and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGROFERT AS

- Anhui Tongua International Trade Group Co. Ltd.

- Asian Paints Ltd.

- BASF SE

- Compania Espanola de Petroleos SA

- Exxon Mobil Corp.

- IG Petrochemicals Ltd.

- Koppers Holdings Inc.

- Lanxess AG

- Mitsubishi Corp.

- Nan Ya Plastic Corp.

- PETRONAS Chemicals Group Berhad

- Polynt Spa

- Proviron Industries NV

- Shandong Hongxin Chemical Co. Ltd.

- Specialty Polymers Inc.

- Stepan Co.

- Thirumalai Chemicals Ltd.

- Tokyo Chemical Industry Co. Ltd.

- UPC Technology Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Phthalic anhydride is a vital chemical intermediate used in the production of various industrial products. Its primary applications lie in the synthesis of phthalate esters, which function as plasticizers in PVC (polyvinyl chloride) and other synthetic resins. These plasticizers enhance the flexibility and durability of PVC products, making them suitable for numerous industries. The demand for phthalic anhydride is driven by the broad application scope of its derived products. In the coatings sector, it is used in the manufacture of unsaturated polyester resins, alkyd resins, and heat resistant paints. These coatings find extensive use in various industries, including maritime, automotive, and construction.

Phthalic anhydride also plays a crucial role in the production of polyester polyols and polyhydric alcohols. These compounds are essential ingredients in the synthesis of polyurethane foams, which are widely used as insulation materials and in the production of flexible foams for furniture and bedding. The electric vehicle industry represents another significant market for phthalic anhydride. It is used in the production of sheathing electrical cables and instrument panels, contributing to the growing demand for sustainable and efficient energy solutions. The agricultural industry is another major consumer of phthalic anhydride. It is used in the production of certain pesticides and herbicides, as well as in the manufacture of certain types of plastic films for agricultural applications.

Phthalic anhydride is also used in the production of various types of dyes, including xanthene dyes. These dyes and pigments are widely used in the textile industry for coloring fabrics and yarns. The production of phthalic anhydride involves the oxidation of phthalic acid, which is derived from the distillation of coal tar or the oxidation of naphthalene. The manufacturing process is complex and requires careful control of reaction conditions to ensure product purity and cost efficiency. The environmental impact of phthalic anhydride production is a topic of ongoing concern. The use of phthalates as plasticizers has been linked to various health and environmental issues, leading to increased regulatory scrutiny and the development of alternative plasticizers.

However, phthalic anhydride itself is not considered to be a significant environmental hazard when handled and disposed of properly. The supply chain for phthalic anhydride is complex, with raw materials sourced from various suppliers and the product distributed globally to meet the demands of diverse industries. The cost efficiency and chemical stability of phthalic anhydride make it a valuable commodity in the chemical industry, despite the challenges posed by regulatory pressures and the need for sustainable alternatives. In conclusion, phthalic anhydride is a versatile chemical intermediate with a wide range of applications in various industries. Its production involves complex manufacturing processes, and its environmental impact is a topic of ongoing concern. However, its importance in the production of essential products and its cost efficiency make it a valuable commodity in the chemical industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.59% |

|

Market growth 2024-2028 |

USD 908.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.42 |

|

Key countries |

China, US, Germany, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Phthalic Anhydride Market Research and Growth Report?

- CAGR of the Phthalic Anhydride industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the phthalic anhydride market growth of industry companies

We can help! Our analysts can customize this phthalic anhydride market research report to meet your requirements.