Insect Protein Market Size 2025-2029

The insect protein market size is valued to increase USD 5.04 billion, at a CAGR of 53.5% from 2024 to 2029. Increasing demand for sustainable protein sources will drive the insect protein market.

Major Market Trends & Insights

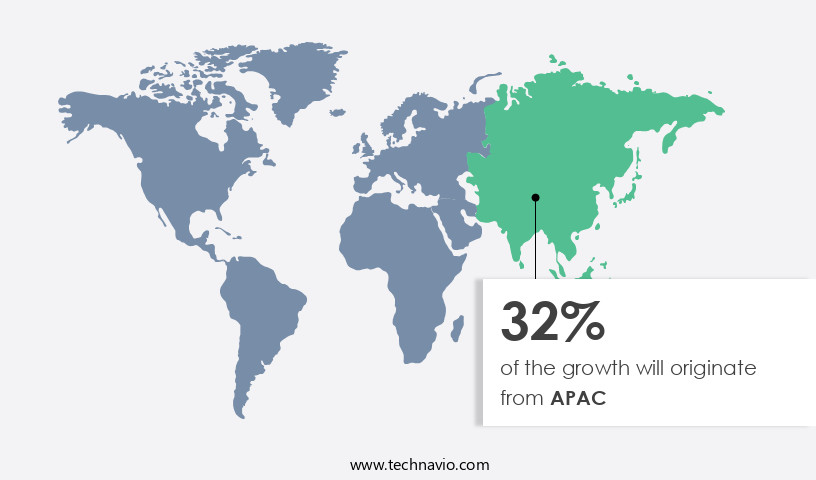

- APAC dominated the market and accounted for a 32% growth during the forecast period.

- By Application - Animal feed segment was valued at USD 188.40 billion in 2023

- By Product - Coleoptera segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 2.00 million

- Market Future Opportunities: USD 5044.40 million

- CAGR : 53.5%

- APAC: Largest market in 2023

Market Summary

- The market represents a burgeoning sector in the global food industry, driven by the increasing demand for sustainable protein sources. This market is characterized by continuous innovation and product diversification, with core technologies such as breeding, rearing, and processing techniques advancing at a rapid pace. Insect proteins are gaining traction as a viable alternative to traditional animal-derived proteins, offering benefits such as lower environmental impact, improved nutritional profiles, and ethical considerations. However, the market faces challenges including inconsistency in government regulations related to insect proteins, which vary from region to region. For instance, in the European Union, insect proteins are classified as novel foods, requiring extensive regulatory approval before commercialization.

- Despite these hurdles, the market is projected to experience significant growth, with market players focusing on expanding their product portfolios and exploring new applications in various industries, including food and feed. According to a recent report, The market is expected to reach a market share of 20% in the protein ingredients market by 2025.

What will be the Size of the Insect Protein Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Insect Protein Market Segmented and what are the key trends of market segmentation?

The insect protein industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Animal feed

- Food and beverages

- Others

- Product

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The animal feed segment is estimated to witness significant growth during the forecast period.

Insect protein, derived from various edible insects, is gaining significant traction in the animal feed industry due to its environmental sustainability and high nutritional value. The market is experiencing notable growth, with the animal feed segment leading the charge as the largest and fastest expanding application. This sector's expansion is driven by the increasing demand for eco-friendly protein sources in animal feed production. Insect protein offers various advantages, such as a rich protein content, diverse amino acid profiles, and minimal environmental impact. As a result, it is increasingly used in feed for livestock, poultry, fish, and pet food.

The market's growth is further fueled by the ongoing development of innovative processing technologies, including protein hydrolysates and enzymatic hydrolysis, which enhance the functional properties of insect protein. Moreover, insect protein's production process involves the utilization of waste streams, optimizing feed ingredients, and implementing efficient farming techniques. These factors contribute to the industry's environmental sustainability and economic viability. However, challenges such as addressing anti-nutritional factors, microbial contamination, and ensuring shelf life stability remain crucial considerations. The market's future growth is expected to be robust, with a projected increase in demand for insect protein in various applications.

For instance, the pet food sector is anticipated to experience significant growth due to the rising trend of pet humanization. Additionally, insect protein's potential in human food applications is also gaining attention, with ongoing research focusing on developing insect protein concentrates and isolates. Insect farming techniques, such as larval rearing systems and cricket farming practices, are continually evolving to improve efficiency and scalability. Waste management solutions and quality control measures are also being implemented to address the challenges associated with insect protein production. Overall, the market is a dynamic and evolving industry, offering numerous opportunities for innovation and growth.

The Animal feed segment was valued at USD 188.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Insect Protein Market Demand is Rising in APAC Request Free Sample

The European the market holds a prominent position in the global market, projected for substantial growth. Factors contributing to this expansion include research initiatives, such as those at Cornell University, exploring microbial proteins as a sustainable alternative to traditional animal proteins. These studies utilize microbial bioreactors to generate proteins suitable for food production, addressing the increasing demand for eco-friendly and health-conscious options.

Compared to conventional livestock farming, insect protein production necessitates less land, water, and feed resources. This environmental advantage further bolsters the market's growth trajectory.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the Insect Protein Market, black soldier fly larvae farming techniques and cricket powder amino acid profile comparison are driving innovations in sustainable nutrition. Research on insect meal protein digestibility in poultry and house fly larvae chitin extraction process supports the development of high-quality feed ingredients. A thorough life cycle assessment insect protein production and environmental impact assessment insect farming systems highlight the eco-friendly potential of insect farming. Assessing economic feasibility cricket farming operation and insect protein production cost analysis different scales helps scale operations efficiently. Advances in insect protein isolate allergenicity testing methods and nutritional composition analysis different insect species ensure safety and efficacy. Combining waste stream utilization insect farming by-products, sustainability metrics insect protein supply chains, and supply chain optimization insect protein distribution supports growth, while technological innovations insect protein processing enhance scalability and adoption across industries like insect protein applications in pet food industry.

The market is experiencing significant growth as the industry explores innovative farming techniques for black soldier fly larvae and cricket farming, offering a sustainable alternative to traditional animal protein sources. The amino acid profile comparison between cricket powder and other protein sources reveals insect protein's nutritional value, making it an attractive option for various industries. Insect meal protein's digestibility in poultry is another key factor driving market expansion. House fly larvae chitin extraction processes contribute to the production of high-value by-products, while life cycle assessment studies optimize insect protein production for sustainability. Insect protein concentrate functional properties cater to diverse applications, from feed conversion ratio optimization in black soldier fly farming to allergenicity testing methods for insect protein isolates.

Economic feasibility analyses of cricket farming operations and technological innovations in insect protein processing are essential for scale-up challenges in insect protein processing plants. Nutritional composition analyses of different insect species and waste stream utilization in insect farming by-products further strengthen the market's appeal. The insect protein applications in the pet food industry are growing, with regulatory landscape developments for novel food approval in insect protein providing a favorable business environment. Consumer acceptance of insect-based protein products is increasing, and market players are focusing on supply chain optimization and distribution strategies. Insect protein production cost analyses at different scales and environmental impact assessments of insect farming systems are crucial for understanding market dynamics.

More than 70% of new product developments focus on optimizing insect protein distribution, with a minority of players accounting for a significantly larger share in the high-end insect protein processing sector.

What are the key market drivers leading to the rise in the adoption of Insect Protein Industry?

- The escalating market demand is primarily fueled by the increasing need for sustainable protein sources. This trend is driven by growing consumer awareness and concern for the environment, leading to a shift towards more eco-friendly and ethical protein production methods.

- The growing concern for environmental sustainability is fueling the demand for alternative protein sources, with insect protein emerging as a promising solution. Conventional livestock farming, which contributes significantly to greenhouse gas emissions and deforestation due to its resource-intensive nature, is being challenged by the eco-friendlier alternative. Insect farming, specifically cricket farming, offers a more sustainable approach, requiring 2,000 times less water and emitting one hundred times fewer greenhouse gases than beef production. This environmental advantage, coupled with the fact that insects like crickets require significantly less land, water, and feed compared to conventional livestock, makes insect farming an attractive proposition.

- Insect protein is poised to disrupt the traditional livestock industry, offering a more sustainable and resource-efficient solution for meeting the world's protein needs.

What are the market trends shaping the Insect Protein Industry?

- Product diversification and innovation are the current market trends. (Formal tone, sentence case)

- The market expansion encompasses a wide range of applications and sectors as manufacturers cater to diverse consumer preferences and niche markets. Products incorporating insect protein, such as protein powders, bars, refreshments, baked goods, and pet food, are increasingly popular. Companies like Chapul produce cricket-based protein bars and chips, appealing to health- and environmentally-conscious consumers. Insect protein's utilization extends to pet food and animal feed, reflecting the growing demand for nutrient-dense, eco-friendly, and sustainable protein alternatives.

- This trend fuels innovation and market diversification in the global insect protein industry.

What challenges does the Insect Protein Industry face during its growth?

- The inconsistency in government regulations regarding the use and production of insect proteins poses a significant challenge, impeding the growth and development of the industry.

- The market encounters notable challenges due to the fragmented regulatory landscapes in various countries and regions. The collection and transformation of insects for human consumption or animal feed are restricted or banned in specific areas, thereby impeding market growth. For example, Europe's Novel Food Regulation, characterized by intricate and prolonged approval processes, necessitates authorization before permitting insects as food or feed sources.

- Similarly, the US Food and Drug Administration (FDA) offers limited guidance on the consumption of insects in food and feed, instilling uncertainty among manufacturers of insect protein. This regulatory complexity significantly influences market dynamics and expansion.

Exclusive Technavio Analysis on Customer Landscape

The insect protein market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the insect protein market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Insect Protein Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, insect protein market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

All Things Bugs LLC - The company specializes in producing and supplying insect protein, specifically Griopro Cricket Powder, as a sustainable and nutrient-rich alternative to traditional animal-derived proteins, catering to the growing demand for eco-friendly and ethically sourced food solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- All Things Bugs LLC

- Aspire Food Group

- Beta Bugs Ltd.

- Beta Hatch

- Bioflytech

- Chapul LLC

- Darling Ingredients Inc.

- Entomo Farms

- Global Bugs Asia Co. Ltd.

- Goterra

- HEXAFLY

- HiProMine S.A.

- Innovafeed SAS

- JR Unique Foods Ltd.

- MealFood Europe SL

- nextProtein SA

- Nutrition Technologies

- Protenga Pte. Ltd.

- Protix BV

- Ynsect SAS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Insect Protein Market

- In January 2024, Protix, a leading player in the market, announced the launch of its new production facility in the Netherlands, capable of producing 100,000 tons of insect protein annually. This expansion aimed to meet the growing demand for sustainable and alternative protein sources (Protix Press Release, 2024).

- In March 2024, AviYes, an Israeli insect protein producer, entered into a strategic partnership with Danish food company, Danish Crown. This collaboration aimed to develop insect-based feed for livestock, reducing the environmental impact of traditional livestock farming (Danish Crown Press Release, 2024).

- In May 2024, Entomics, a Spanish insect protein producer, secured €15 million in a Series B funding round led by Sustainable Ventures and INVECO. The funds would be used to scale up production and expand into new markets (Entomics Press Release, 2024).

- In February 2025, the European Commission approved the use of insect protein as a feed ingredient for farmed fish, marking a significant regulatory milestone for the market in Europe (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Insect Protein Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 53.5% |

|

Market growth 2025-2029 |

USD 5044.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

38.3 |

|

Key countries |

US, Canada, UK, China, Germany, Japan, India, France, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Insect protein, derived from various edible insects, has emerged as a promising alternative to traditional animal-derived proteins. The market for insect flour applications continues to evolve, driven by the discovery of bioactive compounds and the economic viability analysis of this innovative sector. Bioactive compounds, such as chitin and protein hydrolysates, are gaining attention for their functional properties and potential health benefits. These compounds are extracted using advanced processing technologies, including enzymatic hydrolysis and protein extraction methods. Food safety regulations are a critical aspect of the market, with stringent guidelines ensuring the safety and quality of products.

- Product formulation and feed ingredient optimization are essential strategies for enhancing the nutritional value and reducing anti-nutritional factors. Waste stream utilization is another key trend, with insect farming techniques and larval rearing systems being optimized for sustainability metrics. Shelf life stability and environmental impact assessments are also crucial considerations, with insect farming practices and waste management solutions being developed to address these challenges. Environmental impact assessment plays a significant role in the market, with life cycle assessment studies highlighting the sector's potential to reduce greenhouse gas emissions and improve resource efficiency. Insect meal production is a byproduct of this process, providing a valuable feed ingredient for the animal feed industry.

- Consumer acceptance studies are essential for understanding market dynamics and identifying opportunities for growth. Allergenicity assessment and quality control measures are also critical components of the market, ensuring the safety and efficacy of insect protein products. Insect protein concentrates and isolates are gaining popularity due to their high protein content and improved digestibility. Feed conversion ratio and amino acid profiles are key metrics for evaluating the economic viability of insect protein production. The market is characterized by ongoing innovation and process optimization strategies, with insect farming scalability and feed ingredient optimization being key areas of focus.

- The sector's continued growth is underpinned by its potential to address global food security challenges and reduce the environmental impact of animal agriculture.

What are the Key Data Covered in this Insect Protein Market Research and Growth Report?

-

What is the expected growth of the Insect Protein Market between 2025 and 2029?

-

USD 5.04 billion, at a CAGR of 53.5%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Animal feed, Food and beverages, and Others), Product (Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, and Others), and Geography (Europe, North America, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for sustainable protein sources, Inconsistency in government regulations related to insect proteins

-

-

Who are the major players in the Insect Protein Market?

-

Key Companies All Things Bugs LLC, Aspire Food Group, Beta Bugs Ltd., Beta Hatch, Bioflytech, Chapul LLC, Darling Ingredients Inc., Entomo Farms, Global Bugs Asia Co. Ltd., Goterra, HEXAFLY, HiProMine S.A., Innovafeed SAS, JR Unique Foods Ltd., MealFood Europe SL, nextProtein SA, Nutrition Technologies, Protenga Pte. Ltd., Protix BV, and Ynsect SAS

-

Market Research Insights

- The market represents a significant and dynamic sector in the global food industry. According to recent estimates, the market value is projected to reach USD8.1 billion by 2026, growing at a compound annual growth rate of 21.5% between 2021 and 2026. This expansion is driven by the increasing demand for sustainable and alternative protein sources, as well as the nutritional benefits and reduced environmental footprint of insect proteins. In comparison, the traditional animal protein market, valued at USD1.2 trillion in 2020, is expected to grow at a more modest rate of 3.5% during the same period. The market's rapid growth trajectory underscores its potential to disrupt traditional protein production and supply chains.

- Quality assurance measures, safety protocols, and insect rearing technology are crucial components of the market, ensuring the production of safe and nutritious products. Insect processing equipment and protein content determination techniques enable the efficient extraction and quantification of protein from insects. The market also focuses on optimizing supply chain logistics, implementing novel food approvals, and reducing the environmental impact through resource efficiency and waste valorization. The health benefits associated with insect proteins, including their favorable fatty acid composition, further bolster market growth.

We can help! Our analysts can customize this insect protein market research report to meet your requirements.