China Polycarbonate Market Size and Trends

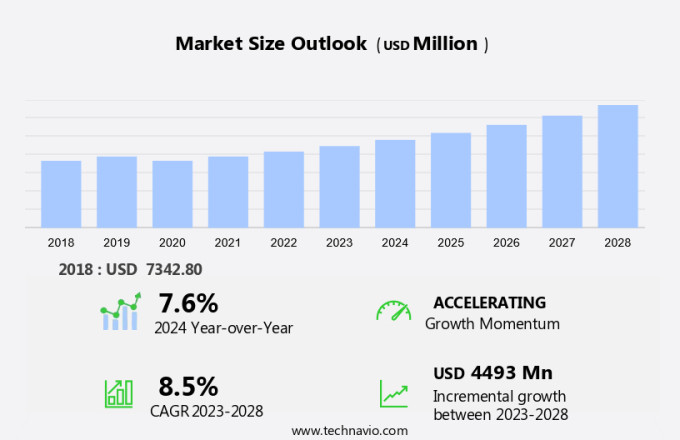

The China polycarbonate market size is forecast to increase by USD 4.49 billion at a CAGR of 8.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing utilization of polycarbonate materials in various end-user industries. The demand for polycarbonate is particularly high in sectors such as electronics, automotive, and construction. In the electronics industry, polycarbonate is extensively used in the production of switching relays, LCD sections, and sensor parts for cell phones and computers. Additionally, the wire insulation application category is witnessing an increase in demand due to the growing use of polycarbonate in power cables. Furthermore, the packaging industry is another major consumer of polycarbonate, as it offers excellent properties such as impact resistance and transparency. The market is also benefiting from the increasing opportunities in China, despite the fluctuations in prices of raw materials.

The market has experienced significant growth in various industries due to its superior properties, including high impact resistance, excellent thermal stability, and good electrical insulation. This versatile material is widely used in several sectors, including automotive & transportation, consumer goods, medical devices, and others. In the automotive & transportation industry, polycarbonate is employed extensively for manufacturing bullet-proof windows, headlamps, and thermoforming applications. The material's lightweight nature and excellent impact resistance make it an ideal choice for automotive components, contributing to the industry's growth. The consumer goods sector in China also benefits from polycarbonate's properties. This material is used in various applications, such as foam molding, injection molding, and extrusion, for producing household items, electrical appliances, and toys. The increasing demand for durable and lightweight consumer goods drives the market's expansion. The medical devices industry in China has also seen a rise in the adoption of polycarbonate due to its biocompatibility and transparency. The material is used in the production of switching relays, LCD sections, sensor parts, and other medical components. With the growing aging population and increasing healthcare expenditures, the market for medical devices is expected to grow, leading to increased demand for polycarbonate. The industrial machinery industry in China utilizes polycarbonate for various applications, including vacuum forming and extrusion. Its excellent thermal stability and impact resistance make it suitable for manufacturing industrial machinery components, contributing to the industry's growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Resin Type

- Virgin polycarbonate

- Polycarbonate regrind

- End-user

- Electrical and electronics

- Automotive and transportation

- Construction

- Medical

- Others

- Geography

- China

By Resin Type Insights

The virgin polycarbonate segment is estimated to witness significant growth during the forecast period. The market employs mechanical recycling as a primary approach for the production of high-quality recycled plastic products. In this method, discarded materials such as polycarbonate and acrylonitrile butadiene styrene (PC-ABS) from electronic components are melt-blended with virgin materials using a twin-screw extruder.

Get a glance at the market share of various segments Download the PDF Sample

The virgin polycarbonate segment was the largest segment and was valued at USD 6.82 billion in 2018. The resulting blends undergo rigorous testing at institutions like the Ohio State University (OSU) to evaluate their flammability properties. The tests include burner flammability assessments, which measure parameters such as extinguishing time, extent of burning, and weight loss. The findings indicate that the incorporation of both virgin and recycled polycarbonate or ABS into the blend progressively enhances the material's desirable properties while maintaining fire safety standards. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

China Polycarbonate Market Driver

Increasing applications of polycarbonate materials in end-user industries is notably driving market growth. The Chinese market has experienced significant growth due to its increasing application in various industries, including automotive and transportation, consumer goods, and medical devices. In the automotive and transportation sector, polycarbonate's high strength-to-weight ratio and excellent impact resistance make it an ideal material for manufacturing automotive parts, such as headlamp housings and exterior components.

In the consumer goods industry, polycarbonate's versatility and durability have led to its use in producing various products, such as electrical appliances, sports equipment, and construction materials. Moreover, in the medical devices industry, polycarbonate's biocompatibility and transparency have made it a preferred material for manufacturing medical devices, such as surgical instruments and medical tubing. Thus, such factors are driving the growth of the market during the forecast period.

China Polycarbonate Market Trends

Increasing opportunities in China is the key trend in the market. Polycarbonate materials hold a significant role in the automotive sector, with applications including acoustic panels, instrument panels, and anti-vibration components. The elasticity, strength, chemical resistance, superior visibility, and temperature resistance of polycarbonate make it an ideal choice for these applications. The expanding automotive industry in China is anticipated to boost the demand for polycarbonate materials.

Furthermore, the Chinese automotive industry experiences high sales due to government support and favorable tax incentives. In the electronics industry, polycarbonate is utilized in various components such as switchgears, LCD sections, and sensor parts for cell phones and computers. Additionally, it is employed as wire insulation and in packaging applications. Thus, such trends will shape the growth of the market during the forecast period.

China Polycarbonate Market Challenge

Fluctuations in prices of raw materials is the major challenge that affects the growth of the market. Polycarbonate is a thermoplastic material widely used in various industries due to its excellent properties, including high impact resistance, thermal stability, and transparency. The primary production methods for polycarbonate include extrusion and vacuum forming.

Regulations play a crucial role in the market, with strict guidelines regarding its production, usage, and recycling practices. The electrical & electronics segment is another major consumer of polycarbonate, driven by its applications in the manufacturing of electrical components and insulators. The price of polycarbonate is significantly influenced by the cost of raw materials, primarily bisphenol A and phosgene, and crude oil. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Chimei Corp: The company offers polycarbonate for the manufacture of optical-grade light guide plates.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Covestro AG

- Entec Polymers

- Ever Best (HK) LTD

- Hebei BenJinXin Industrial Co., Ltd

- Idemitsu Kosan Co. Ltd.

- LG Chem Ltd.

- Lotte Chemical Corp.

- Luxi Chemical Group Co. Ltd.

- Mitsubishi Engineering-Plastics Corp.

- Saudi Basic Industries Corp.

- Samyang Corp.

- Shaoxing Mordun Engineering Plastics Technology Co.,ltd

- Suzhou OMAY Optical Materials Co. Ltd.

- Suzhou TOPO New Material Co., Ltd.

- Teijin Ltd.

- Trinseo PLC

- Wanhua Chemical Group Co. Ltd.

- Xiamen Keyuan Plastic Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The Polycarbonate market in China has witnessed significant growth in recent years, driven by the increasing demand for advanced materials in various industries. Polycarbonate resin, a type of high-performance thermoplastic, has gained popularity due to its superior properties such as steam and dry heat resilience, making it an ideal choice for applications in the safety equipment industry, automotive market, and public infrastructure. In the safety equipment industry, polycarbonate resin is used to manufacture protective helmets, shields, and other safety gear due to its excellent impact resistance and durability. In the automotive market, it is used for making antivibration panels, headlamp housings, and other automotive components.

The packaging application category is another significant end-use industry for polycarbonate resin in China. Its ability to withstand high temperatures and chemicals makes it an excellent choice for food and beverage packaging. The Chinese automotive market, with its local production of automobiles and metrorail systems, presents a significant opportunity for the growth of the polycarbonate market. However, the low plant capacity utilization and the competitive edge of domestic brands can impact production costs and pricing structure. Moreover, the global prices of crude oil and other raw materials have a direct impact on the production cost of polycarbonate resin. In addition, economic activities such as the construction of greenfield airports and the expansion of the optoelectronics industry are expected to further boost the demand for polycarbonate resin in China. Overall, the market for polycarbonate resin in China is expected to continue its growth trajectory, driven by its applications in advanced materials, automotive, and other industries.

ABS polymer, another type of thermoplastic, is also used extensively in China due to its cost-effectiveness and versatility. It is commonly used in the automotive industry, electrical and electronics industry, and construction industry. The competition between polycarbonate resin and ABS polymer will continue to shape the market dynamics in China.

The market has experienced significant growth in various industries due to its superior properties, including high impact resistance, excellent thermal stability, and good electrical insulation. This versatile material is widely used in several sectors, including automotive & transportation, consumer goods, medical devices, and others. In the automotive & transportation industry, polycarbonate is employed extensively for manufacturing bullet-proof windows, headlamps, and thermoforming applications. The material's lightweight nature and excellent impact resistance make it an ideal choice for automotive components, contributing to the industry's growth. The consumer goods sector in China also benefits from polycarbonate's properties. This material is used in various applications, such as foam molding, injection molding, and extrusion, for producing household items, electrical appliances, and toys. The increasing demand for durable and lightweight consumer goods drives the market's expansion. The medical devices industry in China has also seen a rise in the adoption of polycarbonate due to its biocompatibility and transparency. The material is used in the production of switching relays, LCD sections, sensor parts, and other medical components. With the growing aging population and increasing healthcare expenditures, the market for medical devices is expected to grow, leading to increased demand for polycarbonate. The industrial machinery industry in China utilizes polycarbonate for various applications, including vacuum forming and extrusion. Its excellent thermal stability and impact resistance make it suitable for manufacturing industrial machinery components, contributing to the industry's growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2024-2028 |

USD 4.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.6 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Chimei Corp., Covestro AG, Entec Polymers, Ever Best (HK) LTD, Hebei BenJinXin Industrial Co., Ltd, Idemitsu Kosan Co. Ltd., LG Chem Ltd., Lotte Chemical Corp., Luxi Chemical Group Co. Ltd., Mitsubishi Engineering-Plastics Corp., Saudi Basic Industries Corp., Samyang Corp., Shaoxing Mordun Engineering Plastics Technology Co.,ltd, Suzhou OMAY Optical Materials Co. Ltd., Suzhou TOPO New Material Co., Ltd., Teijin Ltd., Trinseo PLC, Wanhua Chemical Group Co. Ltd., and Xiamen Keyuan Plastic Co. Ltd. |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch