Purified Terephthalic Acid (PTA) Market Size 2025-2029

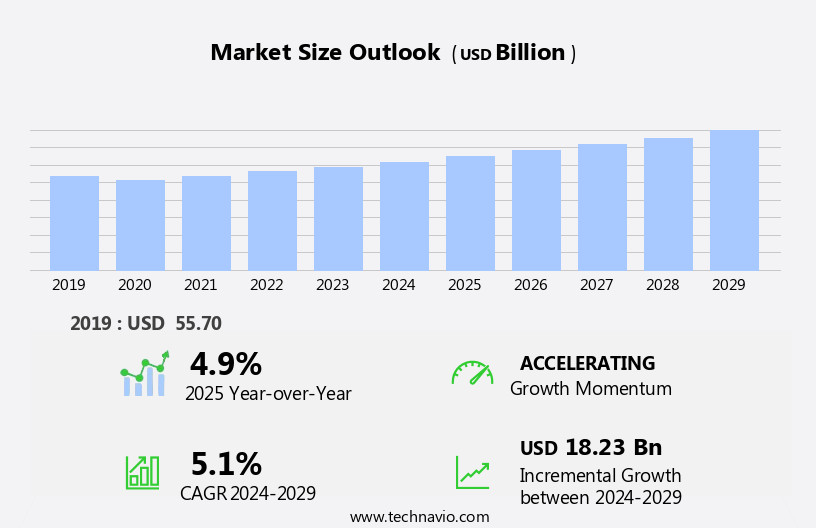

The purified terephthalic acid (PTA) market size is forecast to increase by USD 18.23 billion, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for packaging materials, particularly Polyethylene Terephthalate (PET), which is a primary application of PTA. The shift towards sustainable packaging solutions is driving the demand for bio-based PET products, offering both environmental benefits and market opportunities. However, the market is not without challenges. The volatility in crude oil prices poses a significant threat to the industry's profitability, as PTA is derived from crude oil.

- This price instability necessitates effective supply chain management and price risk mitigation strategies for market participants. Companies seeking to capitalize on the growth opportunities in the PTA market must focus on innovation, sustainability, and cost optimization to remain competitive and navigate the challenges effectively.

What will be the Size of the Purified Terephthalic Acid (PTA) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in pet innovations and the expanding applications across various sectors. PTA production remains a key focus, with ongoing efforts to increase capacity and improve efficiency. PET films, a significant application of PTA, are gaining traction in the packaging industry due to their lightweight and durable properties. In the manufacturing sector, polyester technology is at the forefront of innovation, with PTA playing a crucial role in the production of polyester fibers, yarn, and films. The apparel industry is another major consumer of PTA, utilizing polyester in the creation of sustainable and high-performance textiles.

The electronics industry also contributes to the dynamism of the PTA market, with the ongoing development of new PTA derivatives and applications. The price of PTA remains a critical factor, with fluctuations influenced by supply and demand, logistics, and regulations. Recycling initiatives are gaining momentum, with PTA recycling becoming an essential component of the circular economy. New PTA plants are being established, and existing ones are being upgraded to enhance their sustainability and reduce their carbon footprint. The pet fibers sector is experiencing significant growth, driven by the increasing demand for sustainable and eco-friendly alternatives to traditional fibers.

The PET bottles market is also evolving, with a focus on reducing plastic waste and increasing the use of recycled materials. Polyester sustainability is a key trend, with companies investing in research and development to create more sustainable and e-friendly polyester products. The polyester industry is continuously innovating to meet the evolving needs of consumers and businesses, ensuring the PTA market remains dynamic and vibrant.

How is this Purified Terephthalic Acid (PTA) Industry segmented?

The purified terephthalic acid (PTA) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Polyester fiber

- PET resins

- Films

- Others

- End-user

- Textile

- PET bottles

- Packaging

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Application Insights

The polyester fiber segment is estimated to witness significant growth during the forecast period.

In the dynamic realm of the market, polyester fibers reign supreme, holding the largest application segment share. Unlike natural fibers, such as cotton, polyester fibers boast several advantages, including unhindered availability, a cost advantage, and superior performance characteristics compared to competing materials. These attributes have propelled polyester fibers to occupy a significant position in the global PTA market. The textile industry's burgeoning demand for polyester fibers is a primary driver, as they offer numerous benefits, including durability, wrinkle resistance, and low maintenance. Furthermore, the increasing trend towards sustainability and reducing reliance on natural fabrics, such as cotton and wool, is also fueling the growth of the polyester fibers segment.

Polyester fibers' popularity extends beyond textiles, with applications in various industries, including the bottling industry for producing PET bottles, the apparel industry for manufacturing polyester yarn and fabric, and the electronics industry for producing polyester films. Additionally, the polyester manufacturing sector's continuous innovations, such as advancements in polyester technology and production processes, have further bolstered the market's growth. The PTA industry's key players, including para-xylene (PX) producers and pet resin manufacturers, have been instrumental in meeting the escalating demand for polyester fibers. PTA logistics and regulations play a crucial role in ensuring a steady supply of raw materials and maintaining industry standards.

The recycling of PTA and PET products is another significant trend, with companies investing in research and development to create more eco-friendly solutions. In conclusion, the PTA market's evolution is characterized by the growing demand for polyester fibers, driven by their numerous advantages and expanding applications across various industries. The market's continued growth is underpinned by innovations in manufacturing, production, and sustainability, making it an exciting space to watch.

The Polyester fiber segment was valued at USD 35.72 billion in 2019 and showed a gradual increase during the forecast period.

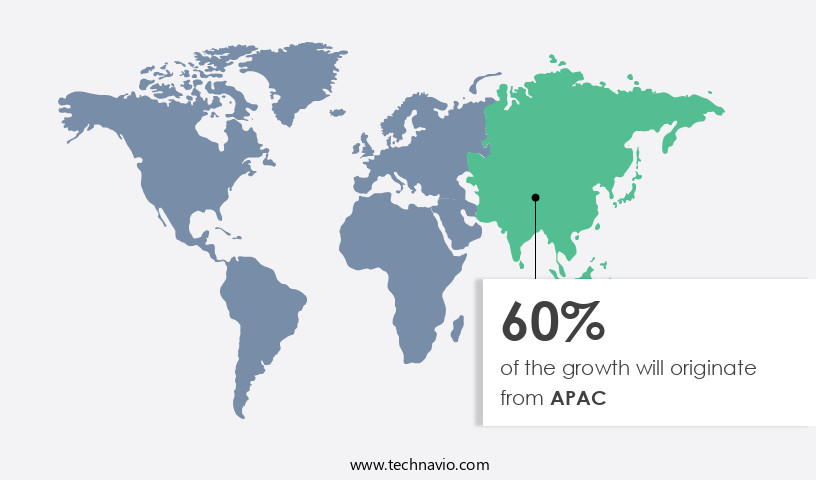

Regional Analysis

APAC is estimated to contribute 60% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Asia Pacific (APAC) region holds a significant position in the market, with China, India, Japan, and South Korea being the major contributors to its revenue. In 2023, China emerged as the largest consumer of PTA due to the expansion of sectors like the renewable sector, consumer electronics, and the organized retail industry, which is propelling the packaging industry's growth. The packaging industry's growth is further fueled by the rapid expansion of the retail and e-commerce sectors in Asian countries, including China and India, which have experienced exponential growth over the past decade. The PTA market in APAC is significantly influenced by the bottling industry, polyester manufacturing, and logistics.

Key players in the PTA industry include para-xylene (PX) producers, who are integral to the PTA production process. PTA is a crucial component in the production of polyester resin, fiber, yarn, film, and fabric, making it an essential element in various industries such as apparel, electronics, and pet sustainability. The PTA market's trends include innovations in polyester technology, capacity expansion, and price fluctuations due to supply and demand dynamics. PTA's applications extend to PET bottles, PET fibers, and PET films. The PTA industry's sustainability is a critical concern, with regulations and initiatives aimed at reducing its environmental impact.

The PTA market's outlook is positive, with increasing demand for PTA derivatives and the potential for growth in emerging markets.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Purified Terephthalic Acid (PTA) Industry?

- The packaging material market is driven primarily by the rising demand for these materials due to increasing consumer preferences for convenient and protective packaging solutions.

- Purified Terephthalic Acid (PTA) plays a pivotal role in various industries, particularly in pet packaging and polyester manufacturing. The packaging sector is the largest consumer of PTA, accounting for a significant market share. Packaging is essential for product promotion, providing vital information to consumers, and ensuring product protection. In the pet packaging industry, PTA is used to produce polyester resin, which is then converted into bottles and containers for various beverages and food products. Similarly, in the bottling industry, PTA is utilized to manufacture polyester fiber for use in bottle brushes and filters. In the textile industry, PTA is used to produce polyester fabric for clothing and upholstery.

- Moreover, PTA's role extends to logistics and transportation, where it is used to produce polyester fabric for making straps, ropes, and bags. In the recycling sector, PTA is used to recycle polyester waste, making it an eco-friendly alternative. The PTA market outlook is promising due to the increasing demand for sustainable packaging solutions and the growing trend towards recycling. The use of PTA in various industries underscores its importance and the potential for continued growth.

What are the market trends shaping the Purified Terephthalic Acid (PTA) Industry?

- The market trend indicates a significant growth in the production and consumption of bio-based PET products. This emerging trend reflects the increasing demand for eco-friendly and sustainable alternatives to traditional petrochemical-derived plastics.

- The global PTA market is experiencing significant growth due to increasing demand from various industries, particularly in the production of polyester film, apparel, polyester yarn, pet bottles, and other applications. The apparel industry's shift towards sustainability and the use of eco-friendly materials has driven the demand for PTA. The need to reduce pollution and address environmental concerns has led to more emphasis on the sustainability of the PTA industry. Para-xylene (PX), a key raw material used in the production of PTA, is under increasing regulatory scrutiny due to its potential health and environmental risks. However, advancements in technology and the development of more sustainable production methods are mitigating these concerns.

- The trend towards sustainability is also influencing the packaging industry, with many consumer product manufacturers preferring to use recyclable and biodegradable packaging materials. This shift is expected to create new opportunities for the PTA industry as it positions itself as a provider of sustainable and eco-friendly solutions. In conclusion, the PTA market is poised for growth due to its wide range of applications in various industries, particularly those focused on sustainability and eco-friendly solutions. Despite regulatory challenges, the industry is innovating and adapting to meet the evolving needs of consumers and the market.

What challenges does the Purified Terephthalic Acid (PTA) Industry face during its growth?

- The volatility in crude oil prices poses a significant challenge to the growth of the industry, necessitating robust strategies to mitigate the impact on businesses.

- The market is influenced by the volatility in the prices of raw materials, primarily polymers and resins, used in the production of Polyethylene Terephthalate (PET). In 2022, the global market has experienced price fluctuations due to geopolitical tensions, such as the Russia-Ukraine war, causing concerns over the supply of Russian oil. As a derivative of petroleum and natural gas, the price of PET is directly linked to the prices of these commodities. Moreover, the oil and gas industry's response to declining oil prices, which includes cost-cutting measures like workforce reductions, has affected the availability and pricing of raw materials.

- In the realm of PTA applications, the market caters to various industries, including pet films, polyester technology, and pet fibers. The demand for PTA remains strong due to its extensive use in these applications. Innovations in PTA technology, such as recycling, continue to gain traction, offering potential solutions to mitigate the impact of raw material price volatility. The recycling of PET bottles and other PET waste into new PTA feedstock is a promising development, reducing the reliance on virgin raw materials and contributing to a more sustainable and cost-effective PTA production process. In conclusion, the PTA market dynamics are shaped by the price fluctuations of raw materials, primarily influenced by geopolitical events and the oil and gas industry's response to market conditions.

- The market's resilience is demonstrated through the continued demand for PTA in various applications and the ongoing innovations in PTA technology, including recycling.

Exclusive Customer Landscape

The purified terephthalic acid (PTA) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the purified terephthalic acid (PTA) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, purified terephthalic acid (pta) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alfa Chemistry - The company specializes in the production and supply of high-purity terephthalic acid (TPA), a critical component in the manufacturing of polyester and polyethylene terephthalate (PET) resins.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Chemistry

- Alfa Corporativo S.A. de C.V.

- Arkema

- BP Plc

- China Petrochemical Corp.

- Colossustex

- Eastman Chemical Co.

- Indian Oil Corp. Ltd.

- Indorama Ventures Public Co. Ltd.

- INEOS Group Holdings S.A.

- Jamorin International

- Johnson Matthey Plc

- Lotte Chemical Corp.

- MCPI

- Mitsubishi Chemical Group Corp.

- Reliance Industries Ltd.

- Saudi Basic Industries Corp.

- SOCAR Turkiye Enerji A.S.

- Sundyne LLC

- Taekwang Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Purified Terephthalic Acid (PTA) Market

- In February 2023, INEOS Styrolution, the world's leading styrenics supplier, announced the successful start-up of its new PTA plant in Marl, Germany, expanding its global PTA capacity by 250,000 metric tons per annum (mtpa) (INEOS Styrolution press release, 2023). This strategic expansion aims to strengthen the company's position as a key supplier in the European PTA market.

- In April 2024, LG Chem and SABIC, two global chemical industry leaders, signed a memorandum of understanding (MOU) to collaborate on the production and commercialization of PTA using renewable feedstocks. The partnership is expected to reduce carbon emissions by up to 30% compared to conventional PTA production methods (LG Chem press release, 2024).

- In October 2024, Covestro, a leading global polymer supplier, announced a â¬1.5 billion investment to expand its PTA production capacity at its European sites in Germany and Belgium. This expansion will increase the company's total PTA capacity by 50% and support its commitment to the circular economy by integrating recycled feedstocks into its production process (Covestro press release, 2024).

- In January 2025, Sinopec, the largest refiner in China, received approval from the National Development and Reform Commission to build a 1.2 million mtpa PTA plant in Zhejiang Province. This project marks Sinopec's entry into the Chinese PTA market and will significantly increase the country's domestic production capacity (Xinhua News Agency, 2025).

Research Analyst Overview

- The market plays a pivotal role in the production of polyester polymers, which are widely used in various industries due to their desirable properties, including colorfastness, water resistance, and flame retardancy. PTA's safety and environmental impact are crucial concerns, with ongoing research focusing on improving catalyst efficiency and process optimization. Polyester blends and composites, incorporating PTA, exhibit enhanced performance in terms of moisture management, biodegradability, and nanomaterials. Paraxylene (PX) production, a key feedstock for PTA, influences market dynamics. PTA's energy efficiency and UV protection properties make it an attractive choice for 3D printing applications.

- Antimicrobial and anti-static properties are also important considerations in the polyester market, with PTA contributing to the production of these specialized polymers. PTA's role in enhancing polyester's durability and performance is a significant market trend. Quality control and regulatory compliance are essential aspects of the PTA industry, ensuring the production of high-quality polymers with consistent properties. The integration of PTA into polyester production processes continues to evolve, with a focus on enhancing the overall performance and sustainability of the final products.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Purified Terephthalic Acid (PTA) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 18.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

China, US, India, Japan, South Korea, Canada, Germany, UK, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Purified Terephthalic Acid (PTA) Market Research and Growth Report?

- CAGR of the Purified Terephthalic Acid (PTA) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the purified terephthalic acid (pta) market growth of industry companies

We can help! Our analysts can customize this purified terephthalic acid (pta) market research report to meet your requirements.