Prosthetics And Orthotics Market Size 2024-2028

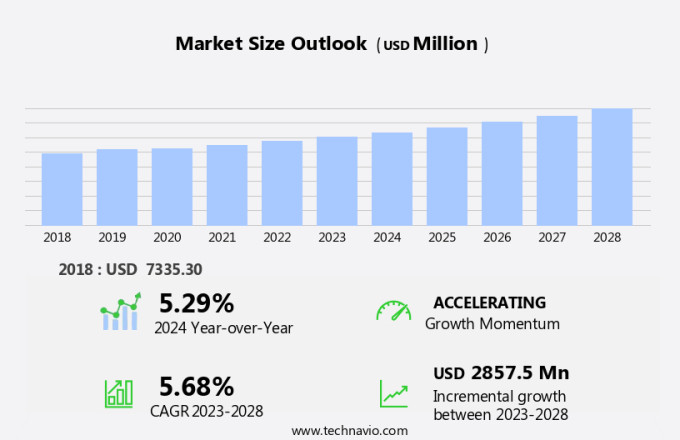

The prosthetics and orthotics market size is forecast to increase by USD 2.86 billion at a CAGR of 5.68% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary drivers is the continuous advancements in prosthetic and orthotic technologies, which include the integration of robotics and artificial intelligence. These innovations offer improved functionality, comfort, and mobility for users. However, the high costs associated with these devices remain a significant challenge for both manufacturers and end-users. Despite this, the market is expected to continue growing as the demand for more advanced and personalized solutions increases. Additionally, the aging population and rising prevalence of chronic diseases will further fuel market growth. Overall, the market presents numerous opportunities for growth and innovation.

What will be the Size of the Prosthetics And Orthotics Market During the Forecast Period?

- The market encompasses the production and sale of artificial limbs and support devices, including braces and orthoses, catering to various populations with disabilities, chronic illnesses, and injuries. Driving factors include the rising prevalence of sports injuries, road accidents, and diabetes-related amputations, as well as the increasing incidence of osteosarcoma and other limb amputation procedures due to cancer. The market is segmented into prosthetics and orthotics, with the latter experiencing significant growth due to the increasing prevalence of musculoskeletal weakness, osteoporosis, and neurological diseases. RD investments in advanced materials and technologies, such as brain-monitored prosthetics and naked prosthetics, are transforming the industry, providing more comfortable, functional, and aesthetically pleasing solutions.

- Reimbursement regulations and accessibility for the low-income population remain challenges, but ongoing advancements in clinical specialties continue to expand the market's reach and potential.

How is this Prosthetics And Orthotics Industry segmented and which is the largest segment?

The prosthetics and orthotics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Clinics

- Hospitals

- Others

- Type

- Orthotics

- Prosthetics

- Geography

- North America

- US

- Europe

- Germany

- France

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

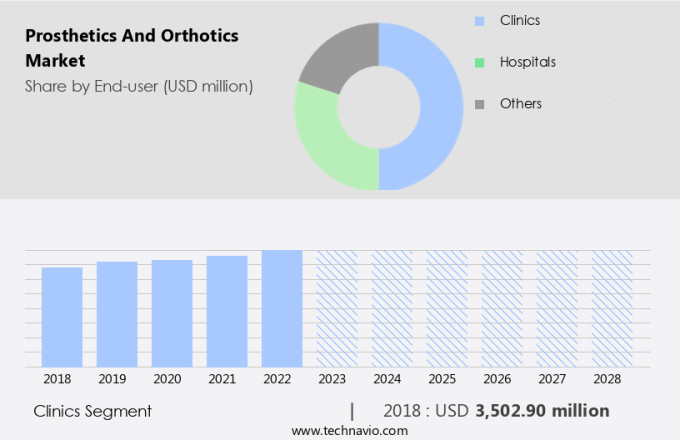

- The clinics segment is estimated to witness significant growth during the forecast period.

The market has experienced substantial growth, with orthotics being a prominent segment. Orthotics are external devices used for supporting, aligning, or correcting musculoskeletal irregularities. The expanding global population with musculoskeletal disorders and orthopedic conditions is a primary growth driver. Factors fueling the demand for orthotics include an aging demographic, sedentary lifestyles, and a rise in sports injuries. Orthotics cater to various conditions, including arthritis, plantar fasciitis, and spinal abnormalities. They alleviate pain, enhance mobility, and improve overall quality of life. The orthotics market expansion is influenced by demographic shifts, sedentary lifestyles, and increasing sports injuries. Additionally, technological advancements have led to the development of customized orthotic devices, pre-fabricated devices, and modular components, enhancing precision and accuracy.

Patients with disabilities due to chronic illnesses or limb amputations benefit significantly from these devices. The market's growth is further influenced by the increasing prevalence of osteoporosis, osteoarthritis, bone injuries, and neurological diseases. The market is characterized by ongoing new product development, favorable reimbursement scenarios, and well-established healthcare infrastructure. The use of advanced materials, design, alignment, and construction techniques has led to the development of innovative products, such as electric prostheses, advanced algorithms, and human movement solutions. The market's growth is also influenced by healthcare spending, digital health systems, and eco-friendly solutions. Despite these opportunities, challenges such as supply chain disruptions, healthcare regulations, and the needs of the low-income population persist.

Get a glance at the Prosthetics And Orthotics Industry report of share of various segments Request Free Sample

The Clinics segment was valued at USD 3.5 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to several factors. The increasing prevalence of musculoskeletal conditions, such as arthritis, which affects over 50 million people In the US according to the Centers for Disease Control and Prevention (CDC), necessitates the use of orthotics and prosthetics for improved mobility and functionality. Technological advancements have led to the development of innovative devices, such as bionic prostheses and advanced braces, which offer natural appearance, ease of movement, and superior support. Key players In the market, like Ossur, are at the forefront of this innovation, providing solutions that closely mimic natural limbs.

Furthermore, the market is driven by the demand for customized and pre-fabricated devices, modular components, liners, and support devices for both lower and upper extremities. The orthotics segment includes spinal orthotics, while the prosthetics segment comprises artificial limbs, brain-monitored prosthetics, and limb amputation procedures. Factors such as osteoporosis, osteosarcoma, diabetes-related amputations, sports injuries, and road accidents contribute to the high demand for these devices. The market is also influenced by regulatory frameworks, reimbursement regulations, and funding opportunities for new product development. The market is further propelled by the aging population, chronic illnesses, and disabilities. The market is expected to grow further due to the increasing focus on precision and accuracy, patient rehabilitation, and the development of eco-friendly solutions.

The market is served by skilled medical professionals, including prosthetists, orthopedists, and allied health professionals, in clinics, hospitals, and rehabilitation centers. The market is influenced by healthcare spending, new medical equipment, and digital health systems. However, challenges such as supply chain disruptions, healthcare facility accessibility, and affordability for the low-income population remain. The market is expected to grow further due to favorable reimbursement scenarios, lightweight materials, and well-established healthcare infrastructure.

Market Dynamics

Our prosthetics and orthotics market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Prosthetics And Orthotics Industry?

Advancements in prosthetic and orthotic technologies is the key driver of the market.

- The market is experiencing significant growth due to technological advancements In the fields of bioengineering, material sciences, and robotics. Innovative prosthetic and orthotic devices, which offer enhanced comfort, functionality, and body integration, are being developed as a result. For instance, the integration of sensors, microprocessors, and artificial intelligence (AI) has led to more precise and accurate prosthetic limbs that can replicate natural movements. This not only improves the quality of life for individuals with limb loss or mobility issues but also increases consumer demand for these advanced products. Sports injuries, road accidents, diabetes-related amputations, and osteosarcoma are major drivers of the market.

- Naked Prosthetics, Ottobock, Bauerfeind, Aether Biomedical, Ultraflex Systems, Zeus, and other key players are investing heavily in research and development (RD) to meet the growing demand for these devices. The Orthotics segment, which includes braces, supports, and insoles, and the Prosthetics segment, which includes artificial limbs, account for the largest market shares. The market is also influenced by reimbursement regulations, which vary by country. In the US, for example, the Centers for Medicare and Medicaid Services (CMS) has specific guidelines for covering prosthetic and orthotic devices. Osteoporosis, osteoarthritis, bone injuries, and neurological diseases are common conditions that require these devices.

- The geriatric population, with its high disability rates, is a significant market for both prosthetics and orthotics. Customized orthotic devices and pre-fabricated devices, as well as modular components, liners, and lower and upper extremity devices, are in high demand. The market is also seeing the development of new product offerings, such as brain-monitored prosthetics, electric prostheses, and advanced algorithms for human movement, speed, and cadence. Robotics and artificial intelligence are also being integrated into prosthetics and orthotics to improve functionality and precision. The market is also influenced by healthcare spending, which varies by country. Developing and underdeveloped regions have a large untapped market for orthopedic prosthetic appliances due to a lack of well-established healthcare infrastructure and favorable reimbursement scenarios.

- Lightweight materials and eco-friendly solutions are also becoming increasingly important In the development of new prosthetic and orthotic devices. In conclusion, the market is driven by technological developments, patient rehabilitation needs, and the increasing prevalence of chronic illnesses and disabilities. The market is expected to continue growing as new products are developed to meet the functional needs of patients and improve their quality of life.

What are the market trends shaping the Prosthetics And Orthotics Industry?

Integration of robotics and artificial intelligence is the upcoming market trend.

- The market is witnessing significant advancements driven by technological developments in robotics and artificial intelligence (AI). These technologies enable the creation of intelligent prostheses that can adapt to users' movements, providing a more comfortable and natural experience. Robotic-assisted therapy, an application of AI and robotics, is revolutionizing rehabilitation methods, leading to improved patient outcomes and enhanced quality of life. Sports injuries, road accidents, diabetes-related amputations, and osteosarcoma are leading causes of limb amputations, fueling the demand for advanced orthopedic prosthetic devices. Companies such as Ottobock, Bauerfeind, Aether Biomedical, Ultraflex Systems, Zeus, and others are investing in new product development to cater to the growing market.

- Orthotics and prosthetics cater to various clinical specialties, including osteoporosis, osteoarthritis, bone injuries, neurological diseases, and the geriatric population. Customized orthotic devices and pre-fabricated devices with modular components, liners, and sockets for lower and upper extremities are essential for addressing functional and physical limitations. The market's growth is influenced by factors such as increasing healthcare spending, the availability of new medical equipment, and favorable reimbursement scenarios. However, challenges like supply chain disruptions and the high cost of these devices, particularly for the low-income population, can hinder market expansion. Innovative products like electric prostheses, advanced algorithms, and power knee systems are transforming the prosthetics segment.

- Orthotics and prosthetics clinics, hospitals, and rehabilitation centers are key channels for the distribution and sale of these devices. The integration of eco-friendly solutions and natural appearance in prosthetic devices is gaining popularity, as is the development of lightweight materials for improved functionality and patient comfort. The well-established healthcare infrastructure and reimbursement guidelines in developed regions facilitate market growth. Chronic illnesses and disabilities continue to drive demand for orthopedic prosthetic appliances and orthopedic disorders treatment. Pain reduction and precision and accuracy are essential considerations for these devices, which must be aligned and constructed to meet functional needs. Skilled medical professionals, including prosthetists, orthopedists, and allied health professionals, play a crucial role In the design, construction, and fitting of these devices.

- The market is expected to continue growing as technological advancements, patient needs, and healthcare infrastructure evolve.

What challenges does the Prosthetics And Orthotics Industry face during its growth?

High costs associated with prosthetic and orthotic devices is a key challenge affecting the industry growth.

- The market encompasses the production and distribution of artificial limbs, braces, and other supportive devices. The market caters to various populations, including those suffering from sports injuries, road accidents, diabetes-related amputations, and osteosarcoma. Companies like Ottobock, Bauerfeind, Aether Biomedical, Ultraflex Systems, Zeus, and others dominate this sector, offering a range of products from customized orthotic devices to pre-fabricated ones. Technological developments continue to shape the Prosthetics and Orthotics industry, with innovations in materials, design, alignment, and construction leading to precision and accuracy. Brain-monitored prosthetics, power knee systems, and electric prostheses are some of the advanced solutions addressing functional needs.

- Patient rehabilitation is a crucial aspect of the market, with osteoarthritis, bone injuries, and neurological diseases being common conditions requiring orthopedic prosthetic devices. The market dynamics are influenced by factors such as RD investments, reimbursement regulations, and healthcare spending. Disability rates due to chronic illnesses and disabilities necessitate the need for new product development and strategic partnerships. However, challenges such as supply chain disruptions, unfavorable reimbursement scenarios, and the high cost of materials can hinder market growth. The industry focuses on catering to the functional and physical limitations of patients, with clinical specialties like orthopedics, rehabilitation programs, and prosthetics clinics providing essential services.

- The market is driven by the demand for eco-friendly solutions, natural appearance, and human movement enhancement, particularly In the geriatric population. The Prosthetics segment includes artificial limbs, while the Orthotics segment comprises orthopedic prosthetic appliances and orthopedic disorders treatments. The market is segmented based on the lower and upper extremities, spinal orthotics, and modular components, including liners and sockets. Despite the challenges, the market continues to evolve, driven by technological advancements, favorable reimbursement scenarios, and the well-established healthcare infrastructure. The industry is expected to witness significant growth In the coming years, with a focus on lightweight materials, device development, and innovative products.

- The high cost of orthotic and prosthetic devices remains a significant barrier to access for many individuals, particularly those in low-income areas and underdeveloped regions. Efforts to reduce the cost of these essential devices while maintaining their quality are essential to ensure they reach those in need. The market's future success relies on continued investment in research and development, favorable reimbursement scenarios, and the availability of skilled medical professionals. The market is poised for growth, driven by technological advancements, increasing healthcare spending, and a growing awareness of the importance of mobility and rehabilitation. With a focus on precision, accuracy, and patient-centered care, the industry is set to transform the lives of millions, enabling them to overcome physical limitations and live more fulfilling lives.

Exclusive Customer Landscape

The prosthetics and orthotics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the prosthetics and orthotics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, prosthetics and orthotics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Ability Matters Group Ltd. - The market encompasses innovative solutions designed to enhance mobility and improve quality of life for individuals with limb deficiencies or orthopedic conditions. Prosthetic devices, such as advanced carbon fiber limbs, offer amputees increased durability, functionality, and comfort. Orthotics, including custom-made braces, provide support and correction for various conditions, including knee, foot, and back issues. Companies specializing in this field, like those offering OrthoCash Pro, prioritize research and development to deliver cutting-edge technology and personalized care. These solutions cater to a wide range of needs, ensuring individuals can maintaIn their independence and overall well-being.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ability Matters Group Ltd.

- Aesthetic Prosthetics Inc.

- Aether Biomedical sp. z o.o.

- Bauerfeind AG

- Bionic Prosthetics and Orthotics Group LLC

- Blatchford Ltd.

- Fillauer LLC

- Globus Medical Inc.

- Hanger Inc

- Mobius Bionics LLC

- Ossur hf

- Ottobock SE and Co. KGaA

- Sarcos Technology and Robotics Corp.

- Steeper Inc.

- Stryker Corp.

- SynTouch Inc.

- THUASNE

- Ultraflex Systems

- WillowWood Global LLC

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of devices designed to enhance mobility and support individuals with various physical limitations. Orthotics refer to braces, supports, and other devices used to correct biomechanical abnormalities, address alignment issues, and provide support for weak or injured muscles and bones. Prosthetics, on the other hand, are artificial limbs designed to replace missing extremities. Both orthotics and prosthetics cater to diverse functional needs, with applications in various clinical specialties. Lower extremity devices address issues related to the legs and feet, while upper extremity devices focus on the arms and hands. Spinal orthotics provide support for the back and torso, addressing conditions such as scoliosis and kyphosis.

The market for these devices is driven by several factors, including technological developments, precision and accuracy, and patient rehabilitation needs. The geriatric population, with its higher prevalence of musculoskeletal weakness and osteoarthritis, represents a significant market segment. Chronic illnesses, neurological diseases, and limb amputations also contribute to the demand for orthotics and prosthetics. Orthopedic prosthetic devices have seen significant advancements in recent years, with a focus on improving functionality, durability, and natural appearance. Electric-powered prosthetics, for instance, offer increased speed and control, while advanced algorithms and robotics enable more human-like movement. Brain-monitored prosthetics represent the cutting edge of technology, allowing users to control their devices through thought alone.

The materials used In the construction of orthotics and prosthetics have also evolved, with a focus on eco-friendly solutions and lightweight materials. This not only benefits the environment but also enhances patient comfort and functionality. The orthotics and prosthetics market faces several challenges, including supply chain disruptions, regulatory requirements, and reimbursement guidelines. The cost of these devices can be prohibitive for some individuals, particularly those In the low-income population. Strategic partnerships and funding opportunities can help address these challenges and ensure access to innovative products for a wider population. The healthcare infrastructure plays a crucial role In the market, with well-established systems offering favorable reimbursement scenarios and access to skilled medical professionals.

Healthcare facilities, rehabilitation programs, and prosthetics clinics are essential touchpoints for patients seeking these devices. Innovative products continue to emerge In the market, addressing diverse functional needs and improving patient outcomes. Power knee systems, for example, offer increased stability and support for individuals with knee injuries. Knee replacement systems provide an alternative to prosthetics for those with severe joint damage. The orthotics and prosthetics market is poised for continued growth, driven by the increasing prevalence of physical limitations and chronic illnesses. The market's future success hinges on ongoing technological advancements, regulatory support, and access to funding and skilled professionals.

|

Prosthetics And Orthotics Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.68% |

|

Market growth 2024-2028 |

USD 2857.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.29 |

|

Key countries |

US, Germany, France, Japan, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Prosthetics And Orthotics Market Research and Growth Report?

- CAGR of the Prosthetics And Orthotics industry during the forecast period

- Detailed information on factors that will drive the Prosthetics And Orthotics growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the prosthetics and orthotics market growth of industry companies

We can help! Our analysts can customize this prosthetics and orthotics market research report to meet your requirements.