Polyurethane Composites Market Size 2024-2028

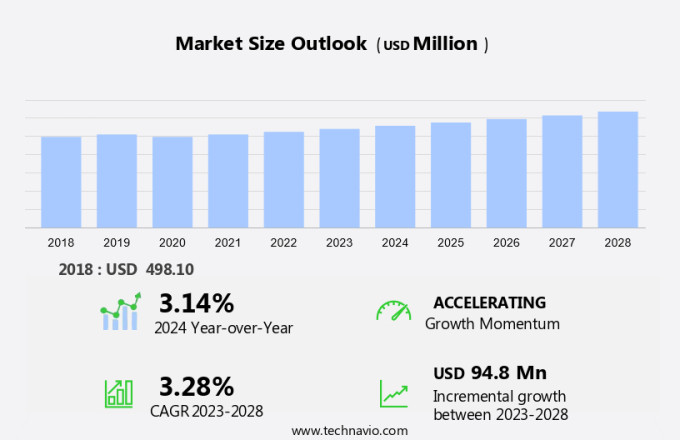

The polyurethane composites market size is forecast to increase by USD 94.8 million, at a CAGR of 3.28% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing demand for lightweight and high-performance materials in various industries, particularly in the automotive sector. This trend is attributed to the superior properties of polyurethane composites, including high strength, durability, and resistance to heat and moisture.

Furthermore, the emergence of bio-based polyurethane composites is gaining momentum due to the growing focus on sustainability and reducing carbon footprints. However, the market faces challenges such as fluctuating crude oil prices, which impact the cost of raw materials, and the high production cost of polyurethane composites compared to traditional materials. Despite these challenges, the market is expected to continue growing due to its numerous advantages and the increasing demand for lightweight and high-performance materials.

Market Analysis

Polyurethane composites are a type of advanced materials known for their high strength, toughness, and excellent insulation performance. They are manufactured using various processes such as lay-up, pultrusion, resin transfer molding, injection molding, and filament winding. These composites are widely used in the production of lightweight materials for semi-structural components in various industries. In the transportation sector, polyurethane composites are extensively used in trunk floors for commercial vehicles and window frame stiffeners for commercial airlines. In the aerospace and defense industry, they are used for manufacturing high-strength and high-modulus beam shear properties for various applications. The use of polyurethane composites is also increasing in the construction industry for the production of lightweight laminate panels and cladding panels.

Glass fiber, PVC window frames, and aluminum are commonly used as reinforcement materials in these composites. However, the use of polyurethane composites is not without challenges. VOC emissions from the production process and the need for continuous pultrusion processes are some of the concerns. Despite these challenges, the demand for lightweight materials with superior properties is driving the growth of the market. The market is expected to grow significantly due to the increasing demand for lightweight materials in various industries. The market is segmented based on the process type, application, and region. The major players in the market include BASF SE, Sika AG, and Covestro AG, among others.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Transportation

- Building and construction

- Electrical and electronics

- Wind power energy

- Others

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By End-user Insights

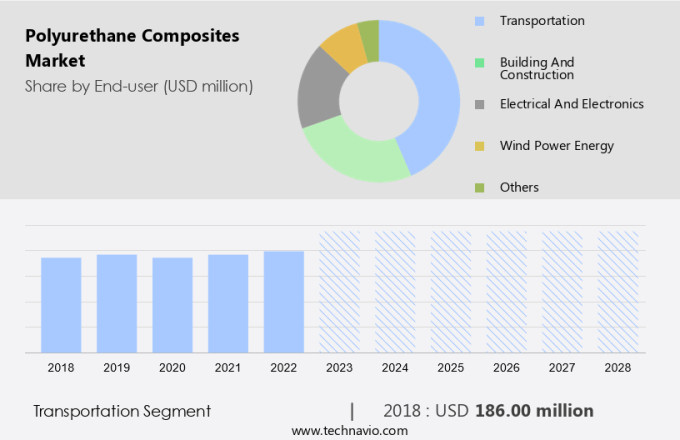

The transportation segment is estimated to witness significant growth during the forecast period. The market encompasses lightweight materials that are gaining popularity in various industries due to their superior strength, durability, flexibility, and resistance to heat and high temperatures. These composites are manufactured using advanced molding technologies such as Lay-up, Pultrusion, Resin transfer molding, Injection molding, and Filament winding. In the automotive sector, these composites are used extensively for manufacturing trunk floors, rear parcel shelves, sunroofs, headliners, semi-structural components, and various exterior and interior parts like pickup truck boxes, floor panels, luggage racks, and inner door panels. The aerospace & defense industry also heavily relies on polyurethane composites for manufacturing window frame stiffeners, lightweight laminate panels, and cladding panels.

However, concerns regarding VOC emissions, reactivity, pot life, and unsaturated polyester resins or vinyl ester resins used in the manufacturing process need to be addressed. Despite these challenges, the market for polyurethane composites is expected to grow significantly due to their unique properties and wide applications in commercial vehicles, commercial airlines, and various industrial applications. Winding technology is also being explored for manufacturing complex shapes and structures from these composites.

Get a glance at the market share of various segments Request Free Sample

The transportation segment was valued at USD 186.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market encompasses lightweight materials that are gaining popularity in various industries due to their superior strength, durability, flexibility, and resistance to heat and high temperatures. The manufacturing processes for these composites include Lay-up, Pultrusion, Resin transfer molding, Injection molding, and Filament winding. These composites are extensively used in the automotive sector for trunk floors, rear parcel shelves, sunroofs, headliners, semi-structural components, and commercial vehicles. In the aerospace and defense industry, they are employed for window frame stiffeners, lightweight laminate panels, and cladding panels. Molding technologies such as Unsaturated Polyester Resins and Vinyl Ester Resins are commonly used, with considerations given to VOC emissions, reactivity, pot life, and unsaturated polyester resins. In the automotive industry, these composites are used for making automotive interior parts like inner door panels and exterior parts like pickup truck boxes, floor panels, and luggage racks. Winding technology is used for manufacturing complex shapes like window frame stiffeners and large structures like trunk floors and rear parcel shelves.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand for PU composites in the automotive industry is the key driver of the market. The market is witnessing significant growth due to the increasing adoption of these materials in various industries, particularly in automotive and construction sectors. PU composites offer numerous advantages such as high-strength, high-modulus, light weight, rigidity, cost efficiency, and ecological responsibility. In the automotive industry, these composites are used extensively in manufacturing components like window frames, bathtubs, light poles, trucks, and off-road vehicles. The use of PU composites in automobiles helps in reducing vehicle weight, improving insulation performance, and enhancing impact strength and toughness. Manufacturing techniques such as vacuum infusion, long-fiber injection, and polyurethane pultrusion are widely used to produce high-performance PU composites.

Further, the continuous pultrusion process is a popular method used to produce continuous fiber-reinforced PU composites. In this process, the reinforcing material is pulled through a resin bath, and the excess resin is removed, resulting in a uniform composite profile. The matrix material, which is usually a high-hardness polyurethane elastomer, provides excellent bonding between the reinforcing material and the composite. PU composites offer new performance benefits, including a high thermal insulation effect, high-tech material properties, and environmentally friendly production methods. The use of glass fiber and PVC window frames, aluminum, and other materials can be replaced with PU composites to enhance their properties while reducing their weight and improving their cost efficiency.

The growing demand for lightweight and high-performance materials in various industries is expected to drive the growth of the PU composites market during the forecast period.

Market Trends

The emergence of bio-based PU composites is the upcoming trend in the market. The market is experiencing significant growth due to the adoption of advanced manufacturing techniques such as vacuum infusion, long-fiber injection, and polyurethane pultrusion. These processes enhance the properties of polyurethane composites, including high-strength, high-modulus, and rigidity. The market is witnessing increased demand from various industries, including automotive, construction, and transportation, for applications such as window frames, bathtubs, light poles, trucks, and off-road vehicles. Polyurethane composites offer superior insulation performance, making them an ideal choice for thermal insulation applications. The use of glass fiber as a reinforcing material and a high-tech elastomer as a matrix material results in composites with excellent impact strength, toughness, and beam shear properties.

Moreover, the continuous pultrusion process ensures consistent product quality and cost efficiency. Moreover, the trend towards ecological responsibility is driving the demand for environmentally friendly and innovative technologies in the market. High-hardness polyurethane elastomers are being used as matrix materials to produce lightweight and high-performance composites. These composites offer new performance benefits, such as improved thermal insulation effect and reduced carbon footprint, making them an attractive alternative to traditional materials like PVC window frames and aluminum.

Market Challenge

Fluctuating crude oil prices is a key challenge affecting market growth. The market encompasses the production and application of these high-tech materials in various industries. Vacuum infusion and long-fiber injection are common manufacturing processes for creating these composites, which utilize glass fiber as the reinforcing material and polyurethane as the matrix material. Applications span across diverse sectors, including window frames, bathtubs, light poles, trucks, and off-road vehicles. The viscosity, impact strength, toughness, and beam shear properties of polyurethane composites offer significant advantages over traditional materials such as PVC window frames and aluminum. These composites exhibit excellent insulation performance, making them high-strength and high-modulus materials. The continuous pultrusion process is used to manufacture these composites, resulting in a lightweight yet strong material with high rigidity and cost efficiency.

However, the thermal insulation effect and ecological responsibility of polyurethane composites make them an attractive alternative to conventional materials. However, the market growth is influenced by the price volatility of crude oil, which is a primary feedstock for producing polyurethane. As crude oil prices rise, the cost of manufacturing these composites increases, compelling end-users to explore eco-friendly alternatives. Innovative technologies, such as polyurethane pultrusion and high-hardness polyurethane elastomers, continue to expand the performance capabilities of these composites, offering new possibilities for various industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BASF SE - The company offers performance materials such as polyamides and polyphthalamides.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Covestro AG

- Dow Inc.

- ELANTAS GmbH

- Henkel AG and Co. KGaA

- Hexcel Corp.

- Huntsman Corp

- Linecross Ltd.

- Mitsui Chemicals Inc.

- Owens Corning

- PPG Industries Inc.

- Rhino Linings Corp.

- Sekisui Chemical Co. Ltd.

- SGL Carbon SE

- SKC

- Toray Industries Inc.

- Wanhua Chemical Group Co. Ltd.

- Webasto SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyurethane composites are a type of advanced materials known for their lightweight properties and high strength. These composites are manufactured using various molding technologies such as lay-up, pultrusion, resin transfer molding, injection molding, and filament winding. The applications of polyurethane composites are vast and include trunk floors, rear parcel shelves, sunroofs, headliners, trays, semi-structural components, and more in the automotive industry. In commercial vehicles and commercial airlines, these composites are used for making window frame stiffeners, lightweight laminate panels, and cladding panels. The aerospace & defense industry is another major end-user of polyurethane composites due to their resistance to heat and high temperatures.

In addition, polyurethane composites are made using unsaturated polyester resins and vinyl ester resins. The molding technology used for manufacturing these composites plays a crucial role in determining their properties such as strength, durability, flexibility, and resistance to heat. The reactivity and pot life of these resins are essential factors that need to be considered during the manufacturing process. However, the use of polyurethane composites comes with certain challenges such as VOC emissions and styrene fumes. Therefore, the focus is on developing eco-friendly and low-emission manufacturing processes to mitigate these issues. Overall, the market for polyurethane composites is expected to grow significantly due to their unique properties and increasing demand from various end-use industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.28% |

|

Market Growth 2024-2028 |

USD 94.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.14 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 48% |

|

Key countries |

US, China, Japan, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BASF SE, Covestro AG, Dow Inc., ELANTAS GmbH, Henkel AG and Co. KGaA, Hexcel Corp., Huntsman Corp, Linecross Ltd., Mitsui Chemicals Inc., Owens Corning, PPG Industries Inc., Rhino Linings Corp., Sekisui Chemical Co. Ltd., SGL Carbon SE, SKC, Toray Industries Inc., Wanhua Chemical Group Co. Ltd., and Webasto SE |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch