Prenatal Vitamin Supplements Market Size 2024-2028

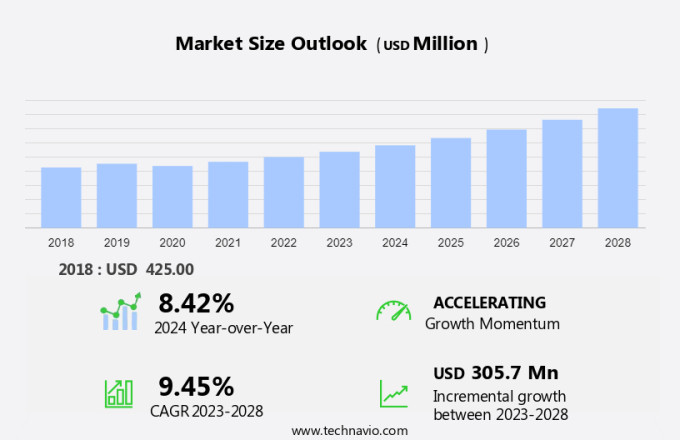

The prenatal vitamin supplements market size is forecast to increase by USD 305.7 million at a CAGR of 9.45% between 2023 and 2028. The market is experiencing significant growth due to several key trends. The increasing number of gynecologists recommending prenatal vitamins to expecting mothers is a major growth factor. These supplements play a crucial role in ensuring the health of both the mother and the developing fetus. Another trend driving market growth is the growing promotion of vitamin ingredients and supplements through various channels, including healthcare professionals, media, and marketing campaigns.

However, there are also misconceptions associated with these supplements that may hinder market growth. Some people believe that prenatal vitamins are only necessary for women with nutritional deficiencies or those with a high-risk pregnancy. In reality, all pregnant women can benefit from taking prenatal vitamins to meet their increased nutritional needs and support the healthy development of their baby. Despite these challenges, the market is expected to continue growing due to the proven benefits of prenatal vitamin supplements for pregnant women and their developing babies.

Market Analysis

Prenatal vitamin supplements play a crucial role in ensuring the health and proper development of babies during pregnancy. With the increasing prevalence of unhealthy diets, sedentary lifestyles, and stressful lifestyles, expectant mothers find it challenging to obtain all the necessary essential vitamins and minerals through a healthy diet alone. Prenatal vitamin supplements, available in various forms such as capsules, tablets, and gummies, provide these essential nutrients to support maternal nutrition and fetal development. These supplements contain vital vitamins and minerals, including folic acid, iron, calcium, and essential fatty acids, which are essential for preventing birth defects and addressing health issues related to pregnancy.

Furthermore, obstetricians often recommend prenatal vitamins to pregnant women to ensure they receive adequate nutrition for themselves and their developing babies. The prenatal vitamin supplement market is witnessing significant growth due to the increasing awareness of the importance of maternal nutrition during pregnancy. The market includes various formulations, such as powders and capsules, and is available through direct selling and online retail channels. Consumers are increasingly seeking prenatal vitamins that are non-GMO and organic to ensure the health and safety of themselves and their babies.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Distribution Channel

- Conventional retail channels

- Direct selling and e-retailing

- Form Factor

- Powder

- Liquid

- Capsules

- Gummies

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

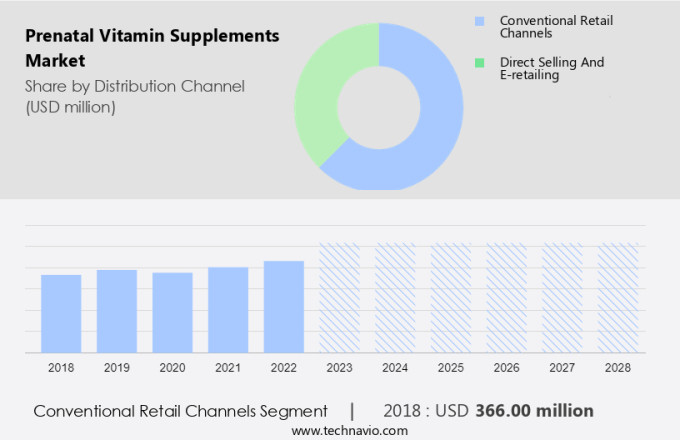

The conventional retail channels segment is estimated to grow significantly during the forecast period. Prenatal vitamin supplements play a crucial role in ensuring the health of both mother and baby during pregnancy. A healthy diet and proper medication are essential, but a sedentary or stressful lifestyle may hinder the intake of essential vitamins and minerals necessary for fetal development. Birth defects and health issues can arise due to deficiencies in vitamins and minerals such as calcium, iron, and folic acid. Obstetricians and health organizations recommend prenatal supplements to prevent anemia, neural tube defects, and other complications. In urban and rural areas, prenatal vitamins are available in various forms, including tablets, capsules, gummies, and liquids.

Furthermore, the shelf life of these supplements varies, and it is important to follow the instructions for swallowing and storage. For vegan-friendly or plant-based alternatives, look for supplements labeled as such. The prenatal vitamin market caters to both offline and online consumers. Pharmacies and drug stores offer expert advice and consultation, while e-commerce and online retailers provide discounts, special offers, and home delivery. Nausea during pregnancy can make it difficult to take supplements, so consider choosing a form that is easy to swallow or consult with a healthcare provider for alternatives. Immunization and institutional delivery are also important aspects of prenatal care, and prenatal vitamins should be taken in conjunction with these measures to ensure the best possible outcome for mother and baby.

Market Analysis

Get a glance at the market share of various segments Request Free Sample

The conventional retail channels segment was valued at USD 366.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

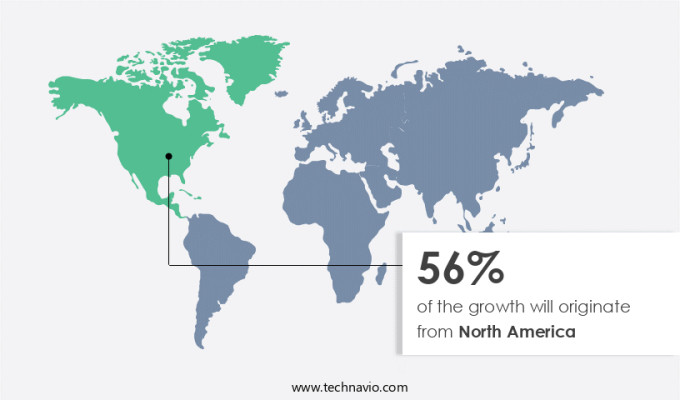

North America is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Prenatal vitamin supplements cater to pregnant women and those in their childbearing age, addressing nutrient deficiencies that can impact immunity, fetal development, and the child's growth. These supplements come in various forms, including capsules, tablets, and gummies, designed to mitigate digestive problems and constipation common during pregnancy. Direct selling and online retail channels have gained popularity due to increasing health awareness and internet penetration. Essential fatty acids, vitamins, and minerals are crucial components of these formulations, ensuring maternal nutrition and preventing birth abnormalities. Teen pregnancy and postanal lactation also necessitate adequate nutrient intake.

Furthermore, health-conscious consumers increasingly prefer non-GMO, organic, and vegan options, free from artificial additives. The market for prenatal vitamins is expanding, driven by maternal age, healthcare awareness, and the preventive healthcare trend in the OTC segment. Expectant mothers seek optimal prenatal care, ensuring the best possible start for their child.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Prenatal Vitamin Supplements Market Driver

The increasing number of gynecologists recommending prenatal vitamin supplements to expecting mothers is the key driver of the market. Prenatal vitamin supplements play a crucial role in ensuring the health of both the mother and the developing fetus during pregnancy. A healthy diet and proper medication are essential for pregnant women, but a sedentary or stressful lifestyle may make it challenging to obtain all the necessary vitamins and minerals. Pregnant women are advised by their obstetricians and health organizations to take prenatal vitamins to meet their increased nutritional needs. These supplements typically include essential vitamins and minerals like folic acid, calcium, and iron, which are vital for the prevention of birth defects and the reduction of health issues. Folic acid is particularly important, as it helps prevent neural tube defects such as spina bifida.

However, a healthy diet rich in folate, such as green and leafy vegetables, is recommended, it can be challenging to consume the recommended amount of folic acid solely from food sources. Pregnant women at higher risk, including those with a history of neural-tube defects, are often advised to take a higher dose of folic acid, typically five milligrams per day, until they are 12 weeks pregnant. Prenatal vitamin supplements come in various forms, including tablets, capsules, gummies, and liquids, catering to different preferences and lifestyles. The shelf life, swallowing ability, and vegan-friendly or plant-based alternatives are essential considerations for pregnant women.

Furthermore, prenatal vitamins can be purchased from offline markets like pharmacies and drug stores or online markets through e-commerce platforms and online retailers. Expert advice, discounts, special offers, and home delivery are added benefits that make purchasing prenatal vitamins more convenient. Nausea, a common issue during pregnancy, may make it difficult for some women to swallow pills, making gummies or liquid forms more desirable. Overall, prenatal vitamin supplements are an essential component of a healthy pregnancy, and pregnant women are encouraged to consult their healthcare providers for personalized recommendations.

Prenatal Vitamin Supplements Market Trends

The growing promotion of prenatal vitamin supplements is the upcoming trend in the market. Prenatal vitamin supplements play a crucial role in ensuring the healthy development of babies during pregnancy. A healthy diet and proper medication are essential, but a sedentary or stressful lifestyle may hinder the intake of essential vitamins and minerals. Birth defects and health issues can result from nutritional deficiencies, making prenatal vitamins indispensable. Obstetricians and health organizations advocate for the use of these supplements, launching campaigns to promote their benefits. Calcium, iron, and folic acid are among the essential vitamins and minerals for pregnant women. Anemia, a common condition during pregnancy, can be prevented with iron supplements. Folic acid is vital for the prevention of neural tube defects.

Furthermore, in urban and rural areas alike, prenatal vitamins are available in various forms, including tablets, capsules, gummies, and liquids, catering to diverse preferences and needs. The shelf life and ease of swallowing are essential factors when choosing prenatal vitamins. Vegan-friendly and plant-based alternatives are also available for those following specific dietary restrictions. The market for prenatal vitamins spans both offline and online channels, with pharmacies, drug stores, expert advice, e-commerce, and online retailers offering various discounts and special offers for home delivery. Despite the convenience and affordability of these options, nausea during pregnancy can make taking prenatal vitamins challenging, necessitating ongoing efforts to improve formulations and delivery methods.

Prenatal Vitamin Supplements Market Challenge

The misconceptions associated with prenatal vitamin supplements is a key challenge affecting the market growth. Prenatal vitamin supplements play a crucial role in ensuring the health of pregnant women and the development of their unborn babies. However, it is essential to clarify some common misconceptions surrounding these supplements to promote their effective utilization. Contrary to popular belief, prenatal vitamins do not replace a healthy diet but rather enhance it. They provide essential vitamins and minerals, including folic acid, iron, calcium, and others, necessary for the prevention of birth defects and the mitigation of health issues. While it is recommended for women to start taking these supplements before conception, it is never too late to begin during pregnancy.

Furthermore, pregnant women, especially those with sedentary or stressful lifestyles, may require additional nutritional support. Institutional delivery settings and health organizations often recommend prenatal vitamin supplements as part of a comprehensive prenatal care plan, alongside immunization and expert advice. Prenatal vitamins come in various forms such as tablets, capsules, gummies, and liquids, catering to different preferences and lifestyles. With the increasing awareness of health concerns, there is a growing demand for vegan-friendly and plant-based alternatives. The market for prenatal vitamin supplements extends beyond urban areas and is gaining traction in rural regions as well. The prenatal vitamin supplement market offers numerous options for purchasing, including offline markets like pharmacies and drug stores, and online markets through e-commerce and online retailers. Consumers can benefit from discounts, special offers, and home delivery services to make their purchases more convenient. However, it is essential to consult with healthcare professionals for expert advice on choosing the right supplement and dosage, especially for those experiencing nausea or other health concerns.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bayer AG: The company offers prenatal vitamin supplements such as prenatal pregnancy vitamins and multivitamins under the brand called Elevit.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Alora Pharmaceuticals LLC

- Bayer AG

- Biotics Research Corp.

- Church and Dwight Co. Inc.

- Dr Reddys Laboratories Ltd.

- Duchesnay Inc.

- Fermentis Life Sciences Pvt. Ltd.

- Kikkoman Corp.

- Natals Inc.

- Nestle SA

- Nordic Naturals Inc.

- Novus Life Sciences Pvt. Ltd.

- Otsuka Holdings Co. Ltd.

- Pharmavite LLC

- PlusPlus Lifesciences LLP

- The Clorox Co.

- The Procter and Gamble Co.

- TherapeuticsMD Inc.

- West Coast Pharmaceuticals

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Prenatal vitamin supplements are essential for pregnant women to ensure the healthy development of their baby. A healthy diet may not always provide all the necessary essential vitamins and minerals, especially for those with sedentary or stressful lifestyles. Proper medication through prenatal vitamins is crucial to prevent birth defects and health issues. Obstetricians and health organizations recommend pregnant women to take vitamins and minerals like calcium, iron, and folic acid. Folic acid is vital for preventing neural tube defects, while calcium and iron help in the growth and development of the baby's bones and blood production, respectively. Prenatal vitamins come in various forms like tablets, capsules, gummies, and liquids, catering to different preferences and swallowing abilities.

Furthermore, the shelf life of these supplements is crucial, as expired vitamins may not provide the intended benefits. Urban and rural areas have different market access to prenatal vitamins. While urban areas have easy access to pharmacies and drug stores, rural areas may rely on e-commerce, online retailers, and home delivery services. Expert advice from healthcare professionals is essential when choosing the right prenatal vitamin supplement. Discounts, special offers, and home delivery are popular trends in the prenatal vitamin market. Nausea during pregnancy may make swallowing pills difficult, leading to the popularity of vegan-friendly and plant-based alternatives. The offline and online markets coexist, with both having their unique advantages and challenges. Immunization and institutional delivery are other crucial aspects of prenatal care that complement prenatal vitamin intake.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 305.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 56% |

|

Key countries |

US, Germany, UK, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abbott Laboratories, Alora Pharmaceuticals LLC, Bayer AG, Biotics Research Corp., Church and Dwight Co. Inc., Dr Reddys Laboratories Ltd., Duchesnay Inc., Fermentis Life Sciences Pvt. Ltd., Kikkoman Corp., Natals Inc., Nestle SA, Nordic Naturals Inc., Novus Life Sciences Pvt. Ltd., Otsuka Holdings Co. Ltd., Pharmavite LLC, PlusPlus Lifesciences LLP, The Clorox Co., The Procter and Gamble Co., TherapeuticsMD Inc., and West Coast Pharmaceuticals |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch