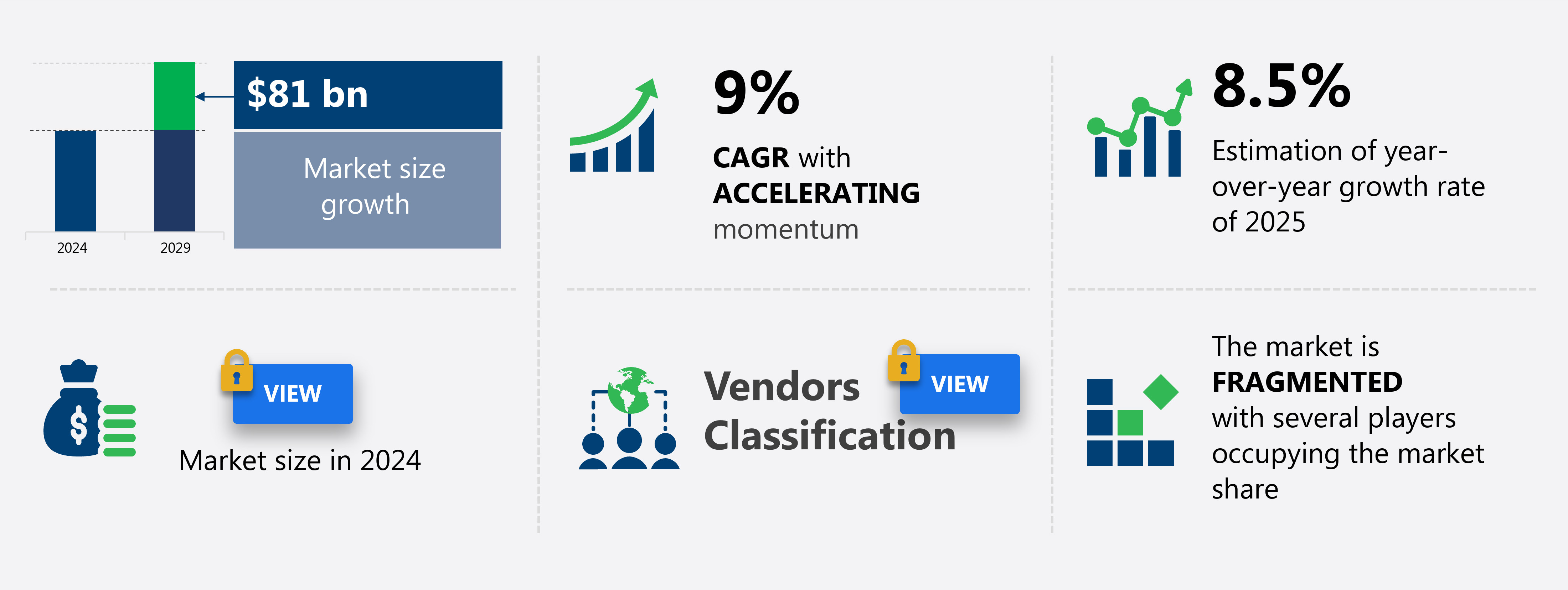

US Automotive Service Market Size 2025-2029

The US automotive service market size is forecast to increase by USD 81 billion, at a CAGR of 9% between 2024 and 2029.

- The automotive service market is experiencing significant growth due to several key factors. The increasing vehicle population, driven by factors such as rising disposable income and urbanization, is leading to a higher demand for automotive services. Additionally, the trend toward vehicle digitization and electric vehicles is creating new opportunities for service providers, as vehicles become more complex and require specialized expertise.

- However, the automotive aftermarket and automotive industry faces uncertainty due to factors such as changing consumer preferences, regulatory pressures, and technological disruptions. Service providers must adapt to these trends and challenges to remain competitive and meet the evolving needs of their customers.

What will be the Size of the market During the Forecast Period?

- The aftermarket automotive services industry encompasses the repair, maintenance, and modification of domestic passenger vehicles and special utility vehicles, including taxis, after the original manufacturer's warranty expires. Market dynamics are influenced by various factors, such as government rules governing emissions and safety standards, the proliferation of connected vehicles, and the rise of electric vehicles. The aging car population necessitates an increasing demand for replacement parts, including batteries, air filters, cabin filters, oil filters, wiper blades, and collision body parts.

- Industry growth is fueled by annual maintenance costs, the adoption of shared mobility services, and the shift toward online sales platforms. Software expertise plays a crucial role in servicing software vehicle systems, from accessories to starters and alternators. Furthermore, mobility fleet sharing and the integration of shared vehicles into the market add complexity to the aftermarket services landscape.

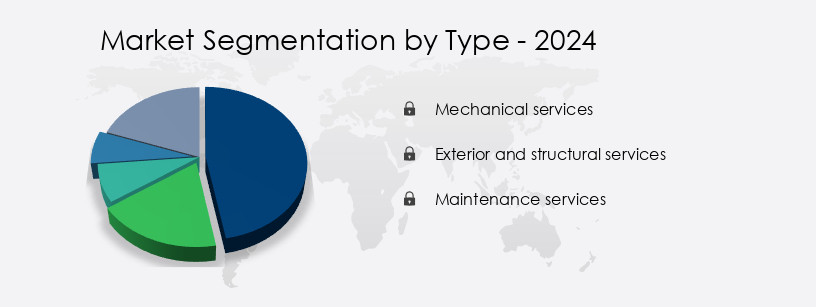

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Mechanical services

- Exterior and structural services

- Maintenance services

- Vehicle Type

- Passenger cars

- Light commercial vehicles

- Two wheelers

- Heavy commercial vehicles

- Propulsion

- Internal combustion engine

- Electric

- Geography

- US

By Type Insights

- The mechanical services segment is estimated to witness significant growth during the forecast period.

The market witnessed substantial expansion In the mechanical services segment in 2023, fueled by the rebound in domestic passenger vehicle sales. This recovery, following the pandemic, marked a record-breaking year for the automotive industry, with sales surpassing pre-pandemic levels. The increase in vehicles on the road heightened the demand for maintenance and repair services, primarily for passenger cars, which constituted over 70% of total global sales. Key factors contributing to this growth include the resurgence in demand for new passenger cars, the rise of electric and connected vehicles, and the emergence of mobility fleet sharing services. The market encompasses various service types, including mechanical, exterior and structural, franchise general repairs, local garage services, tire stores, repair chains, and collision services. The commercial vehicle sector, including light, medium, and heavy commercial vehicles, as well as two wheelers, also presents significant opportunities for growth.

Further, the industry's growth trajectory is influenced by factors such as urbanization, population boom, mergers & acquisitions, facility expansion, and the adoption of new technologies. The market caters to a diverse range of vehicle types and propulsion systems, including internal combustion engines, electric, hybrid, and aging cars. The market offers various aftermarket solutions, such as replacement parts, batteries, air filters, cabin filters, oil filters, wiper blades, collision body parts, starters, alternators, and accessories. The market's future growth is expected to be driven by factors such as increasing annual maintenance costs, the emergence of shared vehicles, and the adoption of predictive maintenance, subscription-based maintenance programs, and software vehicle systems.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our US Automotive Service Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of US Automotive Service Market?

Increasing vehicle population is the key driver of the market.

- The market is experiencing substantial growth due to the expanding vehicle population and high vehicle ownership rates. With over 95 million registered vehicles in 2024, the demand for regular maintenance and repair services is significant. Approximately 90% of American households own at least one vehicle, with 35% having two cars and 30% owning one. This substantial vehicle base necessitates ongoing mechanical, exterior and structural, and engine diagnostics services. Moreover, the emergence of connected vehicles, electric vehicles, mobility fleet sharing, and shared vehicles is driving industry growth. These technological advancements require specialized repair services and replacement parts for vehicle components, including brakes, tires, batteries, air filters, cabin filters, oil filters, wiper blades, and collision body parts.

- The market is also witnessing the adoption of predictive maintenance technologies, subscription-based maintenance programs, and self-driving capabilities. These trends are transforming the automotive service landscape, with a shift towards software expertise, software vehicle systems, and automobile electronics. Additionally, the market is witnessing facility expansion, mergers & acquisitions, and the introduction of new technologies. These developments are enhancing market presence, improving profitability, and data analytics through sensors and other predictive maintenance technologies. Annual maintenance costs for passenger cars, light commercial vehicles, heavy commercial vehicles, two wheelers, domestic passenger vehicles, special utility vehicles, and taxis are driving demand for automotive sales, raw materials, and vehicle customization.

What are the market trends shaping the US Automotive Service Market?

Increasing vehicle digitization and electrification is the upcoming trend In the market.

- The market is experiencing significant growth due to the increasing popularity of connected vehicles, electric vehicles, and mobility fleet sharing. Government rules and regulations are driving the adoption of technologically advanced features, such as engine diagnostics, mechanical, exterior and structural repairs, and software vehicle systems. Domestic passenger vehicles and special utility vehicles are major consumers of aftermarket services, while commercial vehicles, including light, medium, and heavy-duty vehicles, and two wheelers, also require regular maintenance. Aftermarket solutions for vehicle components, such as brakes, tires, batteries, air filters, cabin filters, oil filters, wiper blades, starters, and alternators, are in high demand. The increasing use of internal combustion engines, electric engines, and hybrid vehicles is driving the demand for replacement parts. The aging car population also contributes to the industry's growth, as these vehicles require more frequent maintenance and repairs.

- The market is witnessing mergers and acquisitions, facility expansion, and the entry of new players, including repair chains and local garages, tire stores, and franchise general repairs. The market is also seeing the emergence of subscription-based maintenance programs and predictive maintenance technologies, which enable service providers to offer more personalized and cost-effective services to price-sensitive customers. Data analytics and sensors are playing a crucial role In the industry's growth, enabling service providers to offer more efficient and profitable services. New technologies, such as gear oil, engine oil, and brake oil, are being developed to meet the evolving needs of the market. Auto repair technicians are also being trained to meet the demands of the industry, ensuring that consumers receive high-quality aftermarket services.

What challenges does the US Automotive Service Market face during the growth?

Uncertainty in automotive industry is a key challenge affecting market growth.

- The market is experiencing significant changes due to various factors. Aftermarket services for domestic passenger vehicles, special utility vehicles, and two wheelers are in high demand, with an increasing focus on connected vehicles and electric vehicles. Government rules and regulations, such as automotive safety norms, are driving the industry's growth. The aging car population necessitates annual maintenance costs, leading to a rise in demand for mechanical, exterior and structural repairs, engine diagnostics, and maintenance services. Service centers, local garages, tire stores, and repair chains offer various services, including brakes, tires, and engine diagnostics, for passenger cars, light commercial vehicles, and heavy commercial vehicles.

- The shift towards shared mobility, including taxis and ride-hailing services, has led to the adoption of subscription-based maintenance programs. The industry's growth is influenced by new technologies, such as automobile electronics, connected cars, and self-driving capabilities. Hybrid vehicles and electric vehicle technology are gaining popularity, requiring specialist repair services for replacement parts like batteries, air filters, cabin filters, oil filters, wiper blades, and collision body repairs. Service providers are investing in software expertise and software vehicle systems to offer predictive maintenance technologies and data analytics. Price sensitivity among customers and repair time are critical factors affecting profitability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

AutoNation Inc. - The company offers automotive services such as warranty repair service, engine light diagnosis service, tire rotation and replacement service, and brake service.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alloy Wheel Repair Specialists LLC

- Automotive Service Center

- Belle Tire Distributors Inc.

- Caliber Holdings LLC

- Drivers Tire and Service Center

- Firestone Complete Auto Care

- Hyundai Motor Co.

- Jiffy Lube International Inc.

- Mavis Tires and Brakes

- Meineke Car Care Centers LLC.

- Michelin Group

- Monro Inc.

- Nissan Motor Co. Ltd.

- Pep Boys

- Safelite Group Inc.

- The Goodyear Tire and Rubber Co.

- Toyota Motor Corp.

- USA Automotive

- Walmart Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of offerings, from mechanical repairs and maintenance to the sale of replacement parts and vehicle customization. This sector caters to various types of vehicles, including passenger cars, light commercial vehicles, heavy commercial vehicles, and two wheelers. Government rules and regulations play a significant role in shaping the industry landscape. For instance, automotive safety norms mandate regular inspections and maintenance for vehicles to ensure road safety. Additionally, the adoption of technologically advanced features, such as connected car technologies and self-driving capabilities, is driving the demand for specialized repair services. The advent of electric vehicles and hybrid vehicles is also transforming the industry.

Further, these vehicles require different types of maintenance and repair services compared to internal combustion engine vehicles. Moreover, the increasing popularity of shared mobility services, such as ride-hailing and car-sharing, is leading to higher annual maintenance costs for fleet operators. The industry is witnessing significant growth due to various factors, including the aging of cars, the increasing number of connected vehicles, and the rise of online sales platforms. This growth is evident In the increasing market presence of repair chains, local garages, and franchise general repairs. Price sensitivity among customers is a key consideration for service providers. Repair time and profitability are crucial factors that influence customer satisfaction and loyalty.

To address these challenges, service providers are investing in data analytics and predictive maintenance technologies to optimize their operations and improve customer experience. Subscription-based maintenance programs are gaining popularity among both consumers and fleet operators. These programs offer convenience, cost savings, and peace of mind. Service providers are leveraging software expertise and vehicle systems to offer comprehensive maintenance solutions. The industry is witnessing several trends, including the adoption of new technologies, mergers and acquisitions, and facility expansion. For instance, the increasing use of sensors in vehicles is enabling predictive maintenance, reducing downtime and repair costs. Moreover, the growing popularity of shared mobility services is leading to consolidation In the industry, with repair chains and service providers expanding their offerings to cater to this new market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market Growth 2025-2029 |

USD 81 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.5 |

|

Key countries |

US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.