Portable Speaker Market Size 2025-2029

The portable speaker market size is forecast to increase by USD 26.52 billion at a CAGR of 23% between 2024 and 2029.

- The market is witnessing significant growth due to several key factors. The increasing number of smart homes and the integration of these devices with portable speakers are driving market growth. Moreover, the growing adoption of Bluetooth 5.0 and higher standards for wireless connectivity is making portable speakers more popular. The convenience of using portable speakers with smartphones, laptops, tablets, and online streaming services is also fueling market demand. Additionally, the availability of high-capacity batteries, often using lithium technology, enables longer usage time for these devices. Furthermore, the integration of virtual assistants and microphones in portable speakers enhances their functionality, making them an essential gadget for consumers on the go. The market is also witnessing the rise of audiobooks and podcasts, which are increasingly popular forms of content for portable speakers. However, the easy availability of counterfeit products poses a challenge to market growth, requiring stricter regulations and quality control measures.

What will be the Size of the Portable Speaker Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing popularity of online streaming services and the widespread use of Bluetooth-enabled devices such as smartphones, tablets, and laptops. This market encompasses a range of products, including portable docking speakers, sound bars, and smart speakers, catering to both indoor and outdoor recreational activities. Wi-Fi-based networks and IPx8 water resistance are increasingly important features, enabling users to enjoy their music in various environments. The market size is substantial, with continuous expansion driven by technological advancements and consumer demand. Products in this category include portable Bluetooth speakers, headphones, and microphones, offering convenience and high-quality sound for users on the go.

- The integration of voice assistants and other smart features further enhances the appeal of these devices. Overall, the market is a dynamic and innovative sector, providing consumers with versatile and convenient solutions for accessing and enjoying their content.

How is this Portable Speaker Industry segmented and which is the largest segment?

The portable speaker industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Technology

- Wireless

- Wired

- Connectivity

- Bluetooth

- Hybrid

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- APAC

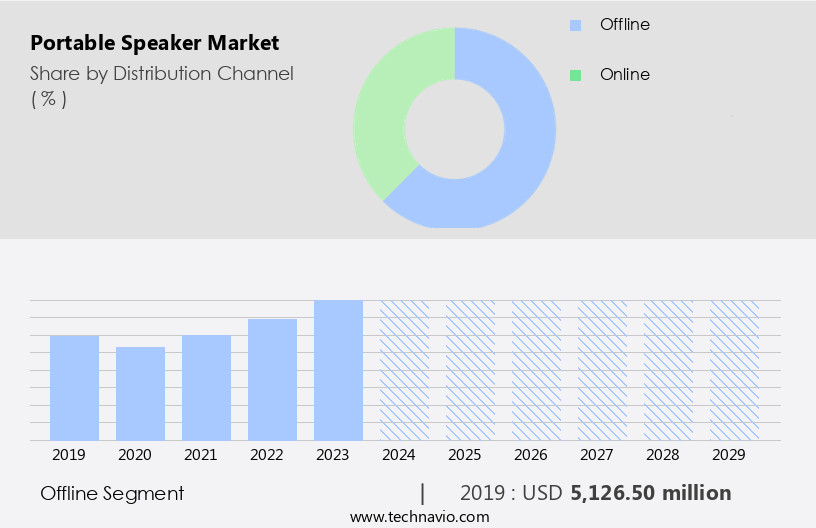

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period. The market encompasses a range of wireless-based audio devices, including Bluetooth speakers, sound bars, portable docking speakers, and smart speakers. These devices cater to various consumer segments, such as tech-savvy young adults, fitness enthusiasts, and professionals, who value portability and convenience. Integration with online streaming services, smartphones, tablets, and laptops is a key feature, enabling users to access music and other audio content seamlessly. Advanced codecs, noise-canceling technologies, and smart assistants like Google Assistant further enhance the user experience. Outdoor recreational activities and Wi-Fi-based networks expand the market's scope. Brands like Yamaha, Skullcandy, and Furrion offer diverse models, such as the Terrain mini, Terrain XL, and Terrain models, catering to different terrains and consumer preferences.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 5.13 billion in 2019 and showed a gradual increase during the forecast period.

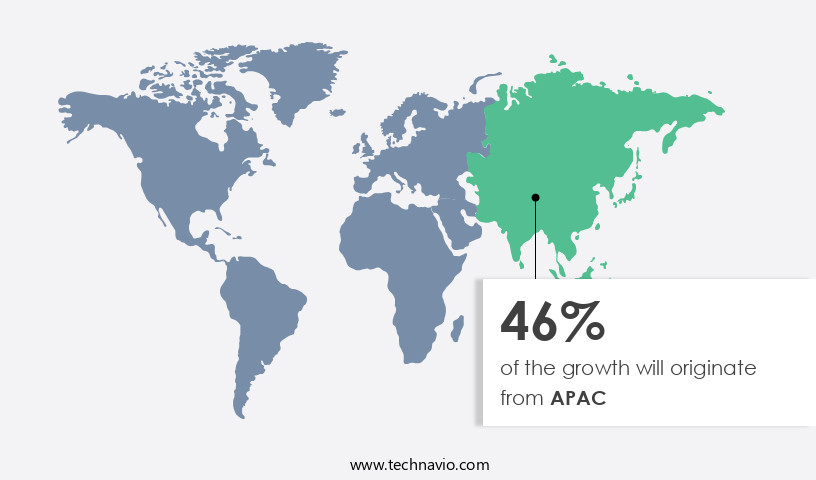

Regional Analysis

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market In the Asia Pacific (APAC) region is experiencing significant growth due to the increasing disposable income and rising popularity of portable speakers. Major tech companies, such as Sony and Samsung Electronics, are based in this region, increasing consumer awareness and driving demand. Online sales channels are also contributing to the market's growth, with consumers purchasing portable speakers for various applications, including outdoor recreational activities and use with smartphones, tablets, laptops, and other Bluetooth-enabled devices.

For more insights on the market size of various regions, Request Free Sample

Advanced features, such as Wi-Fi connectivity, IPX8 water resistance, and integration with online streaming services and smart assistants like Google Assistant, are attracting tech-savvy young adults, fitness enthusiasts, and professionals. Portable Bluetooth speakers, headphones, microphones, and other wireless-based audio devices are becoming essential accessories for modern lifestyles. The market is expected to continue growing, with companies focusing on developing high-quality, long-lasting batteries, advanced codecs, and noise-canceling technologies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Portable Speaker Industry?

- Rise in number of smart homes is the key driver of the market. In today's digitally advanced world, portable audio devices have become indispensable for tech-savvy young adults, fitness enthusiasts, and professionals. The integration of online streaming services with smartphones, tablets, and laptops has fueled the demand for wireless-based audio devices such as portable Bluetooth speakers, headphones, and microphones. These devices offer freedom and convenience, allowing users to enjoy their favorite content on-the-go. Moreover, the trend towards outdoor recreational activities has led to the popularity of portable speakers with IPX8 water resistance, such as Yamaha's Terrain mini and Terrain XL models. These speakers cater to the needs of consumers engaging in various terrains and weather conditions.

- Advanced audio technology, including Bluetooth sig protocols, NFC devices, and infrared technology, ensures seamless connectivity and high-quality sound. Smart speakers with built-in virtual assistants like Google Assistant further enhance the user experience. Battery life and advanced codecs are crucial factors In the selection of portable audio devices. Lithium polymer rechargeable batteries offer longer battery life, while advanced codecs ensure high-definition audio streaming. Wi-Fi-based networks and USBs with card readers enable users to connect their devices to various sources of content, such as laptops and tablets. Some portable speakers even offer additional features like disco lighting and sound bars for an enhanced audio experience.

What are the market trends shaping the Portable Speaker Industry?

- Growing adoption of Bluetooth 5.0 and higher standards is the upcoming market trend. The market is experiencing notable growth due to the increasing popularity of online streaming services and the widespread use of Bluetooth-enabled devices, such as smartphones, tablets, and laptops. Consumers are seeking portable audio solutions for outdoor recreational activities and on-the-go use. Advanced Bluetooth technologies, including Bluetooth sig protocols, NFC devices, and infrared technology, enable seamless connectivity and convenience. Manufacturers like Yamaha, Skullcandy, and Furrion are introducing innovative portable speakers with features such as IPX8 water resistance, advanced codecs, noise canceling technologies, smart assistants like Google Assistant, and long battery life.

- Wi-Fi-based networks and Wi-Fi connection options are also gaining traction In the market, allowing users to stream content from various sources, such as tablets, laptops, and smartphones. Portable docking speakers, sound bars, and wall units with subwoofer systems and in-wall speakers are also gaining popularity for their high-quality audio technology and sleek designs. Lithium polymer rechargeable batteries ensure extended usage time, making these wireless-based audio devices a preferred choice for consumers. The market is expected to continue growing as more consumers seek high-quality, portable audio solutions for their diverse needs.

What challenges does the Portable Speaker Industry face during its growth?

- Easy availability of counterfeit products is a key challenge affecting the industry growth. The market faces significant competition from counterfeit products, particularly In the Asia Pacific region. These unauthorized dealers offer inexpensive alternatives that mimic well-known brands, attracting consumers with their ease of availability. However, these counterfeit devices often fail to connect with Bluetooth-enabled devices, such as smartphones, tablets, and laptops, limiting their functionality. Despite this challenge, the market for portable speakers continues to grow, driven by the increasing popularity of online streaming services and the need for wireless-based audio devices for outdoor recreational activities. Leading manufacturers offer a range of products, including portable docking speakers, sound bars, and smart speakers, with advanced features such as IPX8 water resistance, Bluetooth sig protocols, NFC devices, and infrared technology.

- Tech-savvy young adults, fitness enthusiasts, and professionals all benefit from the convenience and high-quality audio technology of these devices. Companies like Yamaha, Skullcandy, and Furrion offer various models, such as the Terrain mini, Terrain XL, and Terrain models, with varying battery life, advanced codecs, noise canceling technologies, and smart assistant integration, including Google Assistant. These portable Bluetooth speakers, headphones, microphones, and other wireless-based audio devices are a digital, hi-fi solution for consumers seeking a source of content on their smartphones, tablets, laptops, or any Bluetooth-enabled device with a rechargeable battery, such as a lithium polymer one. While the threat of piracy remains a concern, the market's continued growth is driven by the increasing demand for wireless audio devices and the ongoing innovation in audio technology.

Exclusive Customer Landscape

The portable speaker market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the portable speaker market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, portable speaker market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Altec Lansing Inc. - The company offers portable speakers such as Soundbucket XL, Rockbox XL, Mini Lifejacket Jolt, Soundbucket, Lifejacket XL Jolt, and Hydraboom.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Bose Corp.

- Creative Technology Ltd.

- Koninklijke Philips NV

- LG Corp.

- Logitech International SA

- Masimo Corp.

- Panasonic Holdings Corp.

- Pioneer Corp.

- Plantronics Inc.

- Samsung Electronics Co. Ltd.

- Sennheiser Electronic GmbH and Co. KG

- Shure Inc.

- Skyworks Solutions Inc.

- Sony Group Corp.

- ZAGG Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, fueled by the increasing popularity of online streaming services and the widespread use of Bluetooth-enabled devices such as smartphones, tablets, and laptops. These wireless-based audio devices have become essential companions for individuals engaging in outdoor recreational activities, allowing them to enjoy their favorite music and media on-the-go. Manufacturers have responded to this trend by introducing innovative products that cater to various consumer needs. For instance, some portable speakers are designed for use in rugged terrains, boasting IPX8 water resistance and advanced codecs for high-quality audio. Other models prioritize battery life, offering extended playtime for tech-savvy young adults and fitness enthusiasts.

Moreover, the advent of smart speakers has added a new dimension to the market. These devices integrate advanced technologies such as noisecanceling technologies, smart assistants like Google Assistant, and Bluetooth Sig protocols, making them versatile tools for professionals and home users alike. Furthermore, the emergence of NFC devices and infrared technology has simplified the process of pairing portable speakers with Bluetooth-enabled devices, enhancing user experience. The market also offers a range of wireless-based audio devices, including portable docking speakers, sound bars, and even subwoofer systems, catering to diverse consumer preferences. The market is expected to continue its growth trajectory, driven by the increasing demand for high-quality audio devices that offer convenience, portability, and advanced features.

Furthermore, the market dynamics are influenced by factors such as evolving consumer preferences, technological advancements, and competitive pricing strategies. Portable speakers come in various sizes, with some models weighing only a few ounces, while others can weigh several kilos. Yamaha, Skullcandy, and Furrion are among the leading brands In the market, offering a range of portable speakers that cater to different consumer segments. The market for portable speakers is diverse, with applications ranging from personal use to professional settings. These devices have become essential tools for individuals who value high-quality audio and the freedom to enjoy it anywhere, anytime.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23% |

|

Market growth 2025-2029 |

USD 26.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

18.2 |

|

Key countries |

US, China, Japan, Germany, UK, Canada, India, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Portable Speaker Market Research and Growth Report?

- CAGR of the Portable Speaker industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the portable speaker market growth of industry companies

We can help! Our analysts can customize this portable speaker market research report to meet your requirements.