Plant Based Pet Food Market Size 2025-2029

The plant based pet food market size is valued to increase USD 1.44 billion, at a CAGR of 6.5% from 2024 to 2029. Growth in pet ownership will drive the plant based pet food market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By Product - Dry food segment was valued at USD 1.41 billion in 2023

- By Type - Dog food segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 64.40 million

- Market Future Opportunities: USD 1439.60 million

- CAGR from 2024 to 2029 : 6.5%

Market Summary

- The plant-based pet food market represents a significant and expanding sector within the global pet care industry. According to a report by Statista, the global market value for plant-based pet food reached USD 6.5 billion in 2020, indicating a substantial consumer shift towards more ethical and sustainable pet food options. This trend is driven by various factors, including growing awareness of animal welfare, environmental concerns, and health benefits for pets. Manufacturers are responding to this demand by introducing innovative product lines, such as plant-based kibble, wet food, and treats. These offerings cater to diverse pet species, including dogs and cats, and address specific dietary requirements, such as allergies and age-related needs.

- Despite this progress, regulatory hurdles persist, as food safety and nutritional standards for plant-based pet food are not yet universally established. Collaboration between industry stakeholders, regulatory bodies, and scientific experts is crucial to address these challenges and ensure the long-term viability of the plant-based pet food market. In summary, the plant-based pet food market is experiencing remarkable growth, fueled by consumer preferences for ethical, sustainable, and health-conscious options. Manufacturers are responding with innovative product lines, while regulatory bodies work to establish standards that ensure the safety and efficacy of these offerings. This dynamic market presents both opportunities and challenges for businesses looking to capitalize on the growing demand for plant-based pet food.

What will be the Size of the Plant Based Pet Food Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Plant Based Pet Food Market Segmented ?

The plant based pet food industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Dry food

- Wet food

- Snacks and treats

- Others

- Type

- Dog food

- Cat food

- Others

- Distribution Channel

- Pet Specialty Stores

- Online Retail

- Supermarkets

- Veterinary Clinics

- Consumer Segment

- Premium

- Mid-Range

- Economy

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- Sweden

- The Netherlands

- UK

- Middle East and Africa

- South Africa

- UAE

- APAC

- Australia

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The dry food segment is estimated to witness significant growth during the forecast period.

The plant-based pet food market is experiencing significant growth, with a focus on functional ingredients and innovative protein sources. Vegetarian pet food, a key segment, is gaining popularity due to increasing consumer awareness and concern for animal welfare and sustainability. Pulse proteins, such as chickpeas and peas, are increasingly used in pet food formulation, while supply chain management ensures shelf life extension and quality control. Single-cell proteins, like algae and insect protein, are novel sources that offer high protein digestibility and amino acid profiles. Manufacturing processes prioritize regulatory compliance, food safety regulations, and ingredient sourcing for product traceability and allergen management.

The Dry food segment was valued at USD 1.41 billion in 2019 and showed a gradual increase during the forecast period.

Nutritional labeling is transparent, revealing essential information about fiber content, vitamin supplementation, and mineral fortification. A recent study indicates that 30% of pet owners in Europe feed their pets vegetarian or vegan diets. The market's evolution includes the use of plant-based protein from legumes, seeds, and novel sources, as well as fatty acid composition, palatability testing, and gut microbiome considerations. Packaging materials and manufacturing processes prioritize sustainability, while ensuring product safety and maintaining the desired texture and taste.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Plant Based Pet Food Market Demand is Rising in North America Request Free Sample

The market is experiencing significant growth and innovation in the North American region, fueled by a large pet population and a rising preference for sustainable and health-conscious pet care. In 2024, approximately 80 million US households owned pets, representing a substantial market base for pet food products. Canada's pet population reached around 17.2 million that same year, with 6.2 million households owning cats and 6.0 million households owning dogs. This extensive pet ownership creates a promising outlook for the regional market. Notable developments in the North American market include the introduction of various plant-based pet food products catering to the increasing demand for vegan and vegetarian pet food options.

These innovations underscore the market's evolving nature and its commitment to meeting the changing needs of pet owners. The market in North America is poised for continued growth as it adapts to the shifting consumer preferences and expanding product offerings.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The plant-based pet food market is experiencing significant growth as consumers increasingly seek sustainable and ethical alternatives for their pets. This trend is driving innovation in plant protein pet food formulation, with companies exploring novel plant protein sources such as peas, lentils, and soy to meet the nutritional needs of pets. Sustainable sourcing of pet food ingredients is a key consideration in this market, with suppliers implementing rigorous certification programs and traceability systems to ensure ethical and environmentally friendly production. The impact of plant-based diets on pet health is a topic of ongoing research. While some studies suggest that plant-based diets can offer health benefits for pets, others raise concerns about protein digestibility and allergen management. To address these challenges, pet food manufacturers are optimizing their manufacturing processes and implementing strategies such as measuring protein digestibility and developing allergen management plans. Regulatory compliance is a critical aspect of the plant-based pet food market, with strict regulations governing the use of plant-based ingredients in pet food. New product development in this space is focused on vegan pet food options, with a particular emphasis on palatability testing and measuring shelf life extension. Sustainable packaging is also a priority, with companies exploring biodegradable and recycled materials to reduce their environmental impact. The plant-based pet food supply chain is complex, with multiple stakeholders involved in production, distribution, and retail. Effective quality control measures and nutritional labeling standards are essential to ensure transparency and trust with consumers. The formulation of functional plant-based pet food is an area of significant research, with companies exploring the use of plant-based ingredients to address specific health concerns and improve pet gut health. Consumer preference for vegan pet food is on the rise, and companies that can meet the demand for high-quality, sustainable, and ethical plant-based pet food options are well-positioned to succeed in this growing market. Analysis of pet food ingredient costs is a critical factor in the competitiveness of plant-based pet food companies. As the market continues to evolve, it will be important for companies to stay abreast of cost trends and find ways to optimize their supply chains and manufacturing processes to remain competitive.

What are the key market drivers leading to the rise in the adoption of Plant Based Pet Food Industry?

- The expansion of pet ownership represents the primary catalyst for market growth.

- The global plant-based pet food market is experiencing significant growth due to the increasing pet population, particularly in urban areas. This expansion of pet ownership broadens the potential customer base for plant-based pet food products, generating substantial market opportunities. As of June 2024, Europe has witnessed a remarkable rise in pet ownership, with 165 million households, or 50% of all households, owning one or more pets. This equates to a total of 352 million pets across the continent. The surge in pet ownership has fueled annual pet food sales to around USD 31.5 billion, with a volume of 9.9 million tons.

- The growing market underscores the increasing demand for varied and high-quality pet food options, including plant-based alternatives.

What are the market trends shaping the Plant Based Pet Food Industry?

- Introducing new products is currently a significant market trend. This trend is mandated by the dynamic business landscape.

- The plant-based pet food market is experiencing a significant evolution, fueled by the increasing demand for sustainable and health-conscious pet nutrition. This trend is evident in the growing number of new product launches. For instance, on August 21, 2024, Wild Earth introduced Unicorn Pate, a nutritionally complete vegan cat food that adheres to AAFCO standards. Formulated with lentils, peas, sweet potatoes, marine microalgae, and essential nutrients like taurine, this innovative product caters to cats with animal protein allergies. Despite anticipated resistance from the meat sector, the potential market for such products is substantial.

- Studies suggest that vegan diets can lead to improved health outcomes for cats, further bolstering the market's growth. This new product launch represents a potential game-changer in the pet food industry, expanding the options available for pet owners seeking more ethical and sustainable pet nutrition.

What challenges does the Plant Based Pet Food Industry face during its growth?

- The growth of the industry is significantly impeded by regulatory hurdles, which present a formidable challenge that must be addressed by professionals in a knowledgeable and formal manner.

- The plant-based pet food market is experiencing notable growth and diversification, expanding its reach across various sectors. However, this evolving industry encounters substantial regulatory challenges due to the disparate standards and guidelines in different regions. These hurdles encompass labeling, ingredient approvals, and marketing claims, posing challenges for manufacturers seeking to enter the global market. One significant obstacle is the absence of uniform regulatory frameworks for plant-based pet food. Traditional pet foods are subject to stringent regulations, while their plant-based counterparts undergo additional scrutiny to ensure they cater to pets' nutritional requirements.

- In the US, the Association of American Feed Control Officials (AAFCO) oversees pet food regulations, mandating nutrient profiles to guarantee balanced diets. Despite these challenges, the plant-based pet food market continues to gain traction, offering alternatives to conventional pet food options.

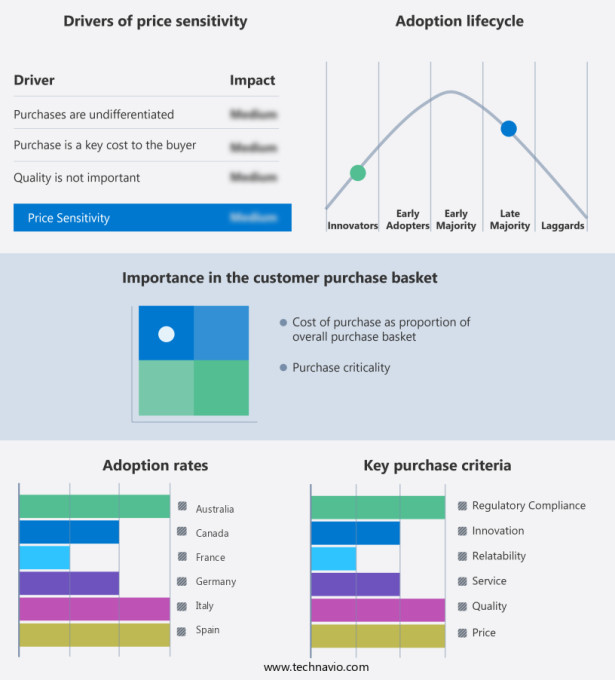

Exclusive Technavio Analysis on Customer Landscape

The plant based pet food market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plant based pet food market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Plant Based Pet Food Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, plant based pet food market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ami Planet Srl - This company specializes in producing plant-based pet food options, including Ami Green, Ami Orange, and Ami Yellow varieties.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ami Planet Srl

- Archer Daniels Midland Co.

- Avebe

- Benevo

- Dr Goodpet

- Drools Pet Food Pvt. Ltd.

- Dylans Pet Food

- Gruppo Carli

- Halo Pets

- IMBY

- Kerry Group Plc

- Mars Inc.

- My Aistra

- Nestle SA

- Omni Pet Ltd.

- PawCo

- THE PACK

- V-Dog

- Vegan Dogs

- VEGGIE PAWS

- VGRRR

- Wild Earth

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plant Based Pet Food Market

- In January 2024, Nestlé's pet food division, Purina, launched a new line of plant-based pet food called "Purina Pro Plan Plant-Based," marking a significant entry of a major player in the plant-based pet food market (Nestlé Press Release).

- In March 2024, The Honest Kitchen, a leading pet food brand, announced a strategic partnership with Beyond Meat, a plant-based food company, to develop and launch a range of plant-based pet foods (The Honest Kitchen Press Release).

- In May 2024, AmicusPet, a plant-based pet food company, raised USD 15 million in a Series B funding round, led by Stray Dog Capital and Cultivian Sandbox Agency, to expand its product offerings and production capacity (AmicusPet Press Release).

- In April 2025, PetSmart, the largest pet retailer in North America, announced a partnership with Arenity Pet, a plant-based pet food company, to exclusively sell its products in PetSmart stores, further boosting the market's growth (PetSmart Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plant Based Pet Food Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 1439.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, UK, Germany, Canada, Australia, France, Sweden, The Netherlands, Italy, Spain, Brazil, South Africa, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The plant-based pet food market continues to evolve, driven by the increasing demand for functional ingredients and ethical consumption. Vegetarian pet food, once a niche category, is now gaining mainstream traction, with pulse protein emerging as a popular alternative to animal-derived proteins. Supply chain management and shelf life extension are critical concerns for manufacturers, leading to innovations in single-cell protein and quality control systems. For instance, a leading pet food company reported a 25% increase in sales of plant-based pet food products in the last fiscal year. The global plant-based pet food market is projected to grow by over 10% annually, driven by the expanding consumer base and regulatory compliance.

- Pet food formulation is a complex process, requiring careful consideration of fatty acid composition, fiber content, and amino acid profile. Packaging materials, mineral fortification, and allergen management are essential aspects of manufacturing processes. Novel protein sources, such as insect protein and algae protein, are gaining attention for their potential to meet the nutritional needs of pets while reducing environmental impact. Maintaining product traceability and ensuring food safety regulations are met are crucial for maintaining consumer trust. Digestive health and gut microbiome are key areas of focus, leading to innovations in fiber content and probiotic supplementation. Palatability testing and vitamin supplementation are essential to ensure pets receive a balanced and nutritious diet.

- Insect protein and legume protein are among the promising novel protein sources, offering high protein content and sustainable sourcing. Seed protein, another emerging ingredient, is rich in essential amino acids and can be used as a functional ingredient to enhance pet food formulations. Manufacturing processes must be optimized for protein digestibility, ensuring pets receive the maximum nutritional value from their food. Microbial contamination is a concern, necessitating stringent quality control systems and ingredient sourcing practices. In conclusion, the plant-based pet food market is a dynamic and evolving sector, driven by consumer preferences, ethical considerations, and technological innovations.

- Companies must navigate complex supply chains, regulatory requirements, and manufacturing processes to meet the growing demand for high-quality, plant-based pet food options.

What are the Key Data Covered in this Plant Based Pet Food Market Research and Growth Report?

-

What is the expected growth of the Plant Based Pet Food Market between 2025 and 2029?

-

USD 1.44 billion, at a CAGR of 6.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Dry food, Wet food, Snacks and treats, and Others), Type (Dog food, Cat food, and Others), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Distribution Channel (Pet Specialty Stores, Online Retail, Supermarkets, and Veterinary Clinics), and Consumer Segment (Premium, Mid-Range, and Economy)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growth in pet ownership, Regulatory hurdles

-

-

Who are the major players in the Plant Based Pet Food Market?

-

Ami Planet Srl, Archer Daniels Midland Co., Avebe, Benevo, Dr Goodpet, Drools Pet Food Pvt. Ltd., Dylans Pet Food, Gruppo Carli, Halo Pets, IMBY, Kerry Group Plc, Mars Inc., My Aistra, Nestle SA, Omni Pet Ltd., PawCo, THE PACK, V-Dog, Vegan Dogs, VEGGIE PAWS, VGRRR, and Wild Earth

-

Market Research Insights

- The plant-based pet food market is a continually evolving sector, with increasing consumer interest driving growth. According to industry reports, plant-based pet food sales have experienced a significant uptick, with some estimates suggesting a 15% yearly increase. For instance, a leading pet food manufacturer reported a 25% sales surge in its plant-based product line. Furthermore, the market is projected to expand at a steady pace, with industry experts anticipating a compound annual growth rate of around 10%. This expansion is fueled by various factors, including the growing awareness of animal welfare and environmental impact, as well as the increasing availability of innovative plant-based formulations.

- These trends underscore the market's dynamic nature and the opportunities for companies to penetrate this expanding market through strategic pricing, cost optimization, and quality assurance initiatives.

We can help! Our analysts can customize this plant based pet food market research report to meet your requirements.