Plastic Container Market Size 2024-2028

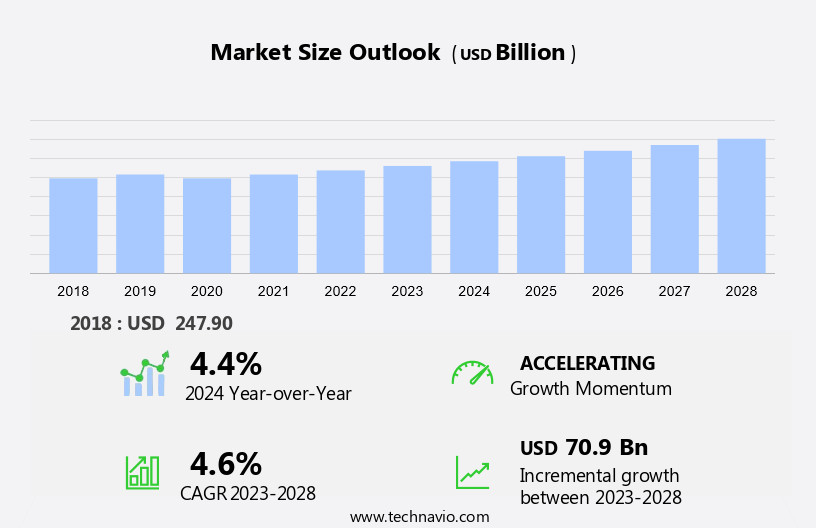

The plastic container market size is forecast to increase by USD 70.9 billion, at a CAGR of 4.6% between 2023 and 2028.

- The market is experiencing significant growth, driven by the surge in e-commerce and online shopping, leading to increased demand for durable and lightweight packaging solutions. The food and beverage industry's high adoption of plastic containers further bolsters market expansion. However, the market faces challenges with stringent regulations limiting the use of plastic due to environmental concerns. Companies must navigate these regulations while maintaining product quality and consumer safety to capitalize on market opportunities.

- Effective innovation and compliance strategies will be crucial for market success.

What will be the Size of the Plastic Container Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, shaped by dynamic market forces and shifting consumer preferences. Virgin plastic remains a significant player, offering superior chemical resistance and production efficiency. However, the circular economy is gaining traction, with pre-consumer recycled (PCR) and post-consumer recycled (PCR) plastic increasingly utilized for inventory management and sustainability. Food contact compliance is paramount, driving demand for food grade plastic and stringent quality control measures. Packaging design and closure systems are continually advancing, with resealable packaging, child-resistant designs, and tamper-evident features becoming standard. Production cost and shelf life are key considerations, with ongoing innovations in blow molding, injection molding, extrusion molding, and additive manufacturing driving down costs and extending product life.

Temperature and impact resistance, as well as barrier properties, are essential for various applications, from industrial to medical and consumer goods. The market's circular economy focus extends to energy recovery and waste management, with chemical recycling and 3D printing offering new possibilities. Material cost and selection, as well as design for manufacturing, are crucial elements of the product life cycle, with sustainable packaging solutions, barrier films, and compostable plastics gaining popularity. Product safety remains a top priority, with ongoing regulatory compliance and rigorous testing ensuring consumer trust. The market's continuous dynamism underscores the importance of staying informed and adaptable to evolving trends and consumer demands.

How is this Plastic Container Industry segmented?

The plastic container industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Rigid plastic container

- Flexible plastic container

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

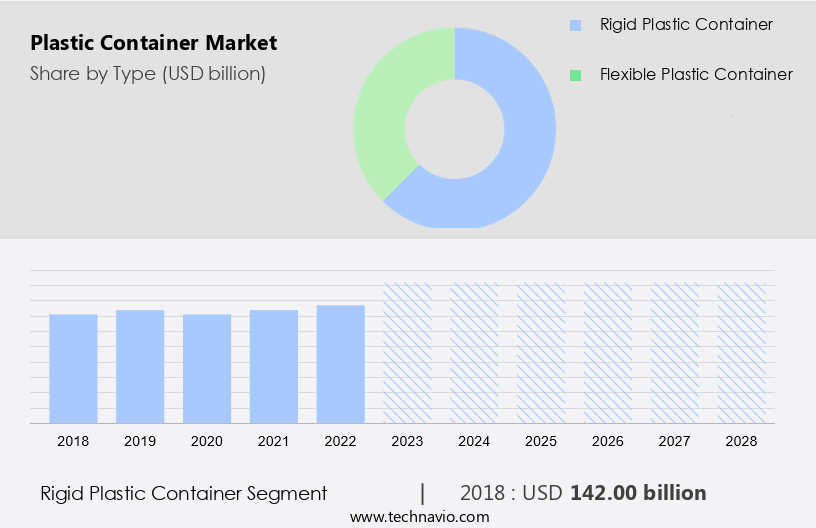

The rigid plastic container segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in the rigid plastic container segment. This growth can be attributed to the increasing demand from the food and beverage industry, which utilizes rigid plastic containers due to their lightweight and cost-effective nature, ability to preserve product integrity, and compatibility with various product types. Additionally, the rising production and consumption of food and beverage products, as well as personal care items like cosmetics, are driving the demand for rigid plastic containers. Food grade plastic is a crucial component of this market, as it ensures food contact compliance and product safety. Mechanical and chemical recycling processes are essential for the production of recycled plastic, contributing to the circular economy and reducing waste.

Inventory management and design for manufacturing principles are increasingly being adopted to optimize production costs and improve packaging efficiency. Consumer preferences for child-resistant and tamper-evident packaging, as well as the development of sustainable packaging solutions, are also influencing market trends. Innovations in additive manufacturing, 3D printing, and injection molding enable the creation of complex designs and customized packaging. The use of barrier films, barrier properties, and temperature resistance enhances the functionality and shelf life of plastic containers. Material selection and cost are significant factors in the market, with virgin plastic and recycled plastic offering varying advantages in terms of production cost, material properties, and sustainability.

Medical grade plastic and industrial grade plastic cater to specific applications, while the adoption of compostable and biodegradable plastics aligns with environmental concerns. Quality control, energy recovery, and waste management are essential aspects of the market, ensuring the production of safe, efficient, and eco-friendly products. The integration of closure systems, such as plastic lids and caps, and resealable packaging further enhances the functionality and convenience of plastic containers.

The Rigid plastic container segment was valued at USD 142.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

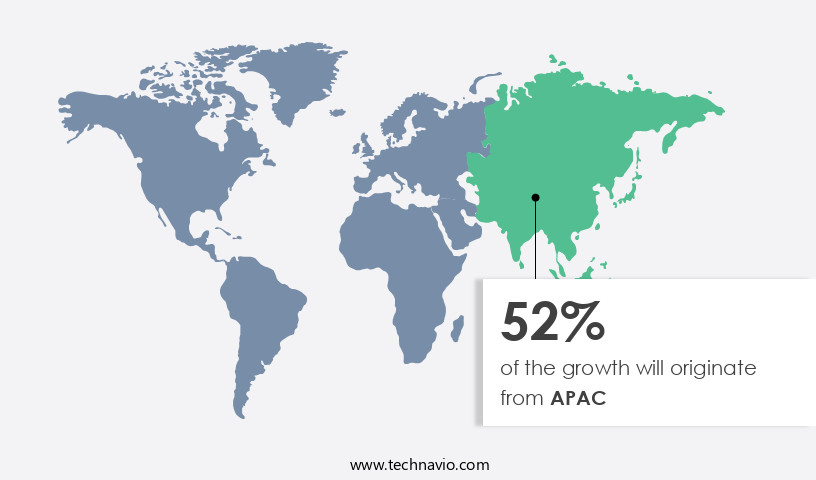

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC holds a significant share of the global demand due to the robust economies of China and India. These countries have seen increasing demand above the world average, making them key contributors to the market. Japan and South Korea also maintain a steady demand for plastic containers. China, in particular, is a global manufacturing hub for low-value mass-produced goods, including plastic containers, due to its low-cost labor and government support. The country is also a primary exporter of low-grade plastics. APAC's growth, which remains above the world average, continues to drive market expansion. Plastic containers cater to various industries and applications, including food and beverage, industrial, and consumer goods.

Product tamper evident features, child resistant packaging, and packaging efficiency are essential considerations in the design process. Food-grade plastics, which comply with regulatory requirements, are popular in the food and beverage sector. Mechanical and chemical recycling processes are employed to create recycled plastic containers, contributing to the circular economy. In the industrial sector, high-performance plastics such as industrial-grade plastic, medical grade plastic, and engineering plastics are used for their chemical resistance, impact resistance, and tensile strength. Inventory management and just-in-time production systems necessitate packaging solutions that offer efficient design for manufacturing, production cost savings, and extended shelf life. Consumer preferences for sustainable packaging solutions have led to the development of biodegradable plastics, compostable plastics, and additive manufacturing techniques such as 3D printing.

These innovations cater to the growing demand for eco-friendly and cost-effective packaging. The market also focuses on product safety, ensuring compliance with food contact regulations and other relevant standards. Plastic containers are produced using various manufacturing techniques, including blow molding, injection molding, and extrusion molding, which cater to different product requirements. Closure systems, such as plastic lids and caps, ensure product security and convenience. The market continues to evolve, offering sustainable packaging solutions that meet the needs of diverse industries and consumers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Plastic Container Industry?

- The surge in e-commerce and online shopping significantly drives the market's growth, making it an indispensable trend in today's business landscape.

- The market has experienced notable growth due to the rise of e-commerce and online shopping. With consumers prioritizing convenience and variety, the demand for effective packaging solutions, specifically plastic containers, has witnessed a significant surge. E-commerce businesses require robust, lightweight, and cost-effective packaging materials to ensure safe and secure product delivery. Plastic containers, renowned for their durability, flexibility, and ease of molding into various shapes and sizes, are ideal for packaging a broad spectrum of online offerings, including food and beverages, electronics, and personal care items.

- This trend underscores the importance of plastic containers in the logistics and shipping sectors.

What are the market trends shaping the Plastic Container Industry?

- The food and beverage industry's increasing adoption of plastic containers represents a significant market trend. This shift towards plastic containers is driven by their durability, cost-effectiveness, and convenience.

- The market is experiencing notable growth due to the widespread use of plastic containers in the food and beverage industry. Consumers' increasing preference for convenience and portability has led manufacturers to adopt plastic packaging solutions. These containers offer numerous benefits, including lightweight, durability, and versatility. They effectively preserve food freshness, extend shelf life, and minimize spoilage, which is essential for both manufacturers and retailers. Moreover, the trend towards on-the-go lifestyles has intensified the demand for practical packaging solutions, such as single-serve containers and resealable pouches. Additionally, the food and beverage sector's focus on sustainability is driving the adoption of recyclable and biodegradable plastic containers.

- This shift caters to consumers' growing preference for eco-friendly products. In terms of supply chain efficiency, plastic containers offer advantages such as design for manufacturing, child-resistant packaging, product tamper evident features, and mechanical recycling capabilities for industrial and food-grade plastic containers. Regulatory compliance is another critical factor influencing the market's growth, as stringent regulations ensure the safety and quality of plastic containers. Overall, the market's growth is underpinned by these market dynamics, making it a significant player in the packaging industry.

What challenges does the Plastic Container Industry face during its growth?

- The strict regulations governing the use of plastic pose a significant challenge to the expansion of the industry.

- The market is subject to regulatory challenges due to growing concerns over plastic use and waste management. Governments worldwide are enforcing regulations to decrease plastic consumption, encourage recycling, and mitigate environmental issues. These regulations may include bans on single-use plastics, mandatory recycling programs, and incentives for eco-friendly alternatives. These measures aim to minimize the environmental harm caused by plastic waste, such as pollution and wildlife damage. Compliance with these regulations can result in increased costs for manufacturers, necessitating investments in sustainable practices and materials. Companies must balance the need to meet regulatory requirements with maintaining cost-effectiveness and product quality in their production processes.

- Key market trends include the use of virgin plastic, chemical resistance, inventory management, circular economy, food contact compliance, packaging design, closure systems, production cost, shelf life, pre-consumer recycled (pcr), and additive manufacturing. Product safety is a critical consideration in the market, ensuring both consumer protection and regulatory compliance.

Exclusive Customer Landscape

The plastic container market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plastic container market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plastic container market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airlite Plastics Co. - This company specializes in manufacturing a diverse selection of plastic containers, including HDPE, HDPE PCR, PET, and PP varieties. These containers cater to various industries, ensuring compliance with industry standards and sustainability initiatives through the use of high-quality materials. The company's commitment to innovation and excellence drives continuous improvement in container design and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airlite Plastics Co.

- Alpha Plastics Inc.

- ALPLA Werke Alwin Lehner

- Altium Packaging

- Amcor Plc

- Berry Global Inc.

- CKS Packaging Inc.

- Clearlake Capital Group L.P.

- DFP Holding BV

- Fortex Fortiflex

- Graham Packaging Co. LP

- Greiner Packaging International GmbH

- Plastipak Holdings Inc.

- Polytainers Inc.

- Rahway Steel Drum Co. Inc.

- Schoeneck Containers Inc.

- Silgan Holdings Inc.

- The Plastic Bottles Co.

- TricorBraun Inc.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plastic Container Market

- In January 2024, global packaging leader Amcor announced the acquisition of Tetra Pak's carton business for â¬2.2 billion, expanding its portfolio with sustainable packaging solutions (Amcor Press Release). This strategic move aimed to strengthen Amcor's position in the growing market for eco-friendly plastic containers.

- In March 2024, Danone and Nestlé, two major food and beverage corporations, formed a joint venture to develop and commercialize recycled plastic food-grade containers. The collaboration aimed to reduce plastic waste and increase the use of recycled materials in their packaging (Danone Press Release).

- In May 2024, Berry Global, a leading plastic packaging manufacturer, announced a USD1.2 billion investment to expand its production capacity in the United States. This expansion was in response to growing demand for plastic containers in various industries, including food and beverage, healthcare, and industrial markets (Berry Global Press Release).

- In April 2025, the European Union passed the Single Use Plastics Directive 2, which bans certain single-use plastic products and sets targets for the use of recycled plastic in packaging. This policy change is expected to drive demand for reusable and recyclable plastic containers in Europe (European Parliament Press Release).

Research Analyst Overview

- The market encompasses various segments, including plastic profile, film, sheet, pipe, pallet, drum, and crates. Supply chain optimization is a critical factor in this industry, with artificial intelligence and machine learning driving process improvement through data analytics and inventory control. Plastic film manufacturers employ predictive analytics to anticipate demand and optimize production planning. Emissions reduction is a significant trend, with industry standards mandating the use of six sigma and product stewardship in manufacturing processes. Custom molding and product development leverage advanced technologies to create innovative plastic parts for sectors such as electronic packaging, pharmaceutical packaging, cosmetic packaging, and industrial packaging.

- Warehouse management systems utilize big data to streamline logistics management and reduce waste. Consumer behavior influences retail packaging trends, with a growing preference for protective packaging and sustainable solutions. End-of-life management remains a challenge, with efforts focused on waste reduction and recycling initiatives. Plastic pallets and crates facilitate efficient transportation packaging for agricultural and industrial applications. Capacity planning and demand forecasting are essential for maintaining a competitive edge in the dynamic the market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plastic Container Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 70.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Key countries |

US, China, Germany, India, France, Japan, Canada, South Korea, UK, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plastic Container Market Research and Growth Report?

- CAGR of the Plastic Container industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plastic container market growth of industry companies

We can help! Our analysts can customize this plastic container market research report to meet your requirements.