Probe Card Market Size 2025-2029

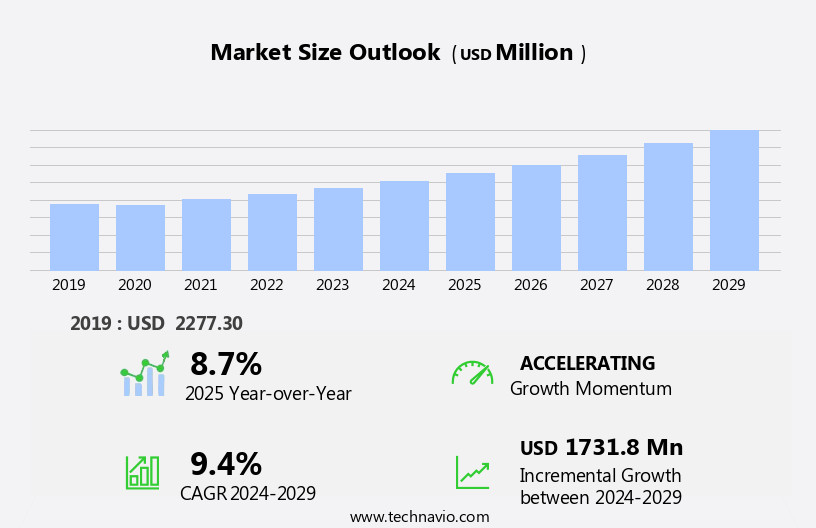

The probe card market size is forecast to increase by USD 1.73 billion at a CAGR of 9.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by increasing investments in semiconductor fabrication facilities (fabs) worldwide. This trend is fueled by the ongoing digital transformation and the demand for advanced technologies such as 5G, IoT, and artificial intelligence, which require more sophisticated semiconductor components. Another key factor is the rapid technological changes in the semiconductor industry, leading to the production of larger wafer sizes and the need for more advanced probe cards to test these complex devices.

- However, this market is not without challenges. The high capital expenditure required to develop and manufacture probe cards, coupled with the short product lifecycles due to rapid technological advancements, can pose significant hurdles for market entrants. Additionally, the intense competition among established players can make it challenging for new companies to gain a foothold. Despite these challenges, the market presents significant opportunities for companies that can innovate and adapt quickly to the evolving technological landscape.

- By investing in research and development and collaborating with semiconductor companies, probe card manufacturers can position themselves to capitalize on the growing demand for advanced probe cards and support the development of next-generation technologies.

What will be the Size of the Probe Card Market during the forecast period?

Geographical market expansion is also a notable trend, as semiconductor companies seek to serve a global customer base. The market's size is substantial, with billions of dollars in annual revenue. Its growth is expected to continue, as the demand for reliable semiconductor manufacturing solutions remains strong across various industries. Cantilever probe cards and membrane probe cards are common types of probe cards used for semiconductor assembly and testing, with each offering unique advantages depending on the specific application. Silicon wafers, test points, and electrical contact are integral components of probe cards, ensuring accurate and efficient semiconductor manufacturing processes.

How is this Probe Card Industry segmented?

The probe card industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Advanced probe card

- Standard probe card

- End-user

- Foundry and logic

- Memory device

- Geography

- APAC

- China

- Japan

- South Korea

- Taiwan

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- APAC

By Product Insights

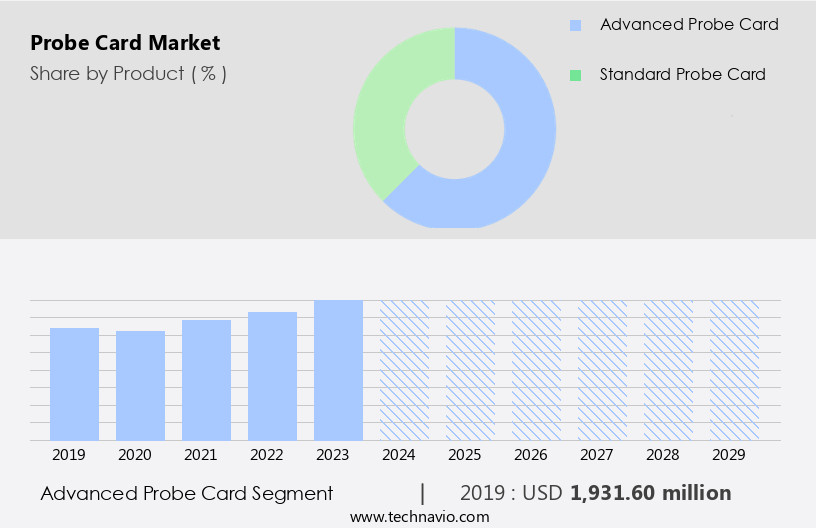

The advanced probe card segment is estimated to witness significant growth during the forecast period. Advanced probe cards offer enhanced capabilities compared to standard probe cards, enabling increased current throughput and higher position accuracy. These cards are particularly beneficial for high-frequency applications in sectors such as consumer electronics, data centers, advanced ICs, electric vehicles, autonomous vehicles, wearable devices, semiconductor manufacturing, health monitoring devices, and 5G technology. Advanced probe cards minimize damage to devices during testing, making them essential for the semiconductor industry's growing complexity, including FinFET, FD-SOI, 3D ICs, and lower nodes. Probe cards facilitate electromechanical interfaces for chip testing, improving production efficiency and product quality.

They support various measurement systems, including electrical, mechanical, and optical measurement systems, as well as measurement sensors and calibration standards. Data analysis software ensures testing efficiency and maintains device quality, while high-performance products cater to the demands of artificial intelligence, IoT devices, and geographical market expansion.

Get a glance at the share of various segments. Request Free Sample

The advanced probe card segment was valued at USD 1.93 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

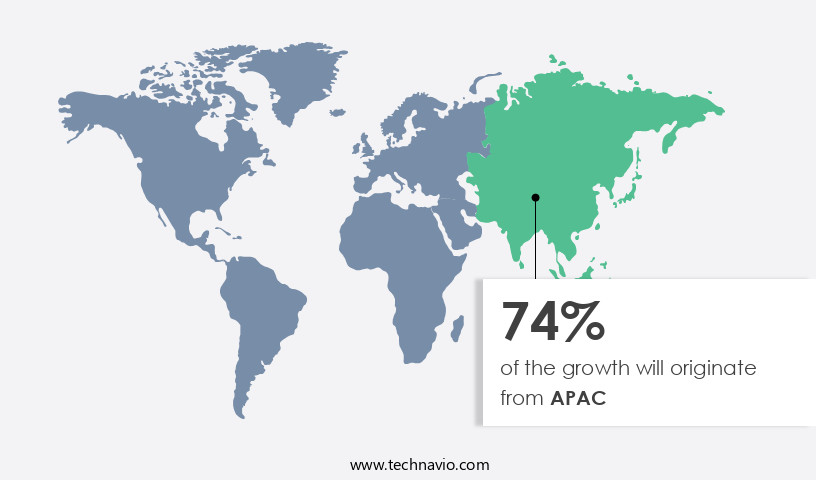

APAC is estimated to contribute 74% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is projected to experience substantial growth due to the region's high concentration of semiconductor manufacturing facilities. The increasing complexity of semiconductors, driven by advancements in technologies such as 5G, artificial intelligence, and the Internet of Things (IoT), is fueling the demand for sophisticated ICs. This trend is particularly prominent in consumer electronics, data centers, electric and autonomous vehicles, and health monitoring devices. Probe cards play a crucial role in the testing and production of these advanced ICs by providing electrical contact to the pads on silicon wafers. The market for probe cards in APAC is expected to expand as new semiconductor manufacturing facilities come online to meet the growing demand for high-performance products.

The market encompasses various types, including cantilever, membrane, and vertical probe cards, as well as measurement systems and calibration standards. The market is further segmented by application areas, such as memory testing, power device testing, and optical measurement systems. The adoption of probe cards is essential for ensuring production efficiency, product quality, and electrical signal routing in the semiconductor industry.

Market Dynamics

The market is experiencing significant growth, driven by the increasing complexity of semiconductors used in various sectors, including consumer electronics, data centers, advanced ICs, electric vehicles, autonomous vehicles, wearable devices, and healthcare monitoring devices. The semiconductor industry's expansion into new technologies, such as 5G technology, artificial intelligence, and the Internet of Things (IoT), is also fueling market demand. Semiconductor manufacturing requires precise electrical contact for testing and measuring chip quality. Probe cards, which provide electrical contact between the semiconductor wafer and the test equipment, are essential in this process. The market is witnessing innovation in probe card technology, with advancements in socket technology, advanced substrates, load boards, and probe card measurement techniques.

The probe card market plays a critical role in the semiconductor testing process, ensuring that chips meet the required performance and reliability standards. Semiconductor test tools, such as wafer probing systems and precision contact pins, are essential for conducting thorough testing on semiconductor devices. High-density probes and fine-pitch contacts enable testing of advanced chips with smaller features, while chip testing rigs and electrical signal testers are used to assess a wide range of electrical characteristics. Probe alignment tech and high-speed probes ensure accurate and fast testing, and multi-site testers allow for the simultaneous testing of multiple devices, improving efficiency in the testing process. Circuit validation tools, probe card cleaners, and test interface boards help maintain the integrity and cleanliness of the testing environment, while probe tip arrays provide uniform contact for comprehensive testing.

Signal integrity checks and durable needle sets are critical for ensuring that electrical signals are transmitted accurately during testing. Wafer-level testing, micro-contact systems, and custom probe layouts cater to the diverse needs of modern semiconductor testing. Test yield boosters and chip defect scanners help identify manufacturing defects, while probe calibration tools and advanced test sockets ensure that the probe cards remain calibrated for precise testing. As the demand for more advanced semiconductors grows, the probe card market continues to innovate, offering products that improve testing accuracy, efficiency, and yield. These technologies are crucial for the development of high-performance and reliable chips across various industries.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers for the Probe Card Industry?

- Growing investment in fabs is the key driver of the market. The semiconductor industry is experiencing significant growth due to the increasing integration of advanced technologies in electronic devices. This trend is driving the demand for more complex Integrated Circuits (ICs), leading semiconductor manufacturers to expand their fabrication facilities. In response to this growing demand, semiconductor foundries are focusing on developing ICs that support advanced technologies, resulting in the construction of new fabs and the expansion of existing ones.

- The manufacturing process of these ICs necessitates the use of wafer testing and probe cards. As a result, the demand for advanced probe cards is on the rise, making it an essential component in the semiconductor industry's value chain.

What are the market trends shaping the Probe Card Industry?

- Increasing wafer size is the upcoming market trend. The semiconductor industry's shift towards larger wafer sizes has been a significant market dynamic, enabling manufacturers to produce more ICs per wafer and reduce costs. While there have been advancements in 450-mm wafer development, the high investment required and limited returns make it a challenging proposition for many firms.

- Currently, the use of 300-mm, 200 mm, 150 mm, and 100 mm wafers caters to the IC manufacturing industry's needs effectively. Despite the potential benefits of larger wafer sizes, the current market trends indicate that these standard sizes continue to meet the industry's demands.

What challenges does the Probe Card Industry face?

- Rapid technological changes in semiconductor industry is a key challenge affecting the industry growth. The semiconductor industry is characterized by continuous technological advancements and short product lifecycles. With ICs shrinking in size while increasing in speed and functionality, probe card companies encounter challenges in developing innovative solutions for identifying functional defects in wafers. Technological shifts, such as the transition to larger wafer sizes and the development of lower technology nodes like 10-nm and 7-nm, contribute to the increasing complexities in IC design.

- Moreover, the emergence of MEMS technology further complicates the landscape. In response to these challenges, probe card companies must invest in research and development to create advanced products that cater to the evolving needs of the semiconductor industry.

Exclusive Customer Landscape

The probe card market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the probe card market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, probe card market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advantest Corp. - The company provides advanced probe card solutions, including CHPT models, enhancing research capabilities and search engine visibility for clients. Our probe card offerings align with our commitment to delivering cutting-edge technology and professional expertise.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advantest Corp.

- Chunghwa Precision Test Tech Co Ltd.

- FEINMETALL GmbH

- FormFactor Inc.

- GGB INDUSTRIES INC.

- INNOTECH Corp.

- Japan Electronic Materials Co. Ltd.

- Korea Instrument Co. Ltd.

- Micronics Japan Co. Ltd.

- MPI Corp.

- Nidec Corp.

- PROTEC MEMS Technology

- Synergie Cad

- Technoprobe S.p.A.

- Translarity Inc.

- TSE Co. Ltd.

- Wentworth Laboratories Ltd.

- WILLTECHNOLOGY

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of electromechanical interfaces utilized in the semiconductor industry for various applications. These interfaces play a crucial role in ensuring the quality and reliability of electronic devices, from consumer electronics and data centers to advanced ICs and emerging technologies such as electric vehicles, autonomous vehicles, wearable devices, and healthcare monitoring devices. Semiconductor manufacturing processes continue to evolve, necessitating the development of increasingly complex probe cards to accommodate the intricacies of modern semiconductor output. The integration of 5G technology, artificial intelligence, IoT devices, and advanced substrates into electronic devices has led to a in demand for high-performance probe cards capable of handling high-speed electrical signals and intricate signal routing.

Probe cards are essential tools for chip testing, enabling the measurement of electrical signals and the evaluation of device quality. They provide electrical contact to the pads on a silicon wafer, allowing for precise measurement and analysis using electrical, mechanical, and optical measurement systems. Probe cards come in various forms, including cantilever probe cards, membrane probe cards, and vertical probe cards, each designed to address specific testing requirements. Memory testing and power device testing are two critical applications of probe cards. Memory testing involves evaluating the functionality and performance of memory chips, while power device testing focuses on assessing the electrical characteristics of power semiconductors.

Probe cards play a vital role in ensuring the production efficiency and product quality of these components. Calibration standards and data analysis software are essential components of probe card measurement systems. These tools enable accurate and reliable measurement results by accounting for variations in probe card performance and environmental conditions. Probe card measurement systems employ electrical, mechanical, and optical sensors to detect and analyze electrical signals, mechanical deformation, and optical reflectance, respectively. Customization is a significant trend in the market, with manufacturers offering tailored solutions to meet the unique requirements of various applications. Customization options include bond pad designs, chip quality assessment, and socket technology.

Probe cards with advanced features, such as high-density test points and advanced substrate compatibility, are increasingly popular in the market. In , the market is a dynamic and evolving landscape driven by the ever-increasing complexity of semiconductor technology and the growing demand for high-performance electronic devices. Probe cards serve as essential tools for ensuring production efficiency, product quality, and device reliability across various applications, from consumer electronics to advanced ICs and emerging technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.4% |

|

Market growth 2025-2029 |

USD 1.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.7 |

|

Key countries |

Taiwan, China, US, Japan, South Korea, Canada, UK, Brazil, Germany, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Probe Card Market Research and Growth Report?

- CAGR of the Probe Card industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the probe card market growth of industry companies

We can help! Our analysts can customize this probe card market research report to meet your requirements.