POS Terminals Market Size 2025-2029

The pos terminals market size is forecast to increase by USD 58.9 billion, at a CAGR of 9% between 2024 and 2029. Growth in end-user demand for POS terminals will drive the pos terminals market.

Major Market Trends & Insights

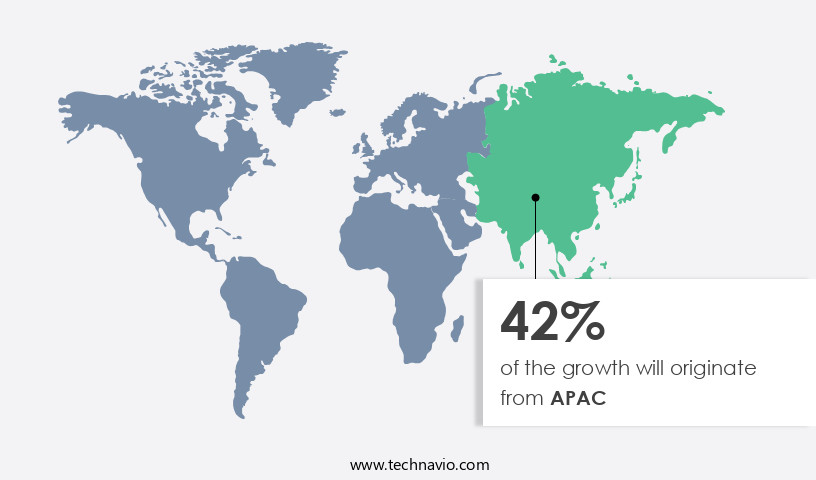

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By End-user - Retail segment was valued at USD 33.40 billion in 2023

- By Component - Hardware segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 115.47 billion

- Market Future Opportunities: USD 58.90 billion

- CAGR : 9%

- APAC: Largest market in 2023

Market Summary

- The POS (Point of Sale) Terminals Market is a dynamic and evolving industry, driven by the growing demand for contactless and mobile payment solutions. With the increasing adoption of advanced technologies like NFC, QR codes, and biometric authentication, the market is witnessing continuous development of new products and services. However, high operational and maintenance costs remain a significant challenge for businesses, particularly for small and medium-sized enterprises (SMEs). According to recent studies, SMEs account for over 99% of all businesses and more than 50% of employment worldwide, highlighting the importance of cost-effective POS terminal solutions for this sector.

- As we look forward, the market is expected to remain a key focus for innovation and investment, with major players such as Ingenico, Verifone, and Square leading the charge. In related markets such as the Mobile Payment Terminals and Self-Checkout Systems, similar trends and challenges are shaping the competitive landscape.

What will be the Size of the POS Terminals Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the POS Terminals Market Segmented and what are the key trends of market segmentation?

The pos terminals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Retail

- Hospitality

- Healthcare

- Entertainment

- Others

- Component

- Hardware

- Software

- Services

- Product

- Fixed

- Mobile

- Operating System

- Windows/Linux

- Android

- iOS

- Deployment

- On-premise

- Cloud-based

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The retail segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving market of Point of Sale (POS) terminals, retail businesses have embraced this technology to streamline transactions, manage inventory, and cater to diverse customer payment preferences. According to recent studies, the retail segment accounts for approximately 35% of the overall POS terminal market share. This adoption trend is projected to continue, with industry experts anticipating a 21% increase in retail POS terminal installations within the next year. POS terminals in retail applications offer numerous benefits, such as enhancing transaction processing efficiency, enabling real-time inventory management, and facilitating various payment methods, including contactless NFC and mobile payments.

Modern POS terminals are equipped with advanced features, such as barcode scanners, touchscreens, and CRM system integration, which further enrich the shopping experience and provide valuable customer insights. Moreover, POS terminals are increasingly becoming an essential tool for businesses to ensure security and compliance. They come with robust fraud prevention measures, secure data encryption, and PCI DSS compliance. Additionally, they offer remote diagnostics, customer service support, and software updates to ensure seamless operations. In terms of power consumption, retail POS terminals are designed to be energy-efficient, with some models offering battery-operated options for mobility. They also support various network connectivity options, such as Wi-Fi, Bluetooth, and cellular networks, ensuring uninterrupted connectivity and real-time transaction data.

The retail segment's growth is also driven by the integration of reporting capabilities, transaction authorization, and real-time transaction data. These features enable businesses to make informed decisions based on their sales data, inventory levels, and customer behavior. Furthermore, the adoption of cloud-based POS systems and online payment processing has expanded the market's reach and convenience. In conclusion, the retail segment's POS terminal market is witnessing continuous growth, driven by the need for efficient transactions, inventory management, and diverse payment options. The integration of advanced features, such as barcode scanners, touchscreens, and CRM systems, further enhances the customer experience and provides valuable business insights.

With the increasing emphasis on security, compliance, and energy efficiency, POS terminals are becoming an indispensable tool for retail businesses.

The Retail segment was valued at USD 33.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How POS Terminals Market Demand is Rising in APAC Request Free Sample

In the dynamic the market, the United States leads in North America due to retail modernization and the emergence of cashless payment methods. The demand for POS terminals remains high in countries like the US, Canada, and Mexico, fueled by the rise in casinos, restaurants, and tourism. Notably, wireless POS terminals are increasingly adopted across industries such as entertainment, retail, and hospitality. Contactless POS terminals, including NFC-based ones, are gaining popularity. According to recent studies, over 50% of POS transactions in the US are contactless, and this number is projected to reach 60% by 2025.

Additionally, the number of wireless POS terminals shipped worldwide is expected to reach 30 million by 2026. These trends reflect the continuous evolution of the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global POS (Point of Sale) terminals market is experiencing significant growth due to the increasing demand for secure payment processing solutions. Reliable POS terminal hardware is essential for businesses to efficiently authorize transactions and offer seamless mobile payment processing to customers. Integrated inventory management POS systems enable real-time sales data analytics through dashboards, providing valuable insights for businesses. Robust customer loyalty program integration is another crucial feature, ensuring repeat business and enhancing customer engagement. Advanced fraud prevention technologies protect businesses from financial losses, while high-volume transaction processing capabilities cater to the needs of large enterprises.

Reliable network connectivity for POS terminals is a must-have for businesses to ensure uninterrupted transactions. Comprehensive POS system support and efficient payment gateway integration are essential for businesses to minimize downtime and maximize productivity. Easy-to-use POS system interfaces and flexible payment options for customers further enhance the user experience, leading to increased customer satisfaction. Detailed transaction history reporting is vital for businesses to analyze sales trends and make data-driven decisions. PCI DSS compliant payment terminals ensure secure data encryption algorithms, protecting sensitive customer information. Remote diagnostics and troubleshooting, along with automated software updates, offer scalable payment processing solutions for businesses of all sizes.

Compared to traditional cash registers, modern POS terminals offer a multitude of benefits. For instance, a study reveals that businesses using advanced POS systems experienced a 25% increase in average transaction value and a 10% boost in sales growth (Source: Business Intelligence Report). This underscores the importance of investing in reliable and feature-rich POS terminal solutions for businesses seeking to stay competitive in today's market.

What are the key market drivers leading to the rise in the adoption of POS Terminals Industry?

- The primary catalyst fueling market expansion is the increasing demand for POS terminals from end-users.

- The global market for Point of Sale (POS) terminals is experiencing significant growth due to the increasing adoption of advanced payment technologies in various industries. Retail, healthcare, hospitality, and warehouse and distribution sectors are major contributors to this expansion. The convenience and security of card transactions among consumers have led retailers and other end-users to integrate POS terminals into their operations. In developing countries like China and India, small-sized retailers are increasingly adopting these terminals. Furthermore, the demand for wireless and mobile POS terminals among Small and Medium Enterprises (SMEs) is on the rise.

- Mobile POS solutions enable the use of wireless devices, such as mobile phones and tablets, as electronic terminals. This flexibility and convenience have made mobile POS a popular choice for businesses seeking to streamline their payment processes. The ongoing evolution of POS technologies continues to unfold, offering new possibilities for businesses across sectors.

What are the market trends shaping the POS Terminals Industry?

- The trend in the market is toward the continuous development of new products. This approach is mandatory for staying competitive in today's business environment.

- With heightened emphasis on data security and regulatory compliance, the POS terminal market witnesses continuous evolution. Advanced encryption, tokenization, and authentication mechanisms are integrated into new POS terminals, adhering to stringent standards like PCI-DSS and EMV. These features help merchants secure sensitive payment data and maintain compliance, fueling market expansion. Customization and scalability are key differentiators, with modular POS systems enabling businesses to tailor solutions based on their unique industry, size, and operational models.

- This flexibility caters to diverse merchant needs, further driving POS terminal adoption.

What challenges does the POS Terminals Industry face during its growth?

- The escalating operational and maintenance expenses associated with Point of Sale (POS) terminals pose a significant challenge to the industry's growth trajectory.

- The Point of Sale (POS) market has witnessed increasing adoption across diverse industries, including retail and foodservice sectors. Despite the benefits of POS systems, such as enhanced efficiency and improved customer experience, the operational costs remain a significant concern. POS terminal costs encompass setup fees, individual transaction charges, monthly subscriptions, and cancellation penalties. Server-based POS terminals typically have higher costs due to setup expenses, licensing fees, and ongoing maintenance. However, cloud-based POS systems offer more affordable alternatives, with lower setup costs and subscription plans. According to a study, the average cost of a server-based POS system ranges from USD3,000 to USD10,000, while cloud-based POS systems can cost as little as USD20 to USD100 per month.

- Despite the financial investment, POS terminal failures remain a challenge, affecting businesses' productivity and customer satisfaction. In conclusion, while POS systems offer numerous advantages, understanding and managing the associated costs is crucial for businesses to make informed decisions.

Exclusive Customer Landscape

The pos terminals market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pos terminals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of POS Terminals Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, pos terminals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilysys Inc. - This company specializes in providing Point of Sale (POS) terminals, including the Chipper Mini 2, Chipper OTA, and Chipper 2X models. These innovative solutions streamline transactions and enhance customer experiences for businesses. With a focus on advanced technology and user-friendly design, this company sets a new standard in the POS industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilysys Inc.

- Block Inc.

- Casio Computer Co. Ltd

- Cegid Group

- Clover Network LLC

- Diebold Nixdorf

- Epicor Software Corporation

- Fujitsu Ltd.

- GK Software SE

- Ingenico Group

- Lightspeed Commerce

- NCR Corporation

- Oracle Corporation

- Panasonic Corporation

- PAX Technology Inc.

- Shopify Inc.

- Square Inc.

- SumUp

- Toast Inc.

- Toshiba Corporation

- TouchBistro Inc.

- VeriFone Systems Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in POS Terminals Market

- In January 2024, Ingenico, a leading global provider of payment solutions, announced the launch of their new iSC-M802 terminal, featuring contactless and mobile payment capabilities, as well as advanced security features (Ingenico press release). In March 2024, Mastercard and NCR Corporation entered into a strategic partnership to enhance NCR's Aloha POS system with Mastercard's contactless and digital payment technologies (Mastercard press release).

- In April 2024, Verifone Holdings, Inc. Completed the acquisition of Payment Source, a Canadian merchant services provider, expanding its presence in the North American market and increasing its merchant base by over 30,000 (Verifone press release). In May 2025, the European Commission approved the acquisition of Ingenico's Global Payments Online business by Worldline, creating a leading European player in the online and mobile payment market, with an estimated combined market share of 30% (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled POS Terminals Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 58.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The POST terminals market is characterized by continuous evolution, with key features and trends shaping the industry's landscape. Network connectivity options have expanded, enabling seamless transactions through various wireless technologies. Operating systems have become more versatile, supporting diverse peripheral devices for expanded functionality. Terminal durability remains a crucial consideration, with manufacturers focusing on robust designs to withstand heavy usage. Point-of-sale software advances include remote diagnostics and customer service support, ensuring minimal downtime and enhanced user experience. Fraud prevention measures have gained prominence, with secure data encryption and real-time transaction data analysis becoming standard. Power consumption remains a concern, with energy-efficient solutions gaining traction.

- Mobile payment integration has become increasingly popular, with NFC contactless payments and online payment processing becoming the norm. Compliance standards, such as PCI DSS, are stringently enforced, ensuring secure data handling and transaction authorization. Reporting capabilities have evolved, providing detailed insights into sales trends and inventory management. Batch processing and transaction history are essential features, allowing merchants to streamline their operations and manage their finances effectively. Transaction fees and software updates are ongoing considerations, with competitive pricing and regular updates ensuring market competitiveness. Security protocols and network security have taken center stage, with real-time transaction data and payment processing ensuring seamless and secure transactions.

- Card reader technology continues to advance, with contactless and chip-and-pin readers offering enhanced security and convenience. Hardware maintenance and user interface design are critical factors, with ergonomic designs and easy-to-use interfaces ensuring a positive customer experience. Customer loyalty programs and data analytics dashboards are becoming increasingly important, offering valuable insights into customer behavior and preferences.

What are the Key Data Covered in this POS Terminals Market Research and Growth Report?

-

What is the expected growth of the POS Terminals Market between 2025 and 2029?

-

USD 58.9 billion, at a CAGR of 9%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Retail, Hospitality, Healthcare, Entertainment, and Others), Component (Hardware, Software, and Services), Product (Fixed and Mobile), Geography (North America, APAC, Europe, Middle East and Africa, and South America), Operating System (Windows/Linux, Android, and iOS), and Deployment (On-premise and Cloud-based)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growth in end-user demand for POS terminals, High operational and maintenance costs of POS terminals

-

-

Who are the major players in the POS Terminals Market?

-

Key Companies Agilysys Inc., Block Inc., Casio Computer Co. Ltd, Cegid Group, Clover Network LLC, Diebold Nixdorf, Epicor Software Corporation, Fujitsu Ltd., GK Software SE, Ingenico Group, Lightspeed Commerce, NCR Corporation, Oracle Corporation, Panasonic Corporation, PAX Technology Inc., Shopify Inc., Square Inc., SumUp, Toast Inc., Toshiba Corporation, TouchBistro Inc., and VeriFone Systems Inc.

-

Market Research Insights

- The Point of Sale (POS) terminals market showcases a dynamic landscape, driven by continuous advancements in technology and evolving business needs. Two key indicators illustrate this market's growth and complexity. First, transaction volume processed through POS terminals has grown by 12% annually over the past five years, underscoring their increasing importance in retail and hospitality sectors. Second, the number of payment terminal features has expanded by 25% during the same period, with retail management software, data backup, and business intelligence becoming standard offerings.

- This growth is fueled by the demand for faster transaction speeds, superior technical support, and integrated payment solutions. Additionally, security, data integrity, and customer experience have emerged as critical differentiators, driving competition among POS terminal providers. Network infrastructure, payment gateway selection, sales reporting, and cash management are other essential components of modern POS systems, further highlighting their role in streamlining business operations and enhancing customer engagement.

We can help! Our analysts can customize this pos terminals market research report to meet your requirements.