Vegetable Capsules Market Size 2025-2029

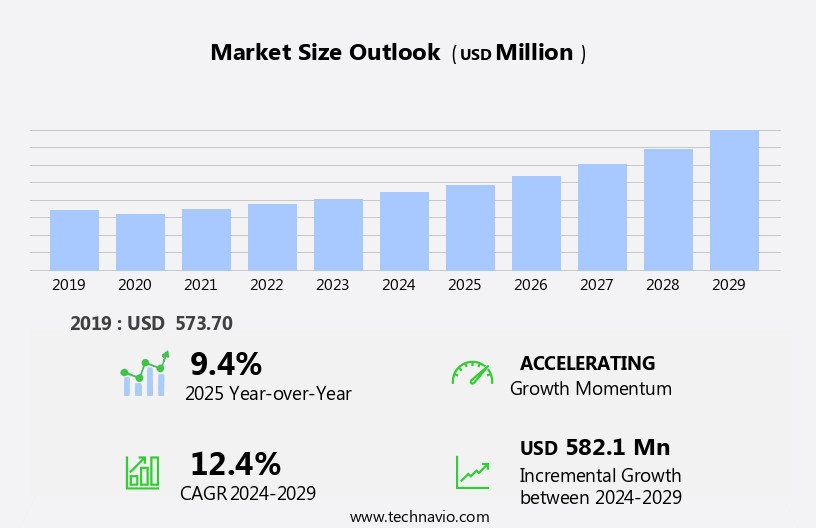

The vegetable capsules market size is forecast to increase by USD 582.1 million at a CAGR of 12.4% between 2024 and 2029.

- The market is experiencing significant growth, primarily driven by increasing applications in the pharmaceutical industry. These capsules offer several advantages over traditional hard gelatin capsules, including improved bioavailability, better taste masking, and increased consumer preference for natural products. Moreover, the growth of the e-commerce industry is providing new opportunities for market expansion, as consumers increasingly turn to online platforms for purchasing health supplements and vitamins. However, the market faces challenges as well. Limited awareness and availability of vegetable capsules in certain regions and markets present a significant barrier to growth. Additionally, the production process for vegetable capsules is more complex and costly compared to traditional capsules, which can hinder market penetration for some manufacturers.

- Companies seeking to capitalize on market opportunities must focus on increasing consumer education and awareness, while also investing in research and development to improve production efficiency and reduce costs. Effective strategies for navigating these challenges and expanding market share include collaborations with pharmaceutical companies, strategic partnerships with e-commerce platforms, and targeted marketing campaigns to increase consumer awareness and demand.

What will be the Size of the Vegetable Capsules Market during the forecast period?

- The market continues to evolve, driven by the growing demand for health-conscious consumer products and innovative solutions in various sectors. Vegetarian capsules, such as hypromellose and cellulose varieties, are increasingly preferred due to their plant-based nature and regulatory compliance. Enteric coating technology ensures targeted delivery of botanical extracts and other sensitive ingredients. Capsule manufacturing advances with automated filling systems, improving efficiency and cost optimization. Personal care products and functional foods incorporate capsule technology for encapsulation of active ingredients, enhancing product performance and shelf life. Biodegradable and sustainable packaging options align with consumer preferences, while GMP certification and stability testing ensure quality control.

- Capsule sealing and fill weight precision are crucial factors in ensuring product integrity. Dissolution rate and release profile are essential considerations for various applications, including nutritional supplements, prescription drugs, over-the-counter medications, herbal remedies, and animal feed. Product innovation continues to unfold, with controlled release technology and plant-based capsules gaining popularity. Regulatory compliance, ingredient encapsulation, and capsule filling techniques remain key focus areas for market players, as they navigate the evolving market dynamics. The market's continuous growth is underpinned by health consciousness and the ongoing quest for advanced, sustainable, and cost-effective solutions.

How is this Vegetable Capsules Industry segmented?

The vegetable capsules industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Health supplements

- Pharmaceuticals

- Others

- Material

- Cellulose

- Starch

- Pullulan

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

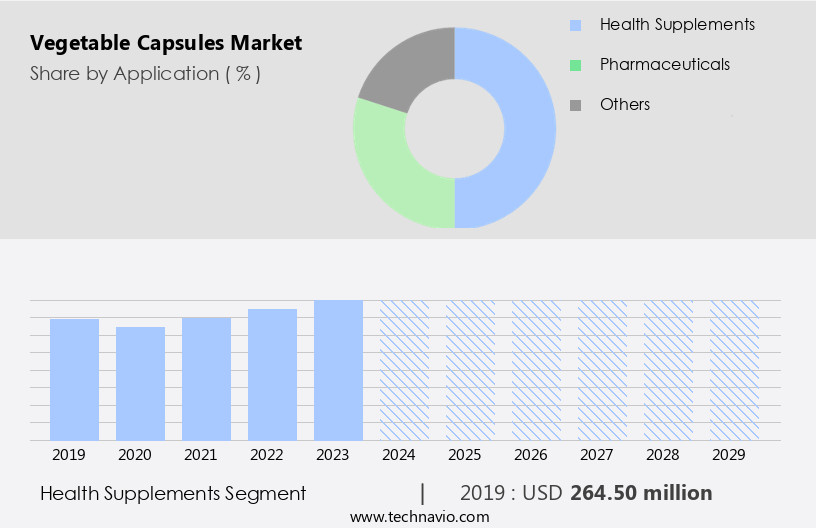

The health supplements segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in the health supplements segment. This trend is driven by consumers' increasing awareness of natural and plant-based products and a growing preference for vegetarian and vegan lifestyles. Vegetable capsules offer several advantages, including effective and convenient delivery of active ingredients. The shift towards plant-based diets is influenced by ethical concerns, health benefits, and environmental sustainability. Quality control is a crucial factor in the production of vegetable capsules, ensuring consistent dissolution rates, capsule size, and fill weight. Regulatory compliance, enteric coating, and targeted delivery are also essential considerations. Plant-based capsules, such as pullulan and hypromellose, are gaining popularity due to their biodegradability and sustainability.

Capsule manufacturing techniques, including automated filling and sealing, contribute to cost optimization and supply chain management. Product innovation, such as controlled release technology and personalized nutrition, is also driving market growth. Vegetable capsules find applications not only in nutritional supplements and functional foods but also in personal care products, animal feed, prescription drugs, and over-the-counter medications. The market's evolution reflects the importance of health consciousness and the demand for more sustainable and ethical alternatives in various industries.

The Health supplements segment was valued at USD 264.50 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

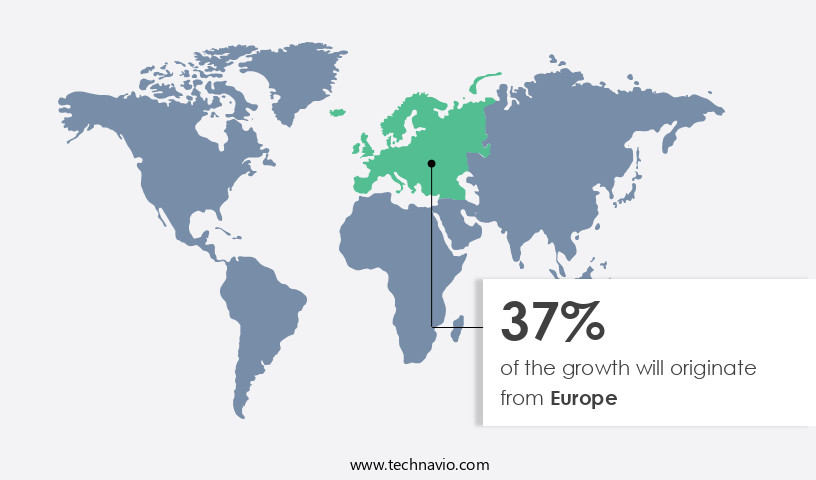

Europe is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth due to the rising trend of plant-based alternatives in various sectors. This shift is particularly evident among consumers adopting vegetarian and vegan lifestyles, driving demand for vegetable capsules in pharmaceuticals, nutraceuticals, and dietary supplements. The nutraceuticals and supplements industry is witnessing a surge in North America as people seek natural ways to enhance their health and well-being. Vegetable capsules offer advantages such as biodegradability, sustainability, and suitability for vegetarians and vegans. These capsules are available in various sizes and can be used for targeted delivery, enteric coating, and controlled release technology.

Quality control measures ensure consistent dissolution rates and fill weights. Regulatory compliance is a priority, with capsule manufacturing adhering to GMP certification. The market encompasses various applications, including functional foods, personal care products, animal feed, prescription drugs, and over-the-counter medications. Product innovation, such as plant-based capsules and personalized nutrition, is a significant factor fueling market growth. Sustainable packaging and cost optimization are also essential considerations. Stability testing is crucial to ensure the integrity and effectiveness of the capsules, particularly for sensitive ingredients like omega-3 fatty acids. Overall, the market in North America is a dynamic and evolving landscape, driven by consumer preferences, regulatory requirements, and technological advancements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Vegetable Capsules Industry?

- The pharmaceutical industry's expanding application base is the primary market driver.

- Vegetable capsules have gained significant popularity in the pharmaceutical industry due to their versatility and stability. These capsules are ideal for encapsulating various formulations, including prescription drugs, over-the-counter medications, herbal extracts, and dietary supplements such as omega-3 fatty acids and personalized nutrition. Compared to gelatin capsules, vegetable capsules provide better protection and stability to sensitive ingredients. They are more resilient to environmental conditions like humidity and temperature, ensuring the encapsulated substances remain effective for extended periods. This attribute is essential for drugs and supplements that necessitate extended shelf lives and reliable protection against degradation. Moreover, vegetable capsules cater to various dietary preferences, including vegan and vegetarian consumers, making them a preferred choice for supply chain management in the pharmaceutical sector.

What are the market trends shaping the Vegetable Capsules Industry?

- The e-commerce industry is experiencing significant growth and represents an emerging market trend. As a professional virtual assistant, I can provide you with up-to-date and accurate information on this topic.

- The market is experiencing notable growth due to the increasing popularity of nutritional supplements and functional foods. Vegetarian and vegan consumers prefer vegetable capsules over gelatin capsules, making them a preferred choice in the market. Moreover, the trend towards biodegradable and eco-friendly packaging is driving the demand for vegetable capsules. Quality control is a significant factor in the vegetable capsule manufacturing process, ensuring consistent dissolution rates and capsule sizes. Targeted delivery is another key advantage of vegetable capsules, enabling precise dosage and improved efficacy for various applications, including herbal remedies.

- E-commerce platforms have facilitated the expansion of the vegetable capsule market by providing easy access to consumers worldwide. With online shopping's convenience and global reach, manufacturers can cater to a broader consumer base, increasing market potential and opportunities. Consumers can easily discover and compare products, leading to informed purchasing decisions and increased sales for vegetable capsule manufacturers.

What challenges does the Vegetable Capsules Industry face during its growth?

- The limited awareness and availability of vegetable capsules pose a significant challenge to the industry's growth trajectory. This issue hinders market expansion as consumers remain uninformed about the benefits of vegetable capsules, and the products themselves may not be easily accessible to those who are aware of them.

- Vegetable capsules, an alternative to traditional gelatin capsules, offer advantages such as regulatory compliance, longer shelf life, and suitability for vegetarian consumers. However, the market's growth is hindered by limited consumer awareness of their benefits. This lack of understanding may result in a mismatch between consumer demand and product availability. Vegetable capsules come in various forms, including hypromellose and enteric-coated capsules, which offer better encapsulation of botanical extracts and improved capsule sealing. Capsule filling technology has advanced, enabling the production of personal care products and various dosage forms. Key market drivers include regulatory compliance requirements and the demand for vegetarian and vegan options.

- Vegetable capsules offer a longer shelf life due to their robust design, making them an attractive option for manufacturers. Ingredient encapsulation is another advantage, ensuring the stability and efficacy of sensitive ingredients. As awareness of these benefits grows, the market is expected to expand, offering opportunities for manufacturers and investors.

Exclusive Customer Landscape

The vegetable capsules market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vegetable capsules market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, vegetable capsules market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACG - The company specializes in providing high-quality vegetable capsules for various health applications. Among its offerings are ACGcaps HR, H plus, and HL capsules. These capsules are designed using advanced technology to ensure optimal potency and bioavailability. ACGcaps HR capsules offer controlled-release properties, ensuring consistent absorption over an extended period. ACGcaps H plus capsules contain additional ingredients to enhance nutrient absorption and promote overall health. Lastly, ACGcaps HL capsules are designed for individuals seeking high-potency supplements, with a higher concentration of active ingredients. All capsules adhere to stringent quality standards, ensuring customers receive effective and reliable health solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACG

- Ajix Inc.

- BioCaps Enterprise

- Dah Feng Capsule Industry Co. Ltd.

- Erawat Pharma Ltd.

- Evonik Industries AG

- Farmacapsulas S.A.

- Fortcaps Healthcare Ltd.

- J RETTENMAIER and SOHNE GmbH and Co KG

- JC Biotech Pvt. Ltd.

- Lefancaps LTD.

- Lonza Group Ltd.

- Mitsubishi Chemical Group Corp.

- Natural Capsules Ltd.

- Qingdao Yiqing Biotechnology Co. Ltd.

- Shaanxi Genex Bio Tech Co. Ltd.

- Shaoxing Zhongya Capsule Co. Ltd.

- Silvaco AS

- Suheung Co. Ltd.

- Sunil Healthcare Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Vegetable Capsules Market

- In February 2023, Nutraceutical Corporation, a leading supplier of vegetable capsules, announced the launch of its new line of plant-based capsules made from renewable sources, marking a significant stride in the eco-friendly production of vegetable capsules (Nutraceutical Corporation Press Release, 2023).

- In April 2024, DSM, a global science-based company in nutrition, health, and sustainable living, entered into a strategic partnership with Capsugel, a Lonza company, to expand its vegetable capsule production capacity and strengthen its position in the nutraceutical industry (DSM Press Release, 2024).

- In January 2025, Gelita, a leading manufacturer of collagen peptides, completed the acquisition of Gelcap, a specialist in the production of vegetable capsules, enabling Gelita to broaden its product portfolio and cater to the growing demand for vegetarian and vegan supplements (Gelita Press Release, 2025).

- In March 2025, the European Food Safety Authority (EFSA) approved the health claim for the vegetable capsule-based omega-3 supplement, AlgaeOmega, which is expected to boost the market growth and increase consumer trust in vegetable capsule supplements (EFSA Journal, 2025).

Research Analyst Overview

The vegetable capsule market is experiencing significant growth, driven by consumer preferences for natural and organic ingredients in various sectors, including sports nutrition and animal health. Capsule integrity is a critical factor in ensuring product efficacy and consumer trust. Manufacturers are focusing on bioequivalence studies to ensure consistent performance and meet industry regulations. Sustainability is a key trend, with an increasing demand for capsules made from plant-based materials and environmentally friendly packaging designs. Non-GMO and allergen-free capsules cater to specific consumer needs, while capsule branding, color, and labeling contribute to product differentiation. Capsule size and weight variation, as well as enteric coating thickness, require careful consideration during capsule design and manufacturing processes.

Safety regulations mandate rigorous testing methods for dissolution, fill uniformity, and capsule labeling. Innovations in capsule material, such as natural ingredients and prebiotic supplements, offer competitive advantages. Automated capsule inspection and stability studies ensure product quality and consistency. Ingredient compatibility and capsule printing are essential aspects of capsule design and manufacturing. Industry regulations and safety standards continue to evolve, necessitating ongoing investment in research and development to meet consumer demands and maintain a competitive edge. Capsule technology is an integral part of the health and wellness industry, shaping the future of functional beverages and dietary supplements.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Vegetable Capsules Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.4% |

|

Market growth 2025-2029 |

USD 582.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, China, Germany, Canada, UK, France, Japan, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Vegetable Capsules Market Research and Growth Report?

- CAGR of the Vegetable Capsules industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vegetable capsules market growth of industry companies

We can help! Our analysts can customize this vegetable capsules market research report to meet your requirements.