Poland E-commerce Market Size 2026-2030

The poland e-commerce market size is valued to increase by USD 88.47 billion, at a CAGR of 25.7% from 2025 to 2030. Proliferation of advanced logistical infrastructure and automated delivery systems will drive the poland e-commerce market.

Major Market Trends & Insights

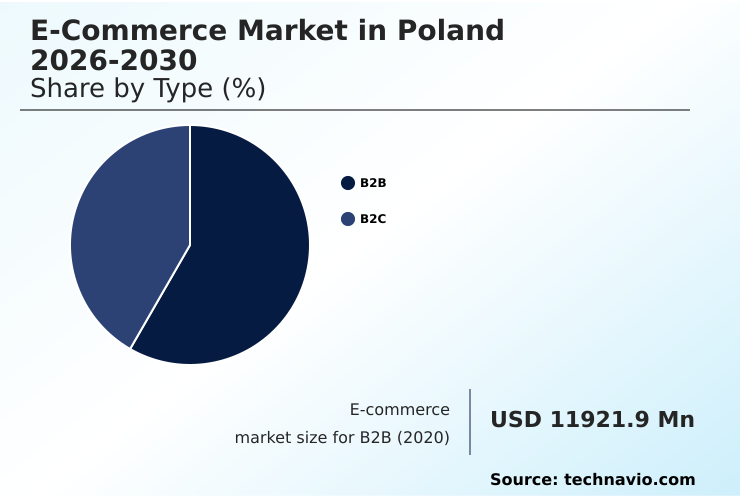

- By Type - B2B segment was valued at USD 20.63 billion in 2024

- By Application - Home appliances segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 109.49 billion

- Market Future Opportunities: USD 88.47 billion

- CAGR from 2025 to 2030 : 25.7%

Market Summary

- The e-commerce market in Poland has matured into a highly competitive and technologically sophisticated digital economy. This landscape is defined by the deep integration of advanced logistics, including a dense network of automated parcel machines that have revolutionized last-mile delivery optimization and enabled efficient reverse logistics frameworks.

- A mobile-first consumer culture, coupled with high digital literacy, fuels demand for seamless omnichannel integration and personalized experiences delivered through dynamic social commerce platforms. In this environment, predictive analytics and AI are critical for managing operations.

- For instance, retailers are leveraging data to refine inventory, reduce waste in the grocery sector, and enhance the customer journey with innovations like the augmented reality fitting room. The convergence of secure digital payment solutions and convenient fulfillment options like click-and-collect services has created a frictionless ecosystem.

- However, this maturity also brings intense rivalry, forcing businesses to continuously invest in technology and data-driven decision making to maintain market share and navigate the complexities of cross-border trade capabilities and evolving consumer expectations for sustainability.

What will be the Size of the Poland E-commerce Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Poland E-commerce Market Segmented?

The poland e-commerce industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Type

- B2B

- B2C

- Application

- Home appliances

- Fashion products

- Groceries

- Books

- Others

- End-user

- Individual

- Small business

- Corporate

- Geography

- Europe

By Type Insights

The b2b segment is estimated to witness significant growth during the forecast period.

The business-to-business segment is undergoing a significant digital transformation, shifting from manual processes to integrated B2B procurement platforms.

This evolution is driven by the need for greater efficiency through enterprise resource planning systems and automated warehouse systems that enable real-time inventory management.

The mandatory adoption of electronic invoicing systems has been a key catalyst, compelling firms to modernize their digital infrastructure and resulting in a 25% reduction in processing errors.

This environment supports sophisticated supply chain optimization, utilizing data-driven decision making for procurement.

The complexity of these operations necessitates robust user experience design on platforms to manage tiered pricing, volume discounts, and compliance with consumer data protection, moving the sector far beyond simple digital storefront management.

The B2B segment was valued at USD 20.63 billion in 2024 and showed a gradual increase during the forecast period.

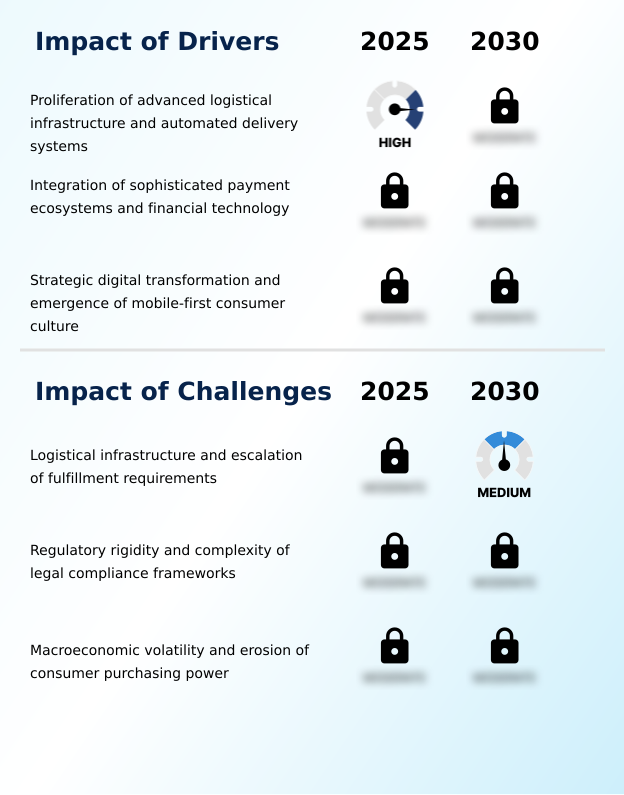

Market Dynamics

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- Strategic success in the e-commerce market in Poland hinges on a nuanced understanding of its defining structural advantages and evolving consumer expectations. The impact of automated parcel lockers on last-mile delivery cannot be overstated, as this infrastructure provides a distinct competitive edge by reducing operational costs and enhancing consumer convenience.

- Platforms that master this ecosystem alongside an effective omnichannel strategy for a seamless customer experience are best positioned for growth. Concurrently, integrating AI for personalized shopping experiences is critical for differentiation in a crowded marketplace, with data showing that tailored recommendations can lift conversion rates by a factor of two compared to generic offers.

- Financially, the role of buy now pay later services in e-commerce continues to expand, unlocking higher-value transactions by mitigating upfront cost concerns for consumers. However, companies must also navigate the challenges of cross-border e-commerce logistics, where regulatory and fulfillment complexities can erode margins.

- Increasingly, sustainability trends in e-commerce packaging are transitioning from a niche concern to a core brand attribute, influencing purchasing decisions. Optimizing reverse logistics for fashion e-commerce and ensuring data privacy compliance in digital retail are no longer secondary considerations but central pillars of a resilient business model.

- Mastering the nuances of mobile payment adoption in online retail and meeting B2B e-commerce platform feature requirements are further imperatives for long-term viability.

What are the key market drivers leading to the rise in the adoption of Poland E-commerce Industry?

- The proliferation of advanced logistical infrastructure, particularly automated delivery systems, is a key driver propelling market growth.

- Market growth is propelled by a synergy of infrastructural, financial, and cultural drivers.

- The widespread network of automated warehouse systems and the density of out-of-home delivery points have fundamentally optimized the supply chain, reducing last-mile costs by over 30% compared to traditional methods.

- This logistical backbone is empowered by the ubiquity of digital payment solutions and innovative deferred payment options, which accelerate transaction velocity and build consumer trust through robust cybersecurity protocols.

- This combination of factors has cultivated a deeply ingrained mobile-first consumer culture, where peer-to-peer exchange groups and constant connectivity are the norm.

- The expectation for seamless digital experiences is high, forcing continuous innovation in enterprise resource planning systems and real-time inventory management to meet demand without friction, making technological agility a primary determinant of success.

What are the market trends shaping the Poland E-commerce Industry?

- The market is increasingly defined by the trend of advanced algorithmic hyper-personalization. This evolution in consumer intelligence tailors every digital interaction to individual user behaviors and preferences.

- Key trends are reshaping the competitive landscape, centered on advanced technology and evolving consumer ethics. The shift toward hyper-personalization, powered by predictive analytics, is a dominant force, with platforms leveraging these tools achieving up to a 20% uplift in customer engagement.

- This data-centric approach extends to the use of an augmented reality fitting room to reduce high return rates in fashion, a sector also seeing the rise of circular economy models. Simultaneously, there is a strong consumer-led push for green logistics practices, where sustainable packaging can improve brand loyalty scores by over 15%.

- This trend influences everything from supply chain optimization to the design of social commerce platforms. The convergence of these trends necessitates a sophisticated approach to customer journey mapping and the adoption of subscription-based models to secure long-term revenue streams in a dynamic market.

What challenges does the Poland E-commerce Industry face during its growth?

- Escalating fulfillment requirements and existing logistical infrastructure limitations present a key challenge affecting industry growth.

- Despite its maturity, the market faces significant operational and economic headwinds. Logistical pressures from escalating fulfillment expectations strain existing infrastructure, with labor shortages and rising fuel costs increasing last-mile logistics expenses by an average of 10% annually.

- The complex web of EU and domestic regulations, particularly around consumer data protection and electronic invoicing systems, creates a substantial compliance burden that can divert significant resources, especially for smaller players. Furthermore, macroeconomic volatility directly impacts consumer purchasing power, leading to more value-oriented shopping behaviors.

- This trend intensifies price competition and threatens brand loyalty programs, as customers increasingly use price comparison engines. Navigating these challenges requires exceptional operational efficiency, robust customer retention strategies, and the financial resilience to withstand margin compression from both local and international competitors.

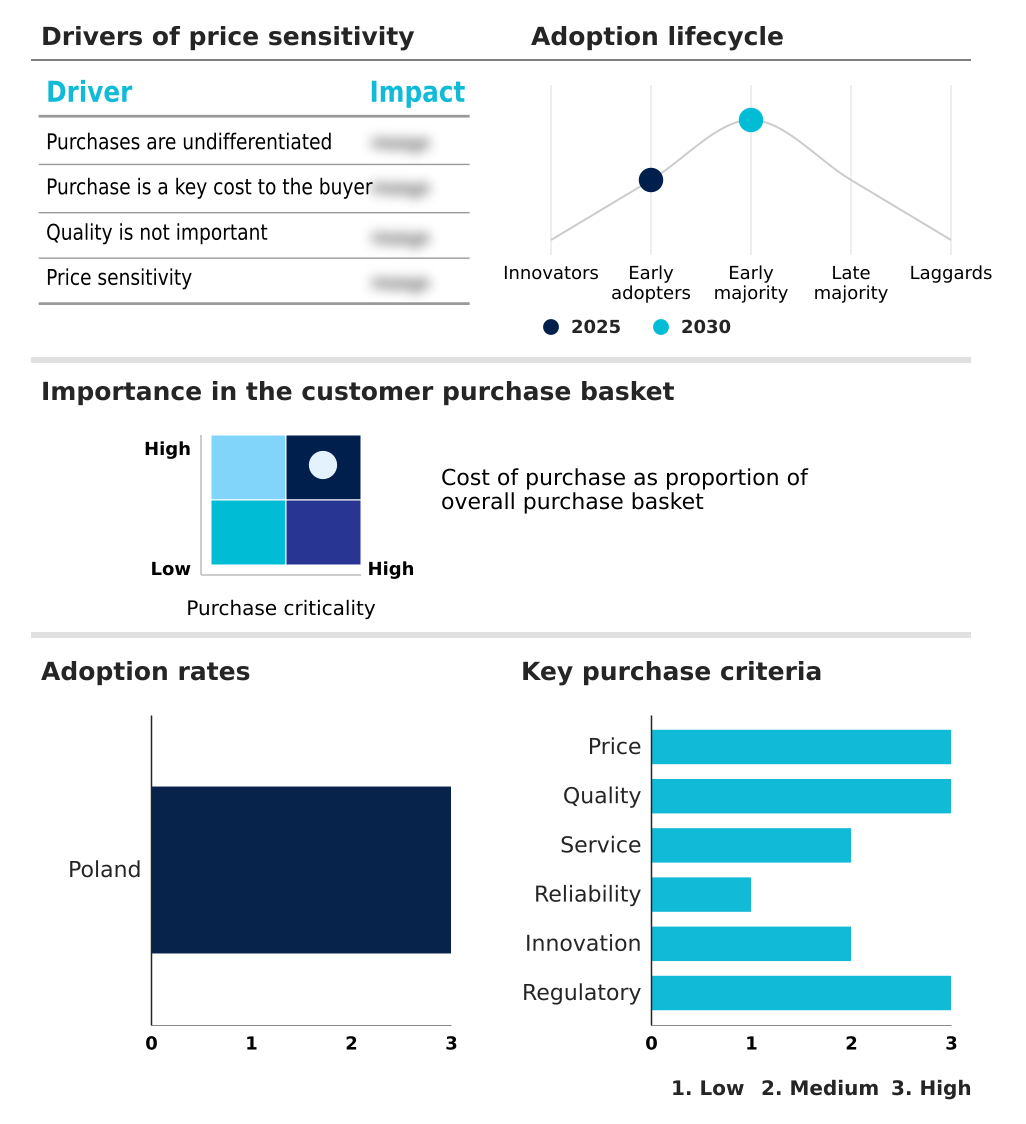

Exclusive Technavio Analysis on Customer Landscape

The poland e-commerce market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the poland e-commerce market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Poland E-commerce Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, poland e-commerce market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

303 AVENUE SP. Z O.O. - A multifaceted e-commerce ecosystem integrates B2C, B2B, and C2C transactions through a hybrid marketplace model featuring auctions, fixed-price listings, and integrated buyer protection.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 303 AVENUE SP. Z O.O.

- Allegro.pl Sp. z o.o.

- Amazon.com Inc.

- Beliani PL GmbH

- Ceneo.pl sp z.o.o

- Decathlon SA

- Desertcart

- eBay Inc.

- Inter IKEA Holding BV

- Meble.pl SA

- Media Expert Group

- OLX Global BV

- Organic24 Sp. z o.o.

- Tesco Plc

- Ubuy Co.

- Vox Sp. z.o.o. sp. k

- X Kom Sp. Z.o.o.

- Zalando SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Poland e-commerce market

- In September 2024, Shoper, a Polish e-commerce software provider, launched an advanced automated marketing module designed to help small and medium-sized businesses optimize their advertising budgets across social media and search platforms using sophisticated algorithms.

- In January 2025, Allegro Business enhanced its platform with an updated procurement interface, introducing a streamlined bulk-ordering system and integrated tax-compliant documentation tools specifically for large corporate clients in Poland.

- In February 2025, Amazon introduced its Easy Ship service in Europe, allowing marketplace sellers to leverage Amazon's logistics network for order fulfillment, thereby competing more directly with established local fulfillment services.

- In March 2025, Allegro finalized the integration of DHL eCommerce and ORLEN Paczka into its Allegro Delivery framework, creating a unified logistics network that provides sellers with direct access to thousands of parcel lockers and pick-up points across Poland.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Poland E-commerce Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 185 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 25.7% |

| Market growth 2026-2030 | USD 88472.5 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 19.7% |

| Key countries | Poland |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The e-commerce market in Poland operates as a highly evolved digital ecosystem where technological prowess and logistical efficiency are paramount. The competitive landscape necessitates deep investments in B2B procurement platforms and consumer-facing social commerce platforms, which are integral to modern retail strategy.

- Core to this market is a sophisticated infrastructure built on automated parcel machines, enabling unparalleled last-mile delivery optimization and robust reverse logistics frameworks. This physical network is complemented by advanced digital payment solutions and a pervasive mobile-first consumer culture.

- For boardroom consideration, the strategic implementation of hyper-personalization through predictive analytics directly impacts marketing ROI and customer lifetime value, with successful campaigns reducing customer churn by over 15%. Innovations such as the augmented reality fitting room are becoming key differentiators, while the push for omnichannel integration forces a holistic view of the customer journey.

- Success is no longer measured by online presence alone but by the seamless orchestration of click-and-collect services, quick commerce, and a circular economy model.

What are the Key Data Covered in this Poland E-commerce Market Research and Growth Report?

-

What is the expected growth of the Poland E-commerce Market between 2026 and 2030?

-

USD 88.47 billion, at a CAGR of 25.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (B2B, and B2C), Application (Home appliances, Fashion products, Groceries, Books, and Others), End-user (Individual, Small business, and Corporate) and Geography (Europe)

-

-

Which regions are analyzed in the report?

-

Europe

-

-

What are the key growth drivers and market challenges?

-

Proliferation of advanced logistical infrastructure and automated delivery systems, Logistical infrastructure and escalation of fulfillment requirements

-

-

Who are the major players in the Poland E-commerce Market?

-

303 AVENUE SP. Z O.O., Allegro.pl Sp. z o.o., Amazon.com Inc., Beliani PL GmbH, Ceneo.pl sp z.o.o, Decathlon SA, Desertcart, eBay Inc., Inter IKEA Holding BV, Meble.pl SA, Media Expert Group, OLX Global BV, Organic24 Sp. z o.o., Tesco Plc, Ubuy Co., Vox Sp. z.o.o. sp. k, X Kom Sp. Z.o.o. and Zalando SE

-

Market Research Insights

- The dynamics of the e-commerce market in Poland are shaped by the interplay between advanced technological adoption and shifting consumer behaviors. The widespread use of mobile commerce applications, which account for over 60% of transactions, has accelerated the need for superior user experience design and seamless mobile wallet integration.

- This mobile-first approach is supported by innovative deferred payment options and buy now pay later services, which have been shown to increase average order values by up to 30%. However, firms face the challenge of managing customer acquisition costs in a highly competitive landscape. Strategic influencer marketing strategies and robust brand loyalty programs are essential for customer retention.

- The market's resilience is tested by macroeconomic factors influencing value-oriented shopping, forcing companies to leverage price comparison engines and peer review platforms to their advantage while navigating complex third-party logistics (3PL) integration.

We can help! Our analysts can customize this poland e-commerce market research report to meet your requirements.