Pre-Insulated Pipes Market Size 2025-2029

The pre-insulated pipes market size is forecast to increase by USD 5.94 billion at a CAGR of 11.7% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing adoption of district heating and cooling systems worldwide. This trend is driven by the need to reduce greenhouse gas emissions and improve energy efficiency in buildings and industrial processes. Additionally, the demand for pre-insulated pipes is on the rise in ultra-deep offshore oilfields due to the extreme temperatures and harsh conditions that require insulation to maintain the integrity of the pipelines. Thermal insulation technology continues to evolve, with advancements in heat tracing systems and pipe insulation methods, including vacuum insulation panels and phase change materials. However, the market faces challenges, including the volatility of raw material prices, which can significantly impact the cost structure of pre-insulated pipe manufacturers.

- This price volatility necessitates effective supply chain management and pricing strategies to mitigate risks and maintain competitiveness. Companies in the market must stay agile and adapt to these market dynamics to capitalize on opportunities and navigate challenges effectively.

What will be the Size of the Pre-Insulated Pipes Market during the forecast period?

- Pre-insulated piping systems continue to gain traction in various sectors due to their ability to enhance energy efficiency and sustainability. These systems, which incorporate thermal insulation, moisture resistance, and fire resistance, are finding applications in modular construction, passive house projects, and renewable energy systems such as Solar Thermal and geothermal energy. In the water distribution sector, pre-insulated piping systems are utilized for district cooling and wastewater treatment, offering significant energy savings and reduced heat loss. Industrial piping, HVAC systems, and pipe supports also benefit from pre-insulation, enabling improved chemical resistance, UV resistance, and pipe length efficiency.

- The ongoing evolution of pre-insulated piping systems is reflected in the development of advanced insulation materials like mineral wool, polyurethane foam, and polyisocyanurate foam. These materials contribute to heat loss reduction, frost protection, and corrosion protection in various industries, including pharmaceutical manufacturing and chemical processing. Pre-insulated piping systems are increasingly being integrated into infrastructure development projects, with a focus on energy efficiency, sustainability initiatives, and low-energy building. Installation methods continue to advance, with pipe jacketing, pipe hangers, and building codes ensuring optimal performance and safety. The continuous dynamism of the pre-insulated piping market is driven by the growing demand for efficient, eco-friendly, and cost-effective solutions.

- Lifecycle cost analysis plays a crucial role in decision-making, with pre-insulated piping systems offering significant long-term savings and reduced environmental impact.

How is this Pre-Insulated Pipes Industry segmented?

The pre-insulated pipes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Flexible pre-insulated pipes

- Rigid pre-insulated pipes

- Installation Sites

- Below ground

- Above ground

- Application

- District Heating

- District Cooling

- Oil and Gas Pipelines

- Others

- End-use Industry

- Residential

- Commercial

- Industrial

- Others

- Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

- Construction Suppliers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

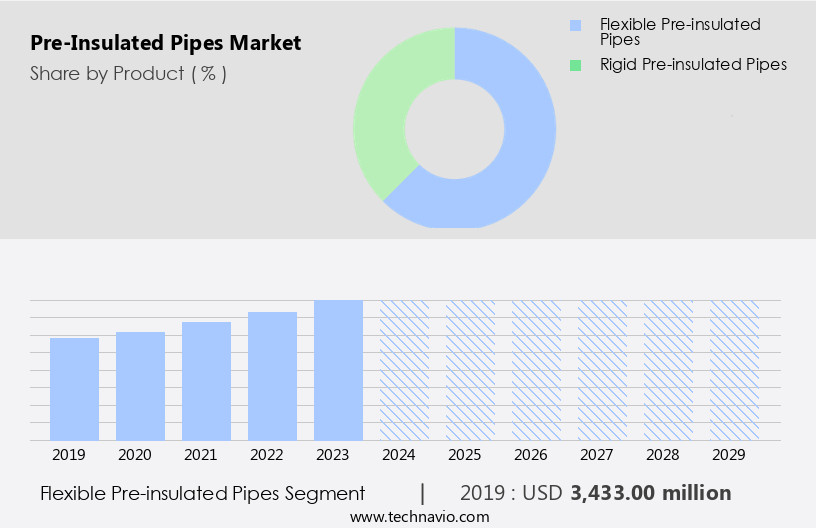

The flexible pre-insulated pipes segment is estimated to witness significant growth during the forecast period.

Pre-insulated pipes have gained significant traction in various industries due to their moisture resistance, thermal insulation, and flexibility. These pipes come with expansion joints, ensuring minimal expansion and contraction during temperature changes. The market for pre-insulated piping systems encompasses applications in water distribution, renewable energy, and industrial piping. Solar thermal systems and geothermal energy projects leverage pre-insulated pipes for improved energy efficiency and heat loss reduction. Flexible pre-insulated pipes are particularly popular for district heating and cooling (DHC) and potable water networks. Their installation methods are streamlined, making them suitable for construction projects in challenging terrains. Fire resistance is another essential attribute, ensuring safety in various applications, including pharmaceutical manufacturing and chemical processing.

Pre-insulated piping systems come in various insulation thicknesses and materials like fiberglass insulation, mineral wool, and polyurethane foam. Pipe jacketing and pipe supports further enhance their durability and chemical resistance. The adoption of pre-insulated piping systems in green building projects, such as passive houses, and low-energy buildings, is on the rise due to their sustainability initiatives and energy efficiency. Infrastructure development projects, including wastewater treatment and district heating, also benefit from pre-insulated piping systems. These pipes offer corrosion protection and are available in various pipe diameters to cater to diverse applications. With the increasing focus on lifecycle cost analysis and energy standards, the market for pre-insulated piping systems is expected to continue its growth trajectory.

Pre-insulated piping systems are essential for various industries, including HVAC systems, plumbing systems, and piping for industrial processes. The market trends include the use of pre-insulated piping systems in retrofit projects and the integration of extruded polystyrene and polyisocyanurate foam for enhanced insulation properties. The focus on energy efficiency and sustainability initiatives is driving the demand for pre-insulated piping systems in various applications.

The Flexible pre-insulated pipes segment was valued at USD 3.43 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Pre-insulated pipes have gained significant traction in the APAC infrastructure development sector, particularly in modern healthcare and medical facilities for condensate, hot water, steam, and chilled water services. The region's focus on green buildings is also driving demand for these pipes, with countries like China, India, and Japan leading the way. In China, as part of its post-COVID-19 relief package, new digital infrastructure projects are underway, including 5G networks, AI, IoT, high-speed rail, and research institutions. Pre-insulated piping systems are essential for these projects due to their thermal insulation properties, which contribute to energy efficiency and sustainability initiatives.

These pipes offer various benefits, such as moisture resistance, expansion joints, and corrosion protection. Insulation thickness and pipe wall thickness are crucial factors in ensuring optimal performance. Installation methods vary, including welding, threading, and clamping. Solar thermal and geothermal energy applications are also viable with pre-insulated piping systems. In industrial piping, chemical processing, HVAC systems, and plumbing systems, pre-insulated piping systems offer heat loss reduction and condensation control. Pre-insulated piping systems are available in various materials, including fiberglass insulation, mineral wool, polyurethane foam, and pipe jacketing. Pipe diameter, pipe length, and chemical resistance are essential considerations when selecting the appropriate piping system.

Building codes and infrastructure development projects require adherence to energy standards and frost protection regulations. Pre-insulated piping systems meet these requirements, ensuring compliance and reducing overall project costs through lifecycle cost analysis. Pipe supports, pipe hangers, and extruded polystyrene insulation are essential components of these systems. Retrofit projects also benefit from pre-insulated piping systems, as they offer a cost-effective solution for upgrading existing piping infrastructure while improving energy efficiency and reducing heat loss. Pre-insulated piping systems are an essential component of modern infrastructure development, contributing to the region's focus on energy efficiency, sustainability initiatives, and low-energy buildings.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pre-Insulated Pipes Industry?

- The significant growth in the adoption of district heating and cooling systems is the primary market driver. These systems, which provide centralized thermal energy solutions for heating, cooling, and hot water, are increasingly being preferred for their energy efficiency, cost savings, and environmental sustainability. The global market for district heating and cooling systems is witnessing robust expansion due to this trend.

- Pre-insulated pipes play a crucial role in district energy systems, which involve the centralized production and distribution of heating and cooling energy to buildings and infrastructure. This approach offers numerous advantages, including improved energy efficiency, sustainability, and safety, with potential sources including water, waste, and biomass. Extruded polystyrene and polyisocyanurate foam insulation are commonly used for pre-insulated pipes, providing effective frost protection and corrosion resistance. Retrofit projects and infrastructure development are significant drivers for the market growth of pre-insulated pipes. Energy standards and regulations, such as those promoting low-energy buildings, further boost demand. The use of district energy systems is prevalent in many developed nations, with Europe being the largest adopter.

- Denmark, Switzerland, and the US are notable consumers of district heating and cooling systems, while the UAE and Kuwait focus on district cooling. Overall, the market for pre-insulated pipes continues to expand, driven by the need for energy efficiency, sustainability initiatives, and the desire to reduce emissions.

What are the market trends shaping the Pre-Insulated Pipes Industry?

- The trend in the oil industry points towards an escalating demand for ultra-deep offshore oilfields. Professionals anticipate this upward trend to continue due to increasing energy demands and advancements in exploration technology.

- Pre-insulated pipes have gained significant traction in various industries due to their moisture resistance and thermal insulation properties. These pipes are essential for transporting fluids, particularly in the oil and gas sector, where the need for cost-effective solutions has become increasingly important. In the context of ultra-deep drilling projects, pre-insulated pipes offer customized insulation thicknesses and the integration of expansion joints, ensuring optimal performance and longevity. The adoption of renewable energy sources, such as solar thermal, has further boosted the demand for pre-insulated pipes in green building projects. The focus on energy efficiency and return on investment has made pre-insulated pipe systems a popular choice for construction projects.

- Installation methods for pre-insulated pipes are versatile, allowing for both above-ground and below-ground applications. Additionally, the fire resistance properties of these pipes make them a reliable solution for various industries, including water distribution and other critical infrastructure projects. Pre-insulated pipe systems contribute to sustainable and cost-effective solutions for businesses, making them a valuable investment in today's market. By providing customized insulation solutions and ensuring optimal thermal performance, pre-insulated pipes help companies reduce energy consumption and save on operational costs.

What challenges does the Pre-Insulated Pipes Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain competitiveness and profitability, companies must closely monitor and adapt to fluctuations in the prices of essential inputs. This market instability can lead to increased operational costs, supply chain disruptions, and decreased predictability for businesses. Consequently, effective risk management strategies and agile business models are crucial for navigating the complexities of this dynamic business environment.

- Pre-insulated pipes are essential components of various infrastructure projects, including modular construction, passive houses, wastewater treatment, district cooling, geothermal energy, and industrial piping. The manufacturing process of these pipes involves using materials such as steel, stainless steel, copper, or plastic for the carrier, and fiberglass insulation for thermal insulation. The prices of these raw materials are volatile, with steel and copper being particularly affected by supply-demand imbalances, low demand, and government policies. In the US, steel prices are projected to rise due to supply disruptions, which may impact the production of pre-insulated pipes.

- Additionally, these pipes are used in HVAC systems, pipe supports, chemical processing, heat loss reduction, district heating, and condensation control. The volatility in raw material prices can directly affect the manufacturing process and the overall cost of pre-insulated pipes.

Exclusive Customer Landscape

The pre-insulated pipes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pre-insulated pipes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pre-insulated pipes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aquatherm - The company specializes in providing pre-insulated piping solutions, available in various colors including blue, green, and red.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aquatherm

- Brugg Group

- Brugg Pipesystems

- CPV Ltd.

- Durotan

- Flexalen

- Georg Fischer

- Insulcon

- Isoplus

- Kingspan Group

- Logstor

- Logstor A/S

- Mueller Industries

- Perma-Pipe International

- Polypipe Group

- REHAU

- Thermaflex

- Uponor

- Watts Water Technologies

- Zeco

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pre-Insulated Pipes Market

- In February 2024, Nexans, a global leader in the energy transition, announced the launch of its new range of pre-insulated aluminum composite cables (ACCS) for offshore wind farms. This innovative product development aims to address the growing demand for renewable energy infrastructure and improve energy efficiency (Nexans, 2024).

- In May 2025, Thermal Energy International (TEI) and Technip Energies entered into a strategic partnership to expand their offerings in the market. This collaboration combines TEI's expertise in pre-insulated piping systems with Technip Energies' engineering, procurement, construction, and installation capabilities, creating a comprehensive solution provider for the energy sector (Thermal Energy International, 2025).

- In September 2024, Uponor, a leading provider of plumbing, heating, and piping systems, completed the acquisition of Aalberts Industries' heating business. This acquisition significantly expanded Uponor's product portfolio and market presence in the pre-insulated pipes segment, enabling the company to cater to a broader customer base and industries (Uponor, 2024).

- In November 2025, the European Union (EU) approved the new regulation on the production and use of pre-insulated pipes. The regulation sets strict energy efficiency standards, promoting the adoption of advanced insulation materials and manufacturing processes. This policy change is expected to drive market growth and encourage innovation in the pre-insulated pipes industry (European Commission, 2025).

Research Analyst Overview

Pre-insulated pipes play a crucial role in heat transfer systems, ensuring optimal thermal performance in various industries. The market for these pipes is witnessing significant trends, including the integration of digital twins in pipe design for improved predictive maintenance. Thermal conductivity is a key consideration in pipe sizing, with insulation materials such as bio-based and recycled content gaining popularity for their sustainability. Installation guidelines are essential for ensuring the efficient use of pre-insulated pipes. Dewar flasks and cryogenic piping require specific insulation materials for effective thermal insulation. Sustainable materials and pipe coatings are increasingly used to minimize environmental impact and extend pipe life.

Building performance simulation and energy audits are important tools for optimizing the use of pre-insulated pipes in Smart Buildings. Remote monitoring and non-destructive testing enable early detection of pipe issues, reducing the need for costly pipe replacement. Predictive maintenance practices employ data analytics to identify potential pipe issues before they become major problems. Thermal performance is a critical factor in pipe repair, with insulation materials and pipe coatings playing a significant role in ensuring efficient energy transfer. Smart building technologies, such as pipe inspection and leak detection, provide real-time data for effective maintenance practices. Pipe stress analysis is another crucial aspect of pipe maintenance, ensuring the structural integrity of pre-insulated piping systems.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pre-Insulated Pipes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.7% |

|

Market growth 2025-2029 |

USD 5937.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pre-Insulated Pipes Market Research and Growth Report?

- CAGR of the Pre-Insulated Pipes industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pre-insulated pipes market growth of industry companies

We can help! Our analysts can customize this pre-insulated pipes market research report to meet your requirements.