US Private-Label Food And Beverage Market Size 2025-2029

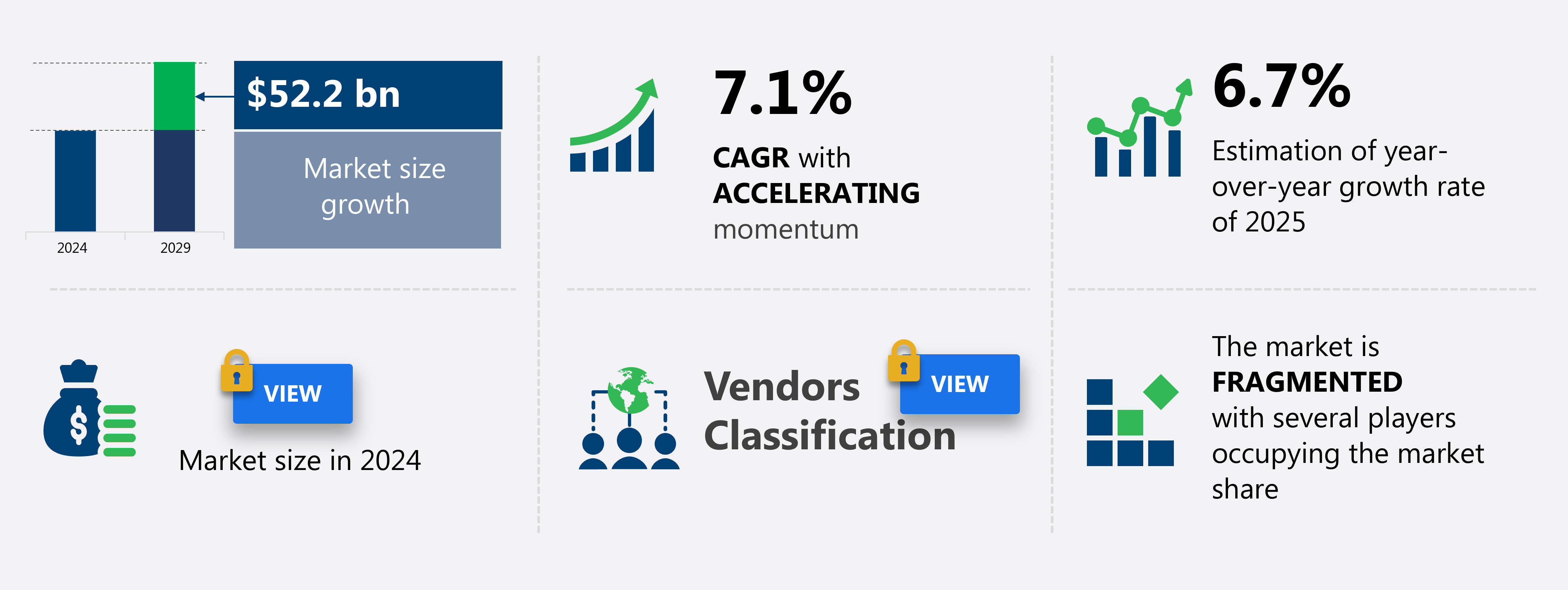

The us private-label food and beverage market size is forecast to increase by USD 52.2 billion at a CAGR of 7.1% between 2024 and 2029.

- The Private-Label Food and Beverage market in the US is witnessing significant growth, driven by the increasing dollar value share of private label brands. Consumers are increasingly turning to private label options due to their perceived value and quality, which is challenging traditional branded players. Another trend shaping the market is the rising demand for private label organic food and beverages, reflecting the growing health consciousness among consumers. However, the market faces challenges, including the low penetration of private label food and beverage companies in certain categories, which presents both opportunities for expansion and competition.

- Companies looking to capitalize on market opportunities should focus on expanding their private label offerings in underpenetrated categories and catering to the growing demand for organic options. Simultaneously, navigating the challenges of market competition and consumer preferences for quality and value will be crucial for success.

What will be the size of the US Private-Label Food And Beverage Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The private-label food and beverage market in the US is experiencing significant dynamics and trends, shaped by advancements in food technology, digital marketing strategies, and stringent food safety regulations. Food microbiology plays a crucial role in ensuring food safety and authenticity, while food fraud detection technologies help prevent adulteration. Ingredient standardization and allergen management are essential for maintaining brand loyalty and catering to diverse consumer needs. Product recalls can significantly impact market performance, emphasizing the importance of effective supply chain transparency and traceability. Food technology innovations, such as plant-based foods, probiotics and prebiotics, and personalized nutrition, are reshaping consumer preferences.

- Market segmentation analysis and customer segmentation are vital for targeting specific demographics and optimizing sales forecasting. Digital marketing strategies, including influencer marketing and pay-per-click (PPC) advertising, are increasingly popular for reaching wider audiences. Food labeling regulations, food chemistry, and data analytics are critical components of food product development and marketing. Food trends forecasting and contract manufacturing help companies stay competitive and adapt to evolving consumer demands. E-commerce fulfillment and packaging technology enable businesses to reach customers more efficiently and effectively, while alternative proteins and dietary supplements cater to the growing demand for healthier options.

- Customer feedback analysis and sales forecasting are essential tools for managing product lifecycle and optimizing market performance.

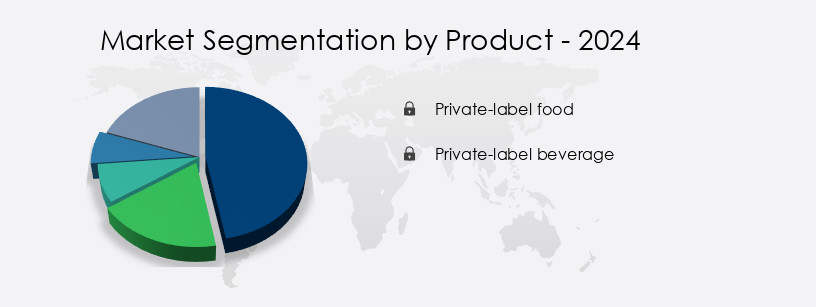

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Private-label food

- Private-label beverage

- Distribution Channel

- Offline

- Online

- End-user

- Retail consumers

- Foodservice and hospitality

- Geography

- North America

- US

- North America

By Product Insights

The private-label food segment is estimated to witness significant growth during the forecast period.

In the private-label food market, companies prioritize product differentiation through premiumization and expansion of specialty offerings. ALDI, for example, introduces a high-end private-label brand, Specially Selected, which includes dairy, frozen foods, pantry staples, and snacks and sweets. Notable products under this brand are Specially Selected Blue Cheese Stuffed Queen Olives and Specially Selected Super Premium Chocolate Ice Cream. Quality control and non-GMO verification are crucial aspects of private-label food production. Shelf life and ingredient labeling are essential for consumer trust. Packaging innovations cater to sustainability initiatives, such as circular economy and waste reduction, while fair trade practices enhance brand development.

Product formulation focuses on artificial sweeteners, functional ingredients, and catering to food allergies. Inventory management, employee training, and pricing strategies ensure efficient supply chain operations. Organic certification, haccp certification, and food safety audits maintain regulatory compliance. New product development, market research, and health and wellness trends drive innovation. Beverage production, food waste management, and retail partnerships strengthen brand positioning. Consumer preferences and product line extensions require ingredient sourcing and ethical sourcing. Marketing campaigns and clean label movements align with logistics optimization and sustainability standards. Private label offerings span various categories, including whole foods, processed foods, frozen foods, chilled foods, sweets and snacks, bakery products, ready-to-eat meals, ice creams, dried processed foods, confectioneries, snack bars, and other specialty foods (gluten-free, non-GMO, and organic).

The Private-label food segment was valued at USD 69.90 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the US Private-Label Food And Beverage Market market drivers leading to the rise in adoption of the Industry?

- The significant growth in the private label brands' dollar share represents the primary market trend.

- The private-label food and beverage market in the US continues to expand, driven by consumer preferences for affordable, high-quality options. Factors such as packaging design, quality control, non-GMO verification, and ingredient labeling are crucial in differentiating private-label brands. Shelf life and product formulation are essential considerations to ensure consumer satisfaction and repeat purchases. Packaging innovations, including eco-friendly and resealable packaging, cater to evolving consumer demands. Quality assurance programs and fair trade practices further enhance brand reputation and consumer trust. Brand development, flavor profiles, and value proposition are key areas of focus for providers seeking to distinguish themselves in a competitive market.

- Effective supply chain management and product formulation are essential for maintaining consistency and meeting demand. In conclusion, the private-label food and beverage market in the US is expected to grow, driven by consumer preferences for affordability, quality, and convenience. Providers that prioritize these factors and invest in product innovation and brand development are well-positioned for success.

What are the US Private-Label Food And Beverage Market market trends shaping the Industry?

- The increasing preference for private label organic food and beverages represents a significant market trend. This demand stems from consumers' growing awareness and prioritization of health and sustainability.

- The US market for private-label food and beverages is experiencing significant growth due to increasing consumer demand for healthier options. This trend is driven by a growing awareness of the potential health risks associated with artificial sweeteners, food allergens, and synthetic ingredients. As a result, there is a strong preference for products made with functional ingredients, such as organic fruits, vegetables, and legumes. Organic certification is a key consideration for consumers, ensuring that the food they consume is free from pesticides and genetically modified organisms (GMOs). Inventory management and employee training are essential for businesses in this market to meet the demands of consumers for fresh and high-quality products.

- Pricing strategies that reflect the premium nature of organic and natural ingredients are also important. New product development is a key area of focus, with a particular emphasis on beverage production and health and wellness offerings. Food safety regulations are a critical consideration for businesses in the private-label food and beverage market. Market research is essential to stay abreast of consumer trends and preferences, as well as to identify opportunities for innovation. The circular economy is also a growing concern, with a focus on waste reduction and sustainability. In conclusion, the private-label food and beverage market in the US is dynamic and evolving, driven by consumer preferences for healthier, more natural options.

- Organic certification, functional ingredients, and food safety regulations are key considerations for businesses in this market. New product development, inventory management, employee training, and pricing strategies are essential for success.

How does US Private-Label Food And Beverage Market market faces challenges face during its growth?

- The limited market penetration of private label food and beverage companies poses a significant challenge to the industry's growth trajectory.

- Private-label food and beverage suppliers in the US face intense competition from national brand manufacturers for retail shelf space. Despite a lower penetration rate in the US market compared to countries like Switzerland, Spain, and the UK, private-label brands can gain a foothold by focusing on key areas. These include effective food waste management, forming strategic retail partnerships, and catering to evolving consumer preferences. Product line extensions, ethical ingredient sourcing, and marketing campaigns aligned with the clean label movement are essential strategies.

- Logistics optimization, HACCP certification, and rigorous food safety audits ensure product quality and consumer trust. Consumer insights into dietary trends and nutritional content are vital for innovation and differentiation. By prioritizing these elements, private-label suppliers can increase their market share and compete effectively with national brands.

Exclusive US Private-Label Food And Beverage Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albertsons Companies Inc.

- Amazon.com Inc.

- Berner Food and Beverage

- Costco Wholesale Corp.

- Dollar General Corp.

- Giant Eagle Inc.

- HEB LP

- Hy Vee Inc.

- Koninklijke Ahold Delhaize NV

- LiDestri Food and Drink

- Lidl US LLC

- SouthEastern Grocers LLC

- Target Corp.

- The Kroger Co.

- Trader Joes

- TreeHouse Foods Inc.

- United Natural Foods Inc.

- Walmart Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Private-Label Food And Beverage Market In US

- In February 2023, The Kroger Co., a leading grocery retailer in the US, announced the expansion of its Simple Truth private label brand with over 200 new products, including plant-based meat alternatives and organic snacks. This expansion signifies a growing trend towards healthier and sustainable food options in the private-label food and beverage market (Reuters).

- In May 2024, Amazon Fresh, Amazon's grocery delivery and pick-up service, entered into a strategic partnership with Danone, a global food company, to offer Danone's private label products exclusively on Amazon Fresh. This collaboration underscores the increasing importance of e-commerce in the private-label food and beverage market (Bloomberg).

- In August 2024, H-E-B, a major US supermarket chain, completed the acquisition of Central Market, a specialty food retailer, to expand its private label offerings and strengthen its position in the premium food market. The acquisition represents a significant investment in the company's growth strategy (Wall Street Journal).

- In November 2025, the US Food and Drug Administration (FDA) approved the use of QR codes on food labels to provide consumers with detailed product information, including ingredients, nutritional facts, and manufacturing details. This regulatory approval marks a significant technological advancement in the private-label food and beverage market, enabling greater transparency and consumer engagement (FDA press release).

Research Analyst Overview

The private-label food and beverage market in the US continues to evolve, with dynamic market dynamics shaping the industry across various sectors. Food waste management remains a critical concern, with retail partnerships and consumer preferences driving innovation in this area. Product line extensions and ingredient sourcing are key strategies for private labels seeking to differentiate themselves. Ethical sourcing and clean label movements are gaining traction, influencing product formulation and brand development. Marketing campaigns emphasize transparency and natural flavor profiles, aligning with consumer demand for health and wellness. Logistics optimization and HACCP certification are essential for ensuring food safety and regulatory compliance.

Consumer insights and dietary trends inform new product development, with nutritional content and functional ingredients becoming increasingly important. Ingredient labeling and packaging innovations are crucial for effective communication with consumers. Supply chain management and employee training are essential for maintaining quality assurance programs. Pricing strategies and sustainability initiatives, such as circular economy and waste reduction, are becoming key differentiators. Private labels are exploring fair trade practices, organic certification, and sustainability standards to enhance their value proposition. Beverage production and distribution channels are adapting to e-commerce platforms and FSMA compliance. Social responsibility and brand positioning are critical components of private label success, with sensory analysis and product innovation driving growth.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Private-Label Food And Beverage Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 52.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.7 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch