Potassium Sorbate Market Size 2024-2028

The potassium sorbate market size is forecast to increase by USD 59 million at a CAGR of 5.26% between 2023 and 2028. Potassium sorbate is a widely used preservative in various industries, including skincare, hair care, and toiletry items, as well as packaged vegan foods and convenience foods. The market for potassium sorbate is driven by the increasing demand for preservatives that prevent microbiological decomposition in these products. Additionally, the versatility of potassium sorbate in various applications contributes to its market growth. However, there are concerns regarding potential allergic reactions to this preservative, which may limit its usage in some personal care and food products. From a sustainability perspective, the market is shifting towards the use of natural and sustainable preservatives, which could pose a challenge to the growth of the market.

Potassium sorbate is a widely used preservative in various industries, including food and beverage, personal care, pharmaceuticals, and industrial applications. This chemical additive is known for its effectiveness in inhibiting microbial growth, thereby extending the shelf life of products and ensuring food safety. Health conscious consumers are increasingly influencing food manufacturers, who must adapt to nutritional preferences, comply with food safety regulations, and offer organic products to meet demand, while also addressing toxicity Concerns and considering genetic aptitude in product formulations. In the food and beverage sector, potassium sorbate plays a significant role in preserving convenience meals, processed foods, and packaged foods. Its primary function is to prevent microbiological decomposition, which is essential for maintaining the quality and safety of these products.

The use of potassium sorbate as a preservative is particularly important in the production of convenience foods, where long shelf life is a critical factor. Food safety is a top priority in the food and beverage industry, and the use of potassium sorbate as a preservative contributes significantly to ensuring product safety. This chemical additive is generally recognized as safe (GRAS) by regulatory bodies, including the US Food and Drug Administration (FDA). However, it is essential to note that excessive consumption of potassium sorbate may cause health issues, such as gastrointestinal disturbances and allergic reactions in some individuals.

Market Segmentation

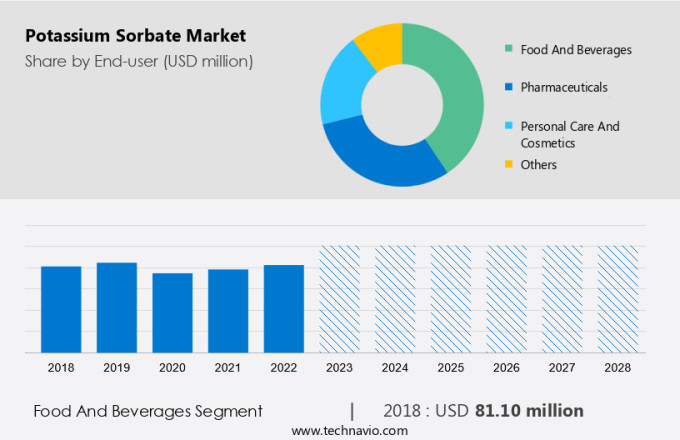

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food and beverages

- Pharmaceuticals

- Personal care and cosmetics

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By End-user Insights

The Food and beverages segment is estimated to witness significant growth during the forecast period. Potassium sorbate is a widely used chemical additive in various industries, including food and pharmaceuticals, for germ protection. In the food industry, particularly in the US, it holds a significant market share, especially in the food and beverage sector. This segment is anticipated to witness the fastest growth during the forecast period. The Food and Agriculture Organization (FAO) and the World Health Organization (WHO) endorse potassium sorbate as a safe and effective preservative. It is extensively employed in dairy products such as cheese, yogurt, processed meat, fish, pickles, wine, dried meats, apple cider, soft drinks, and fruit drinks.

Additionally, it functions as a nutritional agent in food and beverage production. In the pharmaceutical sector, potassium sorbate is used in granule, powder, and liquid form for mold inhibition. Its application extends to industrial usage, where it is used as a preservative in various applications.

Get a glance at the market share of various segments Request Free Sample

The food and beverages segment was valued at USD 81.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market held a significant share in 2023. The Food Processing Industry's reliance on Potassium Sorbate as a preservative, approved by the Food and Drug Administration (FDA) as a Generally Recognized as Safe (GRAS) ingredient, fuels its usage across various end-use sectors. These include dairy and baked goods, fruits and vegetables, fat emulsion products, sugar and confectioneries, and certain meat and fish. Government approvals, such as the US Environmental Protection Agency (EPA) and FDA's authorization for the use of Potassium Sorbate in cosmetics and self-care products, as well as pharmaceutical applications, further boost the market's expansion during the forecast period.

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased demand for potassium sorbate in processed food is the key driver of the market. Potassium sorbate is a commonly utilized preservative in the food and beverage industry to inhibit microbial growth and extend shelf life. This chemical compound effectively prevents the growth of fungus, mold, yeast, and bacteria in food and beverages without altering their taste, color, or smell.

Furthermore, its affordability and ease of availability make it a popular choice for manufacturers of convenience meals and processed foods. The escalating demand for these types of products is driving the market growth for potassium sorbate. This preservative plays a crucial role in ensuring food safety and maintaining the quality of consumables over an extended period.

Market Trends

Diversified applications is the upcoming trend in the market. Potassium sorbate is a widely utilized preservative in various industries, including food and beverage, cosmetics, and pharmaceuticals. In the food sector, it is commonly found in packaged goods such as canned fruits and vegetables, meat, desserts, and dairy products like cheese, ice cream, and yogurt. Its primary function is to prevent microbiological decomposition, ensuring the longevity and safety of these products. Beyond food applications, potassium sorbate is also employed in the cosmetics and personal care industry for skincare, hair care, and toiletry items. Its use in these products contributes to their preservation and enhances their shelf life. Moreover, it is a sustainable alternative to traditional preservatives, making it an attractive option for businesses and consumers seeking eco-friendly solutions.

Furthermore, the beverage industry also benefits from potassium sorbate, as it acts as a stabilizer, preventing secondary fermentation and reinfection. This is crucial for maintaining the consistency and quality of beverages. In the realm of personal care, it is used in various products like shampoos, lotions, and creams, contributing to their stability and effectiveness. Potassium sorbate's versatility extends to the pharmaceutical industry, animal feed, surfactants, and detergents, further underscoring its importance in diverse applications. In the wine industry, it plays a role in the fermentation process, ensuring a consistent and high-quality final product. Overall, potassium sorbate is an essential ingredient in numerous industries, contributing to the production of safe, stable, and high-quality products.

Market Challenge

Allergic reaction caused by potassium sorbate is a key challenge affecting the market growth. Potassium sorbate is a widely used preservative in various industries, including food and beverages, pharmaceuticals, and cosmetics. However, excessive usage of this ingredient can lead to adverse health effects, such as allergic reactions, skin irritation, itchy scalp, and allergies. These side effects can negatively impact consumer preference and trust, leading to a decrease in demand for products containing high levels of potassium sorbate. To mitigate these risks, the use of clean label ingredients and natural preservatives is gaining popularity. Sanitation and food preservation techniques, such as encapsulation, are being employed to ensure product consistency and maintain quality assurance.

Furthermore, these methods help to reduce the need for synthetic preservatives like potassium sorbate, making food and beverage products safer and more appealing to consumers. Foodborne illnesses pose a significant challenge to the global food industry, and the use of effective preservatives is crucial to prevent contamination and ensure food safety. However, the potential health risks associated with potassium sorbate necessitate a careful approach to its usage. By adopting innovative preservation techniques and natural alternatives, the industry can address consumer concerns while maintaining product quality and safety.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Titan Biotech Ltd. - The company offers potassium sorbate in 25gms and 500gms packages.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anant Pharmaceuticals Pvt. Ltd.

- Anmol Chemicals Group

- APAC Chemical Corp.

- Astrra Chemicals

- ATP Group

- BIMAL PHARMA PVT. LTD.

- Celanese Corp.

- Chemball HangZhou Chemicals Co. Ltd.

- CNK Fragrances Pvt. Ltd.

- FBC Industries Inc.

- Hawkins Watts Ltd.

- Jinneng Science and Technology Co. Ltd.

- LUBON INDUSTRY Co. LTD.

- Manus Aktteva Biopharma LLP

- REJOICE LIFE INGREDIENTS

- SHANGHAI NICECHEM CO. LTD.

- Spectrum Laboratory Products Inc.

- Tianjin Haitong Chemical Industrial Co. Ltd.

- Wanglong Tech Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Potassium sorbate is a widely used preservative in the food and beverage industry for microbial growth inhibition. It effectively extends the shelf life of various products, including convenience meals and processed foods, by preventing microbiological decomposition. This natural preservative, derived from sorbic acid, is increasingly preferred by health-conscious consumers due to its clean label status and natural origin. Food safety is a top priority in the production of packaged and convenience foods. Potassium sorbate plays a crucial role in ensuring product consistency and quality assurance by inhibiting the growth of yeast, molds, and bacteria. It is also used in the food processing industry for mold inhibition in baked goods, wine, and beverages to prevent secondary fermentation.

Furthermore, beyond food applications, potassium sorbate is also used in skincare, hair care, and toiletry items as a preservative. Its versatility extends to industrial usage in pharmaceutical products and ecommerce applications for product stability. The use of potassium sorbate as a sustainable preservative in clean label products is gaining popularity due to consumer demand for natural ingredients and health benefits. However, concerns regarding toxicity and potential health issues persist, necessitating ongoing research and development in encapsulation techniques for effective delivery and minimizing exposure.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.26% |

|

Market Growth 2024-2028 |

USD 59 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.7 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 42% |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Anant Pharmaceuticals Pvt. Ltd., Anmol Chemicals Group, APAC Chemical Corp., Astrra Chemicals, ATP Group, BIMAL PHARMA PVT. LTD., Celanese Corp., Chemball HangZhou Chemicals Co. Ltd., CNK Fragrances Pvt. Ltd., FBC Industries Inc., Hawkins Watts Ltd., Jinneng Science and Technology Co. Ltd., LUBON INDUSTRY Co. LTD., Manus Aktteva Biopharma LLP, REJOICE LIFE INGREDIENTS, SHANGHAI NICECHEM CO. LTD., Spectrum Laboratory Products Inc., Tianjin Haitong Chemical Industrial Co. Ltd., Titan Biotech Ltd., and Wanglong Tech Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch