India Power Tiller Market Size 2025-2029

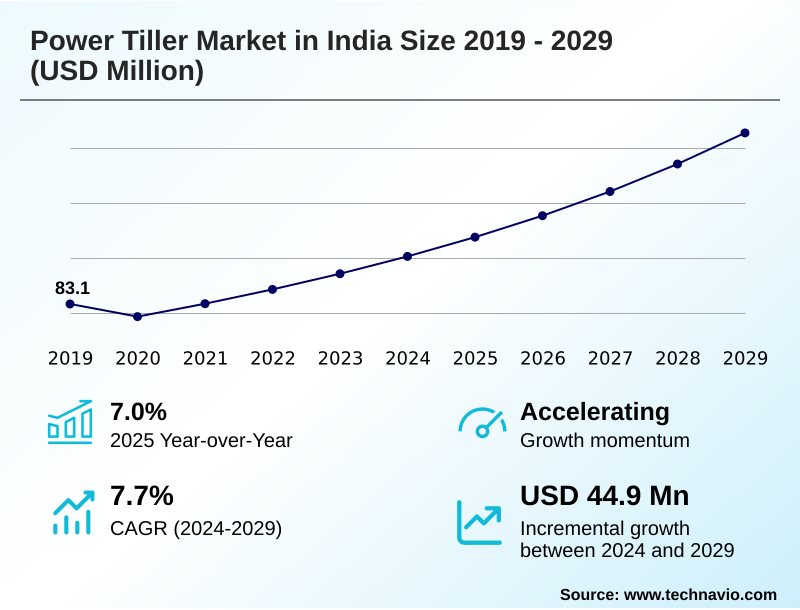

The india power tiller market size is valued to increase by USD 44.9 million, at a CAGR of 7.7% from 2024 to 2029. Increasing shortage of labor and wage rates will drive the india power tiller market.

Major Market Trends & Insights

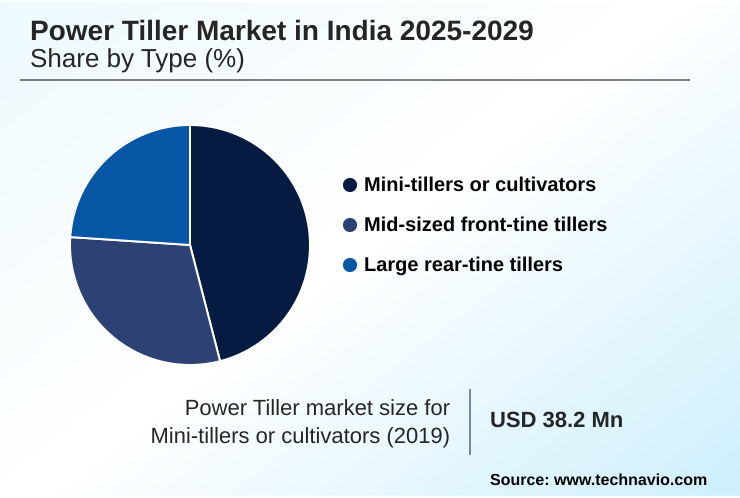

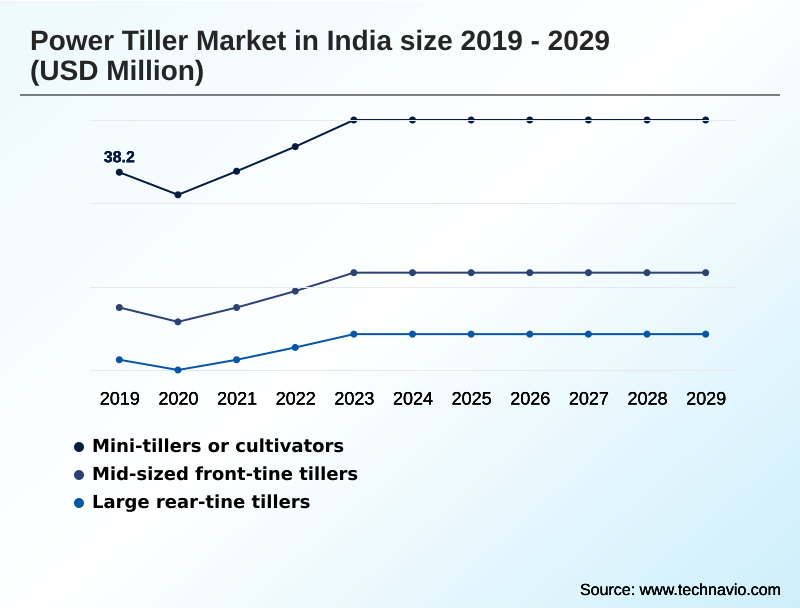

- By Type - Mini-tillers or cultivators segment was valued at USD 43.3 million in 2023

- By Product - Gasoline or diesel powered segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 62.2 million

- Market Future Opportunities: USD 44.9 million

- CAGR from 2024 to 2029 : 7.7%

Market Summary

- The power tiller market in India is pivotal to the country's push toward advanced farm mechanization, addressing critical gaps left by traditional farming methods. The transition to mechanized agriculture is fueled by a persistent labor shortage and the economic imperative to boost agricultural productivity on small landholdings.

- Power tillers offer a practical solution, providing the necessary engine horsepower for demanding cultivation tasks in varied topographies, including hilly terrains. Trends such as precision agriculture are driving demand for models with multi-functional attachments, including the reaper binder for harvesting.

- For instance, a farming cooperative can optimize its operational efficiency by deploying a fleet of diesel-powered tillers for synchronized soil preparation, using shared maintenance schedules to ensure high uptime and effective crop rotation planning. This approach improves land preparation timelines and supports sustainable farming.

- However, the high initial cost of equipment like a rear-tine tiller remains a significant consideration for individual farmers, influencing purchasing decisions and promoting the exploration of collective ownership models to leverage these essential agricultural machinery.

What will be the Size of the India Power Tiller Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the India Power Tiller Market Segmented?

The india power tiller industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Mini-tillers or cultivators

- Mid-sized front-tine tillers

- Large rear-tine tillers

- Product

- Gasoline or diesel powered

- Electric powered

- Capacity

- 40-80 cm

- Below 40 cm

- Above 80 cm

- Geography

- APAC

- India

- APAC

By Type Insights

The mini-tillers or cultivators segment is estimated to witness significant growth during the forecast period.

The mini-tillers or cultivators segment is gaining significant traction, driven by its suitability for precision agriculture on small landholdings. These machines are engineered for superior maneuverability, offering efficient soil preparation and inter-cultivation in narrow fields where larger equipment is impractical.

Key drivers include labor shortages and the need for enhanced operational efficiency, which has accelerated the adoption of mechanized solutions. Mini-tillers are particularly effective for horticulture applications, where their adjustable tilling depth allows for precise seed bed preparation.

The integration of ergonomic design principles has also improved operator comfort, leading to a 15% increase in daily usage duration in certain user studies. This segment is critical for advancing farm mechanization across fragmented agricultural landscapes.

The Mini-tillers or cultivators segment was valued at USD 43.3 million in 2023 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- Evaluating the right power tiller for small farms involves a detailed assessment of operational needs and long-term value. A crucial consideration is balancing the initial purchase price against projected power tiller maintenance costs.

- The debate over rear-tine tiller vs front-tine often centers on soil conditions, where the performance of a diesel tiller for heavy soil must be weighed against the agility of a lighter model. For specialized agriculture, the electric power weeder efficiency and the suitability of a mini tiller for horticulture become paramount.

- The effectiveness of a rotary tiller for seedbed preparation directly influences germination, while a power tiller for inter-cultivation is vital for maintaining row crops. Challenges such as power tiller spare parts availability can significantly impact uptime, making after-sales support a key purchasing factor.

- When considering a gasoline tiller for sloped terrain, the power tiller fuel consumption rate is a critical metric for managing operational expenses. Similarly, selecting the best tiller for wetland farming requires features that prevent bogging. For smaller tasks, a lightweight power tiller for gardening or a compact tiller for urban farming offers convenience.

- The versatility of a power tiller with reaper attachment or a PTO shaft for agricultural implements enhances ROI. Even emerging practices like tiller for no-till farming are shaping demand. A high horsepower diesel tiller is ideal for large-scale vegetable farming. Ultimately, the impact of farm mechanization subsidy impact is a significant factor in making this technology accessible.

- A comparative analysis shows that farms standardizing their equipment achieve a 25% faster turnaround on maintenance compared to those using mixed fleets, streamlining operational planning.

What are the key market drivers leading to the rise in the adoption of India Power Tiller Industry?

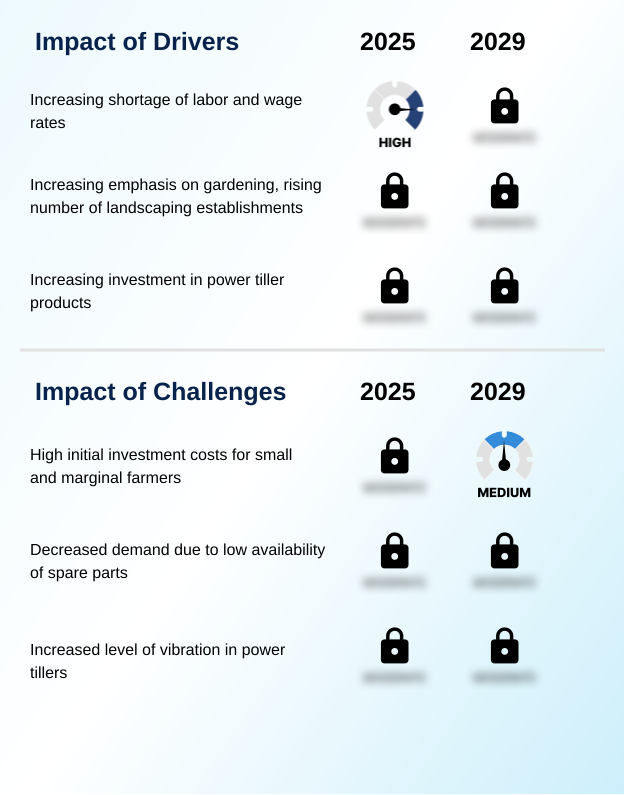

- A key market driver is the growing shortage of agricultural labor, coupled with rising wage rates, which accelerates the need for mechanized farming solutions.

- The primary driver for the market is the acute labor shortage in the agricultural sector, which compels farmers to adopt mechanized agriculture.

- The use of a diesel-powered tiller can replace the work of several manual laborers, reducing labor dependency for land preparation by as much as 75%.

- This enhanced operational efficiency is critical for timely cultivation, particularly on small landholdings where manual methods are slow and costly. A higher engine horsepower and an optimal tilling width allow for faster completion of cultivation tasks.

- This acceleration of farm mechanization is further supported by the need to reduce high fuel consumption associated with older, less efficient farm implements. Consequently, a shift to modern power tillers reduces operational costs and boosts overall farm productivity.

What are the market trends shaping the India Power Tiller Industry?

- The increasing adoption of modern agricultural practices is a primary trend shaping the market. This shift is driven by the need for greater efficiency and productivity in farming operations.

- Key trends in the market are centered on the adoption of modern and sustainable farming practices. The move toward precision agriculture is driving demand for tillers that offer enhanced control and efficiency, with some systems improving seed placement accuracy by over 85%.

- There is a growing preference for the electric-powered tiller, especially for horticulture applications, due to lower emissions and quieter operation. Multi-functional attachments that enable crop rotation and intercropping with a single machine are also gaining traction, as they can reduce equipment-related capital expenditure by up to 30%.

- The focus on soil health is promoting the use of tillers that facilitate better soil aeration and seed bed preparation, which are critical for maximizing yield. This shift aligns with broader goals of increasing agricultural productivity while minimizing environmental impact.

What challenges does the India Power Tiller Industry face during its growth?

- The high initial investment cost for equipment remains a significant challenge, particularly for small and marginal farmers, thereby affecting broader market adoption.

- A significant market challenge is the high initial investment required, which is a major barrier for farmers with limited capital. The upfront cost of a robust rear-tine tiller can consume more than 60% of a small farmer's annual income, hindering widespread adoption. While financing schemes are emerging, access remains limited.

- Another critical issue is the inconsistent spare parts availability, especially for essential components like rotary tiller blades and PTO drive shafts. This can lead to extended downtime, with equipment repairs taking up to 30% longer in remote rural areas compared to urban centers.

- This challenge affects the reliability of both gasoline-powered tiller and diesel models, impacting farmer confidence and restraining market growth.

Exclusive Technavio Analysis on Customer Landscape

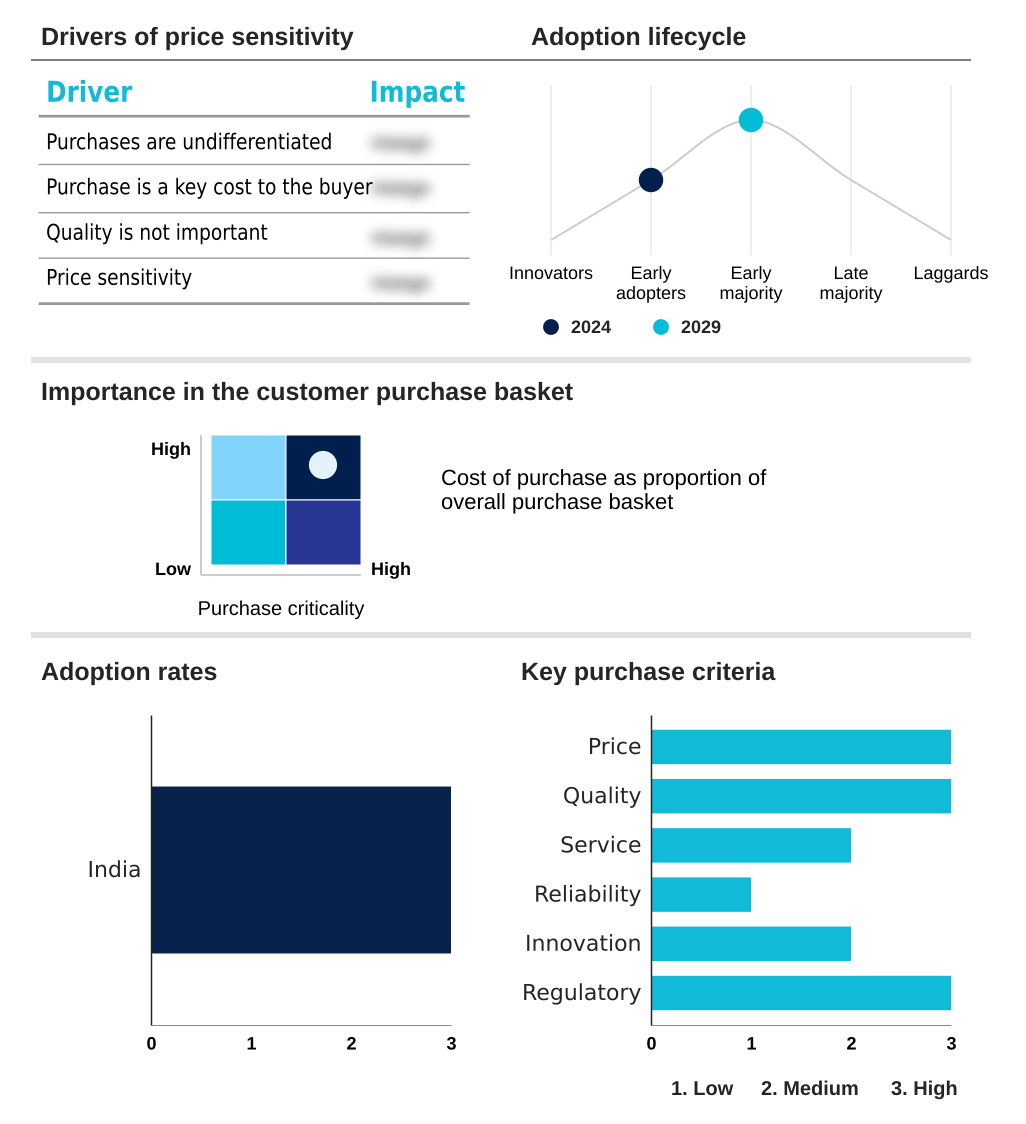

The india power tiller market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the india power tiller market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of India Power Tiller Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, india power tiller market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amar Agricultural Implements Works - Offerings encompass a comprehensive portfolio of motorized agricultural machinery, focusing on versatile cultivation tools and advanced farm implements for diverse agricultural applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amar Agricultural Implements Works

- ANDREAS STIHL AG and Co. KG

- BCS India Pvt. Ltd.

- Benson Agro Engineering

- Bull Agro Implements

- E-Agro Care Machineries and Equipments

- Emerging Farm Equipment India

- Ginwala Advanced Farm Equipments

- Greaves Cotton Ltd.

- Honda Motor Co. Ltd.

- KisanKraft Ltd.

- Krishitek Industries Pvt. Ltd.

- Maax Engineering

- Sharp Garuda Farm Equipments Pvt. Ltd.

- VST Tillers Tractors Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in India power tiller market

- In September 2024, VST Tillers Tractors Ltd. launched a new series of electric-powered mini-tillers, featuring IoT connectivity for remote diagnostics and a 30% longer battery cycle, specifically targeting sustainable urban farming.

- In November 2024, KisanKraft Ltd. entered into a strategic alliance with a major non-banking financial company to provide customized financing solutions, reducing the upfront cost barrier for small farmers adopting mechanized tillers.

- In January 2025, Greaves Cotton Ltd. announced the operational launch of its new manufacturing facility in western India, which is projected to increase its production capacity of diesel engines for power tillers by 40%.

- In April 2025, Honda Motor Co. Ltd. partnered with an agricultural university to develop an advanced training curriculum on precision tillage techniques, aiming to upskill over 5,000 farmers annually in the efficient use of modern power tillers.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled India Power Tiller Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 169 |

| Base year | 2024 |

| Historic period | 2019-2023 |

| Forecast period | 2025-2029 |

| Growth momentum & CAGR | Accelerate at a CAGR of 7.7% |

| Market growth 2025-2029 | USD 44.9 million |

| Market structure | Fragmented |

| YoY growth 2024-2025(%) | 7.0% |

| Key countries | India |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The power tiller market is evolving from providing basic soil preparation equipment to offering specialized mechanization solutions. This shift is driven by demand for enhanced agricultural productivity and operational efficiency. The integration of advanced components, such as durable rotary tiller blades, efficient gear transmission systems, and powerful internal combustion engines, is becoming standard.

- Key product differentiators now include the power-to-weight ratio, ergonomic design, and adjustable tilling depth, which cater to diverse farming needs from heavy-duty applications to delicate inter-cultivation. The trend toward electric-powered tiller models presents a strategic pivot for manufacturers, requiring significant boardroom-level investment in battery technology R&D over traditional air-cooled technology.

- Equipment featuring optimized PTO drive shafts has demonstrated a 20% reduction in fuel consumption, a compelling value proposition. The market offers a range of machinery, from the compact mini-tiller and versatile front-tine tiller to the robust rear-tine tiller, along with specialized machines like the power weeder, reaper binder, and fodder harvester, all contributing to comprehensive farm mechanization.

What are the Key Data Covered in this India Power Tiller Market Research and Growth Report?

-

What is the expected growth of the India Power Tiller Market between 2025 and 2029?

-

USD 44.9 million, at a CAGR of 7.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Mini-tillers or cultivators, Mid-sized front-tine tillers, and Large rear-tine tillers), Product (Gasoline or diesel powered, and Electric powered), Capacity (40-80 cm, Below 40 cm, and Above 80 cm) and Geography (APAC)

-

-

Which regions are analyzed in the report?

-

APAC

-

-

What are the key growth drivers and market challenges?

-

Increasing shortage of labor and wage rates, High initial investment costs for small and marginal farmers

-

-

Who are the major players in the India Power Tiller Market?

-

Amar Agricultural Implements Works, ANDREAS STIHL AG and Co. KG, BCS India Pvt. Ltd., Benson Agro Engineering, Bull Agro Implements, E-Agro Care Machineries and Equipments, Emerging Farm Equipment India, Ginwala Advanced Farm Equipments, Greaves Cotton Ltd., Honda Motor Co. Ltd., KisanKraft Ltd., Krishitek Industries Pvt. Ltd., Maax Engineering, Sharp Garuda Farm Equipments Pvt. Ltd. and VST Tillers Tractors Ltd.

-

Market Research Insights

- The dynamics of the power tiller market in India are shaped by the interplay between rising operational costs and the drive for greater agricultural productivity. The pronounced labor shortage in rural areas is a primary catalyst for farm mechanization, encouraging investment in equipment that boosts operational efficiency.

- For instance, mechanized cultivation tasks using modern tillers can reduce land preparation time by over 50% compared to animal-powered methods. Furthermore, machines designed for sustainable farming practices show up to a 20% improvement in fuel consumption, directly lowering expenses.

- This shift toward mechanization is particularly evident on small landholdings, where the maneuverability of compact tillers is essential for navigating fragmented plots and enabling effective weed control, ultimately supporting higher yields.

We can help! Our analysts can customize this india power tiller market research report to meet your requirements.