What is the Polycarbonate Market Size?

The polycarbonate market size is forecast to increase by USD 4.95 billion and is estimated to grow at a CAGR of 5.3% between 2024 and 2029. The market is experiencing significant growth, driven by key factors such as the increasing adoption of inorganic growth strategies and expanding production facilities. However, regulatory concerns surrounding the production of polycarbonate pose a challenge to market growth. Inorganic growth strategies, including mergers and acquisitions, are being employed by major players to expand their market presence and enhance their product offerings. Additionally, the construction of new production facilities is increasing the global supply of polycarbonate, leading to a more competitive market. Material processing techniques, such as injection molding and extrusion molding, enable the creation of complex shapes and structures from polycarbonate resin. These methods are widely used in industries like plastic manufacturing, resin manufacturing, and glass manufacturing, to produce a wide range of products. Despite these growth opportunities, regulatory hurdles continue to pose a challenge. Stringent regulations regarding the production and disposal of polycarbonate, particularly in North America, are increasing production costs and limiting market expansion. To navigate these challenges, market participants must stay informed of regulatory developments and invest in sustainable production methods. Overall, the market is poised for growth, but players must navigate regulatory challenges to capitalize on opportunities.

What will be the size of Market during the forecast period?

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Method

- Phosgene-based polymerization

- Non-phosgene polymerization

- Application

- Electrical and electronics

- Automotive

- Consumer goods

- Construction

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- Mexico

- US

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- APAC

Which is the largest segment driving market growth?

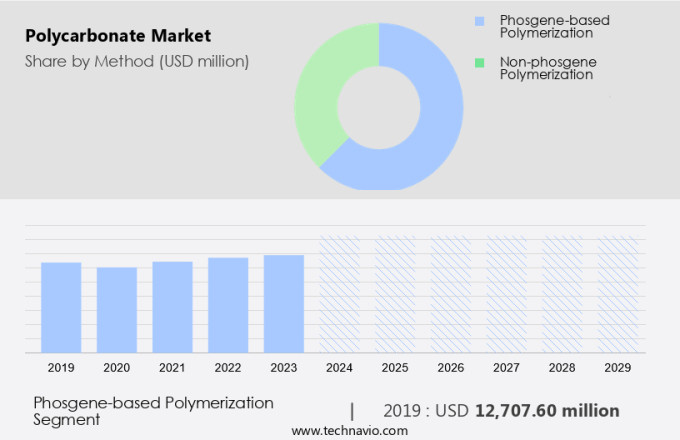

The phosgene-based polymerization segment is estimated to witness significant growth during the forecast period. The production of polycarbonate, a versatile and durable plastic, primarily relies on the phosgene-based polymerization process. This method, which facilitates the efficient creation of large molecular-weight polymers, involves the interfacial polymerization of phosgene with alcohol at the boundary between water and an organic solvent. However, the use of phosgene, a highly toxic compound, poses significant safety concerns. In the automotive industry, polycarbonate is extensively used in manufacturing lightweight components for light vehicles, including headlamp housings and passenger car parts, due to its excellent mechanical properties and resistance to heat and impact.

Get a glance at the market share of various regions. Download the PDF Sample

The phosgene-based polymerization segment was the largest segment and valued at USD 12.71 billion in 2019. In the building and construction sector, it is utilized in adhesives and insulation materials, contributing to cost savings by reducing overall construction costs. Investors in the market can benefit from its wide range of applications, including in the production of plant feedstock and various industrial applications. As the demand for lightweight and durable materials continues to grow, the market for polycarbonate is expected to expand significantly. The interfacial polymerization process plays a crucial role in producing high-quality polycarbonate, making it an essential component in various industries. Hence, such factors are fuelling the growth of this segment during the forecast period.

Which region is leading the market?

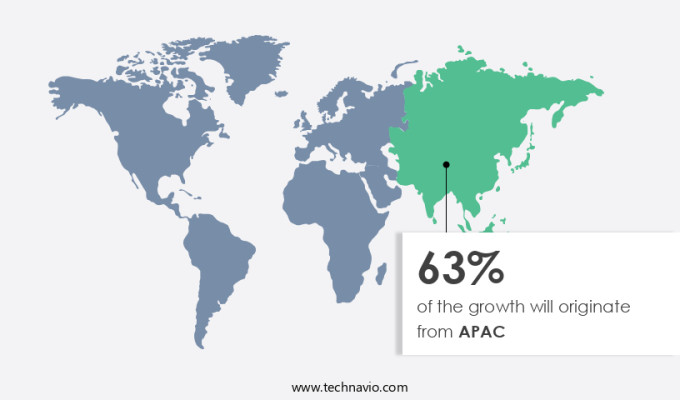

For more insights on the market share of various regions, Request Free Sample

APAC is estimated to contribute 63% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The APAC region's prominence in the global market can be attributed to several factors. These include the region's growing manufacturing sector, increasing consumer goods production, and expanding use of polycarbonate materials in construction, wire insulation, and foam molding. Furthermore, the rising popularity of two-wheeler vehicles and the escalating demand for lightweight and durable materials in the electronics industry, particularly for computers, cell phones, and other consumer electronics, are driving the demand for polycarbonate in APAC. According to industry reports, the market for polycarbonate in APAC is projected to grow at a steady pace in the coming years, making it an attractive investment opportunity for manufacturers and suppliers. In summary, the APAC region's industrial growth and expanding demand from various industries are fueling the global market. Teijin's recent investment in a new production line for its polycarbonate resin in Japan is a testament to the region's growing importance in the global market.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AGC Inc: This company offers polycarbonate under the brand names CARBOGLASS and TWINCARBO . These polycarbonates are lightweight, tough and have high shock resistance, flame retardancy.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- BASF SE

- Chimei Corp.

- Covestro AG

- Entec Polymers

- Formosa Chemicals and Fibre Corp

- INEOS Styrolution Group GmbH

- LG Chem Ltd.

- Lotte Chemical Corp.

- Mitsubishi Engineering-Plastics Corp.

- RTP Co.

- Saudi Basic Industries Corp.

- Teijin Ltd.

- Toray Industries Inc.

- Trinseo PLC

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

5.0 |

Market Dynamics

Polycarbonate resin, a high-performance plastic, has been a game-changer in various industries due to its unique properties. This engineered material offers an exceptional balance of strength, durability, and transparency, making it a preferred choice for numerous applications. In the realm of consumer products, polycarbonate resin's versatility shines. Its heat resistance and impact strength make it ideal for producing durable and lightweight items, such as mobile phone accessories, electrical relays, and even bulletproof materials. Furthermore, its transparency and rigidity make it suitable for LCD display panels and automotive design. The construction industry also benefits significantly from the adoption of polycarbonate resin. As a green building material, it contributes to sustainable development by reducing the overall weight of structures, thereby minimizing the environmental impact. Its excellent thermal properties make it an excellent choice for insulation and energy efficiency. Regulations and industry standards play a crucial role in the manufacturing process of polycarbonate resin. Stringent quality checks and adherence to environmental guidelines ensure the production of safe and eco-friendly materials. The electrical engineering sector relies on polycarbonate resin for its insulation properties. Its heat resistance and electrical insulation capabilities make it a popular choice for wire insulation materials and electrical connections. Logistics and transportation industries also benefit from the use of polycarbonate resin. Its lightweight nature and durability make it suitable for manufacturing center components, such as conveyor belts and storage containers. In the realm of advanced materials, polycarbonate resin stands out for its high-performance properties. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Inorganic growth strategies drives the market growth. The market is witnessing notable growth, driven by strategic investments and collaborations in the industry. Moreover, polycarbonate is a versatile material, widely used in various sectors such as construction, electronics, transportation, and consumer goods. In construction, it is employed as a thermal insulator, offering excellent thermal and electrical insulation properties. In the electronics sector, it is used in LCD sections, switchgears, and thermal pastes. In transportation, it is utilized in the manufacturing of two-wheeler parts, bullet-proof windows, and headlamp housings. Hence, such factors are driving the market during the forecast period.

What are the significant trends being witnessed in the market?

Increasing production facilities is a major trend in the market. The market is experiencing a notable expansion, driven by the increasing demand for high-performance plastics in various industries. This state-of-the-art facility, which commenced production in March 2024, utilizes an innovative platform technology that employs a solvent-free melt process and a novel reactor design. This advanced technology enables the production of customizable polycarbonates, which have undergone extensive testing in laboratories and pilot plants over the past few years.

This technological breakthrough is significant as it addresses the growing need for high-quality, versatile plastics in sectors such as construction, transportation, electronics, and consumer goods. In the construction industry, polycarbonate is used as a thermal insulator, a thermal conductor, and in the production of bullet-proof windows. In the transportation sector, it is used in the manufacturing of light vehicles, two-wheeler bodies, and safety equipment. In the electronics industry, it is used in the production of computers, cell phones, LCD sections, and switching relays. In the consumer goods sector, it is used in the packaging industry, vacuum forming, and injection molding. Hence, such factors are driving the market during the forecast period.

What are the major market challenges?

Regulatory concerns regarding polycarbonate production is a major challenge hindering the market. The market is undergoing transformation due to shifting regulatory landscapes, particularly in sectors such as construction and transportation. For instance, in India, the Ministry of Chemicals and Fertilizers has introduced the Polycarbonate (Quality Control) Amendment Order, 2024, effective March 12, 2025. This amendment mandates that all polycarbonate products adhere to the specifications outlined in Indian Standard 14434:1998.

Moreover, to be approved for sale in India, these products must secure certification from the Bureau of Indian Standards (BIS), which involves meeting rigorous quality standards and displaying the Standard Mark, granted under a license from BIS as per Scheme-I of Schedule-II in the Bureau of Indian Standards (Conformity Assessment) Regulations, 2018. This regulatory development is one of the many factors influencing the polycarbonate market's growth trajectory in the US and globally. Additionally, the market is driven by increasing demand for lightweight, durable, and thermally insulating materials in industries such as computers, consumer goods, automotive, and industrial machinery. Hence, such factors are hindering the market during the forecast period.

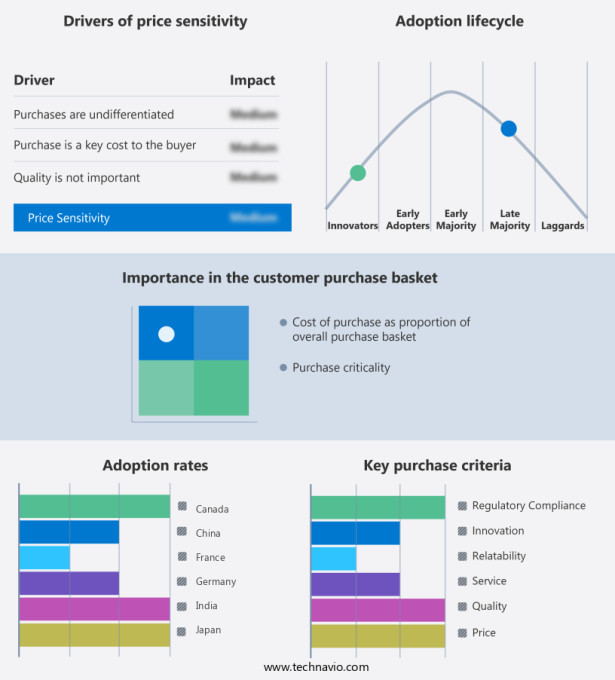

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

This material offers a unique blend of strength, transparency, and thermal resistance, making it an ideal choice for numerous applications. In the realm of glass materials, polycarbonate's use extends beyond the conventional glass. Its high impact resistance and excellent thermal insulation properties make it a preferred choice for thermoforming applications in construction. Architects often incorporate this material in the design of buildings to create energy-efficient structures. The electrical industry relies on polycarbonate for insulation applications, particularly in wire insulation and electrical components such as switching relays. In the automotive sector, it is used for manufacturing bullet-proof windows, headlamp housings, and LCD sections. The construction industry also benefits from polycarbonate's versatility. In foam molding, it provides excellent insulation properties, reducing energy consumption and construction costs. Furthermore, it is used in the production of lightweight, fuel-efficient vehicle technology, contributing to the growth of the EV industry.

The Polycarbonate market is a dynamic and innovative industry that caters to various sectors, including construction materials, packaging solutions, and manufacturing centers. This market is renowned for its versatile offerings, such as heat resistant materials, LCD display panels, and bulletproof glass, which are produced using advanced technologies like injection molding process and thermoforming technology. Polycarbonate's applications extend beyond traditional industries. In the realm of construction materials, it is used for sustainable construction and green building materials due to its lightweight properties and resistance to impact. The industry is subject to stringent regulations to ensure the production and use of these materials adhere to environmental and safety standards. In the packaging industry, polycarbonate is utilized for its durability and clarity, making it an ideal choice for logistics and transportation applications. Moreover, it is increasingly being used in the production of computer hardware, LED lighting, and electric vehicle components, as alternative materials in the circular economy.

The future of materials lies in sustainable manufacturing, renewable materials, and bioplastics. Polycarbonate is no exception, with manufacturers exploring the use of biobased chemicals and composite materials to reduce weight savings and improve the overall sustainability of the product. The industry is also embracing steam technology to minimize waste and improve energy efficiency. In conclusion, the Polycarbonate market is a vital player in various industries, from construction materials and packaging solutions to LCD display panels and computer hardware. With a focus on innovation, sustainability, and regulatory compliance, it continues to shape the future of materials in a circular economy.

The consumer goods sector, including cell phones and consumer electronics, utilizes polycarbonate for its lightweight and durable properties. Injection molding and extrusion are common processing methods used to manufacture various consumer products. Regulations and environmental concerns have led to the development of sustainable-product certification for polycarbonate. Bisphenol A (BPA) free, bio-based polycarbonate is gaining popularity due to its eco-friendly nature. The manufacturing hubs of this material are continually evolving, with new innovations in processing ability and chemical properties. The automotive sector is a significant consumer of polycarbonate, with car manufacturers using it for various applications, such as safety equipment, brackets, and thermally conductive components. The material's high processing ability makes it suitable for creating complex structures and intricate designs. Polycarbonate's unique properties make it a valuable material in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 4.95 billion |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 63% |

|

Key countries |

China, US, Japan, India, South Korea, Germany, Mexico, UK, France, and Canada |

|

Competitive landscape |

Leading Companies, market trends , market research and growth , market research, growth, market report, market forecast, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AGC Inc., BASF SE, Chimei Corp., Covestro AG, Entec Polymers, Formosa Chemicals and Fibre Corp, INEOS Styrolution Group GmbH, LG Chem Ltd., Lotte Chemical Corp., Mitsubishi Engineering-Plastics Corp., RTP Co., Saudi Basic Industries Corp., Teijin Ltd., Toray Industries Inc., and Trinseo PLC |

|

Market Segmentation |

Method (Phosgene-based polymerization and Non-phosgene polymerization), Application (Electrical and electronics, Automotive, Consumer goods, Construction, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa) |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies